Original text; https://newsletter.banklesshq.com/p/which-defi-protocols-are-profitable

By Ben Giove, Analyst, Bankless

A defining theme of the 2022 bear market is the growing focus on fundamentals in all areas of crypto, especially DeFi.

Reckless spending habits and a lack of sustainable business models have come into focus as prices have fallen. While many blue-chip DeFi protocols have been lauded for their ability to generate revenue, less attention has been paid to whether they are actually profitable.

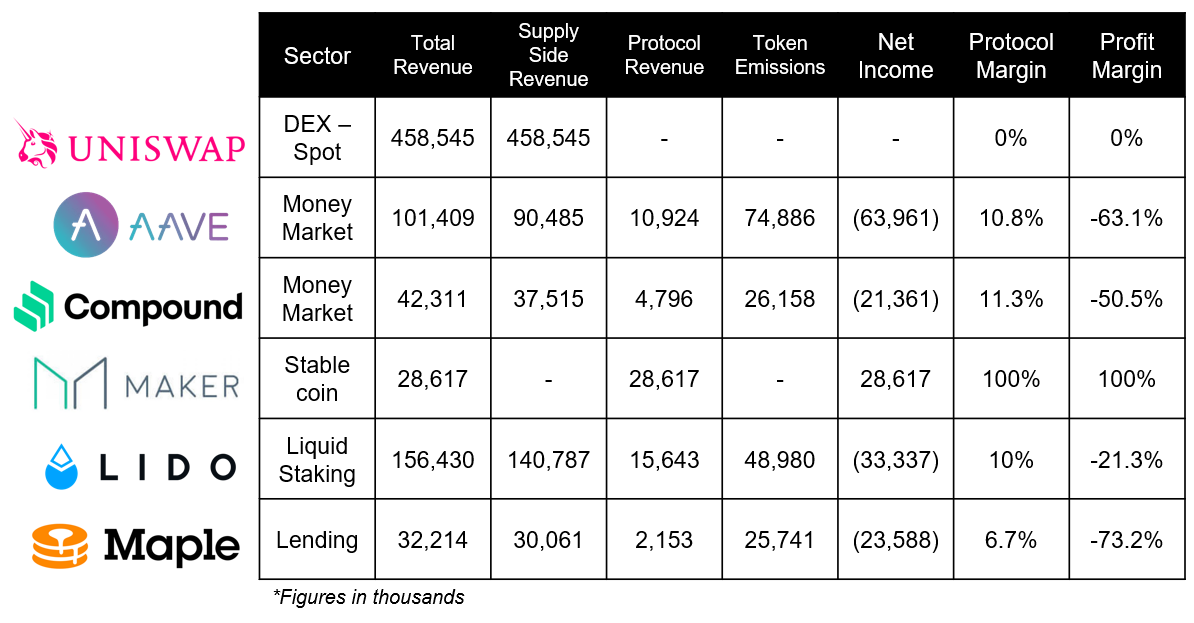

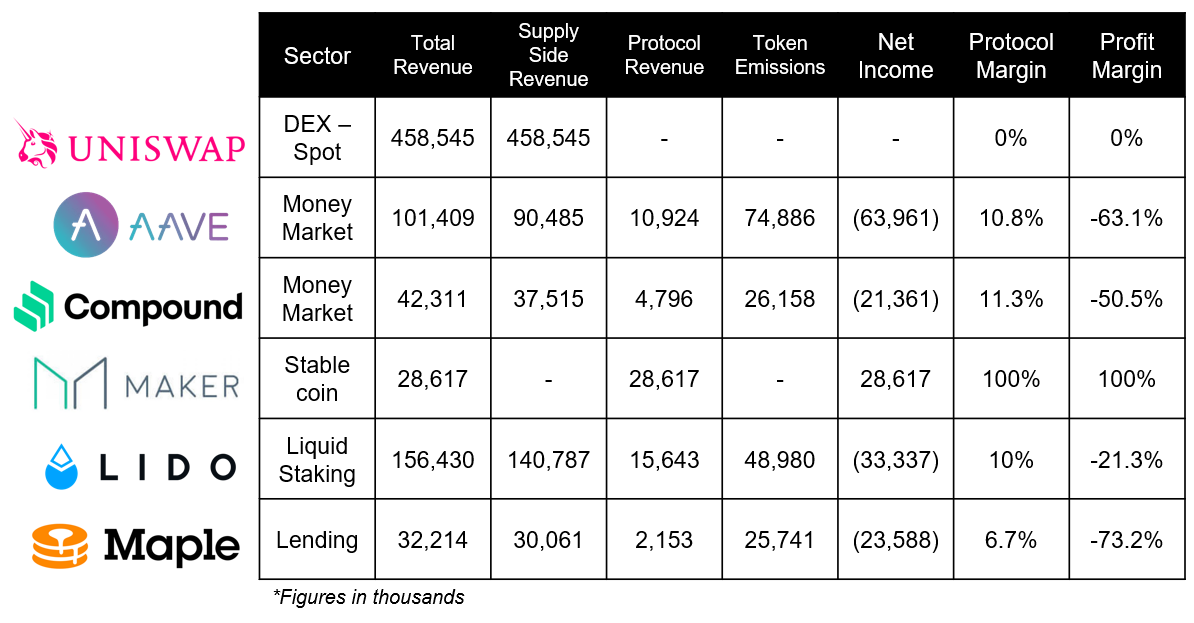

Let’s take a look at the profitability of six market-leading blue-chip protocols Uniswap, Aave, Compound, Maker, Maple, and Lido over the past six months, and dive into the wider implications.

Define Profitability

Before starting our analysis, it is important to define what it means to be profitable for a protocol, on which there is currently a lack of clear consensus.

While all DeFi protocols generate revenue to compensate participants (such as lenders or liquidity providers) for the risk they take, not all protocols capture some value for themselves.

Furthermore, the main costs of generating such revenue are often seldom discussed. Like many businesses, the protocol "costs money to make money". They have costs to spend , and no matter the industry, the largest and most common cost is releasing tokens.

Tokens are a very powerful tool that can be used to incentivize all types of behavior, and are most commonly used in DeFi to incentivize usage in the form of liquidity mining.

With these concepts in mind, in our analysis we will use the profitability definition outlined in the Talking About Fight Club article "Comparing DEX Profitability".

In it, the authors define profitability (net income) as:

Net Income = Agreement Income - Released Amount

While the authors refer to protocol revenue in the context of fees charged to token holders, we will expand this definition to include all DAO revenue, whether they are directed to token holders, accrued to the treasury, or for any other purpose.

Release refers to tokens distributed to participants in the protocol, such as through liquidity mining or referral programs. This definition does not include team or investor unlocks.

While it doesn't cover all operating expenses, such as compensation, it does provide a good indication of the profitability of the protocol for a given DAO operation.

profit ratio

In addition to focusing on net income, we'll also discuss profitability. Profitability is a valuable metric that allows us to understand how efficiently each protocol captures a portion of the total revenue it generates, and will allow for more nuanced comparisons of profitability.

The two ratios we will use are "protocol margin" and "profit margin".

Protocol Margin is a measure of the protocol’s acquisition rate, or what percentage of the total revenue generated should go to the DAO. It is calculated by dividing agreement revenue by total revenue.

result table

profit agreement

Maker

Maker earns income by charging borrowers interest (called a stability fee) and by taking a cut from protocol liquidations.

During the six-month period, the protocol generated $28.61 million in gross revenue, all of which went to the DAO. Since Maker has no token releases, its protocol and profit margins are 100%. Nonetheless, it’s worth mentioning that Maker is one of the DAOs that provides insight into its operating expenses, although the protocol has managed to remain profitable during this period.

unprofitable agreement

Aave

Aave generates revenue by taking a cut of the interest paid to lenders on the platform.

Over the past six months, Aave’s total revenue was $101.41 million, of which $90.48 million was paid to lenders (supply-side revenue) and $10.92 million was paid to protocols. This gives them an agreement yield of 10.8%.

However, Aave paid out $74.89 million in rewards as token releases during this period, costing the protocol $63.96 million.

compound

Compound generates revenue by taking a cut of the interest paid to lenders (although this is currently used as a buffer against the protocol’s reserves).

Compound generated $42.31 million in revenue, of which $4.8 million was owned by the protocol. This gives them a margin of agreement of 11.3%, which is 0.5% higher than Aave's main competitor.

Despite higher margins, Compound still lost $21.36 million over six months (though less than Aave).

Maple Finance

Maple generates revenue from origination fees collected on loans issued by pool representatives, the entities that manage pools on the platform. Currently, the fee is 0.99%, with 0.66% allocated to the protocol (split between the DAO treasury and xMPL stakers), and the remaining 0.33% allocated to pool representatives.

Maple generated $2.15 million in protocol revenue over the past six months, while paying out $25.74 million in MPL incentives to encourage deposits into various pools, which cost them $23.58 million over the period.

Lido Finance

Lido earns by taking 10% of the staking rewards earned by validators on the Beacon Chain.

In this regard, Lido generated $15.64 million in protocol revenue while unlocking $48.98 million in LDO by incentivizing liquidity on exchanges like Curve and Balancer and through Voitum brides and protocol referral programs.

That means Lido lost $33.34 million during the period.

potentially profitable agreement

Uniswap

Uniswap generated $458.5 million in revenue for liquidity providers in the past six months. However, none of this is factored into the protocol, as Uniswap has yet to turn on a "fee switch" where the DAO can earn 10-25% LP fees for the pools that open it.

It’s unclear what impact the fee switch will have on Uniswap’s liquidity, as cutting fees for liquidity providers could cause them to migrate to other platforms. This could worsen trade execution, reducing trading volume in the highly competitive DEX industry.

The advantage of Uniswap is that it has zero releases in the past 6 months, so if they choose to turn on the fee switch, the protocol has a high probability of being profitable.

main point

As we can see, MakerDAO is the only one of the six protocols that is profitable by our definition.

On the one hand, this is understandable. The vast majority of early-stage startups—and DeFi protocols are of course questionable—are unprofitable.

In fact, the protocols listed above, and many others, simply follow the Web2 model of operating at a loss to fuel growth, a strategy that has proven to be very successful for a variety of different startups and corporations.

Still, issuing tokens is of course an inherently unsustainable strategy. Money is not infinite, and yield mining schemes are highly reflexive, losing their potency and effectiveness the longer they last due to the perpetual sell pressure they exert on the tokens being issued. Additionally, since DAO treasuries are typically denominated in the protocol’s native token, the selling pressure of token offerings often robs the protocol of its ability to capitalize itself.

Perhaps more worrisome than the lack of profitability of these blue-chip deals is their thin profit margins.

For example, lenders such as Aave, Compound, and Maple have protocol margins of just 10.8%, 11.3%, and 6.7%, respectively, meaning they only receive a fraction of the total revenue generated by their platforms. Lido has an 89.9% market share in the liquidity staking space with a protocol margin of just 10%.

Given the intense competitive dynamics within DeFi, these protocols are unlikely to significantly increase their profits, or they would expose themselves to the risk of losing market share to competitors or being forked.

To make these protocols profitable, the real solution may be to think outside the box and create higher-margin revenue streams.

While this is certainly challenging, we've seen the earliest signs of DAOs doing this, such as Aave launching their GHO stablecoin, which would have a similar business model to Maker (with higher margins and not having to rely on based on token incentives).

Joy

Joy