In a live-streamed hearing on May 10, U.S. Treasury Secretary Janet Yellen called for stablecoin legislation to be passed by the end of the year and highlighted the risks surrounding Terra USD (UST), saying: The TerraUSD (UST) stablecoin went through a crash and depreciated. I think it just goes to show that this is a fast growing product and there is a risk of rapid growth... financial stability is at risk and we need a framework in place". In response to a question on stablecoins from Republican Senator Pat Toomey (R-PA), Yellen said it was "very important, even urgent," for Congress to pass stablecoin legislation, and further said it would be "very appropriate" for Congress to do so before the end of the year ".

Today, Bitcoin once fell below the $30,000 mark. The collapse of the largest blue-chip currency in the cryptocurrency led to a series of declines in altcoins. Among them, the price of Luna tokens fell sharply, causing the decoupling of the stablecoin UST, and the butterfly effect of accumulation led to a slow death cycle. Up to now, according to the comparison terminal data, the market value of UST is less than 16 billion U.S. dollars . Before that, the market value of UST once reached 20 billion U.S. dollars, becoming the third largest stable currency of cryptocurrency, and successfully ranked among the top ten cryptocurrencies .

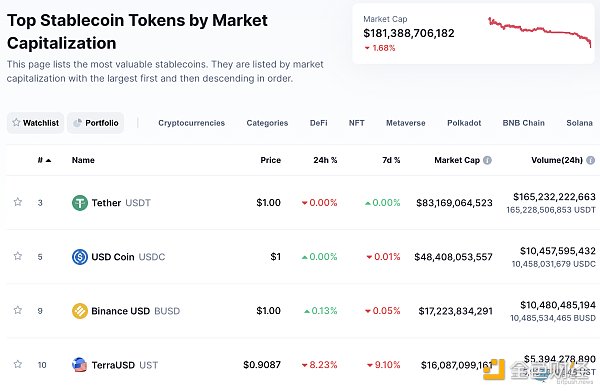

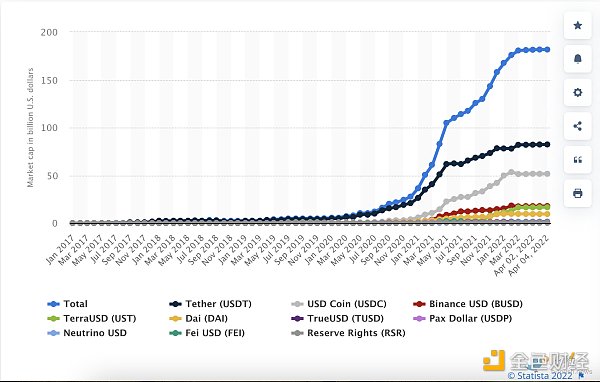

As of now, according to the data on coinmarketcap, four stablecoins have appeared in the top ten cryptocurrencies by market capitalization, namely: Tether (USDT), USDC , BUSD , and UST. The total market cap of stablecoins has reached more than $180 billion. The chart below shows the change curve of the market capitalization of the top ten stablecoins from January 2017 to April 2022:

From the above figure, we can see that the market value of stablecoins will double in 2021, and stablecoins have become one of the most common and practical value media in the current encryption market. In the early days of the development of the encryption market, the basic asset in the eyes of investors is Bitcoin, and other cryptocurrencies need to be exchanged with Bitcoin. However, the huge volatility in Bitcoin's early days has led to greater risk exposure for crypto investors. With the emergence of Ethereum and the development of its ecosystem, in order to meet the needs of more investors for risk control and exit, stablecoins emerged. It can be considered that the emergence of stable coins has further promoted the rapid development and rise of the encryption market.

Problems with Stablecoins

The issue of stablecoins not being stable enough has been mentioned by regulators many times. Regulators worry that most of the stablecoins springing up like mushrooms are pegged to the U.S. dollar, which may plant the seeds of instability in the overall financial market. The effect may be more immediate than the turmoil in blue-chip cryptocurrencies.

What has troubled regulators is which assets the stablecoin uses as a reserve to achieve its promised 1:1 peg to the U.S. dollar. As many might think, it's not just dollar cash, but a combination of commercial paper, bills, bonds and loans.

Credit rating agency Fitch has pointed out, "We think it is unlikely that the authorities will intervene to save stablecoins in the event of a disruptive event, partly due to moral hazard. If the redemption of stablecoins leads to or amplifies the broader commercial paper (CP ) sell-off, weighing on market liquidity and hampering the issuance of new CPs, the authorities may step in to support traders and major money market funds."

The problem that stablecoins can cause is not just decoupling from the value of the US dollar, but decoupling may lead to a series of selling pressure on the assets behind it, resulting in more serious market shocks. Simply put, a stablecoin with a market value of $180 billion is backed by $180 billion worth of assets as collateral. And those $180 billion in assets are the key to the bigger problem.

hug and ban

On July 19, 2021, U.S. Treasury Secretary Yellen met with the heads of several federal agencies to discuss the regulation of stablecoins. Participants discussed the rapid growth of stablecoins, their potential use as a means of payment, and the ultimate Potential risk to users, financial system and national security. According to the minutes of the meeting, Yellen emphasized that it is now necessary to act quickly to ensure that stablecoins have an appropriate regulatory framework in the United States.

The Group of Twenty (G20) finance ministers and central bank governors have also discussed the development and supervision of stablecoins many times. At the G20 finance ministers and central bank governors meeting held in early July 2021, all parties agreed to implement the G20 roadmap on improving the cross-border payment system, looked forward to discussing issues related to central bank digital currencies, and emphasized that global stablecoins need to comply with Relevant legal and regulatory requirements.

Of course, there is still no mature plan for the regulation of stablecoins. However, the contribution of stablecoins in cross-border remittances, B2B/B2C, and digital economy should not be underestimated. The stable currency solves the complex and cumbersome problem of cross-border remittance process, and greatly simplifies the transfer/payment process. In the future development and transformation of the digital economy, stablecoins may gain a large number of enterprise-level adoption.

Author: Zeqi YI

Alex

Alex

Alex

Alex Kikyo

Kikyo Miyuki

Miyuki Anais

Anais Weiliang

Weiliang Catherine

Catherine Weatherly

Weatherly Kikyo

Kikyo Weiliang

Weiliang Weatherly

Weatherly