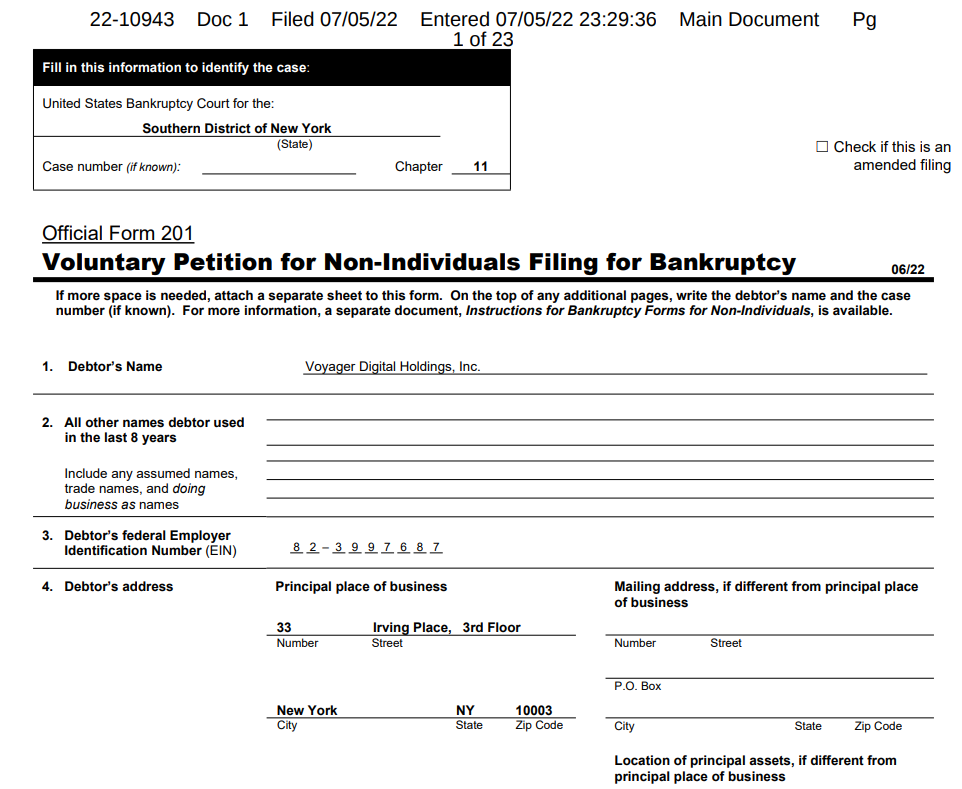

Cryptocurrency exchange Voyager Digital has filed for Chapter 11 bankruptcy in the U.S. District Court for the Southern District of New York, days after suspending trading, withdrawals and deposits.

Voyager filed for Chapter 11 bankruptcy protection, suggesting the company owes $1-10 billion in assets to more than 100,000 creditors.

The struggling cryptocurrency exchange filed for Chapter 11 bankruptcy protection on July 5, immediately after the U.S. Independence Day holiday. In a statement on Wednesday, Voyager explained that the move was part of a "restructuring plan". Once implemented, the program will enable customers to access their accounts again and Voyager will "return value to customers".

Voyager CEO Stephen Ehrlich tweeted on July 6 that under its proposed plan, customers with cryptocurrencies in their accounts would receive cryptocurrencies, proceeds from the restoration of Three Arrows Capital, common stock in the newly restructured company, and Voyager A combination of tokens.

He also confirmed that customers with U.S. dollars in their accounts will be able to access those funds after they "complete a settlement and fraud prevention process with MetBank."

In the same tweet, Ehrlich stated that, all things considered, he believes Chapter 11 is the best path for his clients, and assured that the move will protect assets on the platform and that Voyager will continue to operate .

Voyager Digital filed for Chapter 11 bankruptcy in New York.

Voyager said that during the restructuring process, the company will file a "First Day" motion under Chapter 11, allowing it to remain in business.

Voyager said the company plans to pay employees in the normal way and continue their "key benefits and certain customer programs" without disruption, but transactions, deposits, withdrawals and loyalty rewards will remain suspended.

Signs that Voyager and its clients are struggling have emerged after Voyager struck a $500 million credit deal with trading firm Alameda Research to cover losses from its exposure to cryptocurrency venture capital firm 3AC.

A day later, the platform lowered the daily withdrawal limit to $10,000 before announcing on July 1 that it would suspend transactions, deposits, withdrawals and loyalty rewards.

Voyager Digital LLC, a subsidiary of Voyager Digital, also previously issued a default notice to 3AC for failing to pay its loan of 15,250 Bitcoin (BTC) and 350 million USD Coin (USDC).

However, Three Arrows is going through Chapter 15 bankruptcy proceedings and has reportedly been forced into liquidation by the British Virgin Islands, suggesting that Voyager may struggle to recover the funds it lent.

Brian

Brian