Explosive market growth has created an extremely hot market for buying and selling NFTs. 2021 has witnessed the rapid expansion of existing markets and the emergence of new ones. NFT can be minted and traded on different blockchains such as Solana, Tezos, Flow. However, most transactions still take place on Ethereum, and the Ethereum-based marketplace has dominated the entire NFT market since its inception.

What is Ethereum?

Ethereum is the largest and most well-known blockchain project after Bitcoin. It was created in 2013 by Vitalik Buterin with the vision to expand the potential of blockchain beyond cryptocurrencies. Ethereum does have its own currency, ether, but also provides a platform for various decentralized applications (dapps) in DeFi, gaming, the metaverse, and other industries. The number of dapps on Ethereum is about 3000 .

Ethereum currently has a market capitalization of about $373 billion , roughly half of Bitcoin's market capitalization. Meanwhile, third-ranked Tether has just $83 billion.

What is an Ethereum-based marketplace?

The NFT marketplace allows creators to sell their NFTs and earn royalties, and all other users to buy, store and resell NFTs. Different marketplaces record all transactions on the respective blockchains, and Ethereum-based marketplaces authorize NFT transactions on Ethereum.

Ethereum has two main NFT token standards - ERC-721 and ERC-1155. ERC-721 is by far the most commonly used and sets the minimum data required for transactions on the network, such as ownership details and security. ERC-1155 allows for lower creation and storage costs.

Ethereum is one of the original blockchains for NFTs. The first NFT project on Ethereum appeared as early as 2015-2016, and the first projects based on Ethereum that popularized NFT and promoted the NFT market were CryptoPunks and CryptoKitties in 2017.

Many Ethereum-based marketplaces are primary marketplaces for specific NFT collectibles, games, or Metaverse items. Examples include CryptoPunks , Decentraland , Axie Infinity marketplaces. Other marketplaces offer users NFTs from various fields, including collectibles, art, sports, metaverse, games, and more.

OpenSea , by far the largest NFT marketplace, is an example of such a diverse marketplace. Other marketplaces focus on unique artistic NFTs, catering to collectors and investors in digital art. SuperRare and Foundation are such projects.

Who is the biggest player?

According to Dune Analytics , the total volume of Ethereum-based NFT transactions has exceeded $50 billion so far.

Historically, OpenSea has dominated not only Ethereum-based transactions, but also NFT transactions in general. While LooksRare has captured a sizable share of total transaction volume since its launch in January 2022, OpenSea still holds the highest share of total transaction volume (55% in the past 30 days, according to Dune Analytics estimates).

Data source: DappRadar.com, Dune Analytics

OpenSea is also the absolute market leader in terms of the number of traders: with more than 1.5 million users, far more than LooksRare and Rarible. Art and Metaverse markets, as well as major markets like LarvaLabs' CryptoPunks, also have fewer users because they are more specialized than OpenSea.

Data source: DappRadar.com, Dune Analytics

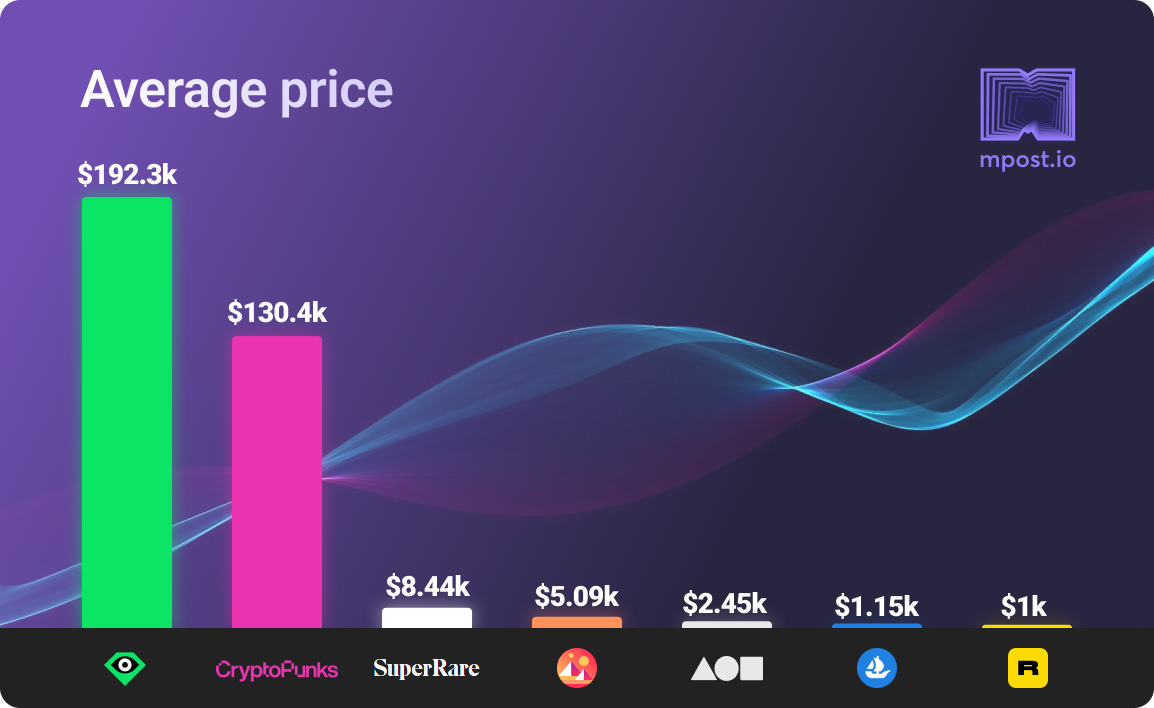

LooksRare is the highest on the market in terms of average NFT price, which explains how it took over such a large market share in a short period of time with far fewer traders than OpenSea. One of the reasons for such a high price on LooksRare is wash trading, which we will discuss later.

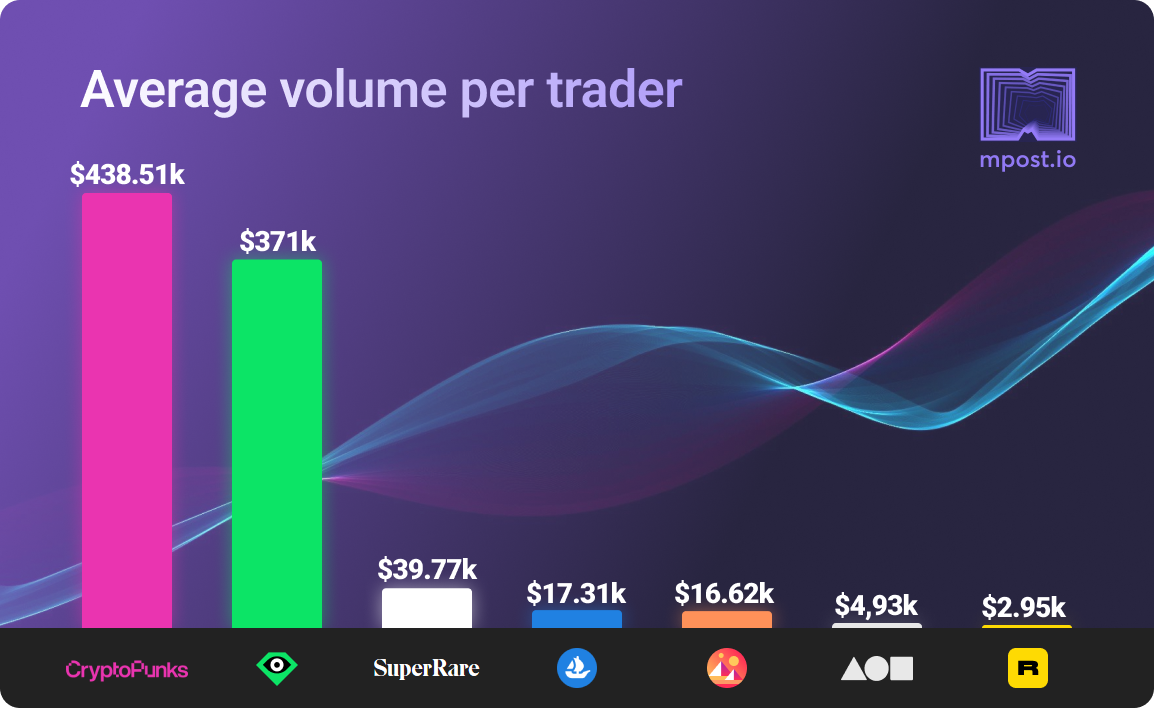

CryptoPunk is one of the most coveted NFT collectibles, with some selling for all-time high prices . So it’s no surprise that the average CryptoPunk price is over $100,000. The average transaction volume per trader exceeds $400,000, the highest in the Ethereum market.

The average NFT price on Rarible is the lowest, and the average transaction value per trader is also the lowest. One reason for this is that the market share of NFTs will drop significantly by the end of 2021-2022, when transactions actually peak and NFTs are trading at ever-increasing prices. Most of Rarible's sales occurred in the first half of 2021, when the average price of NFTs was significantly lower.

Data source: DappRadar.com, Dune Analytics

Data source: DappRadar.com, Dune Analytics

The data shows that the vast majority of NFT transactions occur in multi-segment markets, namely OpenSea and LooksRare. An overview of each major NFT market is summarized below.

OpenSea

Trading volume

$27.5 billion in total $2.48 billion in one month

average price

$1150 all time $1560 per month

number of traders

Total 1,587,556

489,796 per month

Rate 2.5%

OpenSea was founded in 2017 by Devin Finzer and Alex Atallah, who were inspired by the success of CryptoKitties. The idea at the time was to create an "NFT marketplace for everything for everyone." OpenSea has grown into a massive marketplace with over 2 million NFT collectibles , over 80 million unique NFTs, and 600,000 active users. The number of employees has also increased to more than 200.

In 2021, with the full development of the NFT market, OpenSea has experienced rapid growth. The sales growth rate is 100% every month. In January 2022, its sales peak at $5 billion .

While most transactions on OpenSea are still based on Ethereum, it has also been extended to Polygon - a project that aims to provide cheaper transactions. Solana’s NFT transactions are currently in beta.

As a fast-growing company in a booming market, OpenSea has not escaped "growing pains". In early 2022, OpenSea experienced a security breach in which nearly $1.7 million was stolen from its users.

Another issue is the dispute over the intellectual property rights of NFT creators. In 2021, OpenSea banned what was believed to be a "fake" version of the famous Bored Ape Yacht Club NFT. In 2022, OpenSea banned users from some countries according to the US sanctions list. These moves put OpenSea in conflict with Web3's principle of being uncensorable.

In addition, OpenSea adopts fully centralized management and does not issue any governance tokens. Coupled with rumors of an imminent listing, OpenSea has been heavily criticized by cryptocurrency experts.

Top 5 NFT collections (within the past 30 days)

Moonbirds

Azuki

Mutant Ape Yacht Club

Bored Ape Yacht Club

Clone X

Looks Rare

Trading volume

Total $23.87 billion $2.36 billion in one month

average price

$192,300 all time $93,900 per month

number of traders

Total 64,355

15,390 per month

Launched in January 2022, LooksRare directly challenges OpenSea's dominance in the market with a vision of a truly decentralized and censorship-free market - By NFT People, to NFT People (Give Everything to the NFT Community) . The founder of this company is also adhering to the fine tradition of encryption technology, and has been using the aliases Zodd and Guts.

Complete decentralization includes distributing 100% of earnings to platform users. On January 10, LooksRare airdropped $LOOK, and the next day the platform’s sales exceeded $115 million, surpassing OpenSea. Aggressive marketing in the crypto community has played a major role.

Since January, LooksRare has managed to steal a chunk of the market from OpenSea. However, the average price of NFTs sold on LooksRare is much higher and its number of monthly traders is much lower than OpenSea. This means that LooksRare has a lot of "wash-trading" (wash-trading), that is, users turn their left hands to their right hands to drive up prices. And, in LooksRare's case, shuffling trades also allows participants to earn $LOOK.

Several blockchain researchers confirmed the existence of a large number of shuffled transactions on LooksRare. According to CryptoSlam , the volume of wash trades on LooksRare is estimated at $8.3 billion, with Meebits and Terraforms being typical of such trades.

Wash trading, as a form of market manipulation, is illegal in financial markets. While not currently illegal in NFTs, it is a gray area that many market participants may consider to be at least unethical. How this will affect the future of LooksRare, we will wait and see. LooksRare still has a sizable presence in the real deal market, though.

Top 5 NFT series:

Terraforms

Mebeets

Dot dot dot

CATGIRL ACADEMIA

Mutant Ape Yacht Club

Rarible

Trading volume

Total $293.04 million $1.62 million per month

average price

$1000 all time $491.02 a month

number of traders

Total 99,331

3,315 per month

Rate 2.5%

Rarible was founded in 2020 by Alex Salnikov. Its business model is very similar to OpenSea. It houses NFTs from different fields (collectibles, art, sports, metaverse, games) and caters to a wide range of users. The lower average price compared to OpenSea indicates that the platform sells more game NFTs (often at a lower price than collectibles or artwork), but their value is lower due to the platform's decline in popularity in recent months.

Unlike OpenSea, Rarible uses decentralized governance . Holders of its token $RARI can vote and decide key issues of the project. $RARI is distributed weekly to active users until January 2022, when the community votes to use these tokens for projects based on the Rarible protocol.

While similar to OpenSea, Rarible charges a 2.5% sale fee, it offers NFT developers a higher royalty (up to 50% vs. OpenSea's 10%).

Rarible supports multiple blockchains, including Ethereum, Tezos and Flow, which means users can create, sell and buy NFTs on these blockchains.

Despite offering similar services, decentralized governance, and higher royalties, Rarible still has a low market share compared to OpenSea. One possible reason is OpenSea's first-mover advantage, as well as accumulated network effects. Another possible reason is that the management of OpenSea has high flexibility in adapting to market demands.

Top 5 NFT series (within the last 30 days):

Moonbirds

Azuki

Mutant Ape Yacht Club

Bored Ape Yacht Club

Clone X

SuperRare

Trading volume

Total $233.32 million $880,520 per month

average price

$8,440 all time $10,600 a month

number of traders

Total 5,867

single month 131

Rate 3% (only for buyers)

Founded in 2018 by John Crain, Charles Crain and Jonathan Perkins, SuperRare focuses on the unique digital art market. The project bills itself as "Instagram meets Christie's." Compared to OpenSea or LooksRare, SuperRare is one of the more niche platforms targeting art collectors and investors. While the number of traders is modest, the platform can earn handsome fees from some expensive art sales.

In 2021, SuperRare adopted decentralized governance , introduced a DAO and community-curated collection, and distributed RARE tokens, 15% of which were distributed through airdrops and 14.5% went to investors.

SuperRare has had some of the most expensive NFT sales to date. In 2018, XCOPY's artwork "A Coin for the Ferryman" ( A Coin for the Ferryman ) was sold for $6 million. In 2021, Ross Ulbricht's " Genesis Collection, " consisting of original compositions, artwork, and animation, sold for $5.93 million on SuperRare.

Foundation

Trading volume

Total $152.89 million $6.45 million per month

average price

$2450 all time $1780 per month

number of traders

Total 30,991

3,398 per month

Rate 5%

Foundation is a relatively new marketplace and has quickly captured a sizable share of art NFT transactions.

The Foundation was founded in 2021 by Kayvon Tehranian and Matthew Vernon . This is a platform for curating art. Foundation accepts only invited users, meaning artwork can only be created by invited artists, giving the platform a sense of exclusivity. Artists on the list include big names in digital art such as Pak, Jen Stark, Shawna X.

Here, NFT is sold by auction. Foundation charges a 15% commission on all first-tier sales, similar to other digital art-focused platforms like SuperRare.

Some of the most expensive sales on the platform include a Nyan Cat meme NFT that sold for more than $500,000, and Pak's Finite artwork that sold for $800,000.

Makers Place

Trading volume

Total $25.76 million $26,440 per month

average price

$1520 all time $1200 a month

number of traders

Total 4,805

single month 41

Rate 2.5%

MakersPlace is one of the first "art gallery" type NFT marketplaces. Pinterest employees Yash Nelapati, Dannie Chu, and Ryomi Ito began developing the platform in 2016, with the eventual full launch in 2019. The main feature of this platform is the authenticity of all artworks - through a multi-step process to verify artworks.

In 2021, MakersPlace made headlines when it teamed up with renowned artist Beeple and auction house Christie's to sell Beeple's The First 5000 Days . The piece sold for $69.3 million, making it the most expensive NFT piece ever sold.

Despite raising $30 million in VC funding in 2021, the platform has never surpassed $20,000 in daily transaction volume, and in recent months, transaction volume has declined further. This hints at a bleak future for the platform, barring major changes down the road.

primary market

The primary market is the marketplace where NFTs from a specific series, game, or metaverse are minted and traded. Often, these NFTs are also tradeable on secondary markets such as OpenSea and LooksRare, so transaction statistics include data from both primary and secondary markets.

The first professional primary market on Ethereum is the CryptoPunks market. CryptoPunks is an NFT collection of 10,000 unique characters. It was created by LarvaLabs in 2017 and became the inspiration for the ERC-721 token standard. Since its launch, CryptoPunks have totaled $2.66 billion in sales, with some NFTs also fetching all-time highs. Recently, YugaLabs purchased the rights to CryptoPunks.

A typical example of a gaming marketplace on Ethereum is the Axie Infinity marketplace . Axie Infinity is a blockchain-based video game launched by Sky Mavis in 2018. Players can create and collect digital creatures called Axies in the game. The game quickly became popular, with Axies trading volume on Ethereum reaching $18 million at an average price of $110. In 2021, Axie Infinity moved to the Ethereum sidechain Ronin.

The largest metaverse marketplace on Ethereum is Decentraland . Decentraland is a virtual world where users can explore, interact and develop their own space. On the Decentraland marketplace, users can buy and sell LAND tokens that represent assets in the Metaverse. The Decentraland marketplace does not charge any fees. Decentraland’s total sales were $140 million, with an average price of $5,000. In 2021, a piece of land on Decentraland sold for $2.4 million, making it one of the most expensive virtual properties.

The Future of Ethereum-Based Marketplaces

The NFT market has experienced rapid growth in 2021, making it the fastest growing segment of cryptocurrencies. In January 2022, after the market volume peaked, it began to show signs of cooling. While some experts have expressed concerns about a bursting bubble , the market contraction could equally mean that the market has entered a more mature state after an initial boom.

Ethereum-based markets have dominated the market from the beginning. However, competition is becoming more intense as other blockchains tend to offer lower fees and faster transactions. JPMorgan analysts estimate that Ethereum’s share of NFTs has fallen to 80%, compared to 95% in early 2021.

Ethereum, like Bitcoin, is a proof-of-work blockchain, which means running the network consumes a lot of electricity. This feature of Ethereum has led to claims that NFTs are not climate friendly since most NFTs are on Ethereum. This could become a problem when more ESG-conscious tech companies and investors enter the market. As one of the challengers of Ethereum, Solana uses proof of stake and is a greener blockchain.

Markets are able to quickly adapt to challenges and user needs. Many Ethereum-based marketplaces now offer multi-chain support. For example, OpenSea supports Polygon in 2021, and Solana-based NFTs are currently undergoing beta trading testing.

Although in decline, Ethereum is likely to remain a big NFT player for some time. The future of Ethereum-based NFT transactions will have an impact on Ethereum itself, as NFTs and the Metaverse are likely to become one of the dominant industries in the crypto space.

Original: https://mpost.io/nft-marketplaces-on-ethereum-a-market-overview/

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Nell

Nell Beincrypto

Beincrypto Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph