Author: Kyle, crypto researcher; Compiler: Felix, PANews

Since this round of bull market cycle started in 2024, the cycle so far is: BTC ETF launched on January 10 → until Bitcoin hits a new all-time high, boosting the alt season, entering the volatile second/third quarter of 2024, Bitcoin continues to break through $50,000 and $60,000, and is currently hovering around $90,000.

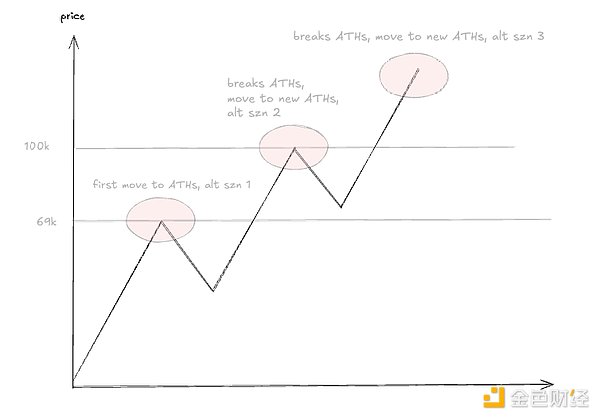

It is worth noting that the alt season started when BTC reached its high point. The first round was BTC moving towards $69,000, but failed to break through properly, and the next round was moving towards $100,000.

The next alt season is likely to be Bitcoin stabilizing at $100,000, which is expected to happen in the first quarter of 2025. But the story of Q2/Q3 2024 could repeat itself in the coming months. Here are all the possible scenarios:

Scenario 1: BTC + Altcoins generally rise. Rise all the way in 2025, then enter another Alt Season, as BTC continues to rise and all tokens perform well, repeating the situation of the past 2 months, everything is rising (30-40% probability).

Strategy: Choose altcoins that perform well and buy on dips.

Scenario 2: BTC rises, and altcoins rise less; the story of 2024 repeats, fluctuating up and down in the next few months, but more bullish than 2024 (because BTC rises); so choose well-performing tokens (50-60% probability).

Strategy: Buy on dips in selected altcoins. Avoid the track with high attention and find the next "get-rich-quick coin"

Scenario 3: BTC rises, and altcoins generally fall (20-30% probability).

Strategy: Sell all altcoins. Reduce altcoin investment; if the altcoins you hold do not rise for a long time, you may have to sell them all.

Scenario 4: BTC falls, and altcoins generally fall. Everything has peaked (10-20% chance). A new BTC ATH breakout may not take as long as it will in 2024 because of the macro tailwinds. ETFs just launched and TradFi is still struggling to sell the BTC story to clients in this hellish summer. On top of that, the outside world is generally not convinced of the importance of Bitcoin. Now that Trump has won and discussions about a strategic Bitcoin reserve are taking place, even though the possibility of establishing a strategic Bitcoin reserve is low, the narrative of Bitcoin has changed. It’s the narrative that matters — the fact that we are in a new regime that has brought new attention to the digital asset space, and now that the next US president is talking about Bitcoin so frequently, it makes it much easier to convince people to buy Bitcoin. This regime change is extremely important. Therefore, BTC will continue to have a tailwind in 2025. For altcoins, the situation is similar, but different.

Total3 (total market capitalization of all altcoins) hits a 2021 all-time high in Q1 2024, and then reaches a cycle high in Q4 2024. It more or less follows the same pattern (Scenario 1 and Scenario 2 above are not much different).

The key is positioning and timing. Although bullish on 2025, it is unknown how long it will take. Although the rise in 2025 may be earlier than in 2024, altcoins will still fall sharply in the absence of catalysts.

As long as the cycle is not over, whether it is Bitcoin or altcoins, stay long. 2025 will not be the summer of 2024 again, although there may be periods like now (just a plateau), but the price still holds up pretty well.

The situation on the chain is different. When the tide recedes, it is easy to see a 70% drop on the chain. It is expected that altcoins have not peaked at this time, because it is not seen how BTC can continue to rise when altcoins "die", nor can it be seen that BTC peaks here.

Conclusion:

BTC up, up more than in 2024

Altcoins are on the rise, and while there will be declines, they will not be as strong as in 2024

Risks

Cycle top

It is far from the cycle top at the moment, but it must be re-evaluated on a weekly basis. The cycle top is not necessarily an "event", but more like a range that is slowly approached over time.

Bitcoin Reserve Program Risks

With the start of a new presidential term, all eyes will be on what Trump says and does. While the upside for Bitcoin exists, it would be quite pessimistic if Trump completely ignores the reserve program. More likely scenario is that the reserve plan didn't happen/was delayed by something.

In the latter case: it's initially bearish but ultimately bullish event as long as it's good for Bitcoin.

TLDR: Bullish signal = cycle continues. Bearish signal = plan must be revised. Cycle may continue, but chances are lower.

Supply Risk

Summer of 2024 saw a crazy macro environment with stocks hitting new highs. However, there was no upside, only downside, as supply giants like Mt. Gox, Grayscale GBTC, etc. kept hitting the market over and over again.

Supply risk can never be mitigated. There's always someone with a lot of Bitcoin - UK government, Silk Road, FTX distribution, etc. It's just something you have to keep an eye on, but if all goes well, these events are good dip buying events.

Macro Risks

A smaller rate cut is expected, which is not as optimistic, but the fact is that as long as interest rates continue to fall, liquidity will improve. Again, bullish signal = cycle continues. Unless there is a rate hike/no rate cut, macro should be favorable for digital assets.

Bearish signal is that inflation is rising again and the Fed may have to raise interest rates to reduce inflation.

Token Recommendations

1. AI

It has been through several waves so far. The next wave is expected to come soon. Buying and holding will not end well. Goat, the token that gave birth to it all, has fallen 60% from its highs and may continue to underperform.

First Choice: Applied Technology / Swarms / Games / Consumer-centric AI

ALCH (game development), Griffain (agent that helps control wallets), Digimon, Ai16z, etc. are all first choices.

2. DeFi

DeFi will continue to be a great narrative, but it is very difficult to invest because few tokens can benefit from it, and even if they benefit, they may not rise sharply.

Frankly speaking, DeFi is not the first choice in terms of risk-return.

First Choice: AAVE / ENA / Morpho / Euler / USUAL

Second Choice: Stablecoin / Payment Related Tokens

3. L1

L1 will make a comeback. The obvious one is Hype. L1 itself is something the market has been ignoring - it is one of those areas that no one pays attention to, but there are huge opportunities (just like Hype grew 10 times).

First Choice: SUI / Hype

Second Choice: Abstract

4. NFT Tokens and Game Tokens

The NFT token space deserves attention. PENGU is slowly coming back, Azuki has ANIME tokens, Doodles has… whatever it is. NFTs are not expected to have a resurgence, but tokens will return. Also, it’s fun to dig deeper and find interesting games that are about to launch tokens.

First choice: Pengu / Anime (Azuki) / Spellborne / Treeverse

Second choice: Prime / Off the grid (if the token is launched) / Overworld

5. Other narratives

Data Token: Kaito / Arkm

Meme: PEPE

DePIN: PEAQ / HNT

Ordinals

Old DeFi: CRV / CVX

DePIN will be implemented by a company in some way, perhaps an acquisition.

Binance will lose market share as the largest exchange. Not from Hyperliquid, but Bybit / OKX

Metaverse tokens gain new life as VR makes new progress

ICOs are great again

ETH on-chain alt season will not happen

Sui reaches double digits ($10 minimum)

Ethereum ETF staking is approved, giving rise to more yield products for staking other tokens, and yield aggregators

A big-name artist uses NFTs and tokens to maintain fans and reward them

Bitcoin reaches $200,000

More L1 institutions CEO/Founder leaves original company after seeing Aptos Labs CEO leave (PANews Note: On December 20, Aptos Labs co-founder Mo Shaikh resigned as CEO, co-founder Avery Ching will take over) Base lost in competition with L1s, another L1 took over. Solana continues to maintain

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Davin

Davin Hui Xin

Hui Xin Jasper

Jasper Jixu

Jixu Davin

Davin Joy

Joy