The cryptocurrency crisis has spilled over to yet another exchange. Singapore-based cryptocurrency exchange Vauld has made the "difficult decision to immediately suspend all withdrawals, transactions and deposits on the Vauld platform," in a statement.

Since June 12, 2022, Vauld's clients have attempted to withdraw "more than $197.7 million" from the crypto bank, and Vauld appears to have suffered a run and intends to "apply for a moratorium on payments from the Singapore courts."

The decision to suspend withdrawals is a U-turn for Vauld. In May, Vauld reportedly claimed $1 billion in assets under management. On June 16, an email from the company said business would "continue to operate as normal." But just 18 days later, the company began exploring "potential restructuring options".

On June 21, CEO Darshan Bathija tweeted that Vauld had laid off 30% of its workforce — the first sign that the company was in crisis. Additionally, Bathija also highlighted that Three Arrows Capital (3AC) was an early investor in the company but exited at the end of 2021.

Vauld said in a statement that they decided to freeze client funds because of "the volatile market environment, the financial difficulties of our key business partners, and the inevitable impact of the current market environment on us".

Nonetheless, the collapse of 3AC is considered a significant reason for the capitulation of centralized finance (CeFi) firms. 3AC had significant exposure to Luna Classic, but the price of Luna Classic suddenly plummeted, causing 3AC's holding to drop from $560 million to $670.

In fact, Vauld is following in the footsteps of large CeFi platforms such as Celsius, Voyager, and BlockFi. Voyager explicitly blamed 3AC for its recent decision to freeze client funds, BlockFi nearly reached a $240 million deal with FTX after encountering financial difficulties, and BnkToTheFuture recently shared plans to save Celsius from bankruptcy.

For crypto investigative journalist Otterooo, the Vauld strife is more of an incentive for investors to hold their own keys. Holding your keys is a guiding principle of cryptocurrency investing: if you don’t hold your keys, you no longer own your cryptocurrency.

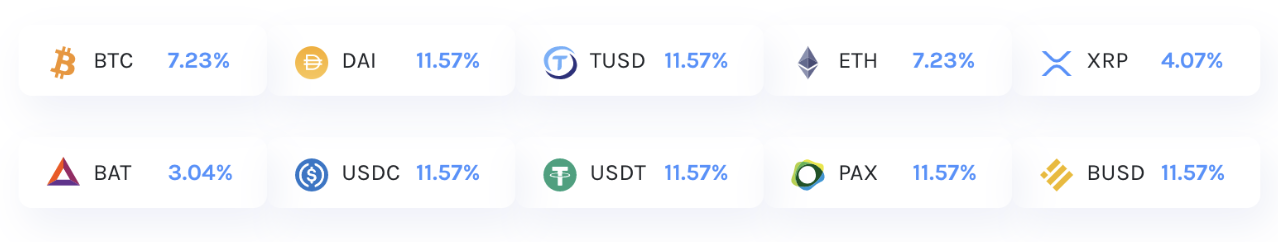

In a press release from March 2021, Cointelegraph said that Vauld has hit double-digit rates on popular stablecoins like Tether (USDT) and Dai (Dai), while Bitcoin (BTC) could hit 7.23%. While you’ll earn money in the process of “loaning” your cryptocurrency to Vauld, you’re effectively handing over ownership of your assets to the company.

Rates offered by Vauld from March 2021. Source: Vauld

Rates offered by Vauld from March 2021. Source: Vauld

These rates are competitive with lenders such as Celsius, BlockFi, and Nexo — only one company currently in operation, Nexo. "Customer transactions may be delayed due to Independence Day," Nexo tweeted.

Weatherly

Weatherly