At 4 pm Eastern Time on Tuesday, Coinbase announced its first quarter 2022 financial report.

The financial report shows:

The net operating income in the first quarter was US$1.165 billion, a decrease of 27.05% year-on-year in the first quarter of last year, and a decrease of 53.2% from the fourth quarter of last year.

The average number of monthly transaction users in the first quarter was 9.2 million, a year-on-year increase of 50.82%, and a quarter-on-quarter decrease of 19.3%.

The net loss in the first quarter was US$430 million, the net profit in the same period last year was US$771 million, and the net profit in the fourth quarter of last year was US$840 million.

The total transaction volume in the first quarter was US$309 billion, a year-on-year decrease of 7.76% and a quarter-on-quarter decrease of 43.5%.

In the first quarter, platform assets totaled US$256 billion, a year-on-year increase of 14.8% and a quarter-on-quarter decrease of 7.91%.

The financial report pointed out that the first quarter of 2022 continued the trend of lower prices and volatility of encrypted assets that began at the end of 2021. These market conditions directly impact Coinbase's first quarter 2022 results. Coinbase believes that these market conditions are not permanent and remains focused on the long term.

In the first quarter of 2022, Coinbase made good progress in product development, highlighted by the beta launch of Coinbase NFT in April 2022, the growing popularity of Coinbase Wallet, the expansion of Coinbase's staking product by adding Cardano , and the hiring of 1,200 Multiple full-time employees building the future of cryptocurrency.

In recent days, affected by the decline in the encryption market, Coinbase’s stock price has continuously fallen below the $90 and $80 mark. On May 10, the closing price was $72.9 per share, a record low. Compared with the high in November last year, it has fallen by nearly 80%, and it has fallen by more than 70% since the beginning of this year. After the announcement of its first-quarter financial report, Coinbase's stock price plummeted 15% after hours.

Coinbase CFO Alesia Haas said that the total transaction volume and monthly transaction users in the second quarter are expected to be lower than in the first quarter, but the outlook for 2022 is "basically unchanged."In the letter to investors, the company stated that during the prolonged bear market, the company will continue to focus on controlling the potential loss of adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) to around US$500 million for the full year .

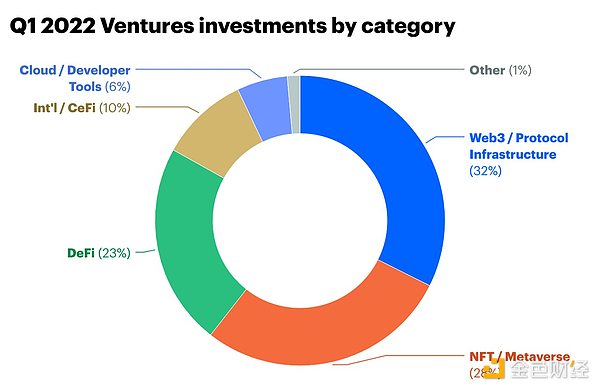

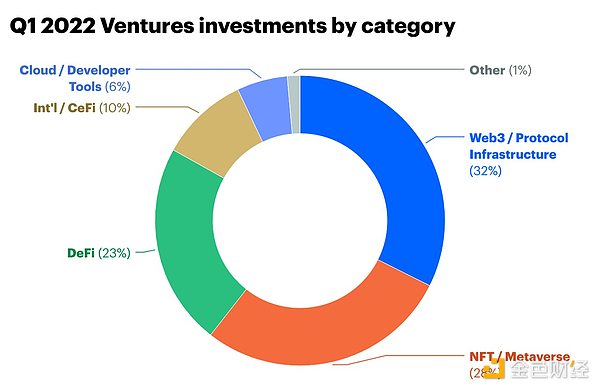

Interestingly, Alesia Haas revealed that the company chose to make 2022 an investment year. According to the data, Coinbase Ventures conducted 71 investment transactions in the first quarter of this year, the highest quarter in history. Among them, the category with the highest proportion is Web3 infrastructure (32%), followed by NFT/Metaverse (28%), and DeFi (23%).

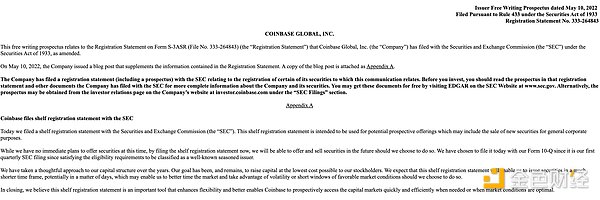

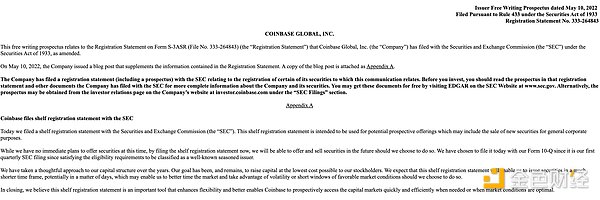

Separately, Coinbase disclosed that it has filed a listing registration statement with the SEC for potential contemplated offerings, which may include the sale of new securities for general corporate purposes. Coinbase said that although there are no immediate plans to sell securities . Coinbase's goal has always been to raise capital from shareholders at the lowest possible cost. This listing registration statement will allow it to issue securities in a shorter period of time, possibly within days, allowing it to better time the market and take advantage of short-term windows of volatility or favorable market conditions.

Weatherly

Weatherly