Author: Tiger Research; Compiler: Felix, PANews

TL;DR

Key development areas for Web3 projects: India has a population of 1.4 billion (median age 28), 9.75 million developers, more than 1,200 projects and US$3 billion in investment, providing the best conditions for achieving the scale required for the development of the Web3 ecosystem

Regulatory uncertainty is a major obstacle: including a 30% fixed tax rate, a 1% withholding tax, a lack of a dedicated regulatory agency, and complex jurisdiction issues

Develop strategies for different stages: Successful market entry requires guiding Web3 Friendly users (local language support, regional marketing), then discover builders (can cooperate with local investors), and finally expand to partnerships with governments and enterprises

1. Why you need to understand the Indian market

New projects are constantly emerging in the Web3 market, and what these projects value most is "data". Data ultimately represents the users, builders, and investors participating in the ecosystem, and many projects are working hard to create this data. Among a large number of new projects, verifiable data is particularly important for attracting attention. Asia, especially India, is a central region that can generate real and meaningful data.

The first advantage of India is its young population. With a median age of about 28, India has a younger population than Indonesia (30) or Vietnam (32). This population group has shown a rapid acceptance and enthusiasm for new technologies. The second advantage is its large population size. India has a population of over 1.4 billion, and only about 8% of them currently hold cryptocurrencies, providing great potential for the expansion of Web3 technology. The third advantage is development capacity. India has many excellent engineering universities and about 9.75 million developers, who have demonstrated excellent development capabilities through successful Web3 projects such as Polygon.

India is the most suitable region for generating the critical "data" needed today, and many projects have entered India and achieved results. However, like all regions, India also has disadvantages. Hashed Emergent, a Web3 venture capital firm headquartered in India, has compiled an Indian market report, providing a "green paper" for entering the Indian market.

2. Hashed Emergent Key Summary of the Report

2.1. Web3 Ecosystem

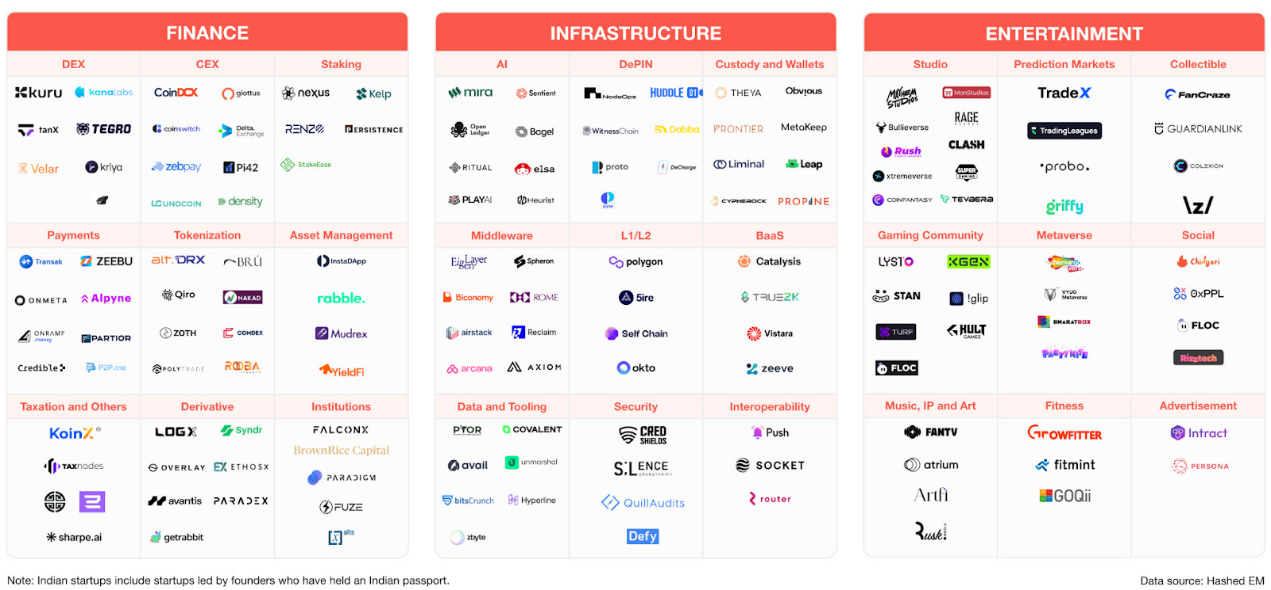

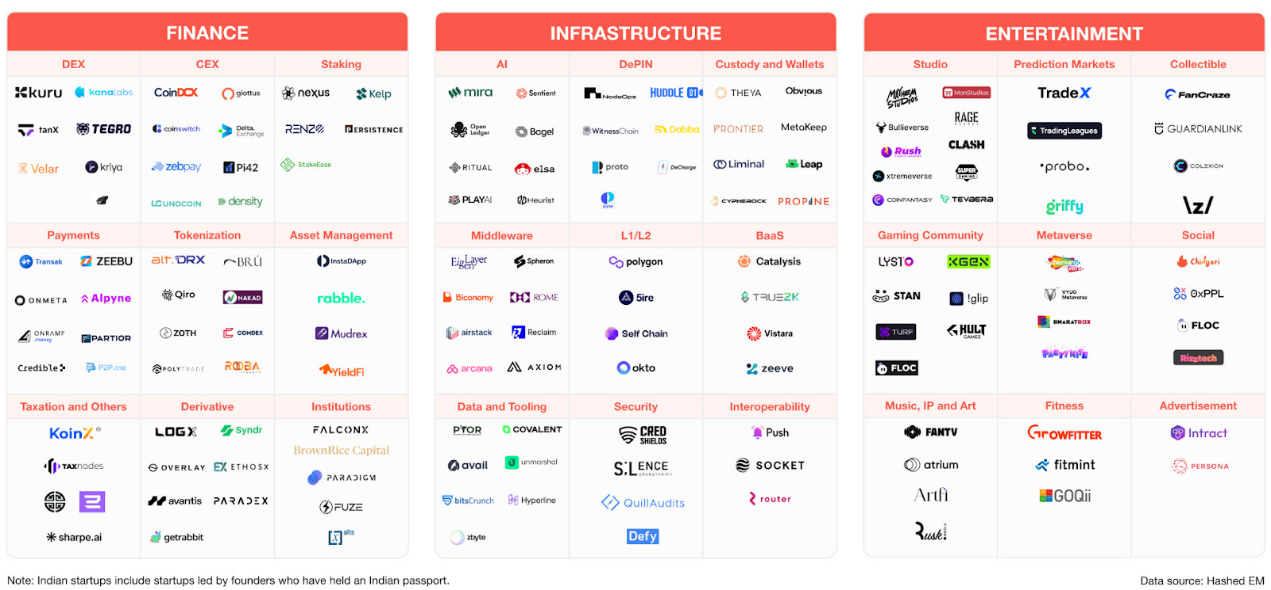

India has established a broad Web3 ecosystem, with more than 1,200 projects operating in various fields. To date, Indian Web3 startups have attracted more than $3 billion in total investment, with particularly strong growth in 2024, receiving $564 million in investment, more than double that of 2023.

By investment field, infrastructure has the highest attraction, followed by finance. In contrast, investment in the entertainment industry has declined significantly. In the hot infrastructure field, Indian founders who have established a foothold overseas have made significant contributions. They have developed globally competitive services such as Eigen Layer, Sentient and Avail, attracting a lot of investment funds.

Recently, emerging fields such as DePIN and BaaS (Blockchain as a Service) have also attracted the attention of investors. These trends show that investors are actively exploring the possibility of applying decentralized technologies to various industries.

Especially for industries applicable to the AI era, AI-based infrastructure, middleware and data tools are becoming key investment areas. In the local market, major venture capital firms including Hashed Emergent and Polygon are actively involved in cultivating and investing in India's Web3 ecosystem.

2.2. Consumer and business adoption

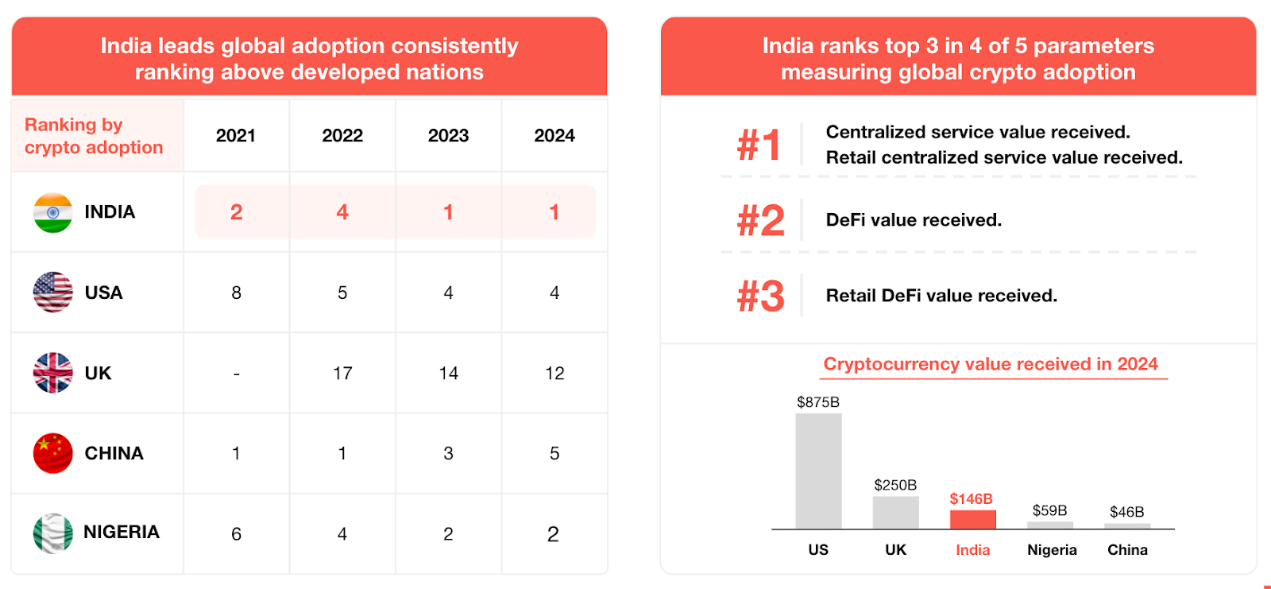

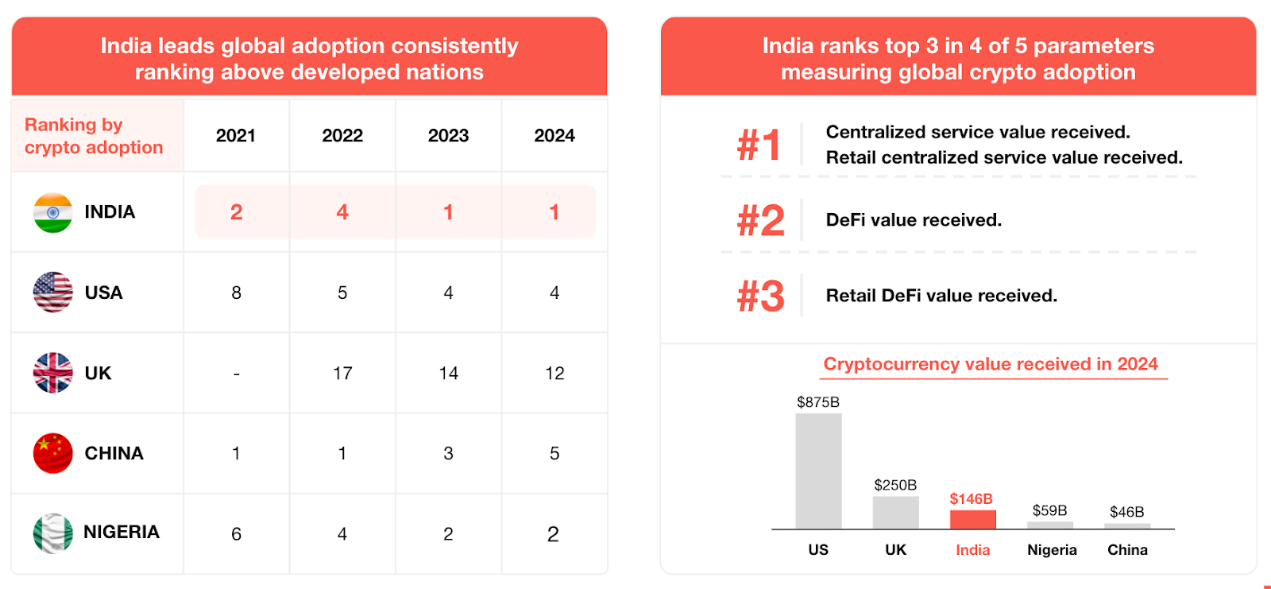

Since 2023, the Indian crypto investment market has shown a clear recovery trend. It ranks first in Chainalysis's cryptocurrency adoption index and scores high in both CEX and DEX fields.

45% of retail investors' portfolios are blue-chip cryptocurrencies with reliable stability. It is worth noting that the trading volume of meme coins has increased fivefold compared to other crypto assets. This shows that the investment preferences of retail investors are changing.

By age, people aged 27-40 dominate token investment with higher income and market awareness. It is worth noting that investors in their 40s have three times the average investment amount of other age groups. Generation Z accounts for 35% of all crypto investors and plays an important role in market expansion.

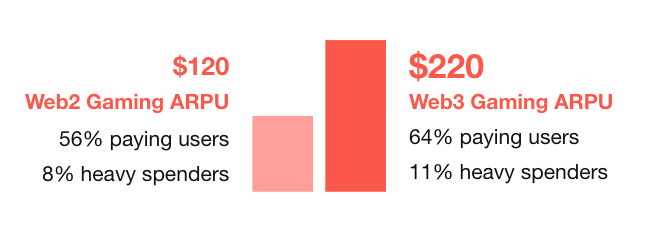

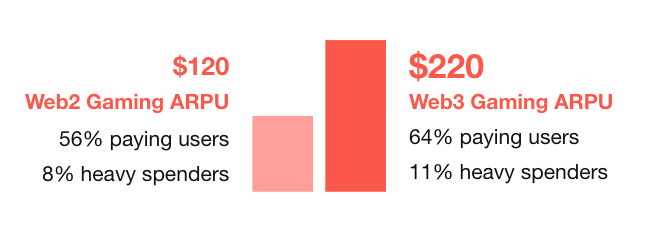

India's Web3 game market has developed by ensuring a user base centered on Generation Z. In particular, 50% of gamers are under the age of 25, indicating that young people can quickly adapt to new game modes. The average revenue per user (ARPU) of Web3 games is $220, much higher than the $120 of Web2 games.

In Web3 games, the proportion of paying users is 64%, the proportion of high-spending users is 11%, and the revenue structure is better than Web2 games (56% and 8% respectively). In addition, 38% of traditional game players have experienced Web3 games, and 60% of them choose to continue to participate.

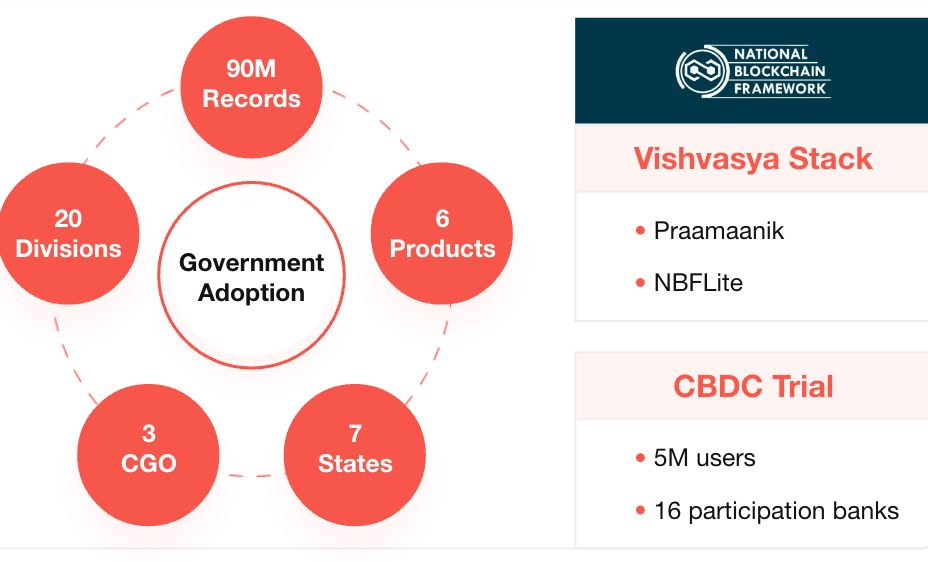

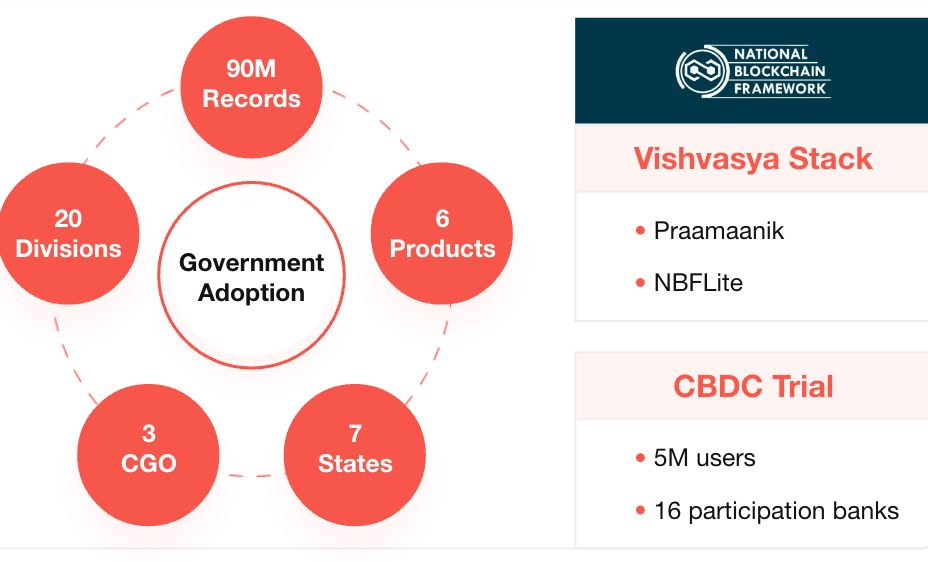

The government has taken positive steps to create a national blockchain framework. The framework aims to improve the security and transparency of services used by citizens. Key components include the "Vishvasya" blockchain-as-a-service platform, the "NBFLite" sandbox for startups and universities to conduct rapid research, "Praamaanik" for verifying the authenticity of mobile applications, and the National Blockchain Portal. In addition, the CBDC pilot project led by the Reserve Bank of India (RBI) has gathered 5 million users from 16 banks to test new payment methods using blockchain technology.

2.3. Developer Ecosystem

India has become a global hub for entrepreneurs and developers, leading innovation in various Web3 fields. It has become the largest developer market, accounting for 12% of the global cryptocurrency developer community.

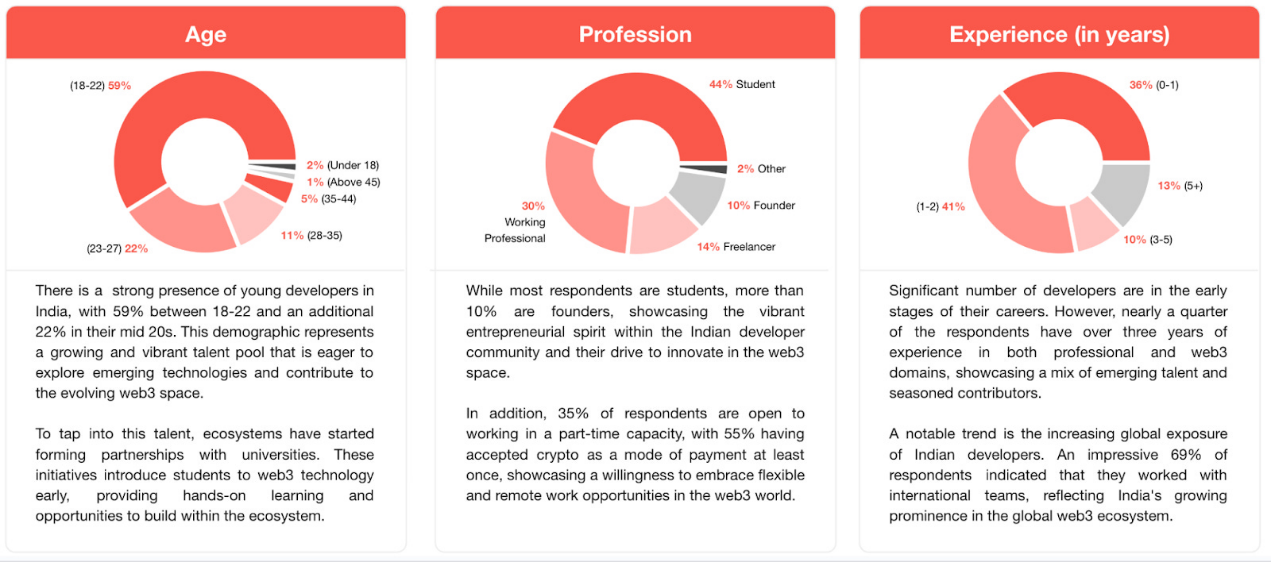

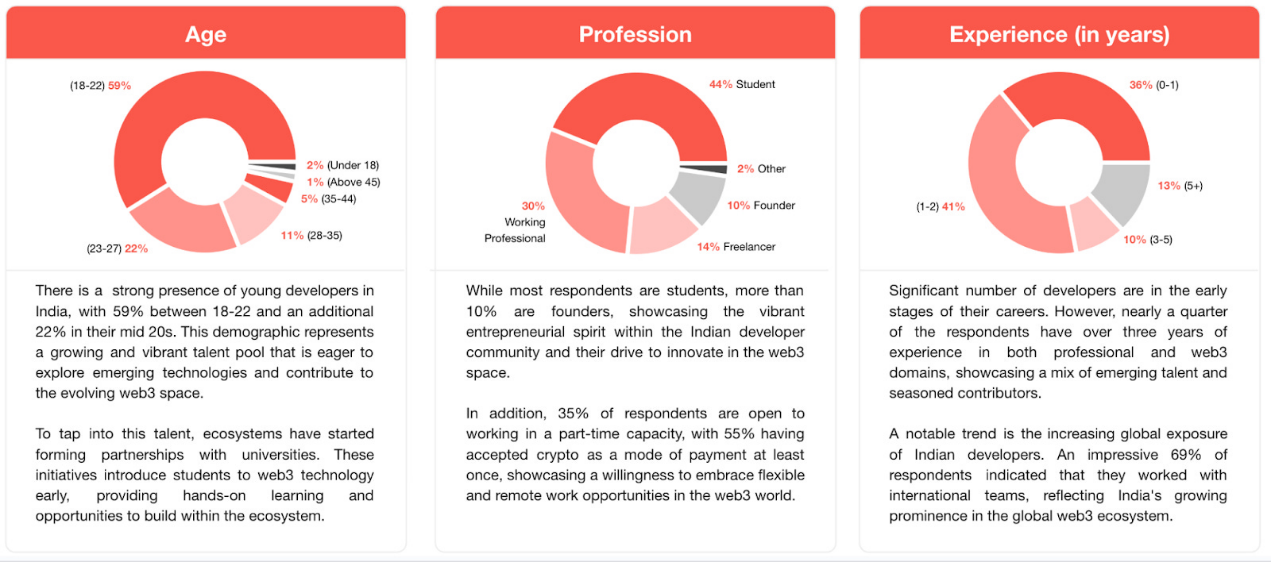

According to a survey of more than 500 developers, India's Web3 ecosystem is developing rapidly with young talent, entrepreneurial vitality and expanding global exposure. Through university partnerships and flexible working models, an ecosystem has been formed to support its growth.

Despite the increasing global exposure of developers, 51% still say their salaries do not meet global standards.

Hackathons and developer communities have become key elements in the development of the Indian Web3 ecosystem. These platforms provide developers with practical experience, mentorship, funding opportunities and global exposure. With the increase in participation rates, the growth trajectory of the next generation of developers is taking shape.

2.4. Regulation, Taxation and Policy

The Indian Web3 industry is currently in a transition period with rapid changes in regulatory and tax policies. The government's strong regulatory measures and high tax rates have restricted market development, so there is an urgent need to adjust policies to support industry development.

From 2023, the Indian government will comprehensively strengthen anti-money laundering regulations and improve transparency in the virtual asset market. All virtual asset service providers (VASPs) must register under the Anti-Money Laundering Act and must implement customer identification procedures, maintain transaction records, and designate dedicated anti-money laundering officers.

By the end of 2024, regulatory tightening is becoming more evident. The Indian government has taken extreme measures to completely block access to foreign crypto exchanges that do not comply with local regulations. This action clearly shows that compliance is a must for entering the Indian market.

Tax policy has also undergone revolutionary changes. The 2025 Finance Bill establishes a mandatory reporting system for crypto asset transactions and user information by adopting the international standard OECD Crypto Asset Reporting Framework. In addition, the legal definition of virtual digital assets is expected to be expanded to a more comprehensive concept of "crypto assets".

The current tax structure imposes a heavy burden on the industry. Crypto investment profits are subject to a high fixed tax rate of 30% without any cost deduction, and all personal transactions are subject to a 1% withholding tax. This tax burden severely restricts market liquidity.

The lack of a dedicated Web3 regulator poses another problem. Regulatory ambiguity regarding the classification of virtual assets and the treatment of decentralized protocols remains as multiple agencies exercise overlapping jurisdiction. From opening a bank account to using payment services, Web3 companies face difficulties in accessing basic financial infrastructure, and many exchanges restrict withdrawals of cryptocurrencies, preventing users from self-custody options.

For the Indian Web3 industry to achieve sustainable development, it urgently needs a regulatory framework for Web3 that reduces the tax burden, improves access to financial services, and reasonably regulates non-custodial services such as asset self-custody.

3. India is about to usher in a breakthrough

On the whole, India has formed a mature ecosystem with a mature industry and user base, but the core problem lies in the government's regulatory confusion. Although the above macro factors are generally favorable, the mature regulatory framework required for the development of the regional ecosystem has not yet been established. Despite the positive results of government-led blockchain initiatives, the lack of a dedicated regulator and overlapping jurisdictions create uncertainty from an external perspective.

In a changing global regulatory environment, this confusion has significantly reduced market attractiveness. This is the biggest barrier for investors and businesses to enter the market and needs to be addressed quickly.

Entering the Indian market requires a phased strategy. First, users with high Web3 adaptability should be prioritized. Indian users have a deep understanding of Web3 and are large in number, so effective results can be produced through successful user onboarding. This requires supporting local languages while hiring local personnel or working with marketing agencies to understand local marketing and business structures.

Secondly, development can be targeted at builders. At this stage, direct contact with investors such as Hashed Emergent becomes important. Local institutions alone have limitations in supporting builders and lack sufficient expertise.

Finally, it can be extended to cooperation with governments and businesses. Despite some confusion caused by the government, it has established a national blockchain framework and achieved tangible results. Strategic collaboration can ensure that it is at the forefront of driving market change.

Kikyo

Kikyo