Author: Martin Young Source: cointelegraph Translation: Shan Ouba, Golden Finance

Bitwise's Matt Hougan said that the United States' strategic Bitcoin reserve "greatly increases the likelihood that other countries will establish Bitcoin reserves".

The United States' establishment of a strategic Bitcoin reserve not only reduces the possibility of the government "banning" Bitcoin in the future, but may also promote more countries to adopt Bitcoin as a reserve asset, which is a common view among crypto industry observers.

On March 7, US President Donald Trump signed an order to establish a strategic Bitcoin reserve (SBR) and a digital asset reserve.

David Sacks, head of White House crypto policy, said the reserve will be capitalized by "Bitcoin obtained by the US government from criminal or civil asset forfeiture cases", about 200,000 BTC. As soon as the news came out, the price of Bitcoin immediately fell by 6%, disappointing traders.

However, many industry insiders believe that the market's interpretation may be wrong and the news is actually a major positive.

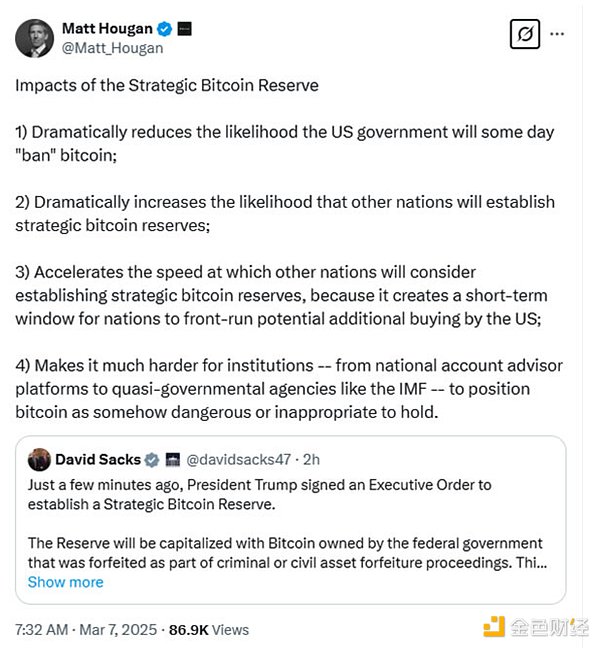

President Trump signed an executive order on strategic bitcoin reserves. Source: David Sacks

1. The U.S. government is unlikely to "ban" Bitcoin

Bitwise Chief Investment Officer Matt Hougan pointed out that the establishment of Bitcoin reserves means that the possibility of the U.S. government "banning" Bitcoin in the future has dropped significantly.

Last November, the Federal Reserve Bank of Minneapolis said that Bitcoin could force the U.S. government to balance its budget:

"The sustainability of long-term fiscal deficits can be restored through a legal ban on Bitcoin, or it can be achieved by taxing Bitcoin."

But now that the U.S. government has established its own Bitcoin reserves, it shows that the legitimacy and future status of Bitcoin have been officially recognized.

2. Other countries may follow suit

Hougan believes that the establishment of the US Bitcoin reserves will greatly increase the probability of other countries establishing Bitcoin reserves and accelerate the process of their consideration of this move.

"This provides other countries with a short 'rush' window to get in before the U.S. starts buying more Bitcoin."

According to BitBO data, the United States is currently the country with the largest national Bitcoin holdings in the world, holding 207,189 BTC, equivalent to US$18 billion.

The Bitcoin reserves of other countries are as follows:

• China: estimated to hold 194,000 BTC

• UK: holds 61,000 BTC

• El Salvador (the only country in the world that uses Bitcoin as legal tender): currently holds 6,103 BTC, approximately US$534 million.

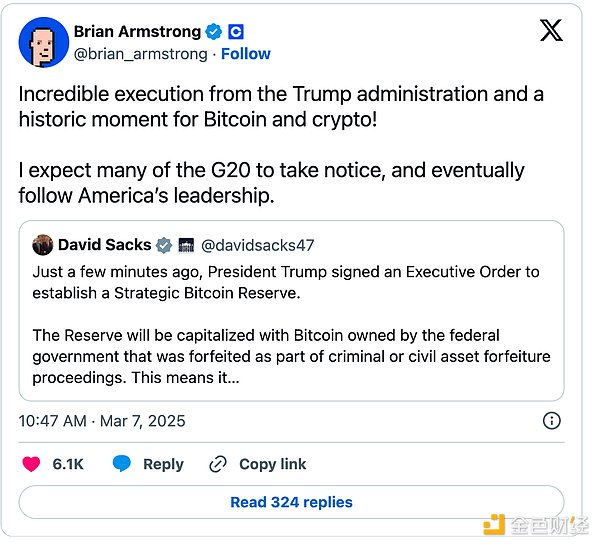

Coinbase CEO Brian Armstrong predicted: “It is expected that many of the G20 countries will take note of this and eventually follow the U.S. leadership.”

3. Institutional trust in Bitcoin increases

Hougan further pointed out that the United States’ Bitcoin reserves make it more difficult for international institutions (such as the International Monetary Fund IMF) to regard Bitcoin as a “dangerous” or “unsuitable” asset to hold.

The IMF has always opposed sovereign countries investing in Bitcoin in the past. On March 3, 2024, the IMF approved a $1.4 billion financing plan for El Salvador, but with the additional condition that the government must not actively increase its Bitcoin holdings.

Bitwise Research Director Ryan Rasmussen further stated: The US government's establishment of Bitcoin reserves does not mean that they will buy all the Bitcoin in the world, but it sends several important signals: other countries will buy BTC, wealth managers have no excuses, financial institutions have no excuses, pensions and endowment funds have no excuses, concerns about the US sell-off have disappeared, the US may buy more, the possibility of states buying has just risen, and the possibility of the government banning Bitcoin is absolutely zero.

4. Bitcoin Reaches New Heights

Meanwhile, crypto lawyer John Deaton noted that US Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick have been directed by the president to find ‘budget-neutral’ ways to acquire Bitcoin. Two years ago, if we had suggested this, we would have been laughed at.

ETF Store President Nate Geraci also added: “It was only a year ago that US regulators approved the first Bitcoin spot ETF.”

Bitcoin’s acceptance is growing rapidly, with prices now back up to $88,000 (as of press time).

Joy

Joy