Author: Tina

It is the filing season for the 13F report in the United States recently. Investment funds have disclosed the holdings of spot Bitcoin ETFs in their reports. According to the document data of the regulatory agency, the number of fund institutions holding spot Bitcoin ETFs has increased to 1,950, which undoubtedly shows that investors are increasingly interested in this asset and are more optimistic about the development prospects of Bitcoin.

1. What is a 13F report

The 13F report is a report that the U.S. Securities and Exchange Commission (SEC) requires all investment funds with assets under management exceeding US$100 million to submit regularly.

Specifically, these investment funds need to submit once a quarter and must submit to the SEC within 45 days after the end of each quarter. For example, the deadline for submitting the 13F report for the second quarter is around August 14.

The main content of the report is to disclose the fund's holdings report, such as the current holdings, which stocks, bonds, and spot Bitcoin ETF funds were added last quarter, and which assets were reduced.

The reason why the US SEC requires this is, on the one hand, for regulatory needs, and on the other hand, in a sense, these institutional funds disclose their holdings to the SEC and the public, which is also of certain reference value to retail investors.

The quarterly financial reports of listed companies mainly disclose data such as the company's profitability, while the 13F report mainly discloses the fund's holdings, such as adding and reducing positions.

Of course, the 13F report also has certain limitations, such as the data has a certain lag, and there is no need to disclose the fund's short selling situation. In addition, funds with less than $100 million in managed funds do not need to submit 13F reports.

For funds holding spot Bitcoin ETFs, their 13F reports can reflect the changes in the fund's holdings in cryptocurrency ETFs. This information is a very valuable reference for cryptocurrency investors.

II. Institutional Fund Spot Bitcoin ETF Holdings

Through the above introduction, we have a basic understanding of the role and importance of the 13F report. Now let's take a look at the spot Bitcoin ETF holdings of these institutional funds.

Goldman Sachs:

As of June 30, Goldman Sachs has spent approximately US$418 million to purchase several spot Bitcoin ETF funds. Its main holding is BlackRock's spot Bitcoin ETF fund IBIT, with nearly 7 million shares worth more than US$200 million. Goldman Sachs is currently one of the top five holders of BlackRock's Bitcoin ETF. The second largest holding is Fidelity's spot Bitcoin ETF fund FBTC. It also holds Invesco's BTCO.

Morgan Stanley:

As of June 30, Morgan Stanley held 5.5 million shares of BlackRock's spot Bitcoin ETF IBIT, worth nearly $200 million. In addition, it also held a small amount of ARKB and Grayscale's GBTC.

Bank of America:

As of June 30, Bank of America held $2.8 million worth of IBIT and $1.5 million worth of FBTC.

Hedge fund companies:

1) Hedge fund company D.E. Shaw increased its spot Bitcoin ETF positions by more than US$170 million in Q2;

2) Hedge fund Capula holds spot Bitcoin ETFs worth US$464 million;

3) Millennium Management, a hedge fund that manages US$68 billion in assets, holds at least five Bitcoin spot ETFs, including iShares Bitcoin Trust (IBIT) issued by BlackRock.

Millennium's IBIT holdings in the second quarter decreased by 48% from the first quarter, with a market value of approximately US$371 million at the end of the quarter. Its holdings in the other two ETFs, Grayscale Bitcoin Trust (GBTC), which was transformed into an ETF, and Fidelity Wise Origin Bitcoin ETF (FBTC), which was co-issued by Fidelity, were reduced by 52% and 14%, respectively.

The media pointed out that Millennium significantly reduced its holdings of Bitcoin ETFs in the second quarter, but it is still the largest holder of most Bitcoin ETFs.

4) Hedge fund Jane Street reduced its holdings of Grayscale GBTC by 83% in the second quarter, and increased its holdings of BlackRock IBIT by US$220 million for the first time. In Q2, it held a total of 8 spot Bitcoin ETFs with a total size of approximately US$690 million. Its holdings in the first quarter were US$634 million, and its overall position in spot Bitcoin ETFs increased in the second quarter.

Pensions:

The Michigan Pension Fund bought $6.6 million of Bitcoin spot ETFs in the second quarter.

In addition, Schonfeld Strategy Advisors and Steven Cohen's Point72 Asset Management also reported ETF holdings. Other buyers included the Wisconsin Investment Committee and corporate market makers from Hong Kong to the Cayman Islands, Canada and Switzerland.

It can be seen that with the popularity of spot Bitcoin ETFs, more and more traditional institutional investors have begun to accept Bitcoin as an asset class, and more and more hedge funds, pensions and banks have begun to hold spot Bitcoin ETFs.

Overall holding changes:

After the deadline for submitting second-quarter 13F reports on Wednesday, 701 new funds reported holding bitcoin spot ETFs, bringing the total number of holders to nearly 1,950, according to Bloomberg.

According to data from Sina Finance, there are currently more than 4,200 13F institutions with a total market value of more than $34 trillion.

There are more than 1,900 investment fund companies holding spot Bitcoin ETFs, which is equivalent to nearly half of the 13F fund institutions holding spot Bitcoin ETFs, which is still a very high proportion.

Let's take a look at the overall holdings and reductions of these institutional funds:

Bitwise data shows that about 66% of institutional investors held or increased their holdings of Bitcoin through US spot exchange-traded funds in the second quarter.

According to the 13F documents submitted to the US Securities and Exchange Commission, 44% of asset managers increased their Bitcoin ETF positions in the second quarter, while 22% of asset managers remained stable. Only 21% reduced their positions and 13% withdrew.

Bitwise Chief Investment Officer Matt Hougan said: "This is a pretty good result, comparable to other ETFs."

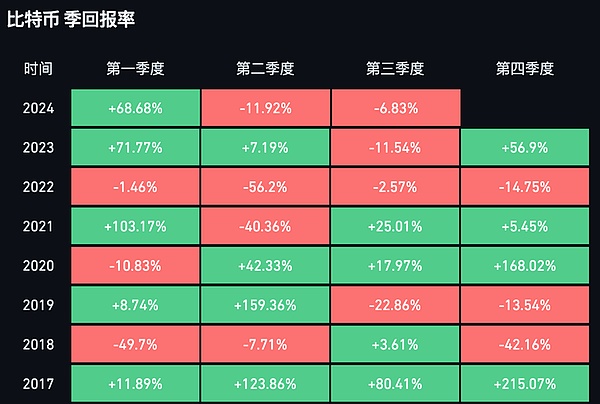

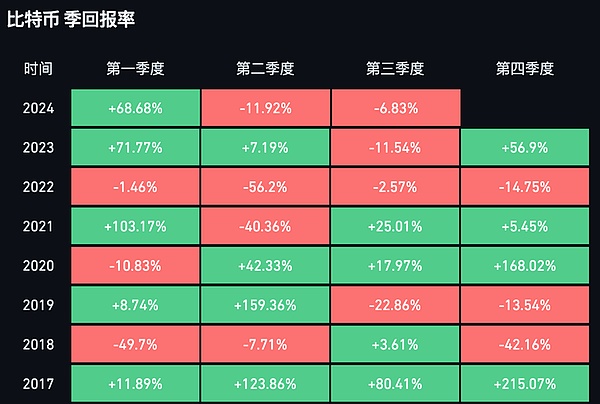

In addition, it is worth mentioning that the above funds established positions in Bitcoin ETFs when the price of Bitcoin fell by nearly 12% in the second quarter of this year. Considering the poor performance of Bitcoin prices in the second quarter and the fact that not many financial advisors on the market are allowed to recommend Bitcoin ETFs to clients, the increase in holders is particularly encouraging.

Three, Conclusion

Since the spot Bitcoin ETF was approved by the US SEC, more and more institutional investors have begun to indirectly hold Bitcoin through the spot Bitcoin ETF, which has continuously increased the acceptance of Bitcoin around the world.

Compared with retail investors, institutional investors hold positions more steadily and for a longer period of time, which is actually conducive to the stability of Bitcoin prices and the development of the entire cryptocurrency market.

In general, the compliance of Bitcoin and its widespread acceptance by mainstream institutions are an irreversible trend in the future. Only when Bitcoin is accepted by more institutional investors and mainstream groups can it have a broader development prospect and realize its grand vision of "the stars and the sea". As ordinary investors, we must follow this trend, actively participate in it, and share the dividends of development.

Sanya

Sanya