Author: Ben Giove

Source: Bankless

Image credit: Logan Craig

Image credit: Logan Craig

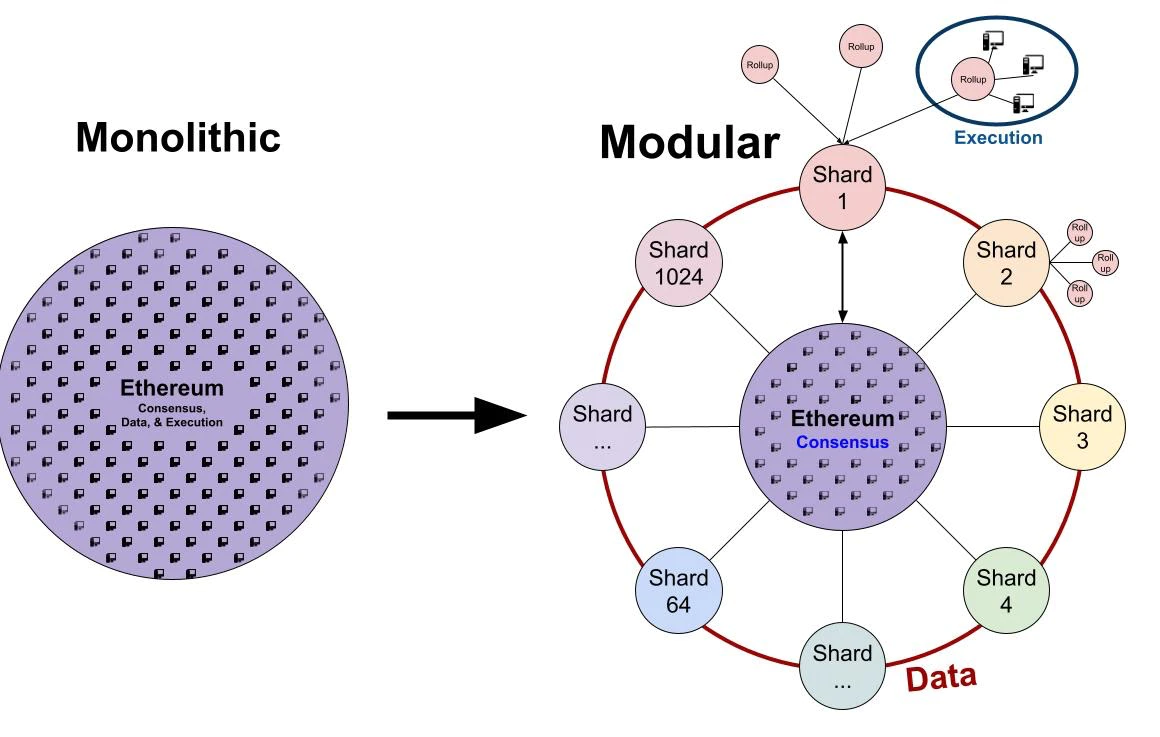

The future of blockchain is modular.

Users and newcomers alike have learned in the 2021 bull market that monolithic blockchains are not suitable for the scale needs of a handful of degens, let alone the largest number of degens in the world, whether due to sky-high gas fees, network congestion, or stability issues. The needs of a billion people.

Thankfully, many forward-thinking developers have long anticipated these challenges and are working on implementing roadmaps that will lead to the creation of modular blockchain networks. Of these, the two most prominent are Ethereum and Cosmos.

Ethereum and Cosmos have been around for a while, and are relatively grassroots and decentralized, with far less influence from VCs and investors than other ecosystems. Both are heading in similar but different directions for a modular future.

Ethereum has a rollup-centric roadmap aimed at scaling a single, highly decentralized settlement layer through Layer 2 (L2) queues.

Cosmos, on the other hand, is trying to create an "internet of blockchains," or an interoperable network of independent, application-specific blockchains.

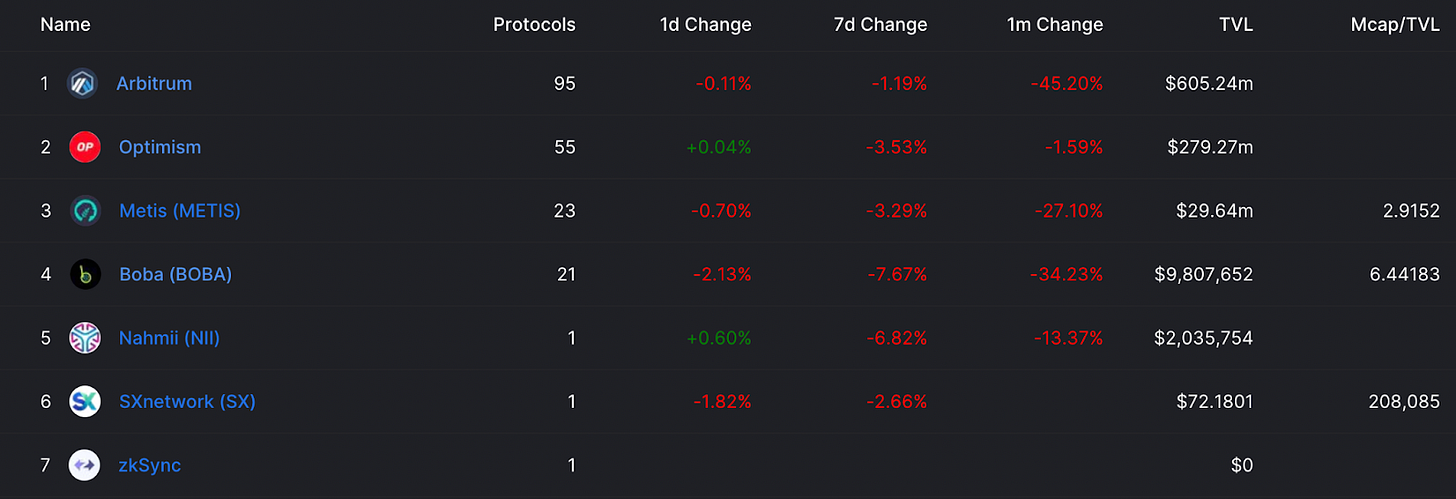

Ethereum L2 TVL – Source: DeFi Llama

Ethereum L2 TVL – Source: DeFi Llama

Both ecosystems are in their early stages. Ethereum L2 accounted for 1.58% of the total DeFi TVL, while the Cosmos chain accounted for 0.82%.

Cosmos Ecosystem TVL – Source: DeFi Llama

Cosmos Ecosystem TVL – Source: DeFi Llama

However, competition is heating up. The market-leading decentralized perpetual derivatives exchange dYdX announced the transition from Ethereum to Cosmos, causing Ethereum to lose its current largest application.

The question arises: are these ecosystems complementary, or are they competing with each other?

What advantages does each side have that the other side does not have?

We can answer these questions by comparing the technical capabilities of each ecosystem, and their ability to serve as neutral settlement layers.

technical skills

Let’s first look at some of the design features of Ethereum L2 and Cosmos to better understand their strengths and tradeoffs.

Ethereum L2 Capabilities

L2 leverages Ethereum for consensus and data availability while moving execution off-chain to a transactional environment called rollup. These rollups process, compress, and submit transaction proofs to L1 in batches, and amortize all transactions on L2, thereby reducing the high Ethereum gas cost of individual users.

This allows Ethereum to scale by accommodating more transactions in the same amount of block space, allowing the network to scale while remaining economically sustainable and maximally decentralized as users can still easily run a node to validate the state of the chain.

There are two types of L2, Optimistic Rollup (ORU) using Falseness Proofs and zkRollup (ZKR) using Validity Proofs. While ZKR has greater transaction capacity than ORU, the challenges of implementing it in production, and the current lack of EVM compatibility, means the latter is more likely to be Ethereum's primary scaling solution for the foreseeable future.

Nonetheless, there are many scaling solutions at both L1 and L2 levels, such as call-data compression, proto-danksharding, and EIP-4488. Furthermore, fractal scaling through L3 (i.e. settlement to L2 rather than direct to L1 rollups) will further improve scalability and open up new design spaces for application-specific rollups.

L2 also offers a fair degree of composability, as general-purpose rollups like Optimism and Arbiturm each host a large, rapidly growing ecosystem of protocols and applications. This composability will be enhanced in the future by adopting common messaging protocols such as Layer 0 and Nomad, which increase interoperability between rollups, albeit introducing new risks and trust assumptions.

Cosmos Chain Capabilities

Cosmos is great for building application-specific blockchains or appchains. These chains are optimized to run a single application, such as Osmosis, the largest exchange on the Cosmos chain, and the aforementioned dYdX chain.

This is achieved through the Cosmos SDK. The Cosmos SDK is a blockchain development framework that allows developers almost complete control over its design. Therefore, the Cosmos chain focuses more on sovereignty.

For example, developers can choose whether their chain will use the account or UTXO model, what language the state machine will be built in, and various other parameters. This is much more flexible than networks like Ethereum, where these parameters are already set and all developers must adhere to them.

The increased customizability of Cosmos also extends to governance and security, as each chain can bootstrap its own individual validator set, or, starting in Q3 2022, leverage a feature called Interchain Security, like Ethereum, like L2, will enable chains to outsource their validator sets to other networks, such as the Cosmos Hub. Interchain security could prove to be a key feature of Cosmos chains, as starting a validator set is difficult and could result in less security, making the blockchain more vulnerable to attack.

Cosmos chains also benefit from native interoperability through Inter-Blockchain Communication (IBC). IBC utilizes light clients to enable trust-minimized bridging and communication between chains that currently enable it.

Another recently deployed upgrade is Interchain Accounts, which allow transactions between IBC-compatible chains, enabling the creation of cross-chain applications that leverage this interoperability standard and helping to improve the Fragmentation and composability.

Summary

Both Ethereum L2 and Cosmos bring significant value. Ethereum L2 supports low-cost applications with the highest level of security, while Cosmos currently provides a higher degree of customization, interoperability and sovereignty for individual applications.

The difference between Ethereum and Cosmos Hub in the settlement layer

As we have seen, both Ethereum and Cosmos plan to utilize some form of shared security. Ethereum L1 will serve as the settlement layer for rollups, and the Cosmos Hub can serve a similar role for chains looking to leverage interchain security.

Ethereum L1

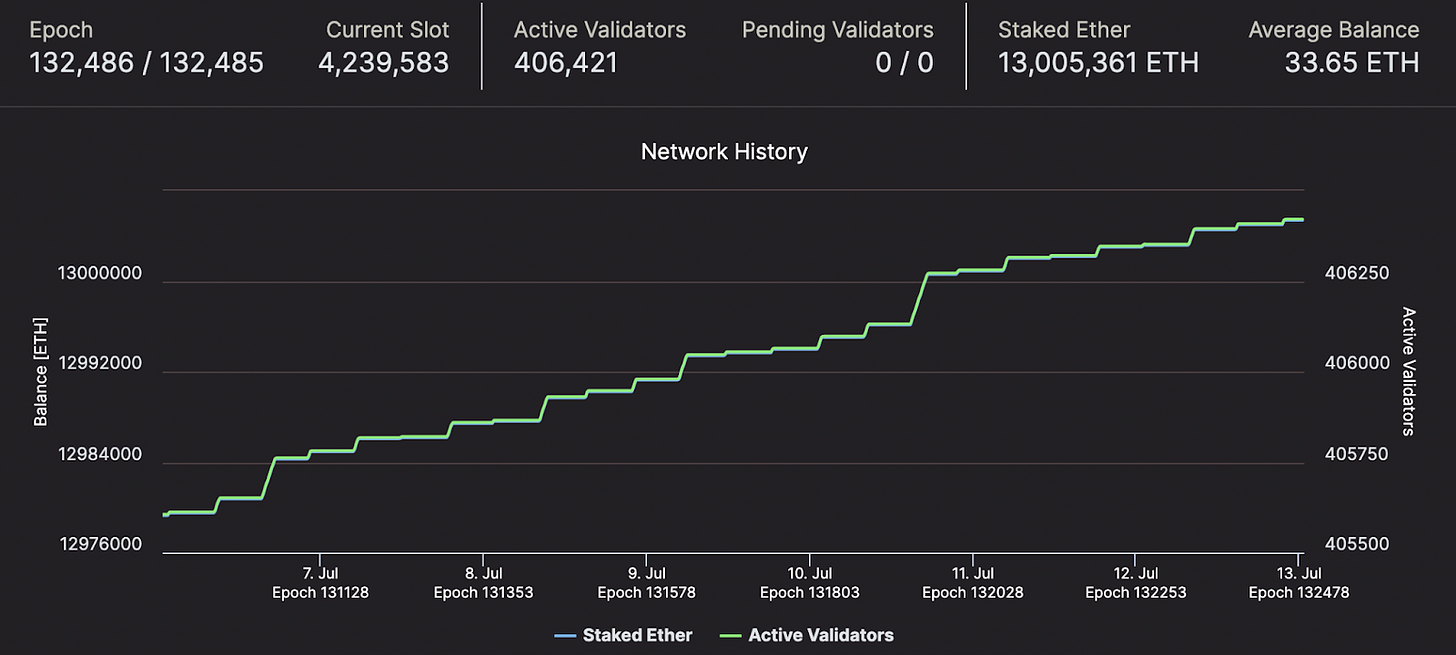

The beacon chain will become the standard chain after Ethereum merges from PoW to PoS. Currently, more than 13.01 million ETH (approximately $13.67 billion at current prices) are pledged on the beacon chain. This will lead to an increase in the cost of reviewing transactions and reorganizing the chain, and the attack requires one-third and two-thirds of the total pledged amount, which is $4.51 billion and $9.15 billion, respectively.

The Beacon Chain currently has 404,125 validators, sharing 32 ETH (~$33,632) per person, which is the threshold for participating in consensus and earning staking rewards and transaction fees. While no specific number was given, researchers at the Ethereum Foundation said that the theoretical maximum number of validators is around 4 million.

ETH staked on the Beacon Chain – Source: Beaconchain.in

ETH staked on the Beacon Chain – Source: Beaconchain.in

Instead of adopting native staking delegation as a solution to the high cost of running validators, Ethereum democratized staking rewards by opening up the market. This could be through a custodial intermediary like an exchange like Kraken, or a non-custodial service like Lido issuing liquid collateralized derivatives.

However, the strong network effects of liquid staking derivatives have led to massive accumulation of staking by entities such as Lido, which holds 31.7% of Beacon Chain deposits. Whether the combined staking distribution will be more widespread remains to be seen.

Still, due to Ethereum’s lack of on-chain governance, entities such as Lido and LDO holders governing the protocol have limited direct influence.

Instead of voting by token holders to determine network changes, Ethereum manages the off-chain network through a rough consensus. This means that all stakeholders of the network, such as core and application developers, users, and ETH holders, must support major upgrades. This spreads governance power over a wider group, increasing Ethereum's credible neutrality by limiting the possibility of plutocracy emerging.

Cosmos Hub

There are currently 189.99 million ATOMs, worth about $1.48 billion, pledged on the Cosmos Hub. This means that it would take approximately $489.39 million and $993.68 million to reach a one-third and two-thirds threshold to stop or reorganize the chain.

The Cosmos Hub has 175 active validators, which is the maximum cap set by governance. The network does employ Delegated Proof-of-Stake (DPOS), whereby token holders can delegate their stake to one of these validators in order to earn rewards associated with securing the network.

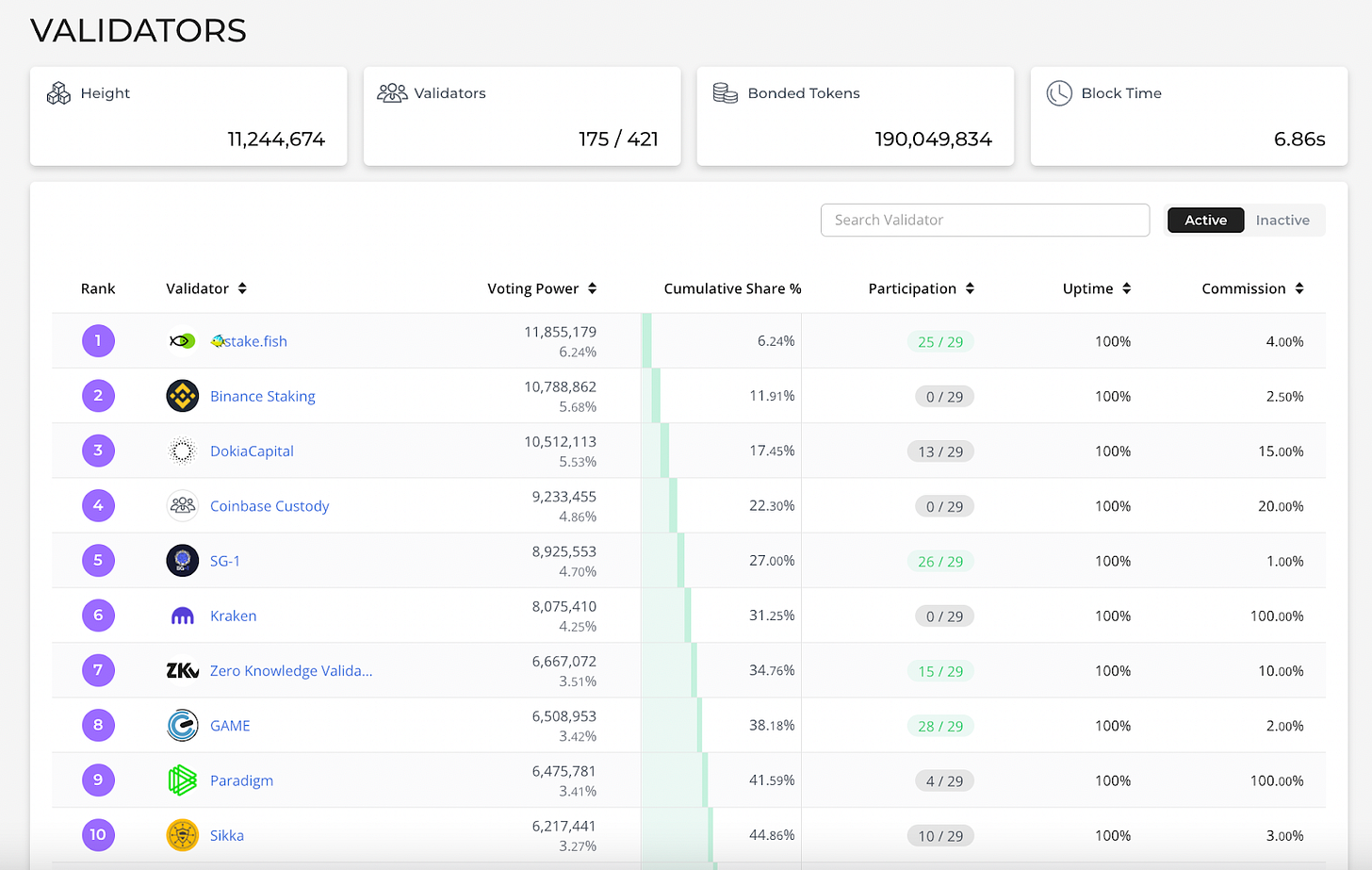

Share of Cosmos validators staking – Source: Mintscan

Share of Cosmos validators staking – Source: Mintscan

Despite the validator setup and DPOS usage cap, staking appears to be widely distributed among more entities than Ethereum. On the Cosmos Hub, 7 and 23 entities control one-third and two-thirds of the stake, while on Ethereum those numbers are 2 and 16, respectively.

While staking is more widely distributed, there is a greater risk of power being concentrated in the hands of validators on the Cosmos Hub due to the use of on-chain, token-based governance. This increases the ability of large holders to enforce their will on-chain, threatening the trusted neutrality of the Cosmos Hub by forcing through proposals that may not have been approved by all stakeholders in the ecosystem.

Summary

As we can see, Ethereum L1 is more secure than Cosmos Hub and has a larger and more open validator set. While the Cosmos Hub has a wider staking distribution, the presence of on-chain governance puts more power in the hands of token holders and validators than in Ethereum.

Are they competitors?

Both Ethereum and Cosmos are building towards a similar vision. Ethereum offers a higher level of security and a more trusted neutral settlement layer, while Cosmos chains are more flexible, interoperable, and optimized for individual use cases.

While there can only be one largest ecosystem, billions of users and trillions of money will still be incorporated into Web3, it seems like both Ethereum and Cosmos will ultimately be complementary, serving different use cases, rather than direct competitors .

All systems are the same, no way is perfect, so they all choose a compromise solution.

Ethereum or Cosmos, which one would you choose?

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph