Jessy, Jinse Finance

Recently, Ethereum experienced a historic surge in unstaked ETH, with over 900,000 ETH queued for unlocking, with the longest wait time stretching to 16 days. After hitting a high of $4,789, the price of Ethereum has been falling for nearly a week, dropping to just over $4,000.

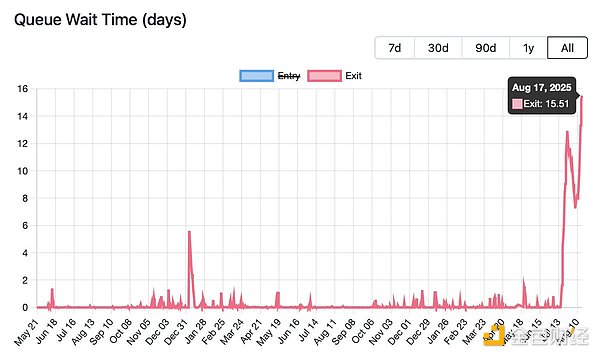

Is the excessive number of ETH waiting to be unlocked causing market concerns and triggering the price drop? Why is there such a massive outflow of funds? What is the underlying market logic? To understand this wave of unstaking, we first need to understand Ethereum's proof-of-stake (POS) mechanism. Since Ethereum switched to POS, validators have been able to participate in network block production and transaction validation by staking at least 32 ETH. In return, stakers receive an annualized return of approximately 2%–4%. Unlike traditional financial markets, Ethereum's staking mechanism is not always open. To maintain network stability, the Ethereum protocol imposes exit restrictions: only a limited number of validators are allowed to exit at any one time per epoch (approximately 6.4 minutes). This mechanism prevents a sudden drop in network security due to large-scale redemptions in a short period of time. However, this also means that when demand for exits surges, queues of over ten days, as is currently the case, can occur. The most direct trigger for this unlocking wave stemmed from decentralized finance lending protocols, particularly the unusually high ETH lending rates on the Aave platform. A Galaxy Research article noted that starting on July 14th, ETH lending rates on the Aave protocol began to periodically spike. While lending rates typically range from 2% to 3%, on July 16th, 18th, and 21st, rates soared to 18%. This volatility was caused by a sharp decrease in the ETH supply on the Aave platform, triggered by a large withdrawal from a wallet associated with the HTX exchange. Since June 18th, this wallet has withdrawn over 167,000 ETH. This sudden drop in ETH deposits put pressure on users running ETH rotation strategies on the Aave platform and led to a surge in some redemption requests. Under Aave's algorithmic interest rate model, interest rates automatically spike when borrowing demand far exceeds the available lending supply. This drastic interest rate shift directly destroyed the "ETH circular leverage" strategy widely used by many investors. When borrowing costs (18%) far exceeded the Ethereum staking yield (approximately 2.9%), this strategy ceased to be a profit-maker and instead became a loss-making machine. Faced with sharply rising funding costs, many traders and institutions employing this strategy were forced to deleverage, leaving their only option to unlock staked ETH to repay high-interest loans. This forced, large-scale liquidation accounted for the majority of the exits. Unstaking does not equal selling; it's not a crisis, but a sign of Ethereum's maturity. However, some large investors were indeed taking profits. Prior to this, ETH prices had experienced a strong rally, nearly reaching new highs, and many early stakers had reaped huge returns on their locked-up assets. Exiting near the price peak, unlocking staked ETH and selling it on the secondary market, is a classic strategy for locking in profits and realizing a return on investment. Therefore, a significant portion of the ETH in the exit queue comes from these long-term investors. The concentrated liquidation of leveraged strategies triggered a chain reaction in the market, creating an entry point for a third force: arbitrageurs. When a large number of users rushed to sell liquidity staking tokens (such as Lido's stETH) to repay loans, their prices briefly decoupled from the underlying ETH asset, creating an opportunity for discerning arbitrageurs. They purchased large quantities of liquidity staking tokens at a discount and then redeemed them for ETH at a 1:1 ratio through official channels, earning risk-free profits. This arbitrage activity undoubtedly further increased the length and size of the exit queue. However, it is worth emphasizing that although the current Ethereum price has fallen due to potential selling pressure, this wave of unlocking is not a sign of crisis. On the contrary, it demonstrates the strong resilience of Ethereum's PoS mechanism and ecosystem. Market participants acted based on clear economic signals, not panic. Ethereum's exit mechanism operated smoothly as designed, handling the unprecedented volume of requests in an orderly manner. This shows that this is not a crisis, but rather a strong demonstration of Ethereum's maturity as a decentralized financial economy. Galaxy Research's article also pointed out that despite large-scale withdrawals, new staking demand remains strong, almost offsetting the impact of withdrawals. This shows that the market remains confident in Ethereum's long-term prospects.

Clement

Clement

Clement

Clement Catherine

Catherine Hui Xin

Hui Xin Clement

Clement Brian

Brian Aaron

Aaron Jixu

Jixu Jasper

Jasper Clement

Clement Kikyo

Kikyo