During the liquidity surge brought on by the bull market, TVL is the preferred metric for investors to measure the success of the protocol and its usage.

Now that liquidity is drying up, investors' attention has shifted to fundamental revenue and profitability metrics.

Fundamentals always matter. They are just overshadowed by the bull market, but not eliminated.

It's important to remember that DeFi protocols are startups. Even the oldest DeFi protocols are only a few years old, while many are only a few months old.

It is unrealistic to demand immediate profit now.

However, the auditability and transparency of the blockchain gives us the unique ability to better understand these agreements and assess paths to profitability.

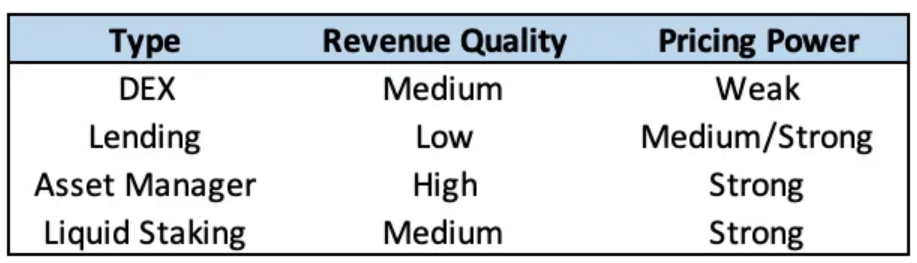

People like to compare DeFi to a single monolith — but it's not. Each type of DeFi protocol operates a different business, differing in revenue quality and pricing power due to their competitive advantages.

In a mature market, like TradFi or Web2, you would expect projects with higher quality revenue and pricing power to trade at higher valuations than projects with lower quality revenue and lower revenue.

Which DeFi protocols have the best business models?

To find out, this article delves into the business models of four different types of protocols: decentralized exchanges (spot and perpetual), lending markets (over-collateralized and under-collateralized), asset management protocols, and liquid pledge protocols.

decentralized exchange

- Description: Refers to the agreement to operate a spot or perpetual futures exchange

- Examples: Uniswap, Curve, Balancer, GMX, dYdX, Perpetual Protocol

- How to generate income: Both spot and perpetual futures exchanges generate income from transaction fees. Fees are split between the protocol and the DEX’s liquidity providers, but the distribution varies from exchange to exchange, with the former often choosing to distribute some (or all) of their shares to token holders.

Quality of Income: Moderate

The income of DEX is of medium quality.

DEX revenue is difficult to predict because trading volume is correlated with market activity. While exchanges will see considerable volume during any period of volatility, be it an upswing or a downswing, over the long term trading activity tends to increase during bull markets and decrease during bear markets.

The income of DEX can be high profit or low profit, it depends on the exchange.

This is due to the degree to which different DEXs choose to incentivize liquidity in order to gain market share.

For example, dYdX released $539.1 million in tokens in the past year, with an operating loss of $226.8 million and a profit margin of -73%.

However, other exchanges such as Perpetual Protocol have managed to remain profitable as the DEX released only $5.9 million in tokens, making a profit of $10.9 million at a 64.6% margin.

Whether frugal or aggressive growth will pay off in the long run remains to be seen.

Pricing Power: Low/Moderate

Spot exchanges and derivatives DEXs have different pricing power.

In the long run, spot DEXs are vulnerable to fee compression because they are not risk-managed, easily fork, and have low switching costs for traders looking for best execution on their swaps.

While some liquidity and trading volume may be loyal to individual exchanges due to their brand recognition and user base trust, spot DEXs are still vulnerable to the price wars we see in centralized exchanges. The first signs of this are already starting to emerge, with Uniswap already adding a 1bps fee tier for certain trading pairs, primarily stablecoins.

DEXes that offer leveraged trading (such as perpetual contracts) are less susceptible to these pricing pressures than spot DEXs. One reason for this is that these exchanges require their DAOs and core teams to actively govern and maintain the exchange to manage risk, as these stakeholders are responsible for setting parameters such as new market listings and margin ratios.

Additionally, DEXs that offer synthetic leverage and can list new markets with only a reliable price feed can more easily differentiate from other competitors by supporting new assets.

borrow money

- Description: A protocol that facilitates over-collateralized or under-collateralized lending

- Examples: Aave, Compound, Euler Finance, Maple Finance, TrueFi

- How it generates income: The overcollateralized lending market generates income by taking a cut of the interest paid to lenders. The under-collateralized lending market generates revenue by charging origination fees, and some also take a cut of the interest paid to lenders.

Quality of income: low

The income quality of the lending platform is not high.

Interest income in the overcollateralized lending market and interest income in the undercollateralized lending market are unpredictable. This is because it, like transaction fees, depends on market conditions.

Borrowing demand is positively correlated with price movements, as leverage demand increases when prices rise and decreases when prices fall.

Origination fees for under-collateralized lending protocols are also unpredictable because the demand for under-collateralized lending is based on the same factors.

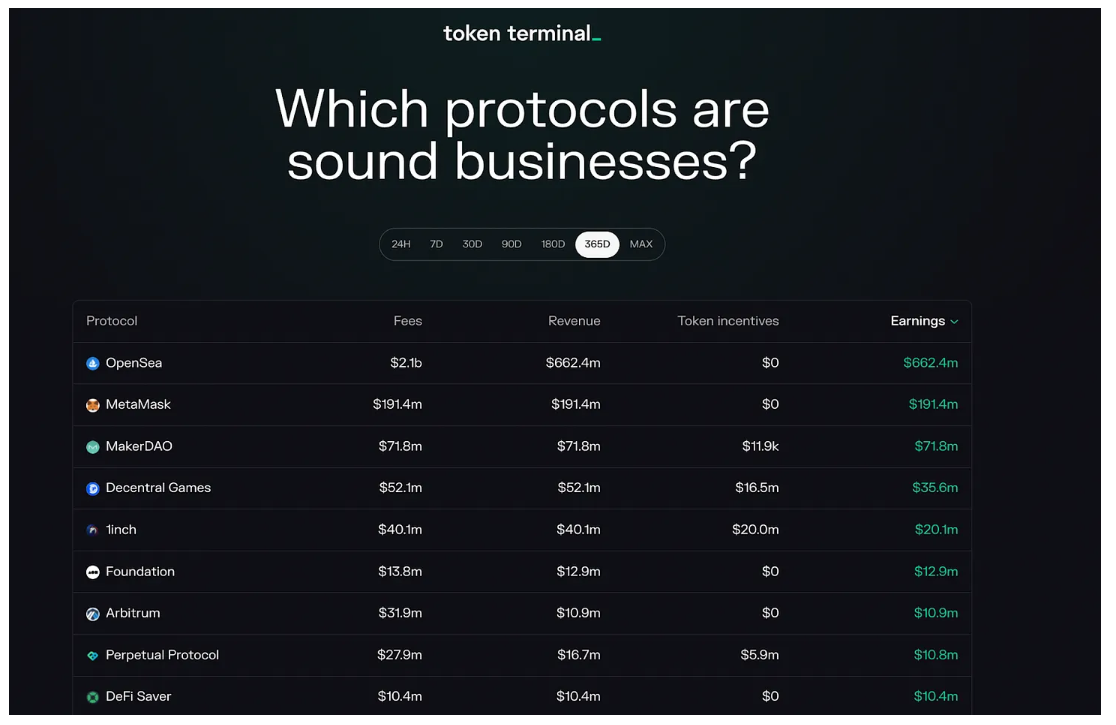

Source: Token Terminal

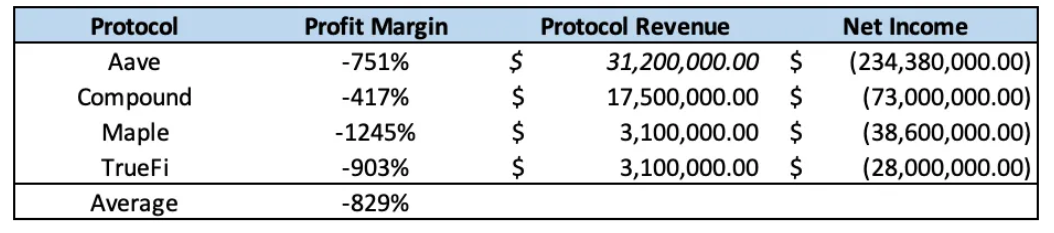

Additionally, lending protocols have very low margins compared to other DeFi protocols as they have to aggressively release tokens to attract liquidity and gain market share, the average TTM (as of the most recent trailing 12 months) profit in the lending market The rate was -829%.

Pricing Power: Moderate/Strong

Over-collateralized or under-collateralized lending platforms have varying degrees of pricing power.

The over-collateralized lending market should be able to retain some level of pricing power, as these protocols benefit from strong brand recognition and user trust, as their governance DAOs require significant risk management to ensure their proper functioning.

This creates a barrier to entry for challengers, and while highly incentivized forks have proven capable of attracting billions in TVL, this liquidity is not sticky in the long run for the reasons above.

However, under-collateralized lending markets have greater pricing power as they focus on compliance and institutional clients (hedge funds, VC firms, and market makers), thereby benefiting from higher barriers to entry for competitors. Additionally, because they provide high-value and differentiated services to these entities, these protocols should be able to continue charging origination fees for the foreseeable future while being immune to fee compression.

asset Management

- Description: Refers to the protocol for operating a revenue generating library and creating and maintaining structured products

- Examples: Yearn Finance, Badger DAO, Index Coop, Galleon DAO

- How to generate income: Asset management protocols generate income from AUM-based management fees, performance fees, and/or minting and redemption fees for structured products.

Income Quality: High

The income from asset management agreements is of high quality.

This is because revenue from asset management protocols is more predictable than many other protocols due to the recurring nature of AUM-based management fees, or revenue generated at predetermined intervals.

Due to its stability, this form of income is considered the gold standard by traditional investors. However, it should be noted that performance and minting/redemption fees are unpredictable and, like trading and interest income, these income streams are largely dependent on market conditions.

Asset management agreements benefit from extremely high profit margins.

These protocols generally do not need to issue a large amount of token incentives, because both yield vaults and structured products inherently generate their own yield.

Pricing Power: Strong

Asset management agreements have strong pricing power.

Asset management protocols may not be affected by price compression due to the considerable amount of risk being managed. While yield-generating strategies can be replicated, users have shown a tendency to park funds in asset management protocols with a strong commitment to safety, even if they offer lower returns and have more aggressive fee structures than their competitors.

Furthermore, given the high degree of variation among many individual structured products, it may take some time for the industry to arrive at a single, standardized fee structure that would help further protect the pricing power of asset management agreements.

liquid pledge

- Description: Refers to the agreement to issue liquid pledged derivatives (LSD)

- Examples: Lido, Rocket Pool, StakeWise

- How it generates income: The Liquid Staking Protocol earns income by taking a commission from all staking rewards earned by validators. Staking rewards consist of issuance, transaction fees, and MEV.

Quality of Income: Moderate

Income from liquid staking protocols is of medium quality.

How much revenue LSD issuers earn is predictable because block issuance is tied to staking participation rates, which slowly change over time. However, revenue from transaction fees and MEV is difficult to predict as it is highly dependent on market conditions and volatility.

LSD issuers can also earn fees in ETH (or other L1 native assets). This means that as these assets appreciate in value over the long term (hopefully), their yield value will increase substantially in dollar terms.

While liquid staking protocols like Lido have thus far had to invest heavily in token releases to incentivize liquidity, with network effects (more on this below), they are likely to be very profitable in the long run .

Pricing Power: Strong

Liquid staking protocols have strong pricing power.

These protocols benefit from the strong network effects brought about by the deep liquidity and integration of their LSDs. This network effect increases switching costs between users, as large stakers will be less willing to hold and stake with LSD providers with less liquidity and utility.

Liquid staking protocols also benefit from high barriers to entry for competitors and are not easily forked due to the technical complexity required to properly manage these protocols, as well as delays in staking queues and withdrawals due to the illiquidity of the underlying deposits.

These competitive advantages mean that liquid staking protocols should be able to maintain their current adoption rates for the foreseeable future.

epilogue

As we have seen, not all DeFi protocols are created equal.

Each protocol has its own unique business model with varying degrees of revenue quality and pricing power.

An interesting finding in my assessment is the strength of asset management business models, as they combine high-quality revenue with strong pricing power.

While yield-generating vaults like those run by Yearn have gained considerable traction, protocols employing this business model have yet to see the same level of success as exchanges, lending protocols, or LSD issuers, as YFI is the only A top 15 asset management token by market cap.

JinseFinance

JinseFinance