Author: NingNing

Although the meme super cycle theory has become a prominent topic in the crypto market recently, there is no doubt about market sentiment. After noise reduction processing, you will find that the secondary market performance of the AI+Crypto project during this period is equally impressive. From the perspective of asset issuance, meme coins are in Tokenize (attention & Cult culture), while AI+Crypto is in Tokenize (monetization (AI)). Both Tokenize objects have strong potential energy and sustainable growth at the moment.

As expressed in the Tokenize (AI monetization) formula, the key to AI tokenization is to first monetize the AI and then Tokenize the AI monetization capability. This path is somewhat similar to traditional securities issuance. Applying Tokenize AI's formula, stock issuance is securitization (future cash flow). But there are significant differences between them, and their asset issuance has their own dedicated primitives.

The primitives of MeMe coin asset issuance: MeMe’s standardized creation-launch-Bonding Curve curve IBO financing-initial liquidity addition-market maker market making-conspiracy The group calls for orders - Exit on CEX

The market is already very familiar with the MeMe tokenization process and it has been standardized. However, how to tokenize AI is still at the stage where hundreds of schools of thought are contending. Some solutions are Tokenize (monetization (AI Agent, vector knowledge base)); The solution is Tokenize (monetization (AI production factors)), and some solutions are Tokenize (monetization (AI large model training, optimization, deployment and use)).

Today we will analyze Flock’s AI tokenization plan.

A brief introduction to Flock, which is a decentralized AI development and deployment platform that aims to redefine the creation of AI through blockchain technology and federated learning. and distribution method. The grand narrative of Flock Follow is the democratization of AI.

Flock has built three core products: AI Arena, FL Alliance and AI Marketplace, which form a complete deAI development life cycle:

< p style="text-align: left;">1. AI Arena: An arena for basic AI large model selection and training.

The innovation lies in:

-Introduction of POS-like pledge Mechanism that closely combines AI training with economic incentives.

-Multiple validation data set design effectively prevents Sybil attacks and model overfitting.

- Dynamic reward distribution mechanism (Reward A and B) balances short-term participation and long-term value creation.

2. FL Alliance: a model optimization platform based on federated learning.

The technical highlights include:

- Decentralized supervision node , which solves the centralized "peeping" problem in traditional federated learning.

- Random role assignment based on blockchain ensures fairness and censorship resistance.

- The innovative "proposer-voter" mechanism improves the efficiency and quality of model updates.

Take a medical AI example: Suppose we want to train a model to predict whether a patient has diabetes. Hospitals A, B, and C all have patient data, but cannot be shared directly due to privacy concerns. Using FL Alliance:

1. The initial model is sent to all hospitals.

2. Each hospital uses local data to train the model.

3. The hospital only sends updated model parameters to the blockchain network, not the original data.

4. The network aggregates model updates from all hospitals through a consensus mechanism to generate a new global model.

5. The updated global model is sent back to each hospital, and steps 2-5 are repeated.

This approach not only protects patient privacy, but also improves model accuracy by leveraging a wider data set. Compared with traditional centralized methods, the accuracy rate can be improved by up to 15-20%.

3. AI Marketplace: a market platform for model deployment and use.

Its uniqueness lies in:

- Introduction With the concept of "use and mine", the more the model is used, the more rewards the creator will receive.

- Implements the "composability" of models, allowing developers to combine different models like building blocks.

- Innovative pricing mechanism that dynamically adjusts prices based on model usage frequency and computational complexity.

Flock skillfully realizes the monetization of AI in the deAI development life cycle:

- AI Arena monetizes the model training process. Staking tokens to participate in the competition is like betting on the potential of the model, and excellent trainers and verifiers can receive generous rewards.

- FL Alliance monetizes the value of data. In our medical AI example, the value of its data is indirectly monetized by contributing model updates while protecting privacy.

- AI Marketplace directly monetizes model applications. Users pay to use the model, and revenue is distributed to developers, data providers and computing resource providers based on contributions.

In this way, Flock not only transforms abstract AI capabilities into quantifiable and tradable assets, but also creates an environment that incentivizes all participants to continue to contribute and Improved ecosystem. Finally, Flock monetizes AI and then tokenizes it by issuing the platform’s native token FML.

It can be seen that the tokenized AI solution adopted by Flock is tokenization (monetization (AI large model training, optimization, deployment and use) ).

Of course, the above is just to observe and understand the Flock project from the perspective of tokenized AI solutions. We can also gain a deeper understanding of it through comparative analysis with other well-known AI+Crypto projects on the market.

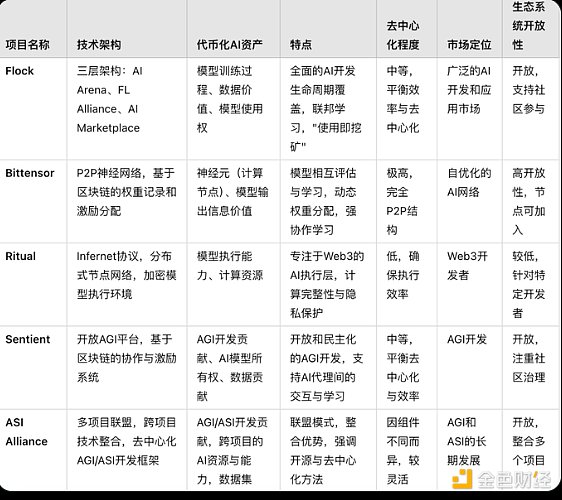

Let’s first compare the technical focus, tokenized objects, degree of decentralization, market positioning, and ecology of Flock, Bittensor, Ritual, Sentient, and Artificial Superintelligence Alliance System openness and other technical features.

1. Technology focus:

- Flock and Bittensor focus more on the current situation Decentralization and incentive mechanism of AI technology.

- Ritual focuses on introducing AI capabilities into Web3 applications.

- Sentient and ASI Alliance are more concerned about long-term AGI/ASI development.

2. Tokenized object:

- Flock’s token It has the widest scope, covering the entire life cycle from training to use.

- Bittensor mainly tokenizes the value of computing nodes and information in the network.

- Ritual focuses on the reasoning capabilities of large tokenized AI models.

- Sentient and ASI Alliance more tokenize the AGI development process and contributions.

3. Degree of decentralization:

- Bittensor may be decentralized The highest level adopts a completely P2P structure.

- Flock and Sentient seek a balance between decentralization and efficiency.

- Ritual may be more centralized to ensure execution efficiency.

-ASI Alliance Since it is a multi-party alliance, the degree of decentralization may vary among different components.

4. Market positioning:

- Flock aims at a wide range of AI giants Model development and application markets.

- Bittensor focuses on creating a self-organizing, self-optimizing AI network.

- Ritual is aimed at Web3 developers who need AI capabilities.

- Sentient and ASI Alliance target the future AGI market.

5. Ecosystem openness:

- Flock, Sentient and ASI Alliance emphasizes openness and community engagement.

- Bittensor’s openness is reflected in the fact that any node can join the network.

- Ritual may be less open and more oriented to specific Web3 developers.

Let’s compare the above total market value/financing

Bittensor FDV: $12.15B

ASI Alliance FDV: $3.65B

Ritual Financing: ~$30M, valuation not yet available Public

Flock financing: $6M, valuation undisclosed

Sentient financing: $8500, The valuation is undisclosed

The AI+Crypto field is in the period of inflated expectations of Geithner’s emerging technology curve. The current high market valuation of Bittensor, Sentient, and ASI Alliance shows people’s optimism about Tokenize (monetization (AI self-organizing network)) and Tokenize (monetization (AGI)), two AI asset issuance solutions. However, this high valuation and high FDV may more reflect investors’ fanatical imagination of AGI and AI self-organizing networks, rather than a rational evaluation of actual technology, nor a focus on monetization (AI self-organizing networks), currency Confidence in the economic feasibility of AGI.

This kind of irrational exuberance is disturbingly reminiscent of The dot-com bubble at the beginning of this century. For the entire AI+Crypto track, we need to stay awake. The current boom may well be a bubble. Most projects are likely to disappear within the next few years. But we also have to see that after the dot-com bubble, projects that focus on solving practical problems and have clear paths to realize their vision may stand out after the "disillusionment period". For investors, now is a good time to re-evaluate and balance your AI+Crypto portfolio.

Let’s compare the above total market value/financing

Bittensor FDV: $12.15B

ASI Alliance FDV: $3.65B

Ritual Financing: ~$30M, valuation not yet available Public

Flock financing: $6M, valuation undisclosed

Sentient financing: $8500, The valuation is undisclosed

The AI+Crypto field is in the period of inflated expectations of Geithner’s emerging technology curve. The current high market valuation of Bittensor, Sentient, and ASI Alliance shows people’s optimism about Tokenize (monetization (AI self-organizing network)) and Tokenize (monetization (AGI)), two AI asset issuance solutions. However, this high valuation and high FDV may more reflect investors’ fanatical imagination of AGI and AI self-organizing networks, rather than a rational evaluation of actual technology, nor a focus on monetization (AI self-organizing networks), currency Confidence in the economic feasibility of AGI.

This kind of irrational exuberance is disturbingly reminiscent of The dot-com bubble at the beginning of this century. For the entire AI+Crypto track, we need to stay awake. The current boom may well be a bubble. Most projects are likely to disappear within the next few years. But we also have to see that after the dot-com bubble, projects that focus on solving practical problems and have clear paths to realize their vision may stand out after the "disillusionment period". For investors, now is a good time to re-evaluate and balance your AI+Crypto portfolio.

Alex

Alex

Alex

Alex Joy

Joy Weiliang

Weiliang Alex

Alex Weatherly

Weatherly Miyuki

Miyuki Anais

Anais Anais

Anais Weatherly

Weatherly Alex

Alex