Author: ROUTE 2 FI Source: The Black Swan Translation: Shan Ouba, Golden Finance

The following are some protocols with untapped opportunities, including revenue opportunities and airdrops, etc. These projects come from different networks and fields.

1. Karak

Karak is a strong competitor of Eigenlayer with more than $900 million TVL. It raised $48 million in Series A financing from well-known investors such as Pantera and Coinbase Ventures, with a valuation of $1 billion. You can earn Karak XP, just like Eigenlayer Points, through several strategies, including depositing LRTs so that you get exposure to Eigenlayer Points while earning Karak XP.

Pendle has launched three pools for farming Karak, with more to come:

Pool 1: Deposit USDe and you can get 2x Karak XP and 20x Sats every day.

Pool 2: Deposit eETH and you can get 1.5x Karak XP, 2x Etherfi Points, and 1x Eigenlayer Points.

Pool 3: Deposit eETH and you can get 1.5x Karak XP, 2x Etherfi Points, and 1x Eigenlayer Points.

Pool 4: Deposit eETH and you can get 1.5x Karak XP, 2x Etherfi Points, and 1x Eigenlayer Points.

Third Pool: Deposit sUSDE and you can get ETH short-term funding rate, 5x Sats per day, and 2x Karak XP.

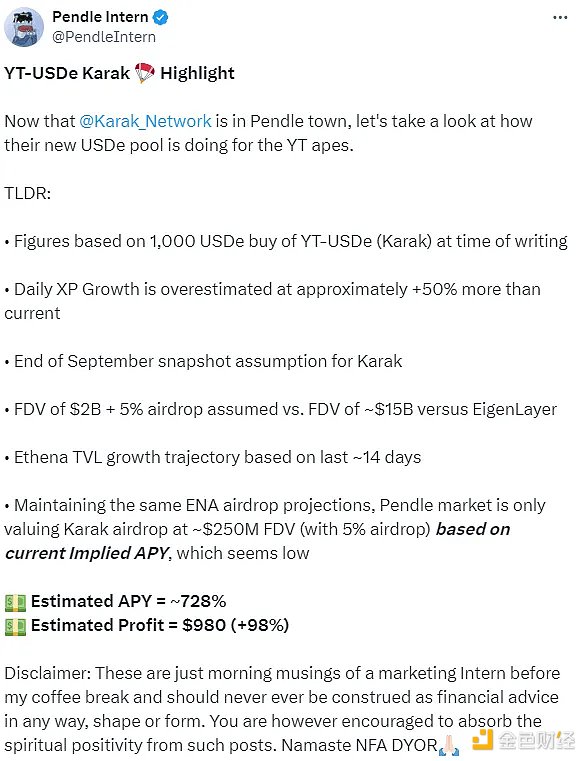

This pool has a cap of $100 million, so choose the pool you like. According to Pendleintern's Moonmath, if Karak is released with a $2 billion FDV, 5% of the supply is allocated and a snapshot is taken at the end of September, the average return on 1,000 YT-USDe is 98%.

2. Catalyst

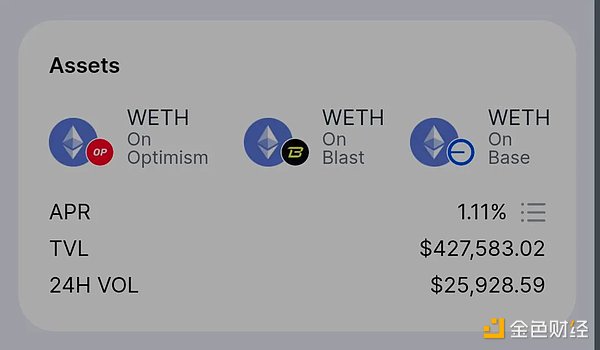

Catalyst is a cross-chain AMM that aims to connect all L1 and L2. They envision a future where all chains automatically connect and efficiently share liquidity when they are launched, eliminating inter-chain barriers and creating a global liquidity layer. The mainnet is live on Op, Base, and Blast, and more chains will be added. They raised $4.2 million in funding from well-known investors like Circle, Hashkey, and Spartan Group.

Catalyst has not been fully utilized; despite the mainnet being online for more than ten days, it has never been listed on DefiLlama and has a TVL of less than $500,000. According to the popular trend of projects rewarding users (airdrops),

Catalyst has a live event to earn eggs through your interactions over eight weeks; the more you exchange, the more eggs you get. Referrals and LPs are also taken into account, but early LPs will receive additional eggs based on the size and duration of liquidity provided.

3. BSX

BSX is a limit order book based on Base, with a non-custodial system of "off-chain execution" and "on-chain settlement", merging to form a decentralized exchange that offers a CEX-like experience, such as instant execution, high throughput, and 10 millisecond order matching. Backed by the Base Ecosystem Fund, it raised funds in an undisclosed funding round, with participants including Bankless. Their advisor is Arthur Hayes.

They have a points system similar to Hyperliquid, but a little different: 8 million points will be distributed over eight weeks/cycles, with 1 million points allocated each cycle. You can earn points by actively trading on the platform, but the system prevents fake activities such as wash trading. Due to different factors such as trading and referrals, there is no exact formula for the calculation of points to avoid system gaming. You can earn more points by holding positions longer, referring users, participating in events, or making deposits.

4. Avantis

Avantis is a decentralized leveraged trading platform where users can go long or short on synthetic assets, cryptocurrencies, foreign exchange, and commodities through a financial primitive called a "perpetual futures contract." If you are not familiar with perpetual futures contracts, it is an important derivative instrument that allows traders to speculate on the price movement of commodities without actually holding them. Unlike traditional futures contracts, perpetual futures contracts have no expiration date and users can hold them forever. It uses a funding rate mechanism to maintain the price of the underlying asset. The Base Ecosystem Fund also invested in Avantis and received $4 million in seed round financing from tier-one investors like Pantera and Galaxy.

Unlike other projects that launch a point system to continuously squeeze users, Avantis rewards users and builds organic relationships in a different way through a campaign called "Trade to Earn", which will distribute more than $250,000 in USDC rewards over 16 weeks ($15,000 per week). $15,000 is up for grabs each week based on trading volume; irregularities such as wash trading are discouraged by the system. The top five and top twenty traders on the weekly trading leaderboard will receive a Chad character on Discord and an Avantis hoodie, respectively. Considering their first-level fundraising, this project is still under-explored, with less than 3,000 traders on the leaderboard and a TVL of $7.5 million. 5. Kakarot Zkevm Kakarot is an Ethereum Virtual Machine (EVM) implemented in Cairo; it leverages STARK proofs to validate blocks and transactions while ensuring transparency and security. Kakarot's core vision is to bring EVM to Starknet, allowing developers to seamlessly deploy their Solidity contracts on Starknet, opening up new opportunities and expanding the Starknet ecosystem. They have received undisclosed investments from Starkwave, OKX Ventures, and Vitalik Buterin, who publicly supported them on Twitter.

They are currently in the public whitelist testnet phase, and your address needs to be on the whitelist to enter. The code to enter the whitelist phase is capped at 200, and 10 invites are given out each day on Discord and Telegram until the cap is reached.

6. Phoenix

Phoenix is a decentralized limit order book Dex on Solana, perennially ranked fifth in the Solana Dex category with over $18 million in TVL.

They raised $23 million in funding from S-level investors such as Paradigm. Despite the large amount of money they raised, they have low discussion and no ongoing events to keep the community engaged due to social media inactivity (e.g. the last tweet on Twitter dates back to May 3rd). Airdrop hunters don't like being in limbo, so they move on to other projects that hint at airdrops. However, OG farmers use this "uncertainty" to their advantage by interacting when no one is paying attention (these interactions are considered organic behavior by the project and rewarded generously). The only way to do this is to continuously trade on the platform. Whether Phoenix will launch a token is still speculation.

7. Superform

Superform is a universal yield market that allows users to deposit within or across chains without switching RPCs or bridging on their own, by using the Amb (cross-chain messaging) solution and two value transfer providers: Hyperlane (tokenless), Layerzero, wormhole, socket (tokenless) and Lifi (tokenless). Interaction with Superform also exposes you to other tokenless protocols, as most of their cross-chain transfer solutions are tokenless. They raised $6.5 million in funding from S-level investors like Circle and Polychain and angel investors like Layerzero founder Bryan.

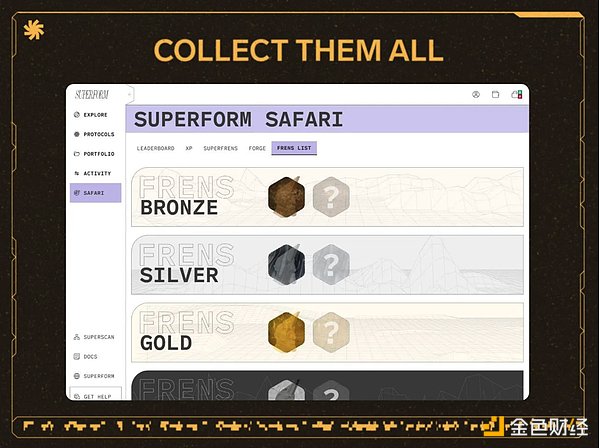

The Yield Market is finally open for access with an event called "Superform Safari," which includes tournaments where you can compete with others to climb the rankings and earn yield, XP, and superfrens NFTs. Anyone who deposits on Superform will earn XP in proportion to their USD position; the more XP you earn, the higher you rank on the leaderboard. Superfrens NFTs act as XP multipliers, and the rarer the better; there are three tiers that determine rarity, called frenslists.

8. Mantle

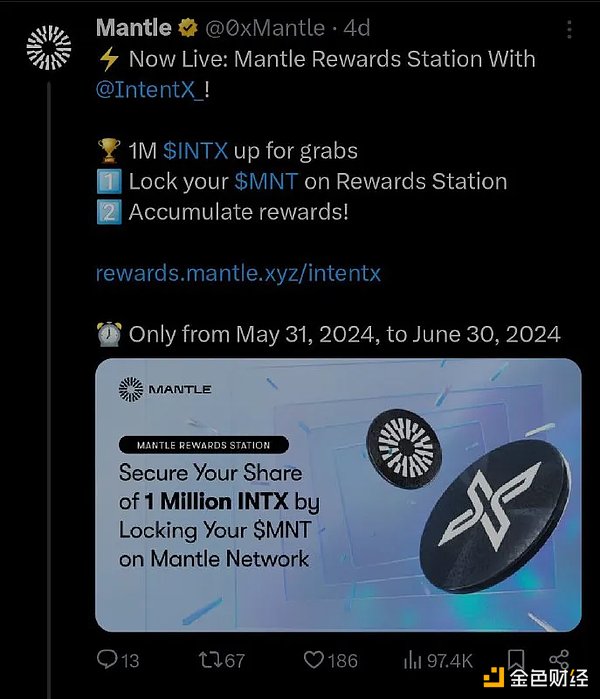

Mantle is one of the more than 100 L2s in DeFi today, but the difference is that there are well-known supporters like bybit (the third largest exchange) with more than $3.93 billion in vaults, ranking second only to Ethereum. One of the ways they use this huge vault is to enhance their ecosystem. For example, to increase the utility of $mETH (their own LST) holdings, they stake part of their treasury on Eigenlayer, in addition to double yield, making $mETH holders eligible for Eigenlayer airdrops, similar to what they did with Ena Sats. $Mnt stakers also earn free tokens through a campaign called “Reward Station”, and they recently provided an airdrop of 1 million $INTX tokens to $Mnt stakers.

They are now about to launch their LRT, called $cMETH, where Mantle deposits directly on a liquid re-staking platform (such as Eigenlayer) and provides receipt tokens $cMETH that can be reused in Dapps while accumulating yield. $cMETH is expected to launch in Q3 and provide a points system for early adopters, $mETH holders, and $Mnt stakers, looking forward to a new governance token called $Cook. More details will be discussed in the future.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Others

Others Tristan

Tristan Coinlive

Coinlive  Beincrypto

Beincrypto Nulltx

Nulltx Cointelegraph

Cointelegraph