Mergers have taken place. Is ETH Overtaking BTC?

The tokenomics dynamics of Ethereum have changed dramatically.

Ethereum now issues much less ETH to block validators.

The drop in ETH supply growth has huge implications.

Ethereum is generating more revenue and has the ability to be profitable , greatly improving its competitive position with Bitcoin.

Does this mean "flippening" is coming?

Is this good for the crypto industry?

Why "Flipping" Is Good for the Crypto Industry

"Flipping" means that the market cap of ETH will eventually surpass that of BTC.

Of course, ETH supporters like me want the "flip" to happen.

But apart from our personal financial interests, is “flipping” good for the crypto industry?

What's wrong with Bitcoin being #1?

So far so good, hasn't it?

If the "flip" could be good for the crypto industry, why hasn't it happened yet?

These questions are intertwined, and perhaps best studied by delving into the details of BTC returns.

Reliable does not mean investable

Bitcoin is the most credible neutral asset. This is because the Bitcoin protocol is mature and not expected to change, and Proof-of-Work largely reduces risk due to its simplicity and proven record.

It has withstood dozens of failed attempts over the years by organized groups to unilaterally modify Bitcoin’s underlying code and increase its node size. Regardless of Satoshi’s original intentions, the reliability of BTC has become its core intrinsic value proposition.

However, the reliability of Bitcoin does not mean that the asset will maintain its value, or increase in purchasing power or fiat currency. On the contrary, the core design of Bitcoin is not programmable, there is no value accumulation for holders, and its mining cost structure will cause a large amount of value leakage.

This is why, for Bitcoin, reliable does not equal investable.

With that in the background, let's take a look at how BTC works, starting with its historical returns.

What happened around 2016?

From 2013 to 2016, if you buy low and sell high, BTC returns about 6 times. But if you bought bitcoin at the 2013 high and sold it in 2016, you didn't make a profit.

After 2016, the situation is completely different: if you bought Bitcoin in 2016 and held it until today, you earned 20 to 40 times.

What about buying Bitcoin at the 2016 low and selling at the 2021 all-time high? You earn 130 times.

One might protest, "Before 2016 it was like the dark ages of crypto. That's irrelevant. We're just getting started."

What happened around 2016 to make BTC perform better in the following years?

What happened to Bitcoin before or around 2016 to create very high returns?

Bitcoin itself has not changed. After all, immutability is the hallmark of Bitcoin and part of its optimal reliability. Of course, the Lightning Network was launched after 2016, but it was hardly popular.

What else might have happened around 2016 that unlocked Bitcoin's potential? Maybe the whole world fell asleep on Bitcoin and woke up for some reason?

Or, maybe some intangible element was brewing for BTC, and that milestone was accomplished around 2016?

None of these explanations are plausible. The idea that Bitcoin somehow evolved or unlocked its potential around 2016 simply cannot be explained by the narratives and data we have seen over the past few years.

Bitcoin rides the web3 ride

So, what's going on here?

The simplest fact that fits the historical narrative and data, in my opinion, is that every major catalyst in the crypto market since 2016 has been driven by the promise or realization of web3 applications, which Bitcoin does not support program.

In 2016, a small project called ethereum began to achieve major success, striving to multiply the public blockchain's role as a computer rather than just an abacus.

The truth is, so far, roughly in the second half of its lifecycle, BTC has just been surfing a giant wave of "actually useful stuff" created by the Ethereum community (and a few others).

At this point, one might reasonably expect a reaction from a Bitcoin supremacist or a cryptocurrency basket investor: “Wait, why should investors buy Bitcoin if it’s just a supporting player? Currently BTC dominance is about 38%. Are you kidding me? You think ~$400B market cap is just a mistake?"

Yes, that's exactly what I said, and I'll prove it below.

This is why BTC is unsustainable as an investment, why "flipping" is guaranteed, and therefore why "flipping" is a good thing for the crypto industry - because it will eliminate an uninvestable asset as our Industry leader.

totally unsustainable

Bitcoin fits the definition of an "unsustainable investment" perfectly. If we take a serious look at Bitcoin's use of proof-of-work, it's hard to question Bitcoin's sustainability in terms of value retention or accumulation.

Bitcoin fees are paid directly to miners, providing no value accumulation to Bitcoin holders.

This makes BTC perpetually unprofitable, especially given the expensive mining cost structure.

Before the halving in 2024, BTC has an annual inflation rate of 2%.

On paper, that sounds good, right? What's wrong with only 2% inflation?

The problem is that due to the economics of mining, Proof of Work inflation (issuance) is a direct capital drain on BTC's valuation.

Coupled with the weak liquidity of the spot price, the miners' selling of BTC has caused great damage to the market value of BTC. Let's break it down...

On average, in the medium term, miners have to dump most of the BTC they earn because they are willing and able to spend up to $1 in hardware and energy costs to compete for $1 of BTC.

This is a huge problem for BTC (and ETH before yesterday's merger!), as dumping X% of supply hurts market cap far more than X%.

It is estimated that dumping $1 of Bitcoin could cost $5 to $20 in market cap.

It's an open secret in crypto that you can't sell more than a fraction of the total supply at the spot price. Order books are small and liquidity is thin. So if not nearly everyone can sell at today's prices, miners are clearly using up scarce resources by constantly selling.

That said, BTC miners may only be dumping about 2% of the total supply per year, but they capture far more than 2% of net fiat inflows per year. Since BTC fees are always low and paid to miners (leading to selloffs), the sum of these facts has two very important effects that may be overlooked by many BTC holders:

On average, someone has to buy a lot of bitcoins every day to keep the price stable. In 2021, a daily net inflow of about $46 million in fiat currency will be needed to keep the price of BTC stable. In other words, "I have this great investment for you, we just need $46 million a day in new money from other people to avoid losing our principal..."

When bitcoin investors get 50% or 5x or 40x returns, those profits can only come from new entrants. Holders receive no meaningful fee income, there are no meaningful applications on Bitcoin, and the price of Bitcoin cannot remain stable due to mining costs.

social imbalance

Who would knowingly buy an investment that is not sustainable in the long run? Who would recommend buying it? How did BTC end with a 40% dominance last year and a total cryptocurrency market capitalization of $3 trillion?

As far as I know, a handful of different types of buyers may have driven capital into BTC, each for their own reasons, and most are unaware of the true risk profile of their investment.

First, new entrants buy bitcoin. These are, for example, veteran hedge funds, long-term institutional investors, ultra-high-net-worth individuals, and retail investors turning to web3. These new entrants in web3 - during the bull market, in terms of numbers - are all excited, they know that cryptocurrencies are novel and complex, they see that we are on a long journey to the moon, they Reasonable and proportionate allocation of a basket of top crypto assets. Proportional is an investment term, and in this case it means "there's no clue, so I'll buy everything proportional to today's market cap." These new entrants are often the result of BTC's unsustainability as an investment Lamb to slaughter.

Second, long-term basket allocators buy Bitcoin. These people may be crypto OGs who like early investment, or crypto VCs with more contacts and funds, rather than cultivating independent investment targets. These people are buying Bitcoin because they really don't have or want to develop confidence in the direction the space is headed, and they want to avoid being on the wrong side of an argument they see as risky. To make matters worse, these long-term basket allocators are often pundits who play an important role in helping push new entrants to invest in BTC.

Third, reflexive wolves buying BTC. But they could also sell all at the next all-time high. These are often the brightest, savviest, and/or hungriest of crypto OGs, VCs, and finance folks moving to web3. The reflexive wolves are usually well aware that Bitcoin is not the best performing investment. However, they feel that for the greater good (often theirs), "we" must avoid making a mess of things and instead focus on promoting Bitcoin. The reflexive wolves believe that a bitcoin crash would mean huge losses for some of the largest and most influential cryptocurrency investors, potentially damaging the entire space and their portfolios. So reflexive wolves leave the problem behind. Some may question their existence, or think they are mere traders.

Fourth, traders buy BTC and rotate profits into BTC, the de facto reserve currency of the crypto space. Traders just go with the flow. On the surface it seems so. They know that in the current era, BTC performs better in bad times and worse in good times. Traders have very short time horizons and they just use Bitcoin as a riskier investment base. In a way, traders are the most rational and/or least destructive of all Bitcoin buyers.

Fifth, BTC hardcore fans buy BTC. They truly believe that Bitcoin is the closest thing to the most reliable money in the history of the world. They believe that not only does BTC have top-notch reliability, but that this reliability is bound to translate into an excellent long-term investment and/or the best cryptocurrency investment to date on a risk-adjusted basis.

Here’s the thing — out of these five types of Bitcoin buyers, only the hardcore Bitcoin buyers have any hope that most of them will stick around after Bitcoin’s dominance collapses. Bitcoin buyers are collectively engaging in one of the biggest reflexive games of chicken in modern finance. Of them, only the Reflexive Wolves had any idea of the nature of the game.

While this categorization of bitcoin buyers is simplistic, I think it's useful.

Reading this, BTC supremacists and “flip” skeptics may be getting more confident:

“The water is wet, the sun is up this morning, and this sane ETH supremacist is saying we are all wrong, BTC is doomed as an investment vehicle. So, why hasn’t the ‘flip’ happened yet?”

Let me explain: the numbers, the reasons.

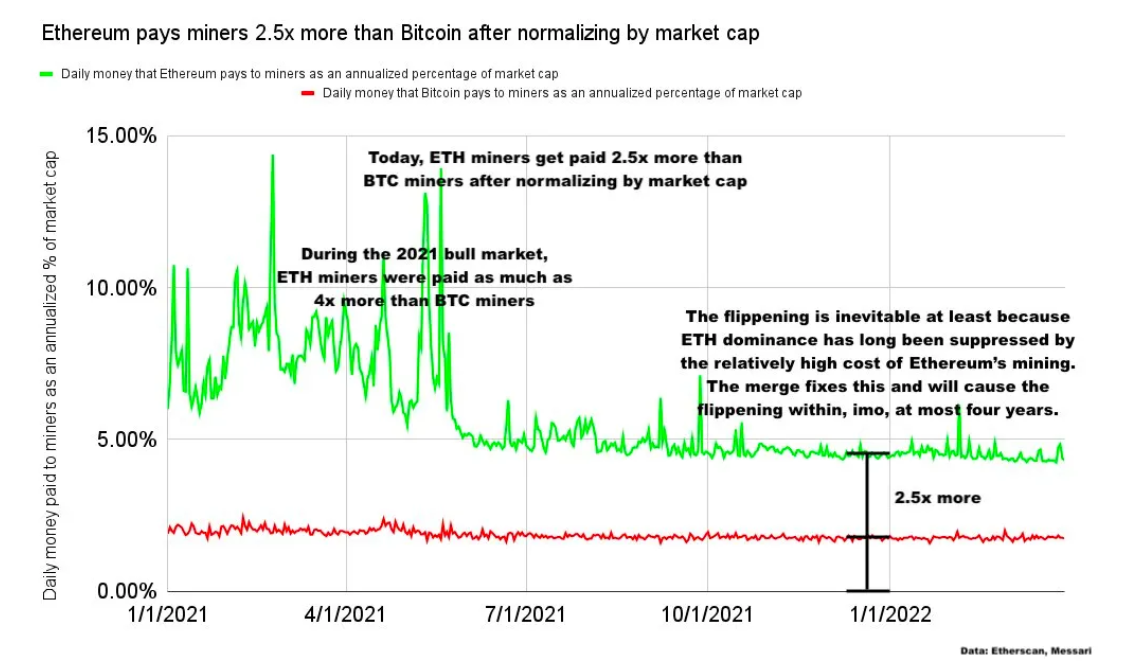

ETH miners have historically been paid much more than Bitcoin miners. If the cost structures of the two chains were swapped, e.g. if BTC miners earned the same as ETH miners or vice versa, or if the merger was ready two years ago, I think the "flip" could have already happened.

Let's break down the numbers...

Standing on the shoulders of giants

If miner sell-offs matter — and, as stated above, they do — it also matters that ETH miners have been paid 2.5x to 4x more than BTC miners (normalized by market cap) over the past few years:

Last year, BTC miners were paid $16.6 billion, while ETH miners were paid $18.4 billion.

Conversely, if we swapped the cost structures of Bitcoin and Ethereum over the last year, then ETH miners would earn and sell about $6 billion, while BTC miners would earn and sell about $50 billion.

This is key: Last year, Ethereum miners earned and dumped $1.8 billion more ETH than Bitcoin miners dumped BTC. If we imagine reversing the cost structure of both chains, in 2021 alone, BTC miners would earn and dump ~$44 billion more BTC than Ethereum miners dump ETH (50 billion minus $6 billion).

To put this into perspective: In 2021, Ethereum is more expensive to operate than Bitcoin, and if the situation were reversed, Bitcoin would require an additional ~$45.8 billion in net fiat currency inflows (i.e. new buyers of BTC), all else being equal. In this case, the market capitalization of the two chains will remain at the same level as it is today.

These extremely large numbers — especially with ETH facing increased selling pressure from miners relative to its market cap — are the key drivers of why the “flip” has yet to happen.

Bitcoin is no longer ahead

What's next?

Ethereum has eliminated miner dumps and moved to proof-of-stake after the merger.

We are now on the path to profitability, scaling through Layer 2, and web3 is gaining global adoption.

Ethereum has become a positive-sum productive economy.

In the next few years, for the above reasons, I see a 99% chance of ETH "flipping" BTC. 1% is an unknown uncertainty factor. tail risk. For example, aliens appear and force us to use Bitcoin as the only global currency.

The profitability of ETH, the low cost of verification, the huge growth of dapps, and the good atmosphere brought by credible neutrality will lead our industry through the "flip" period and enter the post-BTC era.

Farewell to the Bitcoin era

The day "Flip" succeeds will be explosive and spectacular.

In the medium term, this is a one-way transition of BTC into the wastebasket of crypto investment antiques.

Unfortunately, many well-meaning crypto and web3 investors are likely to lose a lot during BTC's slow decline and violent crash.

In short, Bitcoin's current ~40% dominance certainly seems highly reflexive to ETH's pre-PoS cost structure and, to a lesser extent, Ethereum's scaling challenges before the L2 ecosystem really kicks into full swing this year.

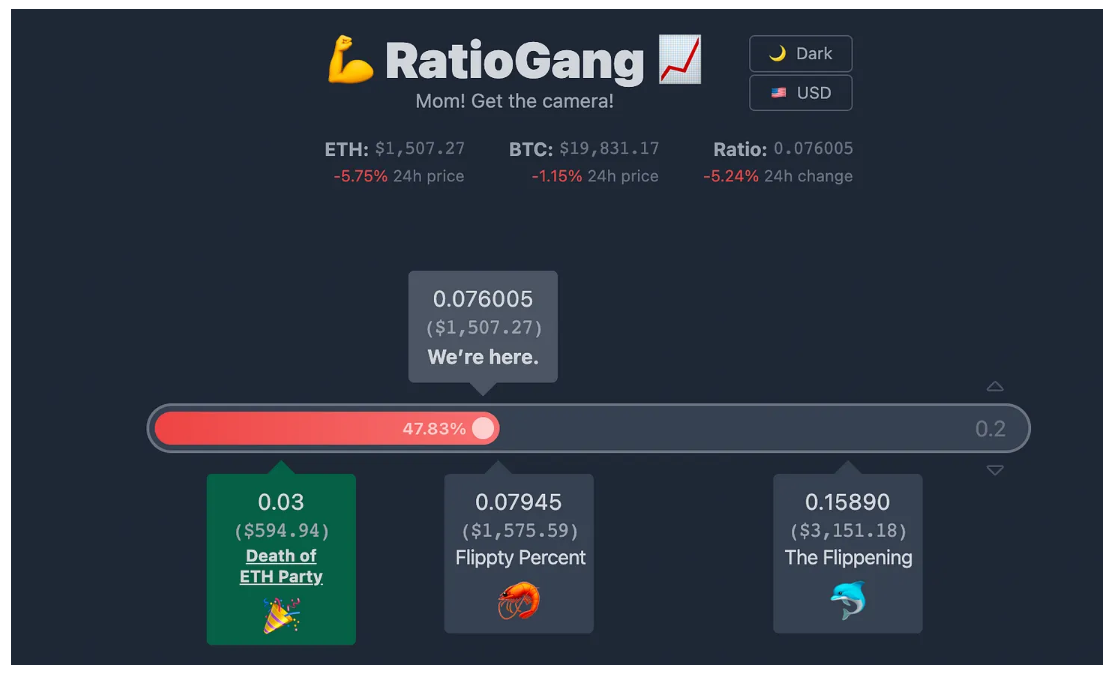

Right now, the "flip" rate is a little under 50%.

As ETH slowly overtakes BTC, we'll hit a breakout point, and then the "flip" rate will jump from 70% to 100%, or 80% to 120%, or whatever the end result is in one day. Say goodbye to the Bitcoin era.

Why 'Flipping' Is Good for Crypto: A New Era of Health

I guess that eventually, years from now, all of us, including most BTC owners today, will look back and see how stupid it was to think BTC could stay number one.

all in all:

BTC is inherently an unsustainable investment and will never be sustainable due to the absence of an application layer and promising revenue prospects.

BTC mining will never be ESG friendly, even if a large portion of mining becomes truly environmentally friendly.

BTC attracts capital, attention, and especially monetary premium, which can flow to Ethereum and other ecosystems that more directly and actively improve the world.

Instead of accumulating value, BTC will leak value. "Flipping" is a good thing for the crypto industry, because it is unstable and unhealthy to have an uninvestable, value-diluting asset as an industry leader, and we need a stable and healthy web3 investment environment.

My opinion of "flip" hasn't changed in two years:

The fate of BTC is to survive the "flip" and eventually become a respectable pet rock.

Original digital collectibles. Maybe I'll buy some for my trophy cabinet when the time comes.

After the "flip", the encryption industry will start a truly healthy era.

This is an era of ESG friendliness, streamlined cost structures, profits from valuable applications, web3 universalization, and Ethereum as a global settlement layer—an era in which all human beings can compete fairly.

JinseFinance

JinseFinance