Author: Marco Manoppo

Source: pensivepragmatism.substack.com

Over the past decade, we have witnessed the revival of a new asset class: tokens.

Now ask everyone a question, do you think there is any difference between tokens, coins, digital assets, and cryptocurrencies? Frankly, I don't care. We might as well leave it to academics, lawyers, and regulators to define the terms, and focus on how this new asset class creates value.

In what follows, I will refer to tokens as any cryptographic asset on the blockchain.

Main points of this article:

• The ultimate goal of tokens is to become "equity-like", but with more use cases.

• Tokens will become digitally native assets, more seamless and interoperable than all existing asset classes.

• The regulatory environment will catch up to this new reality, but it will take time.

• Value cannot be accrued efficiently into tokens and equity at the same time.

• The next cryptocurrency bull cycle will require integration of tokens with real economic activity.

What are tokens?

Digital tokens began to emerge and become popular about a decade ago, when Bitcoin showed the world the possibility of having a fully digital, cryptographically secure, unalterable form of money that could be used by any party and not subject to The impact of centralization.

Thanks to blockchain technology, for the first time in history, we have a truly digitally native asset that can take advantage of the growth of the internet and transcend geographic borders. We can see at a glance that this will unlock enormous value and accelerate the pace of globalization, especially as the global economy has become more intertwined over the past decade.

Fast forward to 2014, Ethereum came along and pioneered the idea of smart contracts. This opens up the possibility of creating decentralized applications and businesses on the blockchain. Ultimately, the discovery of smart contracts became the cornerstone of what we now call Web 3.0. Additionally, innovation around token use cases has been developing rapidly over the past 5 years, especially since 2017, when crypto first penetrated mainstream consciousness.

However, these innovations still cannot solve the number one problem that has been plaguing the crypto market:

What does my token represent? How does it add value?

In this article, we propose mental models and ideas to help existing projects, developers, and other industry players consider the future of tokens and create an appropriate framework for their business models.

To understand this article properly, we first need to understand the various types of tokens that have emerged over the past decade and how they have shaped the current crypto space.

digital currency

As the name suggests, digital currencies aim to be a form of internet money that people can use to transact with each other. It does not have any other functionality, such as smart contract functionality, nor does it represent any use case related to a particular project.

While Bitcoin began as a "peer-to-peer electronic cash system," its current form and narrative are far removed from what the original white paper described.

Bitcoin will become more useful through projects such as the Lightning Network and Stacks, which will make Bitcoin more than just a digital currency. At the same time, the main investment philosophy they convey is to treat Bitcoin as digital gold. Proponents say bitcoin should appreciate over time because of its inherent scarcity.

Network/L1 Tokens

Ethereum pioneered the idea of writing smart contracts using blockchain technology, enabling the creation of decentralized applications. This unlocks a whole new type of token for powering blockchain "networks", often referred to as "Layer 1 (L1) tokens". The L1 token is used to secure the underlying blockchain network on which it depends, and is also the de facto currency that users and developers need to use when using blockchain-based decentralized applications.

For example, when one transfers tokens through the Ethereum blockchain, ETH is required to pay. Likewise, ETH is required when developers or users interact with decentralized applications and execute smart contracts on the Ethereum blockchain.

utility token

As the L1 token matures and multiple smart contract-capable blockchain networks emerge, the number of developers interested in building applications on top of these networks increases. In 2017, we saw many projects raise funds through Initial Coin Offerings (ICOs) to build their own blockchains for specific use cases. These ideas are often grand and broad without explaining in detail what problem they are actually trying to solve. ICOs started to proliferate as people realized how easy it was to raise money through ICOs. During the ICO boom of 2017, crypto projects were often criticized for trying to find problems with existing solutions.

Unsurprisingly, this has been followed by a 99% plunge in ICO tokens and heavy regulatory enforcement from authorities around the world, leading founders to be wary of raising funds through ICOs. This result has fueled the rise of crypto VCs.

However, in this era, we are also witnessing the rise of utility tokens. Projects that did not build their own chains but did a great job of infusing utility value into their tokens, such as Basic Attention Token (BAT) and Binance Coin (BNB), saw some form of success and kicked off the utility token landscape. Era - These items are also known as "application layer" items.

governance token

Fast-forward to 2020, and application-layer projects have found a product-market fit through decentralized finance and achieved great success. DeFi 1.0 projects, such as MKR, UNI, AAVE, COMP, and SNX, do not build their own blockchains, but build decentralized financial services on top of the Ethereum blockchain, and for a variety of reasons and use cases to issue their own tokens.

While these use cases vary, a common thread that emerged after DeFi Summer 2020 is the concept of governance tokens. Owners of these tokens can submit and vote on proposals. These proposals can determine the future of the project, such as changing the fees charged for services, or using project revenue to buy back tokens from the open market. Admittedly, token holders’ degree of governance power also varies from project to project, but for the first time in cryptocurrency history, token holders have rights fairly similar to equity shareholders.

However, the concept of governance tokens does not seem to be enough.

The chart below shows that despite Uniswap’s growing revenue and user base, the price of the UNI token simply does not reflect this growth. The Uniswap team has long touted that it will eventually activate a fee switch that distributes a portion of transaction fee revenue to UNI token holders. Since most of the Uniswap team lives in the US, and the SEC is investigating Uniswap Labs, we can only continue to wait for the value of the UNI token to increase.

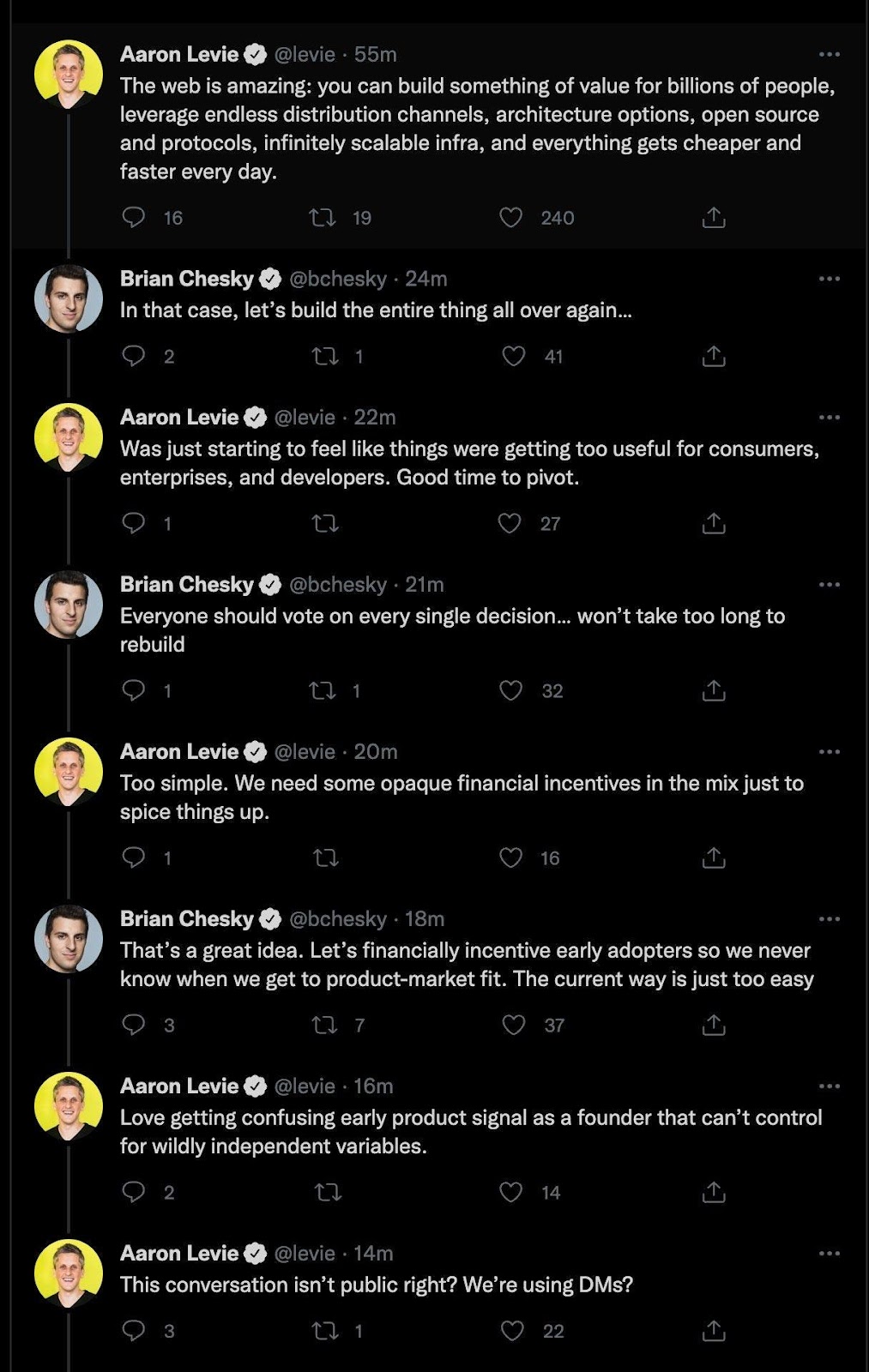

Source: Twitter

Source: Twitter

But wait, if these governance tokens weren’t Uniswap, their price action would be even worse. Uniswap is the de facto largest decentralized exchange in the crypto market, with defensible moats such as first-mover advantages and a solid security record. Application-layer projects that rely solely on “governance power” for funding without proper consideration of the defensibility of the token’s use case will suffer the most, especially altcoins raised on alternative L1 chains.

Source: Twitter

A few weeks ago Richard Craib, founder of crypto project and quant hedge fund Numerai, made it clear (23:00 - 25:30) on the Blockworks podcast that if we live in a world where regulators allow us to raise money through ICOs, And simply say "yes, we're raising money for a business", what about? Unfortunately, that means it's a security, and the government would rather let us raise money for an art project or a weird governance token. For me, this candid perspective is refreshing, especially from someone who has been in the crypto space for quite some time and has a good understanding of both technical and financial aspects.

Ok, we’ve shown that having governance power is not enough, so what about the x-to-earn model?

Ride-to-Earn (R2E)

Uber and other ride-hailing companies in the early days subsidized the cost of travel by offering cheap rides to acquire users. This growth hacking strategy has worked and has been emulated by many tech companies, hoping that this combination of cheap costs will create network effects and retain users when they finally find a way to make money.

Now imagine if instead of offering cheaper rides, Uber distributed tokens to its early users, making them part of the community and rewarded for being active consumers of the aforementioned products. For every ride you take and every ride you (as a driver) take, you will be rewarded in UBER tokens.

It’s safe to say that most end users, including early adopters, will dump UBER tokens for cash unless there’s a reason to hold them. In the crypto space, this often means sacrificing the token’s price (at least in the short term) to help build the project’s user base and enable growth.

We can also safely assume that opportunists will try to game the reward system to grab as much short-term profit as possible. True, if the product is really good, users will still stick around (for example, STEPN is more sticky than Axie Infinity), but this means that projects need to be able to balance their growth hacking strategy with a good product and sustainable token distribution.

Often, projects try to artificially delay sell pressure by obfuscating the true use case of their token or creating one, rather than improving their product or simply unlocking value accretion mechanisms to achieve this balance.

Even so, that doesn't solve the question: Who qualifies for cash flow?

Can I submit a proposal to the Uber Governance Forum and turn on the fee switch for Uber token holders to receive a portion of the revenue?

Maybe -- but if that's the case, then what's the use of Uber's equity?

If UBER token holders get cash flow, and have the right to manage the future of the business, it should just be a tokenized UBER stake and have more utility, otherwise one of the assets would be worthless.

Additionally, focusing too much on growth hacking tactics rather than products often creates unsustainable gamification mechanisms, or worse, Ponzi economies.

The ultimate evolution direction of tokens is: tokenized equity

Are you surprised?

Like it or not, for application layer projects, even chain agnostic, the end goal is to make your tokens as equity-like as possible. If both equity and tokens exist, I don't believe they both add value.

Some might argue that both have the potential to generate value if the token has the proper "value accretion mechanism," but all mechanisms that might give your token value will make it "equity-like" or make Equity is useless. At that point, for heaven's sake pick one and decide.

So the next time you look at a project, ask yourself: do I really "own" the project and the cash flow/governance associated with it, or am I just an accessory.

Fortunately, some protocols are increasingly leaning in this direction, where all value added will flow to token holders. But of course, they have to be careful in describing the above mechanisms to ensure that their tokens are not considered securities. Their earnings are not dividends.

This is largely the regulator's fault. For the first time, encryption technology has opened up a way to organize capital and operate organizations in a truly global and decentralized manner. Failure to adapt to new technologies or attempting to implement outdated laws will hinder the development of the field and lead to mispricing of the crypto market.

However, I remain optimistic that the regulatory framework will eventually catch up and be on the side of innovation. This may not start in developed countries due to self-interest, but we will get there eventually.

in conclusion

The author is not a securities or legal expert, but web 3.0 founders need to weigh:

1. How "equity-like" their token is while ensuring it is useful

2. Where to market and sell their tokens

3. Create a truly remarkable product that is loved by users even without a token

Tokens are not products, but tokens must enhance products.

Unfortunately, decentralization through tokens is one of the easiest ways to claim you've improved your product, but doing it right can make your tokens too "equity-like". So your best bet is most likely to target emerging markets where the laws may be friendlier and raise most of your capital from accredited investors and high net worth individuals.

It also means testing how decentralized and incentivized a project really is. I believe that true decentralization is not only about code, technology or governance (such as who is the multisig holder), but also means who is the penultimate owner of the project and the recipient of the cash flow.

If I own 10% of Apple, even if the stock goes down 50%, that still means I own 10% of the company and everything for that matter. If I own 10% of the total UNI supply and the token drops 50%, what do I actually own? (Right now, it's a promise to a future value).

We have a long way to go before owning tokens becomes as easy as owning Apple stock.

Anais

Anais