Text: Cumberland Labs, Translation: Golden Finance xiaozou

After a few weeks of hanging out on Discords, lurking in Telegram groups, browsing Twitter, and contacting several research analysts and traders in the space, I had a comprehensive understanding of everyone's views on meme coins (from seasoned algorithmic traders to my wife's brother). I asked about how to improve the UI/UX for limit orders and complex order execution, asked friends if they thought Moo Deng was really good, or if they had heard of Peanut the Squirrel. What you are about to read is a distillation of field research, a summary of existing public data on this vertical, and anonymous feedback on this narrative. We at Cumberland Labs believe this narrative is compelling and will endure for years. What may seem like an uncomplicated and oversimplified narrative on the surface actually represents a shift in user behavior that will bring billions of dollars of marginalized on-chain capital, whether those trading these tokens realize it or not.

1、What is Memecoin?

The story of Meme coins is a story of continuous evolution. From DOGE's initial appearance as a Bitcoin imitation that attracted the attention of Elon Musk, to SHIB and PEPE capturing the possibilities of the retail industry, to today's fair launch phenomenon based on Solana - we see this market constantly reinventing itself.

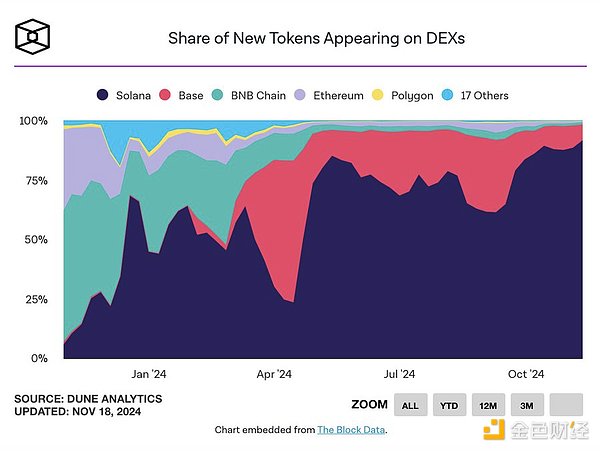

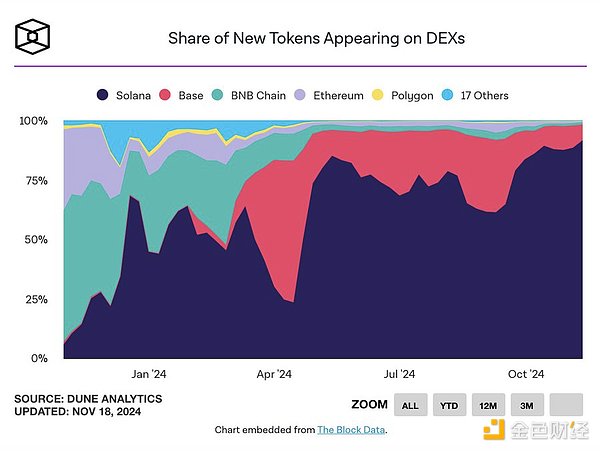

Today, Solana dominates the space, powering 89% of new token issuance. Just last week, 181,000 new tokens appeared on DEXs (decentralized exchanges). This is not just a capacity issue, but also an accessibility issue. Platforms like pump.fun allow anyone to issue a token, but the success rate tells us something important: less than 2% of tokens make it to Raydium, and only 0.0045% of tokens can maintain a market cap of more than $1 million.

But what is the difference between a memecoin and a “shitcoin”? The difference lies in the key features that drive success:

The most successful tokens – whether it’s DOGE or Moo Deng – share common elements: strong meme potential, attention catalysts, and community engagement. DOGE leveraged Elon Musk’s attention and first-mover status. Moo Deng captured people’s imagination with a viral social media presence. But most importantly, they built communities, turning casual onlookers into passionate supporters.

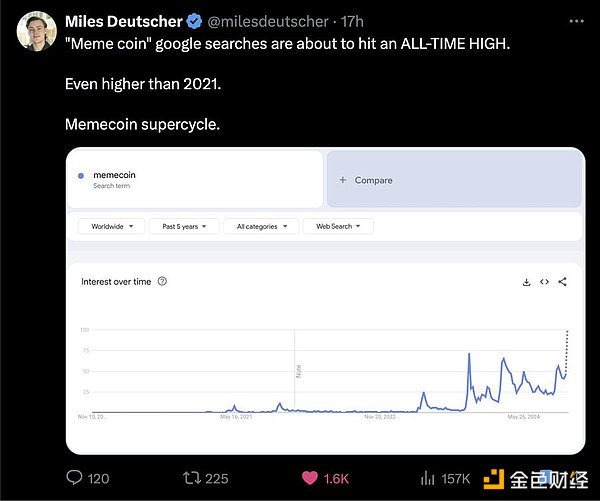

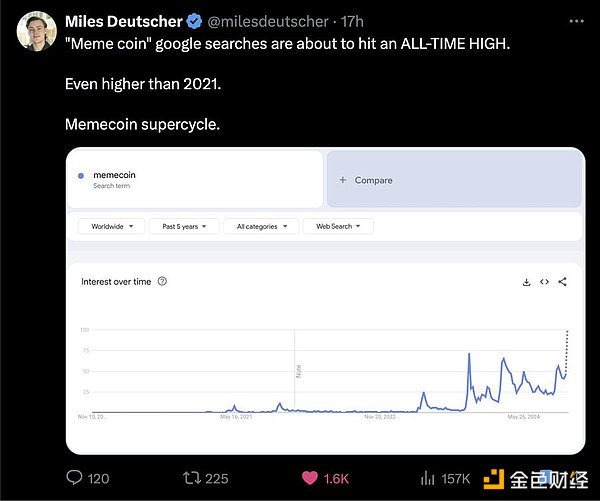

2、Numbers Don’t Lie

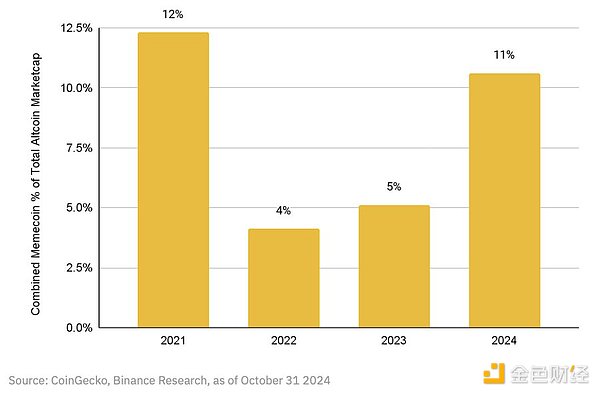

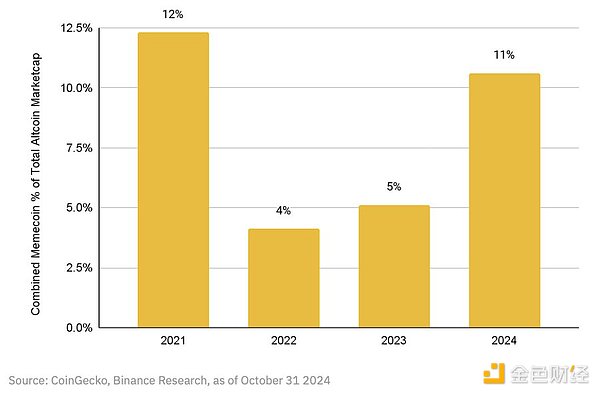

The recent growth of meme coins is far from a flash in the pan. Binance Research points out that since 2022, the percentage of meme coin market capitalization as a percentage of non-BTC/ETH/stable coins has soared from 4% to 11% in just two years, almost tripling its market share in such a competitive field.

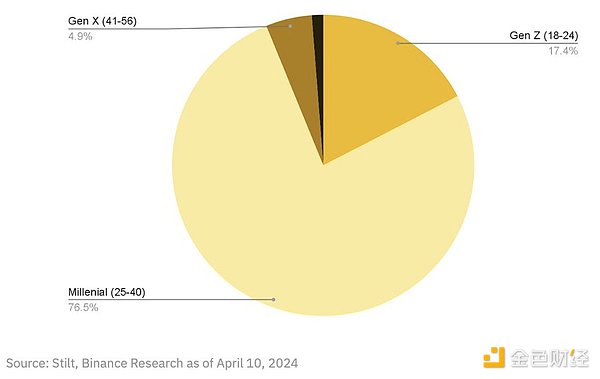

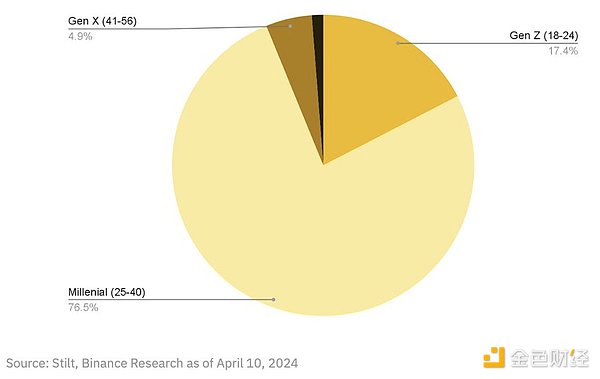

Millennials and Generation Z now account for 94% of digital asset buyers. This is not just a demographic coincidence - this is an entire generation responding to the environment they live in. They’re not just buying tokens; they’re rejecting the traditional path to financial security that their parents followed. On the surface, meme coins look like a joke, but to these traders, they represent a real opportunity to earn returns outside of a system that has consistently failed them.

Andrew Edgecliffe-Johnson summed it up well: “It’s hard to blame people for wanting to get rich quick if they’ve lost faith in their ability to get rich slowly.” The belief in getting rich slowly has been eroding for years. In 1963, it took 4.4 times the average annual salary to buy a house; now it takes 8.1 times. Combined with the fact that inflation has soared in recent years, reaching 7% in 2021, it’s clear that younger generations are looking for alternative financial opportunities.

This trend is more than just a gamble to make a quick buck (although there’s certainly an element of that). It’s about using their money to protest a system they’ve lost faith in. The meme coin phenomenon is high risk, high reward, and happens to resonate strongly with today’s traders. This isn’t just a game, it’s a vote of no confidence in the way wealth was built in the past.

3、Analysis of the Meme Coin Phenomenon

The development speed of the Meme Coin market is amazing. Our research shows that BOME reached a market value of $1 billion in 2 days, PNUT reached the same market value in 14 days, WIF reached it in 104 days, SHIB reached it in 279 days, and DOGE took 8 years. It is crucial to attract and retain traders' attention.

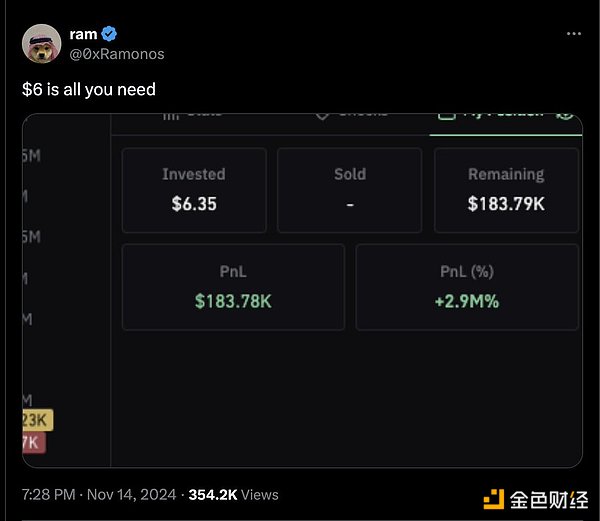

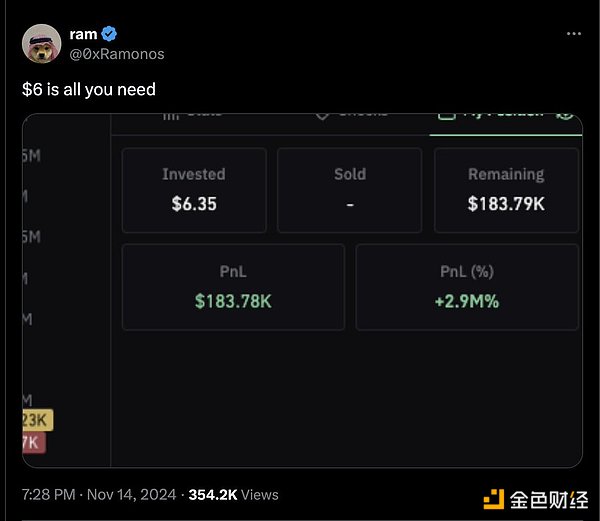

Screenshots of Phantom Wallet on X show returns of 633% and more than 10,520%, respectively, highlighting a broader trend: accessibility and fairness have become core. In the 2017 ICO boom, a key feature was universal participation - no private placements, no venture capital allocations, no complicated vesting timelines.

Today’s memecoin traders are resisting what one Discord user called the “VC exit liquidity simulator” of modern token offerings. A new meme coin without team allocation and market pricing brings back the level playing field of the early crypto era, where community and network effects are key.

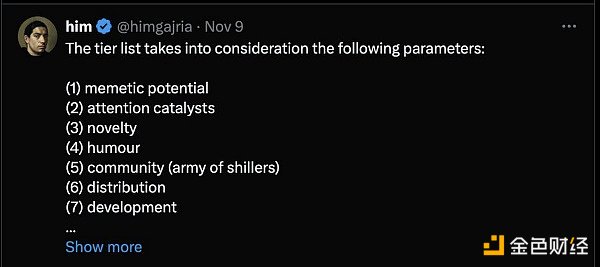

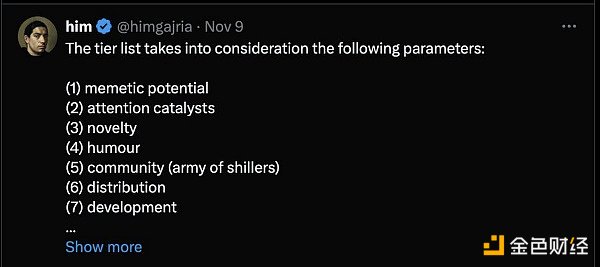

The meme coin craze makes more sense when seen as an opportunity to participate in a level playing field without having to worry about VC vesting and token unlocking. People are tired of the traditional model, and fair launch platforms like pum.fun make it easy for anyone to issue tokens, allowing everyone to participate. 4. Achieving 100x Escape Velocity What separates successful token launches from the thousands of failed launches? The numbers clearly tell us that less than 2% of tokens launched by pump.fun make it to Raydium, and only 0.0045% of tokens maintain a market cap above $1 million. But some tokens do achieve what we call “escape velocity” and escape the black hole of obscurity. The success stories follow a clear pattern, with the strongest tokens excelling in at least one of the following seven key areas: meme potential, attention catalyst, innovation, humor, community, distribution, and development. Look at any successful meme coin and you’ll see that these elements are important, with attention catalyst, meme potential, community, and distribution being the most critical factors.

Take Moo Deng as an example, success is no accident. The project attracted attention through social media such as Twitter, Telegram and TikTok. Its cute and highly memorable features constantly surfaced in the information flow, creating a viral recognition and sharing cycle. Although it is not particularly humorous, its strong attention catalyst and distribution strategy created growth momentum.

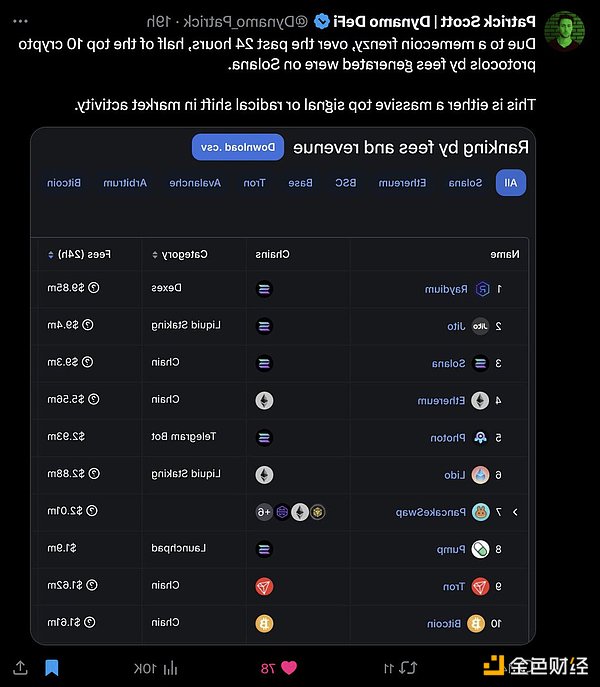

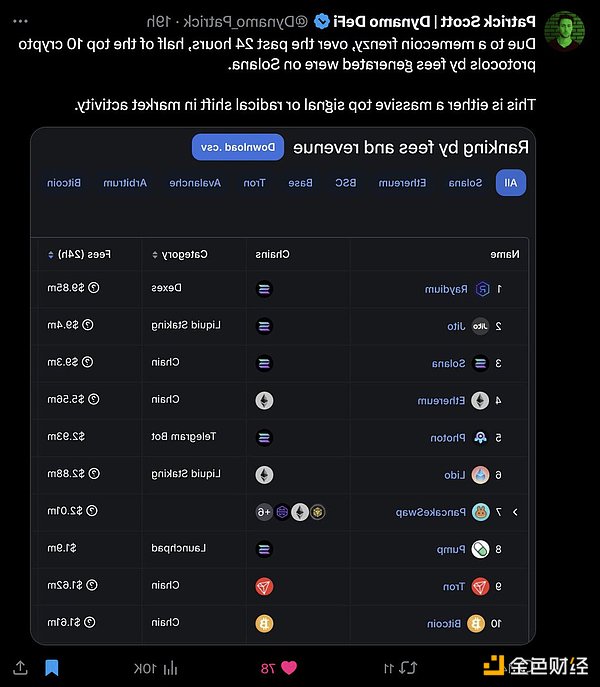

Solana’s role in this transformation cannot be overstated. The network now supports 89% of new token issuance and processes approximately 41 million non-voting transactions. This dominance is no accident - Solana’s low fees and fast transaction times create an environment that makes rapid experimentation possible, although most experiments end in failure.

5, Data Analysis of the Current Situation

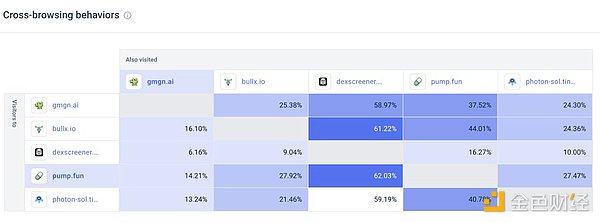

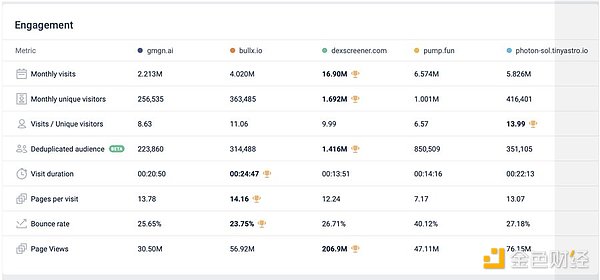

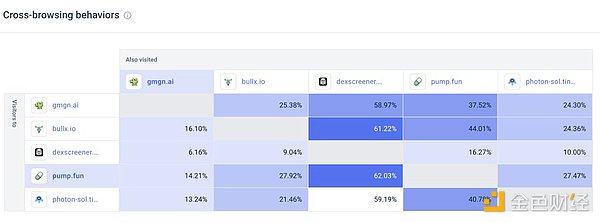

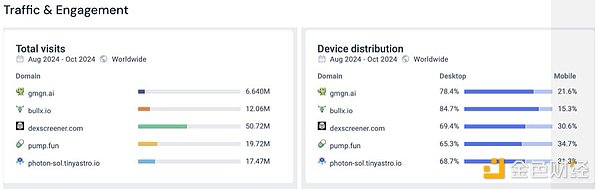

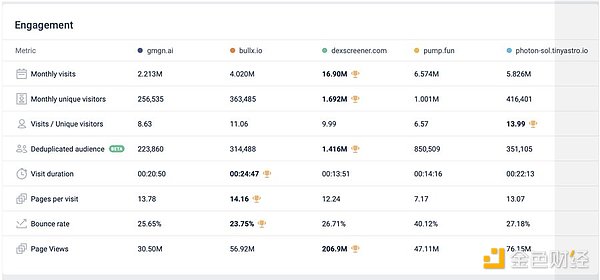

The data provides valuable insights into how traders interact with different meme coin platforms and highlights key gaps in the market.

First, it is worth noting that about 60% of users still visit DexScreener after using their preferred trading terminal. They are using DexScreener's insights, advanced filters, and analytical tools, which shows that existing platforms are not fully meeting their needs. However, only 10-12% of DexScreener users end up using trading and execution terminals, even though these terminals offer improvements in customizability and parameter settings over DexScreener's interface. This shows a gap in user satisfaction - trading terminals may have better features, but they are still underutilized.

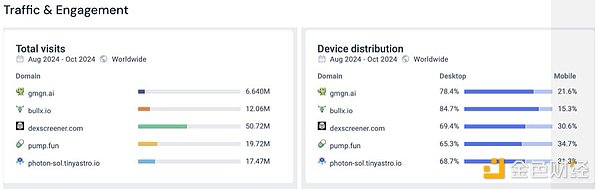

When we compare mobile and desktop usage, Photon stands out. Of the three major trading terminals, gmgn.ai, BullX, and Photon-Photon have the most mobile users, while BullX has the most desktop users. Although BullX has a large desktop user base, a large part of its traffic comes from links on Telegram. This shows that even though it is distributed using the mobile-first platform Telegram, users eventually interact with BullX on the desktop. This also shows to some extent the complexity of these terminals and that users prefer to operate in an environment where they can manage all functions more comfortably.

This trend points to a broader problem: the plight of existing trading terminals. Their desktop dominance suggests that they are too cumbersome for mobile devices, leaving a huge gap in the market for trading terminals that work seamlessly across devices. Traders want powerful tools that can be accessed on their phones, with the flexibility to switch to a simple interface when needed. The market needs an all-in-one solution - an intuitive platform that combines advanced features and ease of use, whether the user is on a desktop or mobile device.

The fragmentation of the current experience is inherently inefficient and inconvenient. Traders must switch between multiple platforms to get the insights they need to execute trades effectively. Providing a unified solution that is deep and easy to use, while also being accessible on mobile devices through an adaptive UI, will significantly improve the trading experience.

6, In-depth Trader Perspective

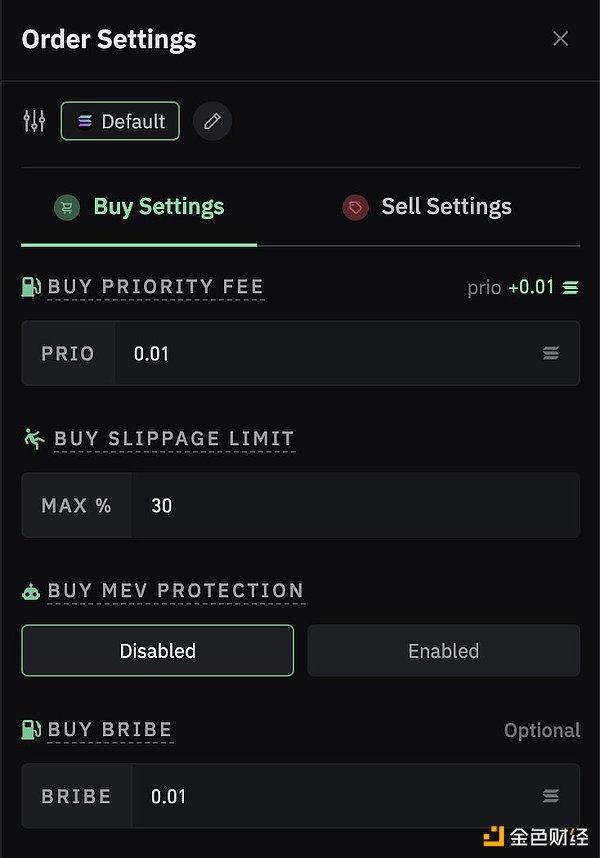

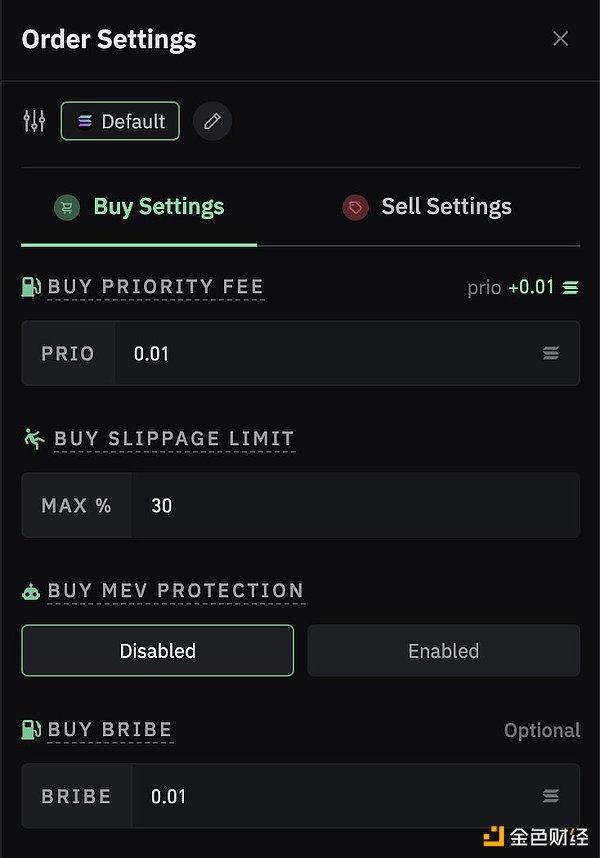

Talking to traders revealed a consistent demand - they want uncomplicated support. One trader explained: “When network load is high, I still need to set priority fees and bribes. I want smart defaults that work well but allow me to adjust when needed."

This balance between simplicity and control comes up repeatedly. Current platforms either simplify everything or throw all the complexity at the user. There is no middle ground that makes things work out of the box but provides depth when needed. "It would be nice to have a UI for swaps, charts, and a list of recent transactions in a single interface. Fewer clicks, and all the important information in one place," one high-volume trader told me. Another said it took hours to teach his team basic concepts like gas optimization — time that could have been spent on actual trading.

A recurring complaint is about limit orders. One trader noted: "I was filled, but lost all the positive slippage to the platform." Others pointed out that limit orders on one platform seemed to be filled earlier than others, creating an unfair competitive environment that no one understood.

7 Market Structure: The Real Problem

Current platforms are built for cryptocurrency native users and on-chain traders, who already understand terms such as "slippage tolerance", "priority fees" and "bribes". But most traders just want to know how much they paid and whether their trades will go through. One trader who manages more than 100 wallets told me that he can’t even keep track of his positions.

The mobile experience is even worse. While Telegram bots fill some gaps, they’re not a real solution. They’re a Band-Aid on a system that needs to be rethought from scratch.

This fragmentation problem has real costs. Traders switch back and forth between different interfaces, miss opportunities due to failed trades, and lose money due to poor execution. The current ecosystem forces users to choose between expensive tools and poor performance - there is no middle ground.

8Building solutions: Beyond the Band-Aid

The current memecoin trading landscape feels like a makeshift patchwork that is just enough to keep people happy, but it could certainly be improved. When a trader tells us "it would be nice if someone could create a tool that lets you customize LP strategies", or complains that they "have to set priority fees and bribes when fees are high", or "wish there was better execution on SL and TP order strategies", they are pointing to a fundamental problem: existing solutions are not real solutions at all.

Most platforms feel like they are built for people who are already familiar with on-chain trading, bridging, and DeFi - all of which means complexity. But after talking to several different traders, I found that traders seem to want the option to get complex features without the complex interface. The existing "advanced" UIs still don't provide the parameterized features that experienced traders need, and the default UI is too simple and abstracts away features that can have a huge impact on returns. For example, as one trader put it, even a feature that “automatically tells me how much I’m going to spend on this trade (gas + transaction fees) to make sure it goes through” allows power users to say “hmm, that seems high, I probably don’t want to pay that,” while also giving regular users some context as to how much they’re going to pay.

The solution is not just to simplify the interface, but to rethink the way traders interact with these markets. When someone compares memecoin trading to “a game,” they’re not oversimplifying anything. What they really want is what a gamified experience brings. They want analytics that show win rates, meaningful performance tracking, and tools that help them understand trading patterns.

9、The Way Forward: Cumberland Labs' Vision

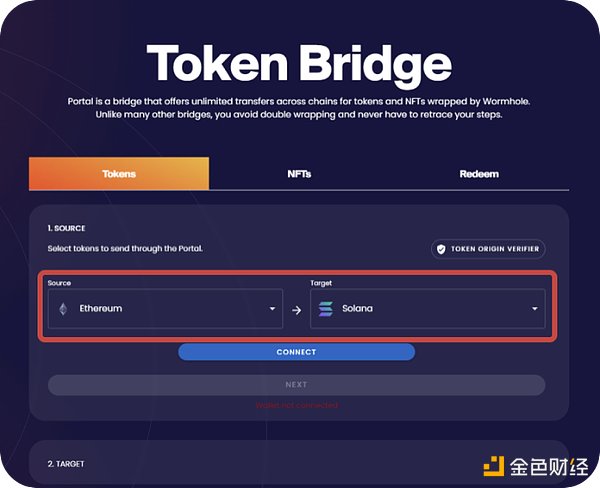

We are not here to create another trading terminal or launch another Telegram bot. The opportunity we see is much bigger: to create an interface that bridges the gap between the simplicity of Moonshot and the power of advanced trading terminals. A platform that evolves with its users, providing an accessible entry point while offering the depth and sophistication that experienced traders need. More retail traders means more volume, greater liquidity, and better opportunities - for both seasoned on-chain traders and newbies just discovering the space.

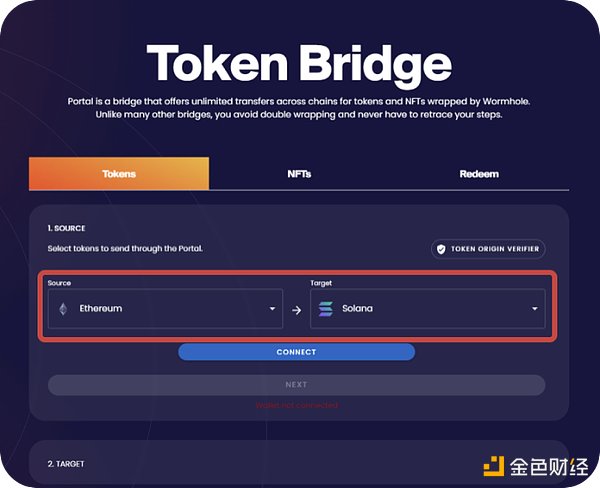

This means:

Abstracting complexity without compromising functionality - smart defaults and full customization when needed.

A unified trading experience that combines charting, execution, and analytics into a single window.

Really effective cross-chain portfolio management.

Real-time performance tracking to help traders understand their strategies.

Avoid obvious risks, but don’t limit opportunities.

The current platform has laid a solid foundation for today’s crypto-native on-chain traders. But the next retail trader will need something different - a platform that starts simple and grows with them. They need intuitive interfaces that allow them to learn and progress as they trade, gradually introducing more complex features when they are ready. Existing "advanced vs default" UI settings can improve their functionality to better suit both goals. This does not mean dumbing down content, but creating multiple levels of complexity that users can explore at their own pace.

The meme coin market is evolving faster than ever before. While 75% of meme coins have been created in the past year, we saw an opportunity to create a tool that welcomes newcomers while providing support for experienced traders.

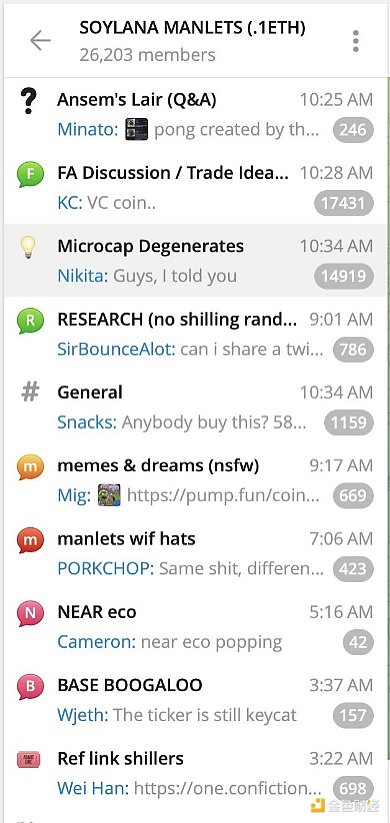

10, Beyond Trading: Building Community

Trading is just one piece of the puzzle. Community, education, and shared experience are driving the development of the meme coin ecosystem together. While there has been some form of integration through existing platforms such as Discord and Telegram, being able to bring the community to the platform for execution is a new thing. One of the reasons why the existing mobile activity in the Telegram bot exceeds the trading UI is that it is able to copy the contract address from a TG group to the bot and it is faster than buying on the trading UI.

We envision a more integrated approach. Imagine tracking your progress alongside other traders, sharing strategies when you want, and building a reputation based on actual performance. Not just arbitrary metrics, but real insight into what's working and what's not.

This social interaction is not about creating another crypto echo chamber. It's about providing context and insights to help traders make better decisions. Whether observing how different entry points affect returns, understanding performance patterns before and after migration, or learning successful strategies, each attribute is related to improving trading results.

Jixu

Jixu