Source: AiYing Compliance

Following the above "Singapore Virtual Assets in 2024 Fund Management: Overview of License Application Requirements and Exemption Guidelines" introduces Singapore crypto funds: two situations of licensed fund management company LFMC and exempted licensed funds. As far as fund structures are concerned, the common fund structures in Singapore are as shown below:

Crypto funds\virtual asset funds can usually be established in the following two ways:

1. You can choose not to apply for a license , investing directly in non-security cryptocurrencies, taking advantage of certain exemptions to avoid becoming a licensed manager.

2. Secondly, the fund can also adopt a traditional private equity fund structure, created by a fund manager registered or authorized by the Monetary Authority of Singapore (MAS), and adopt the organizational form of a Singapore variable capital company. (VCC).

Today we will mainly talk about the establishment of VCC in Singapore and the latest compliance supervision requirements:

Introduction to VCC

On January 15, 2020, the Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) officially jointly launched VARIABLE CAPITAL COMPANIES ("VCC"). For Singapore at that time, VCC was a new type of corporate structure that was suitable for all types of investment funds and could provide fund managers with greater operational flexibility and greater cost savings.

1. VCC regulatory laws:

2. The main advantages of Singapore Variable Capital Company (VCC)

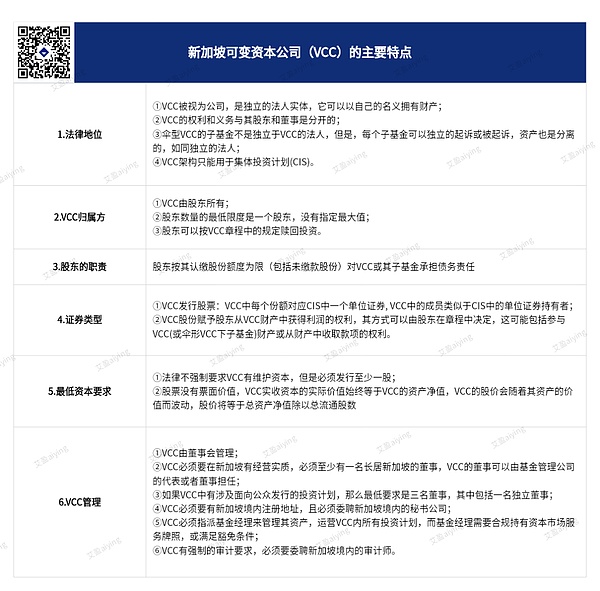

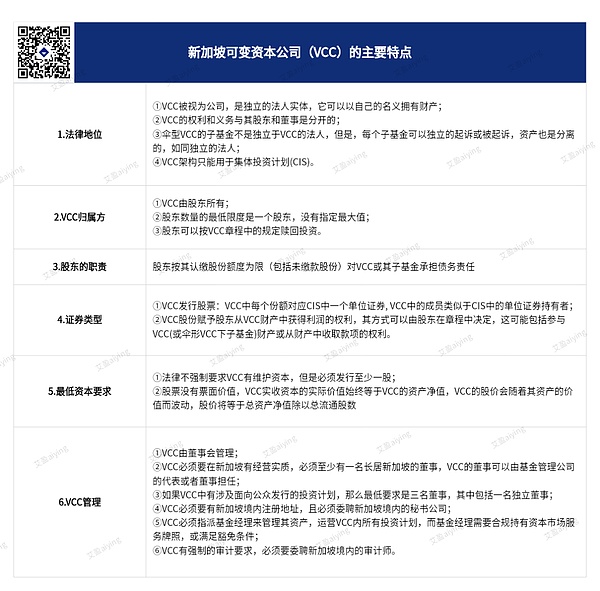

3. Main features of Singapore Variable Capital Company (VCC)

< strong>4. VCC Fund Infrastructure

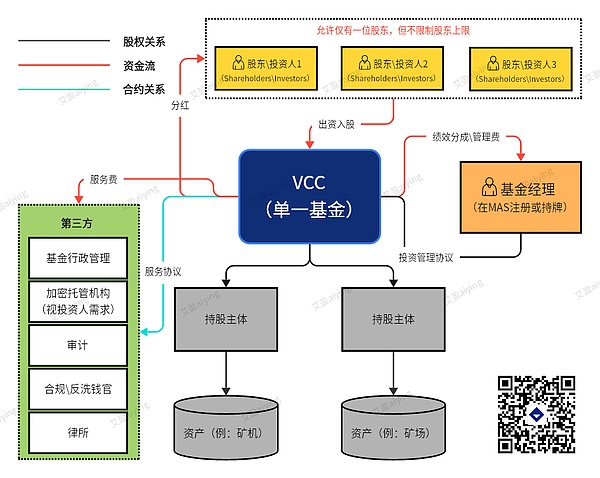

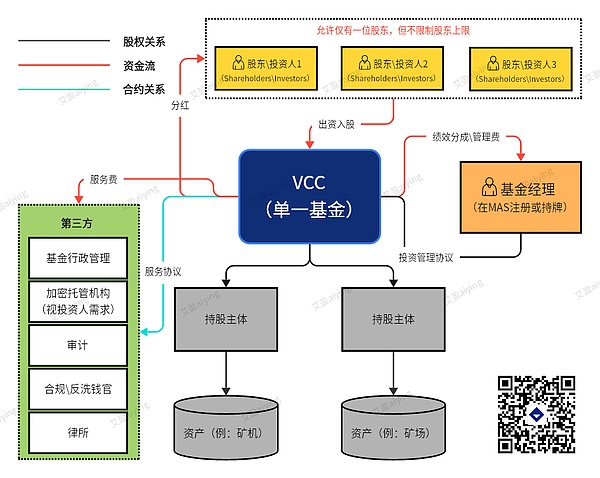

1. Single VCC

The single VCC structure is similar to the original Singapore common joint-stock company fund structure. Investors As a shareholder of VCC, it will hold VCC shares, conduct investment activities through VCC, and indirectly hold the assets of the invested company through VCC. The single VCC structure only contains a single investment portfolio.

2.Umbrella VCC

The umbrella VCC structure is an independent corporate entity with multiple sub-funds. The sub-funds do not have legal personality, but the shareholders of each sub-fund Or the investors can be different, and the investment goals and investment plans can also be different. The umbrella VCC structure has significant advantages, as follows:

The assets and liabilities of each sub-fund and between the sub-fund and the VCC are independent of each other

Although the sub-fund does not have an independent legal personality, according to the provisions of Article 29 of the VCC Act, under any circumstances, the assets of the sub-fund cannot be used to pay off the liabilities of the VCC or other sub-funds; the liabilities of the sub-fund can only be used by itself. repayment of assets. At the time of liquidation, each sub-fund is liquidated individually. This provision is mandatory and any VCC charter, agreement or contract that stipulates the contrary shall be invalid.

Thus, each sub-fund under the umbrella VCC structure has a high degree of independence. A sub-fund will not be affected by the dissolution or liquidation of other sub-funds, and can guarantee the normal operation of each sub-fund, thereby ensuring the normal operation of each sub-fund. Protect the interests of investors to the greatest extent.

High operational efficiency and low costs

The VCC main fund and its sub-funds are regarded as the same legal entity. At the governance structure level, each sub-fund can share a board of directors and service providers, including the same fund manager, custodian, auditor and administrative agent; at the operational level, each sub-fund can be managed collectively or merged Carry out matters such as convening shareholders' meetings and preparing prospectuses.

Considering the many advantages in operation, investors often choose to invest in an umbrella VCC structure in practice. The specific investment model is: investors hold participating shares (defined as Participating Shares) issued by the target sub-fund. See below), VCC signs investment transaction documents with investors on behalf of its sub-funds. The investors obtain the status of shareholders of the sub-fund, and the sub-fund invests in the invested company. The final investor achieves indirect holdings through the sub-fund. Equity in the investee company.

5. VCC registration process

According to Singapore’s official guidelines, the specific VCC registration process is summarized as follows:

Step 1: Name Verification

1. Choose an appropriate name (not a registered name, not an indecent name, not a financial (a name prohibited by the Ministry of Commerce), and the name must end with "VCC". 2. After the name is approved, it will be retained for 120 days and must be registered during this period. Otherwise, the applicant needs to resubmit the application after the expiration date.

Second step: Determine the VCC type

That is, determine whether it is a non-umbrella fund or an umbrella fund, or an umbrella fund. The assets and liabilities of sub-funds are independent of each other.

Step 3: Provide the registered office address

The registered office address (Registered Office) refers to the VCC for sending and receiving communications and notifications. and where the VCC's registers and files are kept, usually provided by the local company secretary.

Step 4: Prepare the VCC Constitution (Constitution)

The constitution must include the following content:

1. The main characteristics of VCC;

2. Describe the rules of its management;

3. Describe how the VCC conducts its business;

4. Describe the directors , rights and responsibilities of shareholders and company secretary. Applicants must attach a copy of the Bylaws when registering. Constitutional documents submitted to the Registrar are not open to the public but must be disclosed to the Singapore authorities upon request for supervisory and enforcement purposes.

Step 5: Register VCC

After successful registration of VCC, a Unique Entity Number (UEN) will be issued. This UEN can be used to conduct transactions with ACRA or any other government agency. Registration takes 14 to 60 days.

Step 6 Sub-fund registration (if any)

Sub-funds can only be registered under one general VCC. The following is the information required for registration:

1. The proposed name of the Sub-Fund; 2. The date of establishment of the Sub-Fund. If a VCC decides to transition from a non-umbrella VCC to an umbrella VCC, the VCC information must be updated within 14 days. If it needs to be transferred to other government agencies for approval or review, the processing time for sub-fund registration may take up to 3 working days.

6. VCC Annual Maintenance and Compliance Obligations

VCC funds should make annual returns every year and submit them on time Annual financial statements. Before making annual returns and preparing financial reports, one should first confirm its financial year and its year-end date.

7. Necessary roles and requirements in the establishment process

JinseFinance

JinseFinance