Author: Marco Manoppo

Source: Pensive Pragmatism

In markets where prices only go up, not down, market participants are often less concerned with the sustainability and defensibility of a company's business model. New ways of assessing company valuations and high-pitched rhetoric have been cleverly concocted to justify rising prices. No one wants to be the spoiler at the party.

As crypto market prices continue to rise, this is the scene: browser-based virtual world online games with poor graphics are called next-gen games, and they claim to let users own a part of the game, while virtual real estate plots sell for money. Also reached millions of dollars. Meanwhile, the oft-flawed "earn while you play" mechanic is considered the future of gaming and work. Radical proponents of the concept argue that players end up prioritizing the element of making money instead of focusing on creating a great gaming experience in the first place.

Stray is an excellent new game that puts you in the role of a cat in a dystopian future.

New DeFi primitives that increase market efficiency by lowering end-user fees and protecting them from MEV arbitrageurs are considered innovative ideas that deserve 9-figure valuations. Don't get me wrong, these cool features are of course the result of months (if not years) of research, but that probably doesn't justify the valuation given the underlying business model.

When prices drop, even the most ardent supporters and community members start to question how exactly these protocols make money and whether their business models really make sense. In this post, we present some ideas on how cryptographic protocols can explore sustainable profit models. What we have to consider is, is it a good product, or is it just a public product?

Main points of this article:

Founders need to expand their business acumen and learn non-crypto business.

Understand which business model is a race to the bottom and which is sustainable in the long run.

There are some hard-to-solve important problems that require deep research work that may never be good business.

The open-source, forkable, and decentralized nature of cryptocurrencies makes it challenging to predict your business model on a replicable mechanism.

Selling tokens for income can be controversial, but it's one of the current working models.

Are Protocols a Business?

First, are protocols a business? Regardless of what you think, the reality is that the founders and team members of these crypto projects need to pay rent. While VC money might be able to subsidize a 21-year-old crypto founder renting out yacht parties as a way to "socialize" for a few years, these projects ultimately need to make money on their own to survive (not to mention thrive), especially in the context of macroeconomics when entering the contraction period. By the way, the yacht thing is real.

I have long touted that the concept of decentralization and the need to generate income are somewhat antithetical to each other. It is not easy to maintain a good level of decentralization while also operating in an efficient manner to maximize profits. This point of view often falls back on the idea of decentralization, which doesn't really make much business sense, especially if you decentralize too early in the process. A more mature protocol/network can certainly do this once it reaches a certain level of adoption - striking the right balance between knowing when to move to a more decentralized structure and when to maximize growth is critical important.

develop your business acumen

People on Twitter love to poke fun at management consulting firms like McKinsey for being overpaid for writing reports and recommending strategies without taking any real responsibility. While consultants aren't the best operators, these individuals have learned multiple different trades during their tenure and generally have good business acumen.

My number one piece of advice (if I'm qualified to give one) to aspiring cryptocurrency founders is to learn how non-cryptocurrency businesses work.

Highly educated people in developed countries tend to specialize in service-oriented businesses, whether it's financial markets, consulting or software. In emerging markets, your misguided old-school parents will say that these aren't "real" businesses because you don't have direct access to what you're selling.

Sarcasm aside, here's the point: Cryptocurrency founders need to think more about how what they do make money -- unless you realize you're working to improve the technology, or you're smart enough to wait until you've satisfied yourself with knowledge Convince the VC firm to pay your rent while you crave it.

Of course, there are some important problems in encryption technology that are difficult to solve and need to be studied in depth. However, when you're raising money to solve these problems, it's best to have a path to profitability. Admittedly, this is more difficult in web 3.0 because most protocols are open source and forkable, which removes the IP defense moat that most web 2.0 startups have. Founders also face the risk of experienced operators entering the space with a lot of money and vertically integrating into the business you are building. Remember Apple's foray into BNPL (buy now, pay later) space? - Worse, there are no antitrust laws in blockchain.

Sadly, all of the above lead to a natural progression of our need to continually experiment with new business models applicable to cryptocurrencies. Therefore, most of the successful crypto companies we see are crypto trading markets. They're the ones who sold shovels during the gold rush.

rent-seeking business model

Cryptocurrencies are conceived as a new innovative technology that removes centralization, returns power to the people, and creates a more level playing field for all parties involved. But ironically, at the same time, the largest and most successful companies are exchanges/marketplaces, and they are successful because they implement a rent-seeking business model. CEX, DEX, and NFT markets are giants in the crypto space, which has rightfully sparked criticism that the entire use case of cryptocurrencies is based on speculation.

By the way, we are not discussing Bitcoin and Layer 1 assets here, because they are either digital currencies or blockchain networks, which require a completely different frame of mind - which does not necessarily constitute a business model. Bitcoin's "business model" is its claim as a substitute for gold. The "business model" of L1 assets is gas fees and adoption.

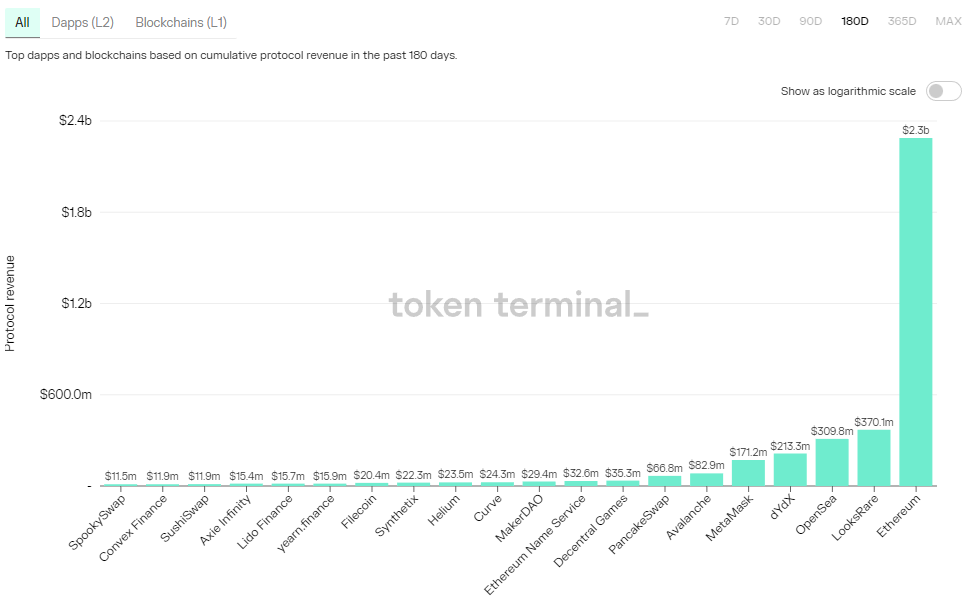

Source: Token Terminal

We see what you mean, so what other ways can we start exploring new crypto business models?

recurring income

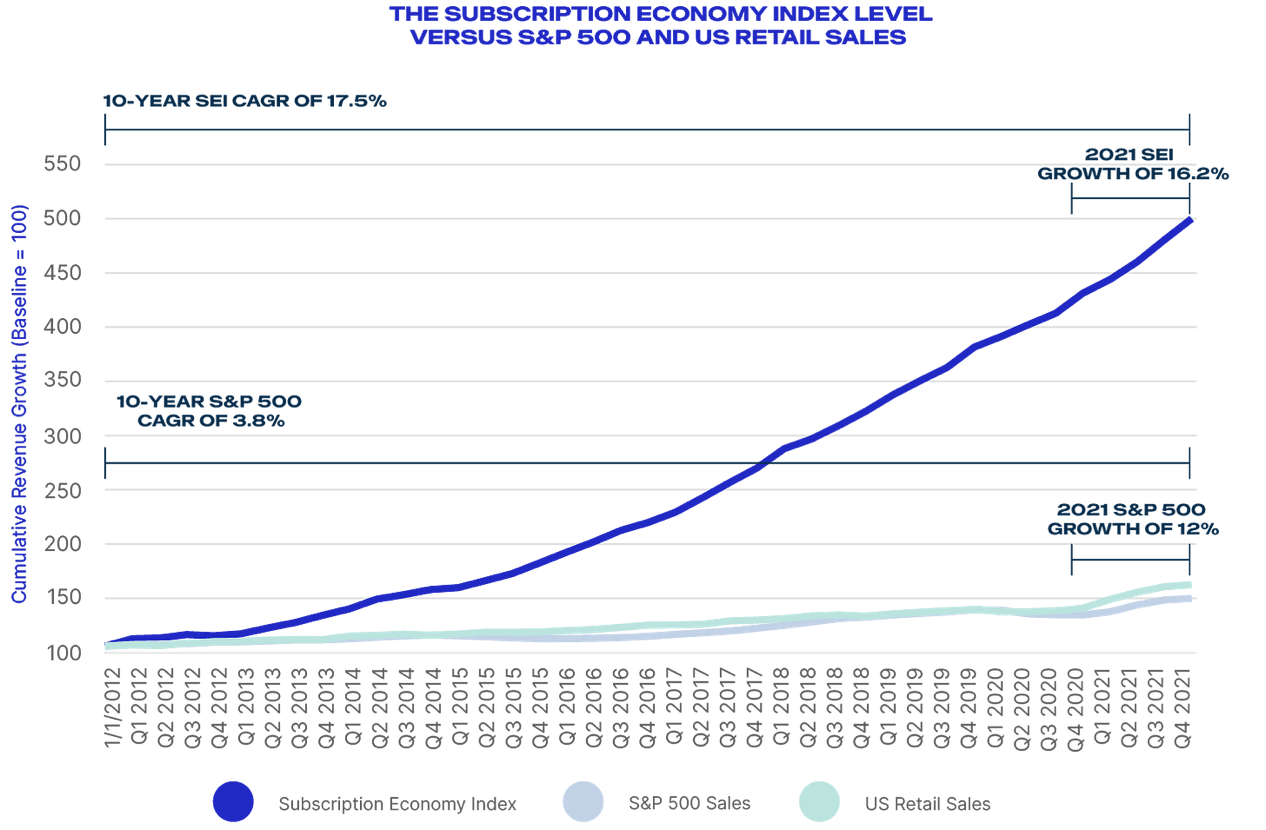

The recurring revenue model has one of the largest business valuation multiples for public stocks over the past five years. Companies whose cash flow sources are primarily subscription-based not only create a more sustainable consumer base, but also have more predictable future cash flows. This instills confidence in the investor class and creates long-term relationships with end consumers.

Source: Zuora

Source: Zuora

Let's look at a few examples:

Amazon Prime

82% of U.S. households are Amazon Prime members. Thus, Amazon can be vertically integrated and become the dominant entity in these households. From Alexa smart speakers to Ring smart home tech, and now even One Medical. The company has become a marketplace for pretty much everything you might need in your day-to-day life.

Imagine someone having a mild stroke, calling for help through an Alexa smart speaker, a Ring smart lock automatically unlocking the front door, and a One Medical dispatcher rushing into the house in no time to administer ambulance (this service doesn’t exist yet, but we’re free Use your imagination).

Apple One

As of the second quarter of 2022, Apple One has 825 million users. This is a multi-billion dollar market. The world's richest economic class is willing to pay $100 billion for a phone with a profit margin comparable to that of a luxury brand.

However, due to technical limitations and lack of product variety, the recurring revenue model has largely failed to materialize in the crypto space, as most profitable crypto companies make money through market-related fees, which do not necessarily lend themselves to a subscription model. Robinhood has tried to launch Robinhood Gold, and Coinbase is currently trying to launch a beta version of Coinbase One, but the response from consumers has not been good.

That said, the building blocks are starting to emerge, and we're seeing more and more projects solving different problems that will eventually enable more seamless programmable cash flow, including subscriptions. Combined, we can see how the following stacks will eventually lead to killer decentralized applications that can integrate subscription-based business models.

Sablier and Superfluid support encrypted payment streams.

Aave launched the Lens protocol, a decentralized social media stack.

The Ethereum Naming Service provides a clear web 3.0 identity.

Mirror introduces a web 3.0 subscription and notification system.

Web 3.0 communication applications are being built.

Token sale income

Just hitting that headline feels like a mortal sin in the crypto space. The industry is extremely sensitive to terms that could accidentally classify a token as a stock. That said, it is not uncommon in the crypto space to sell tokens and record revenue from them as operating expenses. In fact, Ripple (XRP), once one of the top three crypto assets by market capitalization, has done so many times.

“Fast forward to 2022, and the paradigm shifts. A “sponsoring” company builds the protocol and owns a percentage of the token supply. Properly designed, the token economics of said protocol actually returns value to the Token holders (usually some kind of fee-sharing mechanism), generate revenue for the protocol and the company in the process. The company then sells these tokens for revenue to continue operating. Over time and with the right adoption , you can add complexity by implementing a governance process or even a full-fledged DAO to manage the assets (and yield) of said protocols, which are often largely controlled by the original team members.”

I don't think the model is wrong per se, but it requires a lot of trust from the original team members to bring the protocol to a mature state and have a functioning DAO (is there really such a thing?).

What's the big idea?

During a bull market, it's easy to wrap their big ideas in compelling stories without carefully considering the sustainability and defensibility of the business model. This happens with web 2.0 tech startups (such as Uber), and it happens with crypto. In the crypto space, this can be further confused by the existence of tokens, which can create a false understanding of the actual health and earning power of a project.

While developers and founders may be working on cool and innovative new technologies, it's important to realize that encryption is open source and you don't have any real defenses when it comes to intellectual property. Knowing first-hand allows founders to plan their strategy carefully and give more thought to the business they plan to build. If your goal is to make money, don't fall into the trap of building public goods.

As an industry, we need to do a better job of constantly thinking up new concepts for projects to make money, rather than resorting to predatory pseudo-Ponzi economics (which rely on attracting new users and dumping them to generate revenue). I'm not saying I have all the answers, but the first step in solving a problem is acknowledging that there is one.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Tide Captial

Tide Captial JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Catherine

Catherine Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph