An interesting hypothetical: what would the state of the crypto industry be like without Terra, Three Arrows, and so many crypto banks falling?

Obviously...it's going to be a lot better.

Unfortunately, the damage has already been done.

We can't help but wonder how quickly the industry can recover?

Institutional crypto asset manager Bitwise has released a quarterly crypto report that captures key trends in different sectors of the crypto industry.

This article summarizes some of the highlights of the report.

Despite the grim second quarter, there's more good news than you might think.

The crypto industry is recovering.

In-Depth Analysis Q3 2022: Bitwise's Crypto Market Quarterly Review

Q3 2022 is a good quarter for cryptocurrencies.

Overall, it's up 10%, with gains in many individual assets rising sharply.

Taking Ethereum as an example, it rose by 31%, mainly due to the technical upgrade of the Ethereum blockchain - the success of the merger, which reduced its carbon footprint by more than 99% and so on. Meanwhile, popular DeFi asset Lido jumped 260% as users flocked to its "liquid staking" service.

The changes look all the more impressive in a poor macro environment. In the macro environment, the S&P 500 index fell more than 5% this quarter.

The positive price trend for the cryptocurrency is supported by a generally positive news flow. On the regulatory front, the White House released the first "comprehensive framework" on cryptocurrencies, while Congress took important steps toward crafting thoughtful stablecoin rules.

Meanwhile, venture capital continues to flow into the space (albeit at a slower rate), and multiple blockchains pass important technical milestones.

However, none of these developments can hide the damage done by the implosion of Terra and 3AC and the resulting crypto credit crunch in Q2.

The second quarter was the worst quarter for cryptocurrencies in a decade, with the leading broad-cap asset down nearly 63%. Under such a framework, the recovery in the third quarter would be modest at best.

The third quarter wasn't all smooth sailing. We’ve seen the US SEC threaten aggressive enforcement action, as well as continued declines in user activity in DeFi, NFT, and other areas.

Still, we're excited by the strength of developer activity, one of the most fundamental measures of growth in the space. Ethereum, for example, saw a 143% year-over-year increase in crypto application deployments in Q3, and a massive 14% increase in deployments in the two weeks following the merger.

As we enter the fourth quarter, investors are uncertain about what to expect.

Will cryptocurrencies continue their modest recovery that began in Q3, or will negative macro news overwhelm fundamentals and drive prices to new lows?

With cryptocurrencies increasingly the subject of discussion and heated debate among regulators and lawmakers, what role will it play in the upcoming U.S. midterm elections? if you can.

This report answers these questions. Through a study of fundamental data and qualitative news, the report explores key developments in several areas of the crypto market: Bitcoin, Ethereum and emerging Layer 1 blockchains, DeFi, NFTs, and crypto stocks.

5 Highlights to Know About Bitwise's Q3 Report

1. Bitcoin survives global currency turmoil

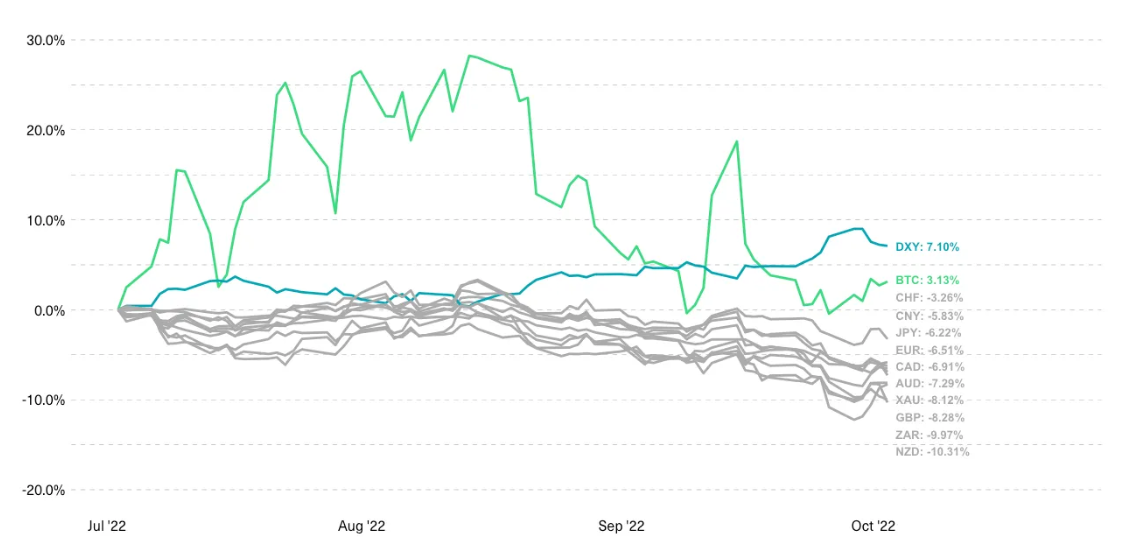

In the third quarter, a stronger dollar was the dominant force globally, weighing on all other currencies. From this perspective, Bitcoin is doing pretty well.

The third quarter was tough for the world's major currencies and gold. Major global currencies (Euro, British Pound, Japanese Yen, Swiss Franc) and Chinese Yuan all fell by 3-8% against the US dollar. Gold was also down 8% in dollar terms.

Bitcoin, meanwhile, bucked the trend and gained 3.1%.

The move was so surprising that the New York Times ran an article with the headline: “Global Currencies Are Plunging. Except Bitcoin.”

The chart below shows the performance of some global currencies, gold and bitcoin from June 30 to September 30, 2022

Source: Bitwise Asset Management (data via Bloomberg)

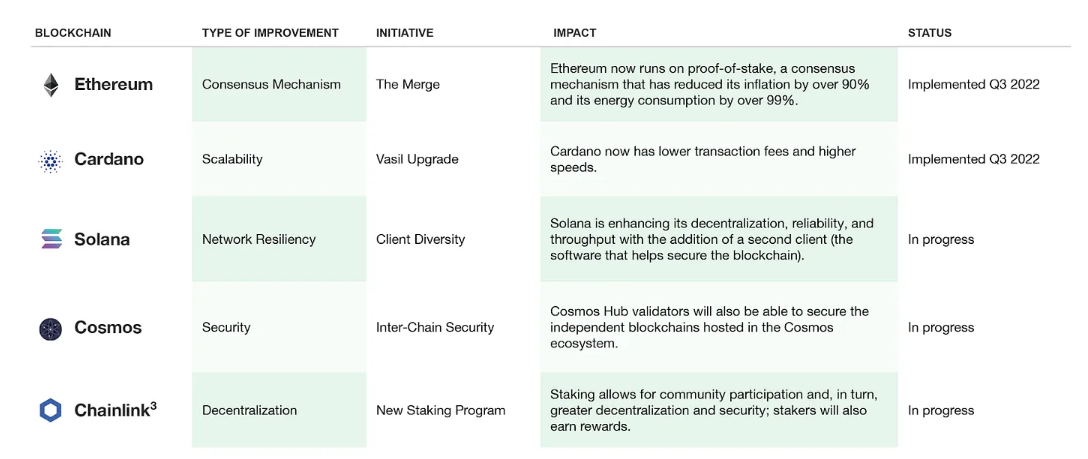

2. Major network upgrades drive Ethereum and other Layer 1 growth

Layer 1 blockchains rallied 27% in the third quarter as positive news about mergers and other network upgrades overcame macro headwinds.

Ethereum’s inflation rate has dropped by more than 90% after the merger, and its energy consumption has dropped by more than 99% (the network now consumes less energy than Paypal, YouTube, or Bitcoin).

The transition to proof-of-stake has been seamless, and many doubt that this consensus mechanism can power a major blockchain.

But not just Ethereum, other blockchains are also undergoing major upgrades. The shared vision is more features, lower costs, and more mainstream applications.

The diagram below shows key blockchain infrastructure improvements announced or deployed between June 30 and September 30, 2022.

Source: Bitwise Asset Management

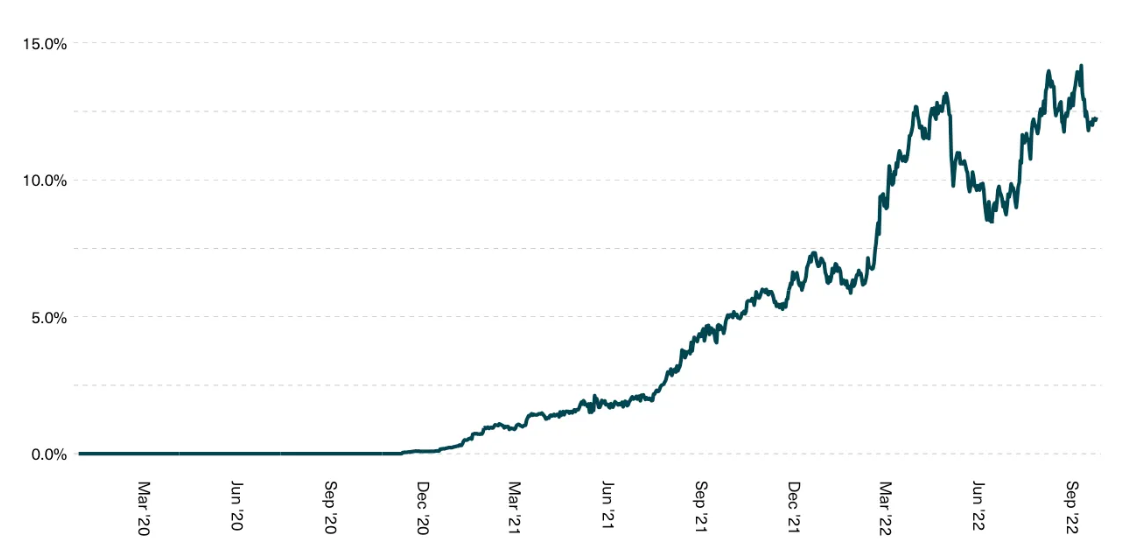

Lido dominates the liquid staking market

Combined, liquid staking has solidified its position as an important new primitive for DeFi, with DeFi liquid staking hitting an all-time high in Q3.

Staking is one of the first financial services where a DeFi protocol beats a centralized financial service provider: Lido, the leading decentralized staking service, surpasses Coinbase in staking market share, dominating 31.0% of all staked ETH status.

Lido has generated more than $375 million in cumulative revenue, almost all before the merger.

The figure below shows the percentage of liquid pledges in DeFi's total TVL from January 2020 to September 2022.

Source: Bitwise Asset Management (data from The Block and Defi Llama, as of September 30, 2022)

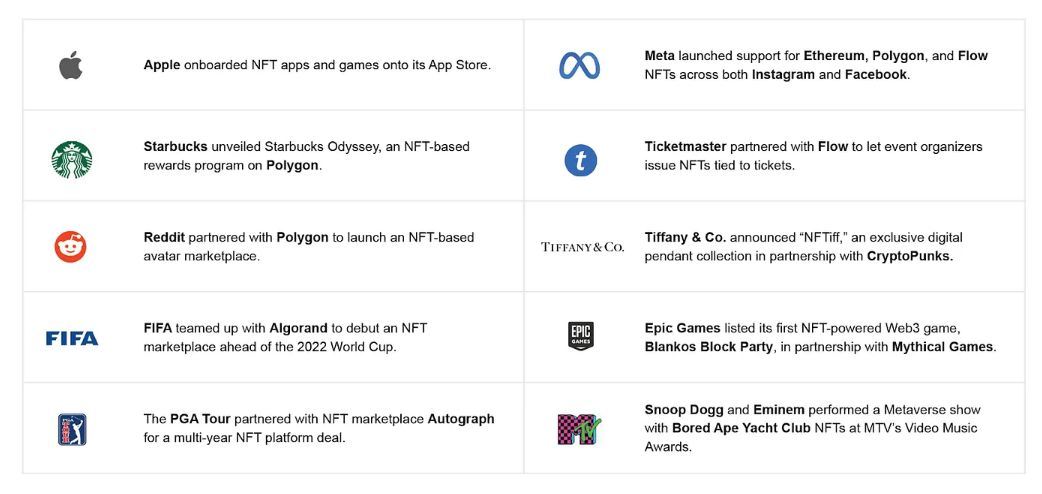

4. Venture capital pours into NFT and Web3 games

Venture capital and major brand partnerships were bright spots in a tough quarter for NFTs.

Venture capital investment in NFT and Web3 games in August increased by 66% compared to July.

This stat is notable given the general decline in blockchain/crypto VC activity. Overall, the new transactions illustrate the evolution of NFT usage — from digital art and collectibles to games, metaverse apps, and more utility-focused apps. Another major area of growth for the NFT industry in Q3: Big brands, sports and media companies announced new partnerships to launch NFT strategies.

The chart below shows the major NFT partnerships announced from June to September 2022.

Source: Bitwise Asset Management (as of September 30, 2022)

5. Circle prepares for the public market

Circle’s planned SPAC listing is expected to close in the fourth quarter of 2022, offering the public access to an emerging leader in the stablecoin craze.

Circle, the co-creator of USDC, plans to go public through a merger with SPAC company Concord Acquisition Group between the fourth quarter of 2022 and early 2023, with a valuation of $9 billion.

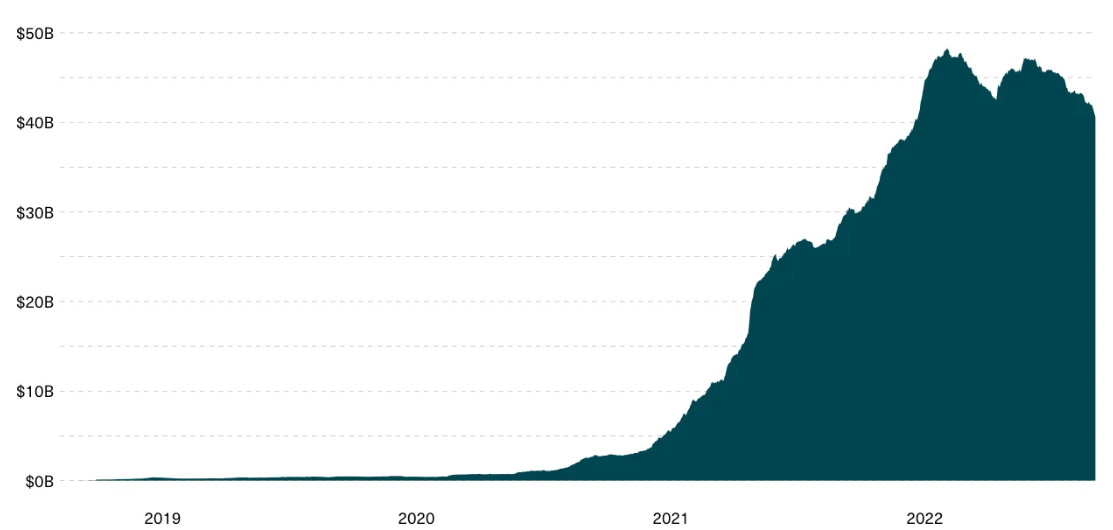

USDC is one of the fastest-growing stablecoins in the world: as of the second quarter of 2022, USDC issuance has increased by 85% year-on-year, and there are currently more than $55 billion USDC in circulation.

At the same time, Circle’s business model — which earns income from the collateral backing its stablecoin — will be affected by rising interest rates. With interest rates rising, the revenue opportunity is huge: Circle holds a $43.5 billion reserve of Treasury securities, which would generate $722 million in annual revenue at current yields.

Total assets under management of USDC from September 2018 to September 2022 (billions of dollars)

Source: Bitwise Asset Management (data from The Block and Coin Metrics)

Xu Lin

Xu Lin