Author: Bryan Biswas, Cointelegraph; Compiler: Deng Tong, Golden Finance

BTC price fell just 0.3% over the past week, but new data suggests there are some positive catalysts for a potential rebound.

Bitcoin’s price range has been between $41,800 and $43,900. While the immediate direction of Bitcoin’s price is uncertain, there are three factors that suggest positive price action is likely in the short term.

Bitcoin inflows hit $702 million

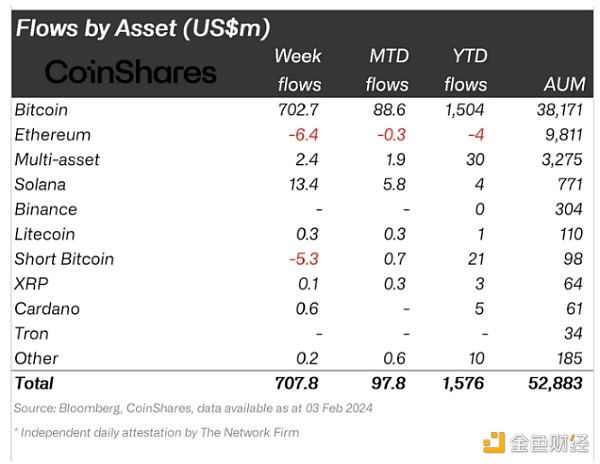

According to CoinShares report, Bitcoin Investment The product attracts 99% of all incoming funds. Bitcoin welcomed $703 million in inflows, bringing total global assets under management to $53 billion.

Cryptocurrency institutional asset inflows. Source: CoinShares

Also, outflows from Grayscale’s GBTC ETF continue to slow. On the other hand, short-selling Bitcoin investment vehicles that make money from falling prices have seen small outflows. This coincides with the reversal of negative emotions.

It’s worth noting that BTC investment products faced over $500 million in outflows at the end of January, and this, along with GBTC’s aggressive selling, may have played a role in the market correction.

Bitcoin miner reserves increase

Bitcoin Miners Reserve. Source: CryptoQuant

At the end of January, Bitcoin miners began selling like crazy. Net miner traffic totaled -13,542 BTC on February 1st. This metric measures the difference between coins flowing in and out of the exchange. Negative numbers indicate a decrease in miner reserves. However, as of press time, miners’ reserves have grown by more than 2,400 BTC in the past 24 hours. The increase in reserves means that selling pressure from this group of market participants is currently waning.

However, theMiner Position Index (MPI) remains above 1, which means that on a one-year average, miners are currently selling moderately. If miner reserves continue to rise in the coming weeks, the MPI index will decline. An MPI index below 1 indicates moderate holdings by miners.

Bitcoin fees rise 35% in a week

Increase in on-chain revenue during market consolidation is network demand symbols of. According to data from blockchain analytics provider Token Terminal, Bitcoin fees incurred rose by 35.71% in the past week.

Bitcoin network fees. Source: token terminal

Increased utilization of the Bitcoin network may lead to an expansion of the user base. Together, these metrics boost the user base and price tends to follow a positive path.

If fees are increasing, it means users are willing to pay a higher fee to be included in the next block. Current market dynamics indicate this is the case, which could bring positive momentum to Bitcoin’s price action.

Bitcoin price returns to 50-EMA

BTC/USDT daily chart. Source: TradingView

The daily chart above shows immediate resistance for Bitcoin near $44,500. While BTC fell to the $38,500 support on January 23, it immediately recovered above the 50 exponential moving average. While top resistance lies at Bitcoin’s swing highs at $49,100,if the current bullish momentum continues, Bitcoin could retest $44,500.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance decrypt

decrypt Beincrypto

Beincrypto Business Insider

Business Insider Beincrypto

Beincrypto Nulltx

Nulltx Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph