In Brief

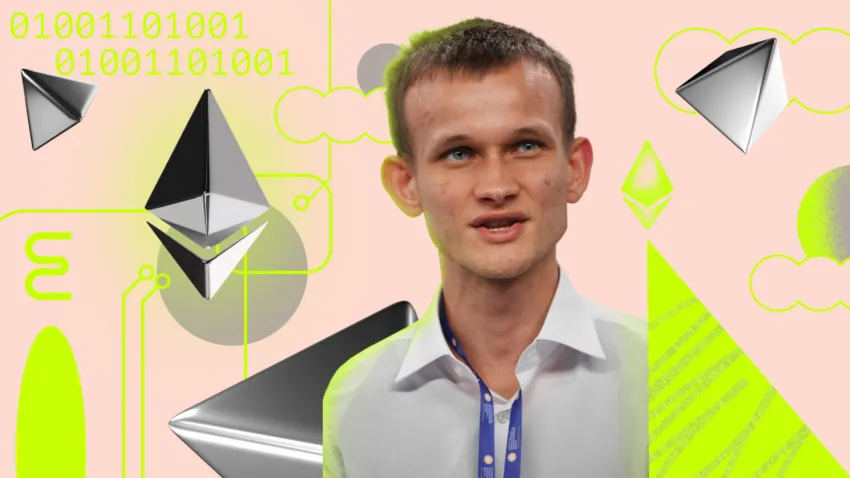

- The Ethereum co-founder has released his own book.

- Ethereum has lost 21.5% since the Merge.

- ETH liquid staking assets could make holding ETH obsolete.

Ethereum co-founder Vitalik Buterin has just launched his book but that hasn’t prevented ETH prices from tanking even further.

On Sept. 28, Vitalik Buterin tweeted that his book titled ‘Proof of Stake (The Making of Ethereum and the Philosophy of Blockchains).’ was available in physical and digital editions. It comprises a compilation of various writings he has made over the past decade or so.

The book is listed on Gitcoin and can be found on retailers such as Amazon for $16.99 for the paperback and $12.99 for the digital edition. There are also signed digital copies in nonfungible token (NFT) format available for Ethereum aficionados.

The story starts in 2013 when Ethereum was conceived of the need for a Bitcoin scripting language for application development. It then goes on to discuss proof-of-work concepts and Ethereum’s evolution to proof-of-stake.

ETH down 21% since Merge

Unfortunately for Ethereum holders, the asset has taken a dive on the day Buterin’s book was launched. ETH is currently trading down almost 7% over the past 24 hours falling to $1,285 at the time of writing according to CoinGecko.

ETH prices hit an intraday high of just under $1,400 around 17 hours ago, but resistance proved too strong resulting in today’s slump. The asset has now lost around 18% over the past fortnight and is currently down 74% from its Nov. 10 all-time high of $4,878.

The long-awaited Merge was executed on September 15, completing the network’s transition to proof-of-stake consensus, officially deprecating proof-of-work and reducing energy consumption by around 99.95%.

However, markets had already priced this in as Ethereum traded as high as $1,780 in the days leading up to the Merge. Since the Beacon Chain went live on the mainnet, ETH prices have dumped 21.5% to current levels.

ETH is now trading at support again but if broken, prices could quickly drop to the next lower level and its trough during this bear cycle at just over $1,000.

Ethereum staking popularity growing

Regardless of the bearish price action, ETH staking continues to gain in popularity for those seeking a longer-term investment. There are currently around 14 million ETH staked which is valued at $18 billion. This equates to roughly 11.6% of the total supply which has seen issuance dramatically reduced since the Merge.

Liquid or flexible staking assets such as those issued by Lido are now more capital efficient than simply holding unstaked ETH. Holders of assets such as stETH are able to gain exposure to asset price action and maintain liquidity while accruing staking benefits which could make holding ETH itself obsolete.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Catherine

Catherine