Author: wassielawyer

Source: wassielawyer's twitter

After the disclosure of the 1,157-page court document of Three Arrows Capital, it immediately aroused widespread discussion. This article will introduce and summarize some interesting findings in these documents.

The main points are as follows:

(1) yacht

(2) Reasons for 3AC's bankruptcy

(3) Kyle and Su did not cooperate with the investigation

(4) Mysterious Tai Ping Shan

First of all, this document is an application to the Singapore High Court for recognition of the liquidation procedure in the British Virgin Islands. It's very informative and basically gives us an update on the liquidator's information as of July 9, 2022.

At 1,157 pages, the document is exceptionally long because it is accompanied by other court documents, some of which are repetitive. Here are many affidavits from angry creditors, and some very useful information.

The most interesting content is the yacht, which is mentioned in the liquidator's application and appears in large numbers in the http://blockchain.com affidavit. Su Zhu and Kyle Davies are very proud of it, with Kyle reportedly claiming the yacht is bigger than "any yacht owned by the richest billionaire in Singapore".

Except, they bought it with borrowed money. Even paid a deposit when everything around was crumbling. Yes, according to http://blockchain.com's affidavit, they made a down payment on the yacht at the same time they defaulted on the loan.

The yacht was due to be delivered in Italy two months later, but Su started showing it off to friends early on.

I guess the yacht is up for sale, who can start a DAO to buy it?

The next interesting point is how did 3AC get to where it is today?

Based on the accounts of the Liquidator and Kyle himself, Terra's collapse seems to have completely destroyed them. The exposure is about $600 million.

But despite this, 3AC clearly lied to investors (and the market) about the extent of its exposure. There was some text exchange between 3AC and their investors, the investors asked if 3AC was affected by Terra, and they assured the investors that they were fine.

Now, the liquidator is also saying that Kyle and Su are playing tricks. They cite some of the problematic transactions the DRB found:

(a) Transfer $31.6 million in stablecoins to Tai Ping Shan (more on that later)

(b) Transfer over 10,000 ETH from FTX to Aave

(c) Transfer of $10.9 million in stablecoins to an unknown address

In addition, Kyle and Su liquidated 3AC without informing any shareholders or creditors, and did not show up until July 6, 2022. Their offices were also locked and abandoned when liquidators tried to gain access to them. The liquidators finally got in touch with Kyle and Su's lawyers.

But they didn't help much either. They arranged an "introductory call" between Kyle and Su, and they were said to be off video, on mute the entire time, and even if they were asked questions, they said absolutely nothing. The liquidators requested access to the Singapore office.

Then the lawyer said there were no 3AC documents there, the liquidator said "haha, this is a real photo of the 3AC documents", the lawyer tried to say that the Singapore office only belonged to the management company. The liquidator pressed on, noting that apparently the management company would have received the 3AC's documents, "which was accepted by (the law firm)". But still did not enter the company.

It seems like DeFiance is in control of their own wallets, but that doesn't seem to be the case. I'd really like to know what happens if they don't hand over the assets in their wallets (since they can't accurately identify them).

Now the answer is finally revealed - Tai Ping Shan (TPS).

The name had previously appeared in some news sources, but the reference in those documents was to a Cayman entity indirectly owned (as majority shareholders) by Su and Kyle’s wives.

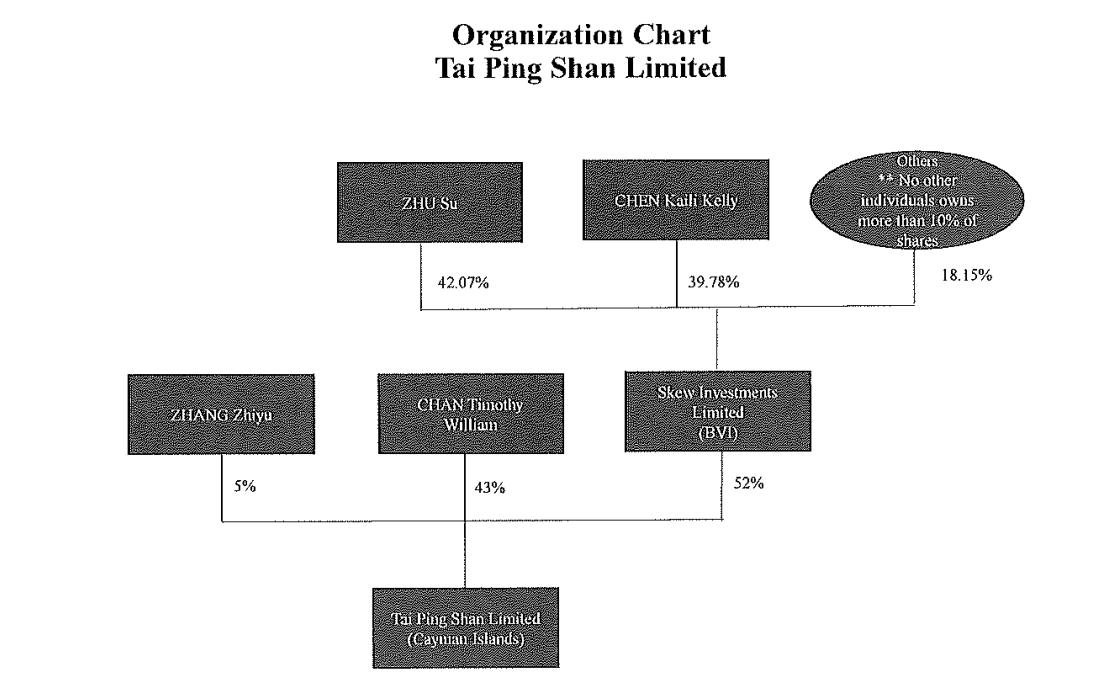

The organizational structure is as follows.

Honestly, this entity is shrouded in mystery. Coindesk once published an article about TPS Capital, TPS Capital is Tai Ping Shan Limited and Three Lucky Charms Ltd.

Subsidiaries registered in Singapore.

How "TPS Group" worked is unknown - apparently TPS Capital used to be 3AC's over-the-counter (OTC) arm, but what exactly Tai Ping Shan Limited (the Cayman Islands-based parent company) did is unclear. Is it just a holding company? Who are these shareholders?

Most importantly, why did 3AC transfer $31 million to Tai Ping Shan Limited after bankruptcy?

By the way, they are not transferring to the "over the counter arm" TPS Capital, but to their 52% owned parent company (48% of which is held by people we are not familiar with).

Tai Ping Shan appears in only one document - a demand document from Mirana.

Interestingly, 3AC is the guarantor for Tai Ping Shan Limited's debt to Mirana under the master loan agreement.

Why does 3AC guarantee the loan of TPS Limited? Again, it's not the OTC division, it's the parent company that owns the OTC division. As for the $31 million transferred to Tai Ping Shan Limited, no one knows where it went.

All in all, the liquidator expects to have a lot of fun researching the relationship between Tai Ping Shan and 3AC and its founders.

Miyuki

Miyuki