Author: Kirill Naumov

Source: Kirill Naumov's Twitter

In recent years, both DeFi and NFT have gained widespread attention. Lending platforms around DeFi have emerged in an endless stream, and various blue-chip NFTs have also entered the mainstream public's field of vision. While the two continue to develop, the relationship between them is becoming closer, and the NFT lending platform was born against this background.

The NFT lending platform allows users to borrow liquid assets by staking NFT. This article will give you an in-depth introduction to the peer-to-peer, peer-to-pool and CDP lending markets in NFT.

Compared with homogeneous cryptocurrencies, NFT is a long-term investment, and one of the challenges it faces is fund management. Holding an NFT means locking up a large amount of money in an illiquid investment that can drop in price within a few days.

Over-collateralized NFT lending protocols (such as Compound, Aave, and Maker in traditional DeFi) allow users to release part of the liquidity in NFT portfolios without losing NFT exposure. The current NFT lending market has the following three types:

Peer-to-Peer

In peer-to-peer (P2P) lending, borrowers are directly matched with lenders. This is the main way of current NFT lending. P2P lending platforms include NFTfi, TrustNFT, PawnfiOfficial, YawwwNFT, etc.

These platforms typically require users to lock NFTs as collateral in escrow contracts, and then apply for loans for a specific period. Later, others will bid on the borrower, offering different interest rate terms.

In this way, NFT owners can choose from various combinations of loan values and interest rates, and ultimately choose the one that suits them best. Therefore, peer-to-peer lending is perfect for hedging exposure to NFTs.

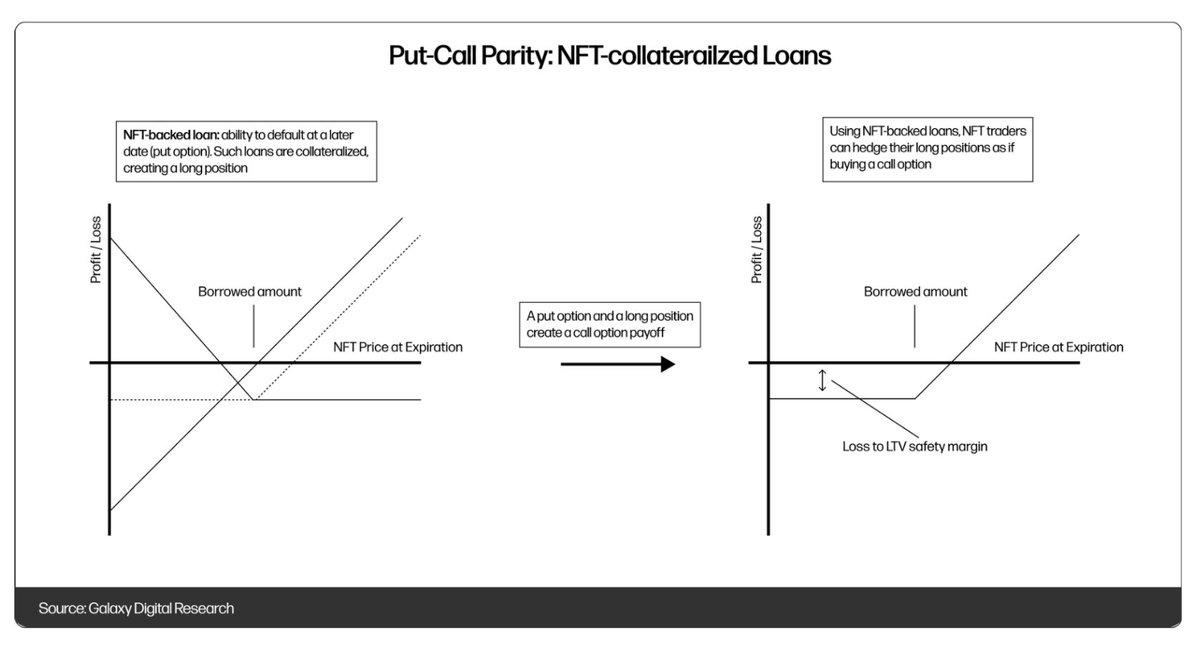

Can I understand that NFT loans are like put options (if the NFT price is lower than the loan amount, the user had better default). By owning the NFT (in the contract) and owning the put option, the user creates a profit analysis of the call option, avoiding the loss of the NFT falling too much.

Another thing that sophisticated traders can do with NFT peer-to-peer lending is leverage. For example, a user can borrow $50,000 by locking BAYC NFT and buy two MAYC NFTs. If the NFT price rises, they only need to return $50,000 plus interest, thereby making a profit.

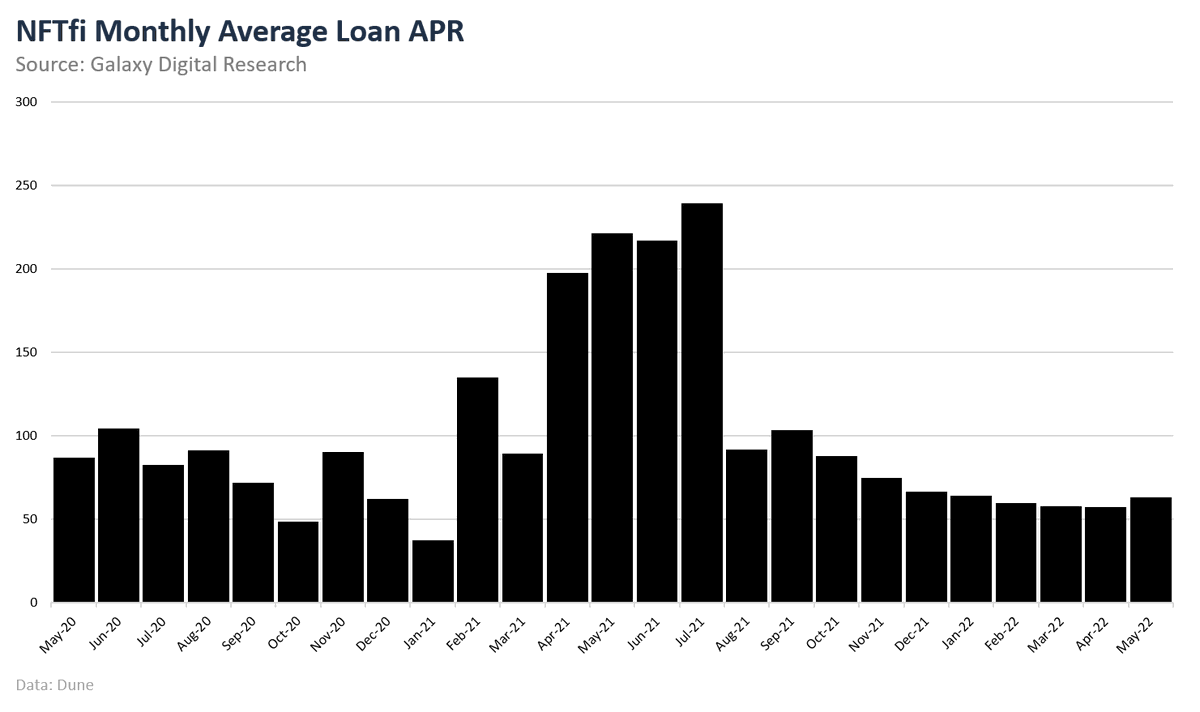

Peer-to-peer lending typically has high interest rates and moderate loan-to-value ratios (LTV). Of the platforms we analyzed, NFTfi is the most attractive, with $28.6 million in loans currently outstanding. Last month, the average APR was 63%.

Peer-to-Pool

Drops operates a Compound-like money market where users can stake their NFT portfolios for loans in USDC and ETH. NFT pricing is adjusted for outliers via Chainlink oracles and averaged over time.

From a user perspective, they stake their NFT as collateral and borrow funds from the pool at variable interest rates. These funds are provided by lenders who earn interest from borrowers.

Like Compound and Aave, Drops uses a segmented interest function, targeting a specific utilization rate and starting to significantly increase the interest paid by borrowers when funds are low.

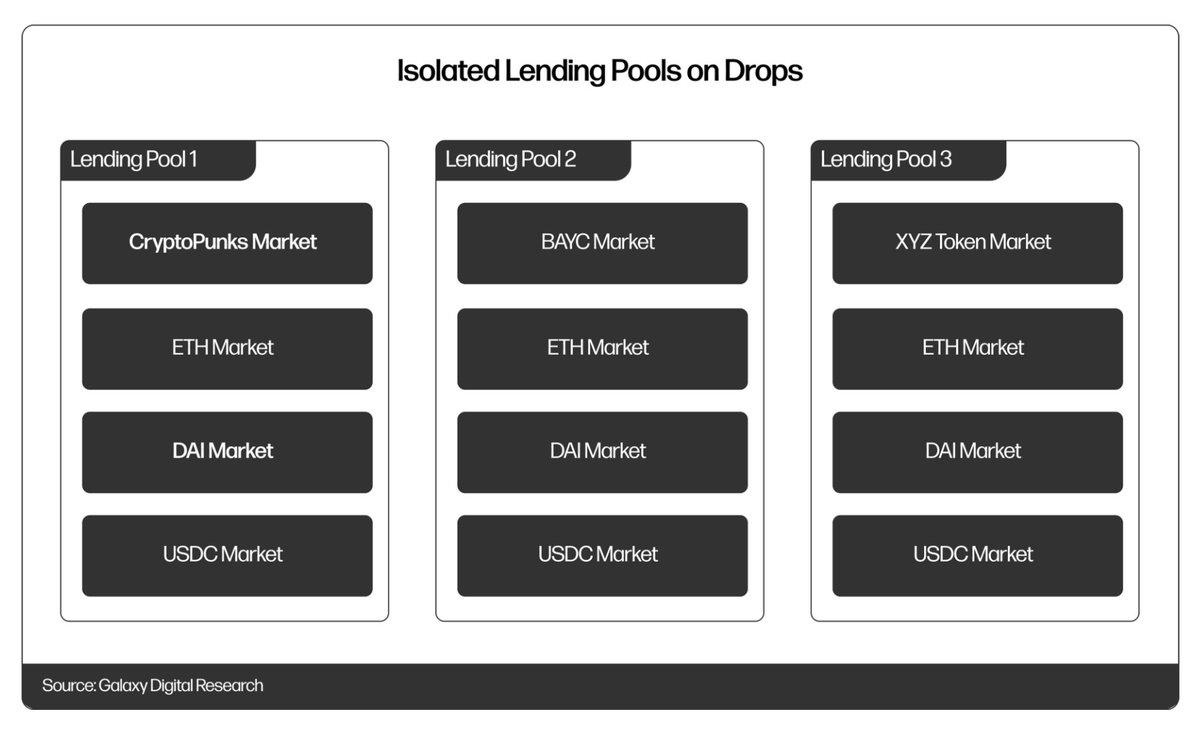

To limit the exposure of liquidity providers, Drops splits the protocol into independent pools, each with its own collection of NFTs. This is similar to how Fuse operates at Rari Capital. This ensures that lenders can choose the NFT they are happy with.

Drops currently has $2.6 million in supply capital and $388,000 in outstanding loans. They offer a moderate LTV ratio to ensure solvency and relatively low interest (approximately 10% APR for Yuga Labs treasury).

Other peer-to-pool NFT collateral lending platforms include BendDAO and BailoutFi. BendDAO provides borrowers with 48-hour liquidation protection, and Bailout limits loan terms to 30 days to ensure solvency.

The peer-to-pool NFT mortgage lending agreement, just like the DeFi peer-to-pool money market, only accepts blue-chip assets as collateral. The normal operation of these protocols requires an oracle machine infrastructure and a stable floor price.

Collateralized Debt Position (CDP)

Collateralized Debt Position (CDP) was pioneered by MakerDAO and is the ultimate model of the NFT mortgage lending market.

JPEG'd is a lending protocol that leverages CDPs to enable NFT collateralized lending.

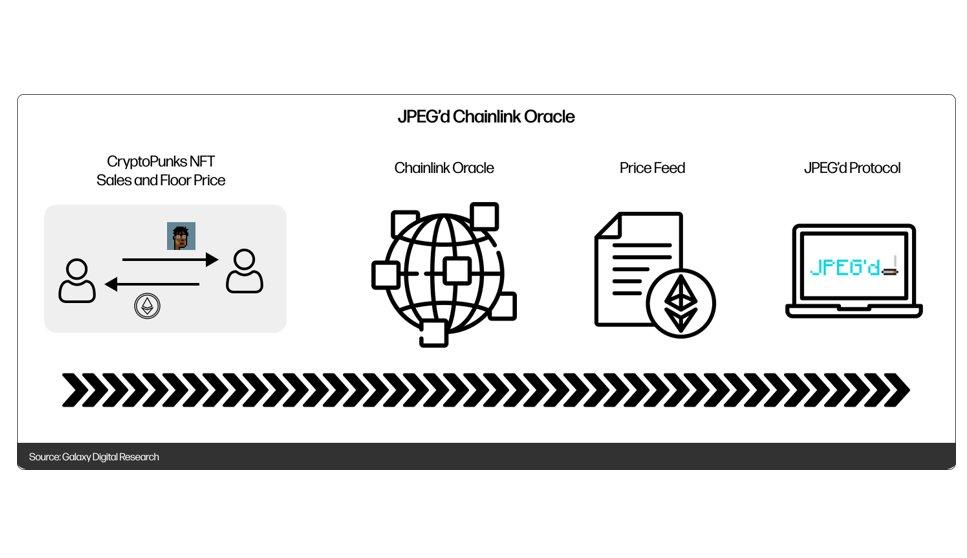

After users deposit NFTs into their treasury as collateral, they can mint PUSd — a stablecoin pegged to the U.S. dollar. JPEG'd allows up to 32% of the collateral value of PUSd debt positions, priced through Chainlink oracles. The agreement only charges a 2% annual interest rate.

At JPEG'd, when a given user's debt/collateral ratio exceeds 33% (or 40% for Cigarette NFT cards), liquidations will be performed exclusively by the DAO. The DAO will pay down the debt and either continue to hold the NFTs or auction the NFTs, thus building up its treasury.

Users can purchase a one-time liquidation insurance when withdrawing a loan, the price is 5% of the loan amount, and the insurance is non-refundable. This gives users the option to repay the debt themselves (with penalty) within 72 hours of liquidation.

JPEG'd raised $7,200 in 2022 through a "donation drive." JPEG'd CDP lending, suitable for users who seek to obtain liquidity from blue chip NFT without paying high interest.

In my opinion, the NFT mortgage lending market is still in its early stages of development and may develop significantly in a bear market. However, it is important to be cautious when experimenting with these protocols as they rely heavily on oracle performance and market stability.

JinseFinance

JinseFinance