Author: Jords

Source: Jords

Before discussing this topic, you might as well listen to my story.

I started working when I was 14. My first job was one of the best jobs I've had in a while. It was a simple job, I was working at a 5-star resort helping the hotel rent out e-bikes for cash - no more, no less. Even better, I do nothing until someone walks into reception and says they want a bike. Reception would call me and I would go over and give them a helmet and have them sign a waiver and off they go.

It seems like a solid job and I get paid for being there 8 hours a day. 8 hours is a long time, when in reality I only work about 30 minutes in total each day. I started calculating how much I was making per minute for the actual "job" I was doing, and knew I had hit the jackpot. Throughout the day I'm listening to music, reading, and if there's a particularly good day of traffic, I get commissions for booking bikes. For a while, life there was so good it felt too good to be true—and probably because it wasn't.

It didn't take long for my boss to realize that by paying me for doing almost nothing, I wasn't getting the full value of the capital he was spending, so he decided to keep me busy the rest of the time. What was once a job of reading by the pool with headphones turned into gardening gloves and shoveling mulch in the scorching Australian summer without changing pay. Looking back on that time, I still can't believe I was ever paid for doing nothing, thinking that I should be paid as long as I showed up on time.

Then I grew up and understood that if something is too good to be true, it almost always is, so I never had the idea of getting something for nothing again.

Until I learned about NFTs and heard that these pixel monkeys do nothing but just hold an asset (many people buy assets for less than $100) and make thousands of dollars a month (at their peak every day), I thought to myself, wow, how is this possible - they don't even have to pretend to be busy, they get daily bonuses.

At that time, the NFT of this series was too expensive for me, so I chose another series. Fortunately, considering the gas fee of ETH, it is very complicated for other projects to replicate the CyberKongz model, and then Solana appeared. It can be said that Solana-related Ponzi schemes have existed a long time ago, and many DeFi tokens have gradually returned to zero, but for NFT, there is no doubt that Boryoku DragonZ has started the so-called "utility-NFT" trend on Solana.

Oxford Dictionary defines "utility" as "the state of being useful, profitable or beneficial". The meaning of this English word in Chinese can be understood as "utility, practicality". Based on this understanding, we can take a look at how those popular practical NFTs provide their claimed utility.

If Bernie Madoff (the largest fraudster in American history) was reincarnated as a young man in his 20s during the NFT boom, he would feel at home, and his favorite phrase is undoubtedly "utility token" (utility token). ). With just one simple phrase, you can inflate the underlying asset while delivering visible daily returns to all investors, all without spending a penny on your part. Best of all, they will never ask you for their money back, they just need to find another willing buyer at the current fair market price, and you can even earn a commission!

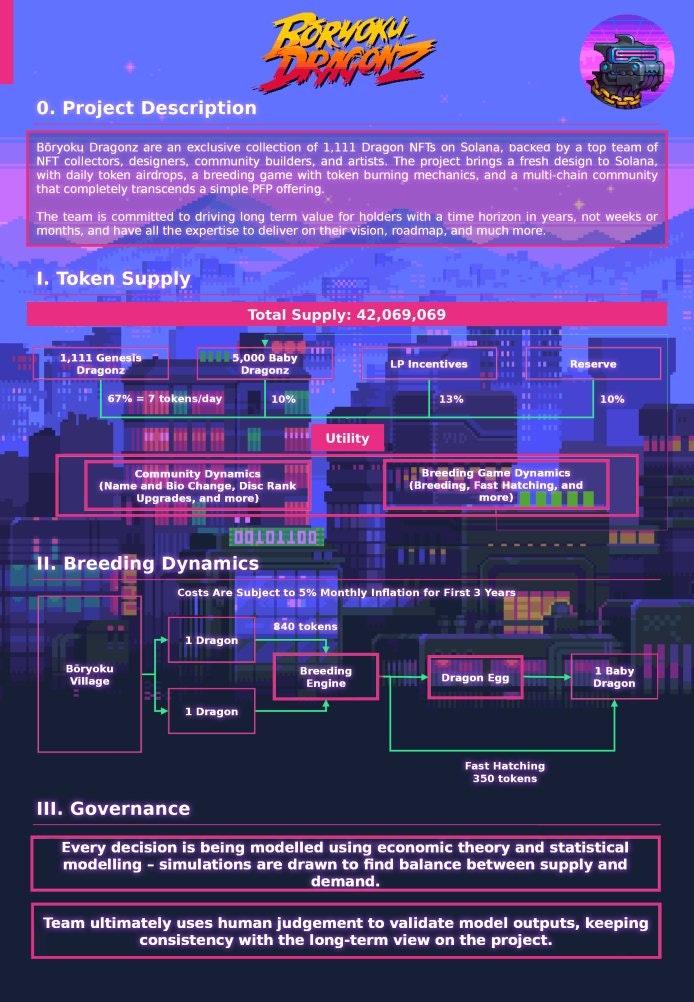

The Dragonz team took a lot of inspiration from the Cyberkongz model, which is evident if you compare the roadmap and token economics. The value proposition of $BOKU was simple in the beginning, you buy a dragon and receive 7 tokens per day, equivalent to 67% of the total supply allocated to 1111 holders (including 111 pre-minted for teams and promotions) currency). To incentivize holders not to sell this token, a breeding mechanism is implemented, creating the necessity to hold BOKU. If you accumulate or buy enough BOKU and hold two dragons, you can click some wacky buttons to successfully bring them together. After the dragon has had time to bond, you receive an egg - which will eventually hatch into a baby dragon - and you get another NFT, and hopefully someone wants to keep holding the tokens to breed new ones baby dragon.

Arguably, for cryptocurrency to become an advanced asset class, we need to continue experimenting with projects like this. It can also be argued that the team did everything they could to make it a success, they planned to release the token long enough for it to be sustainable, and space out the breeding to catch up with demand. Unfortunately, cryptocurrencies are an extremely reflexive asset class, and what happens in the speculative market is that it gets completely out of proportion very quickly. They released the roadmap as expected, and the team may have simply grown too fast for what was needed to deliver.

A common theme for many of these tokens is that their all-time high prices typically occur shortly after launch, often coinciding with the time period before the token does anything — at best illiquid speculation. Here are some notable examples of utility tokens, adding that as of this writing, most cryptocurrencies are down 70-90% from the May 2022 crash.

$BOKU (Dragonz)

Here, we see BOKU reaching its all-time high just 11 days after it started trading, which is after the breeding function has been launched, and holders are rushing to battle, hoping to breed new dragons before everyone else.

$DUST (Degods)

DUST saw its all-time high price 40 days after it started trading, with a spike following Degods' art upgrade and DUST generation increase. Degods also used an interesting tactic of gradually increasing the DUST required to carry out the process, which would translate into a pool of buyers to ensure they could upgrade at the cheapest possible price. It is worth mentioning that DUST has a halving mechanism that can help offset some inflation.

$WOOD (Mindfolk)

Mindfolk is an NFT project that came out long after Dragonz launched, and people are keen to call it the "next big thing." Speculators were so excited about their breeding (building) that the WOOD token reached its all-time high price just 8 days after trading began. Their breeding system allows holders to increase the amount of WOOD produced each day, which puts more selling pressure on the token and is impossible to lift. This is one of the projects that crashes the fastest, and unfortunately I suffered from it too - don't be greedy!

Are we always thinking “will this time be different”? When it comes to these tokens, the CyberKongz team are pioneers in this space and have encountered the same obstacles that all other projects face. You are returning so many tokens to the genesis asset, how can you continue to return an equal amount of value to future expansion of the project? Once that question is unanswered, the rest quickly falls apart.

So let's go back to the "useful, profitable, or beneficial state" framework. I would say utility tokens are useful, profitable and beneficial to projects for about two months, but not necessarily after that. Once the primary use case for a token begins (usually propagation), then the token becomes a very heavy burden for the founder to carry for the rest of the time. Two months is also enough time for holders to convince themselves that the project is a passive source of income, and once that narrative starts to shift, there will be a core group of holders who are unhappy and looking for new utility to add to the token middle.

Being a founder of a project is not an easy job, it's essentially like being a founder in any industry, except your investors are mostly inexperienced retail investors expecting immediate 100x returns. If you can't return that 100x value, then they're not going to be happy, and what they're not happy about is that new entrants are going to come in at a higher rate, with new expectations. Now imagine that you created a project and worked tirelessly to be able to generate X amount of value, which you can be legitimately proud of, because it's not an easy task. For every X amount of revenue you need to feed 5,000 people, everyone has new tokens to sell over and over again every day, but X can only go so far. Teams have to choose where they want to return value, which creates at least one weak link.

Every project has similar examples, and of course it's a lot easier than when you're caught in a FOMO storm. Mindfolk is a great example of something that looked great in the utility token space but inevitably fell apart because there were so many moving parts to return value. Mindfolk is my biggest (unrealized) loss in the NFT bull market, I like to tell myself I'm hedging in case I'm wrong about utility tokens, but no doubt I use that as a reason , placing bigger bets on an unsustainable ecosystem.

The lesson I took from this was that I let my ego get in the way of a deal that was supposed to be emotionless, and I wanted them to be different from everyone else because it was my wallet, I wanted passive income, and I believed in the team. I believe that if they look back at what has happened, they will wish the tokens were not part of the project. They have many advantages, but unfortunately, the burden of managing a symbol (eternity) is too large to bear.

We see the same result in many DeFi protocols, they have good business and generate significant income, but the operation of the protocol is just not returning any value to the token. Think of SRM, RAY, FTT, LINK and many other tokens that don't seem to be properly assessed for potential business success. There is only one thing these multi-million dollar projects can return value to, and that is their underlying tokens, and even doing so still seems very difficult.

We're at the absolute extreme end of the risk curve, and we've convinced ourselves that these projects, which are only a few months old, with first-time founders and retail-backed startup capital, can somehow pass the same operation while funding up to 5 subs. Projects bring value. There is a first time for everything, but I bet expecting a different outcome is probably largely delusional.

Another way to look at this is to try to imagine who the buyer might be and what narrative they are buying with your favorite Ponzi token. Who will buy WOOD at $0.04 after all known catalysts are over? Now that the roadmap has been completed, who is selling BOKU every day to withdraw from liquidity? Who will add DUST coins to their long-term portfolio once the Duppies are all minted? Who is adding liquidity to SCRAP pools these days? The list goes on, and it's unlikely that your favorite projects will be left out, but they could be in different parts of the Ponzi cycle, in which case it's best to reassess your position.

Essentially, my argument is simply that each token need not exist outside the extremely narrow confines of an individual project's roadmap. Attracting outsiders (which all Ponzi schemes require) is very difficult and can only be sustained through bribery for a while, until the insiders sell each other in a race to the bottom. All projects want to create an ecosystem around their tokens, but do we know anything about network effects? If any token is going to accumulate any legitimate value, the most plausible is APE for obvious reasons, and even then I don't believe it will have any significant footprint. For all BAYC holders, APE has played a very, very good role in exit liquidity. Do you still think things are different this time?

All of these projects reached a tipping point where it was impossible to return value to tokens without expanding the supply, or to return value to new supply without inflating tokens. A project is only as strong as its weakest link, and creating more weak links is the only way for these ecosystems to move forward. We will see many go to great lengths to extend their token journey to zero. Their focus is on burning as many tokens as possible, staking them for as long as possible, and pumping out as little dopamine as possible to their holders - but that doesn't change the fact that they will most likely trend towards zero. The question we have to ask is, is the token worth owning if the team spends so much time fighting to return value to the token? In my opinion, this is a capitalized negative.

The worst part about owning a token is that you have to complete events that should be promoted in the native token, a small dopamine hit for the creator of the chart, but a long term for the funding and long term success of the project hit. An upcoming example is the casting of Duppies from Degods.

I would like to summarize my opinion with the following points, and I would very much like to be proven wrong. But as things stand, if none of these projects adjust their total token supply, I believe they are all overvalued, no matter what their current prices are. Here's the current market price as I write it, as a timestamp for people to look back on in the months and years to come:

$BOKU priced at $0.28 (overvalued)

$DUST is priced at $1.17 (Overvalued)

$WOOD is priced at $0.03 (overvalued)

$SCRAP is priced at $1.10 (Overvalued)

Price of $BANANA is $0.87 (overvalued)

Proving me wrong is welcome.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Joy

Joy Brian

Brian Hui Xin

Hui Xin Brian

Brian Joy

Joy Alex

Alex Alex

Alex Hui Xin

Hui Xin Joy

Joy