Today marks exactly one month since the 1011 disaster. Each time the tide recedes, many projects that were clearly unethical are exposed. Currently, the hardest hit are the various "wild stablecoins" that jumped on the stablecoin bandwagon a few months ago. They mainly touted DeFi and the stability of their underlying assets, and many projects even received investment from prominent VCs. Now, they're entering a period of mass de-anchoring!

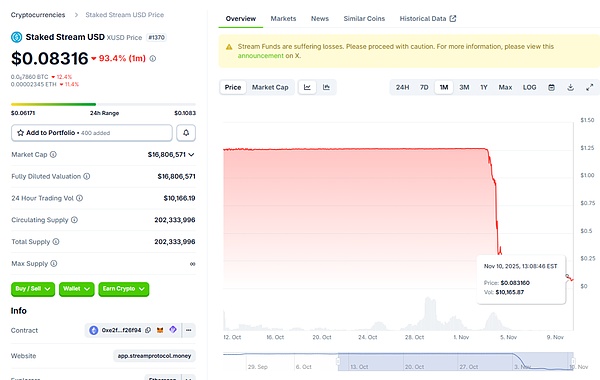

01 Stream Finance xUSD

First, the so-called stablecoin "xUSD" issued by Stream Finance has collapsed. Its price is now only 0.083, a severe 87% decoupling from its peg, and this has been going on for several days.

The total issuance of xUSD is approximately 200 million, but its current market capitalization is only 16 million, meaning nearly 200 million has vanished into thin air.

Although this project only raised $1.5 million, its background is impressive. The funds came from Polychain, a top-tier crypto VC, and it claims to invest in US Treasury bonds using crypto assets.

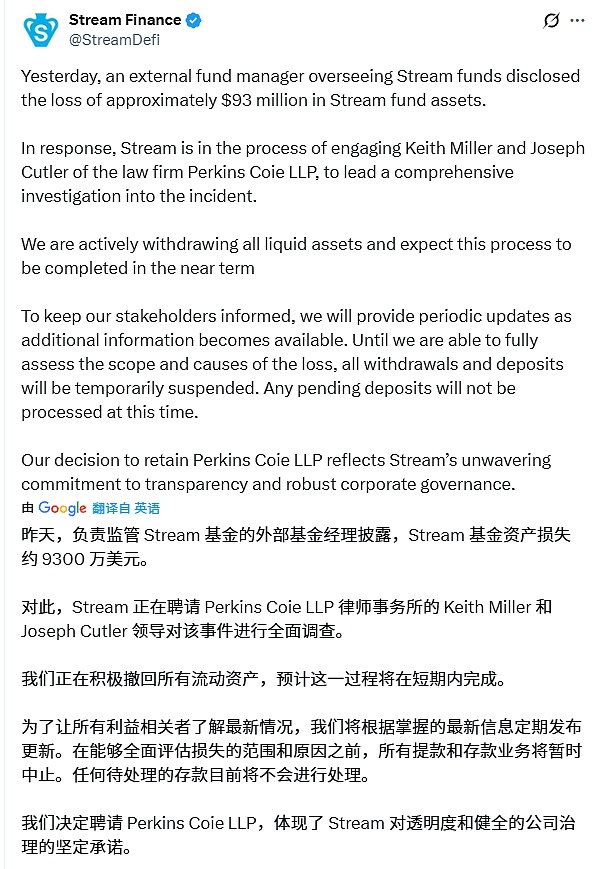

But now that it's decoupled like this, the official statement is that they acknowledge a loss of 93 million US dollars, but the reason for this loss is still unknown. They've hired a law firm to investigate...

It's really interesting. A loss of 93 million US dollars caused 200 million US dollars of stablecoin market value to evaporate, and they didn't even report it to the police!

They just hired a law firm to investigate themselves.

They just hired a law firm to investigate themselves.

It's really interesting. A loss of 93 million US dollars caused 200 million US dollars of stablecoin market value to evaporate, and they didn't even report it to the police!

They just hired a law firm to investigate themselves.

They just hired a law firm to investigate themselves.

It's highly likely an internal risk control issue. After Elixir deUSD collapsed, it directly dragged down another "stablecoin," deUSD. This is because Stream Finance's largest single exposure to risk, resulting in a $93 million loss, was in Elixir's deUSD, where the protocol lent $68 million in USDC to Stream, representing approximately 65% of deUSD's total reserves.

DeUSD is in even worse shape, currently priced at only 0.018, with a de-pegging rate as high as 98%!

Elixir's official Twitter account stated that the stablecoin deUSD has been officially retired and no longer possesses any value.

Elixir's official Twitter account posted that the stablecoin deUSD has been officially retired and no longer possesses any value.

Although the official statement claims that losses will be compensated, major exchanges have already issued risk warnings for this project's tokens. However, Elixir actually has a stronger background, having raised $17.6 million in funding from the Sui Chain and the well-known Hack VC.

03 USDX

Compared to the previous two projects, the USDX performance of the Chinese project Stable Labs is quite good, currently priced at 0.65 with a de-pegging rate of only 35%. This project has received support from many Chinese-funded funds, securing up to $45 million in funding. Investors include top funds like Dragonfly and traditional capital firms like UOB. Despite this, the founder of this project, Yang Zhou, can be considered a seasoned fraudster: Users who suffered losses due to previous failed projects have yet to receive compensation.

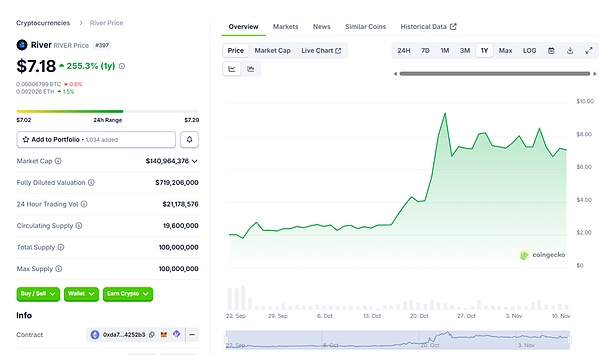

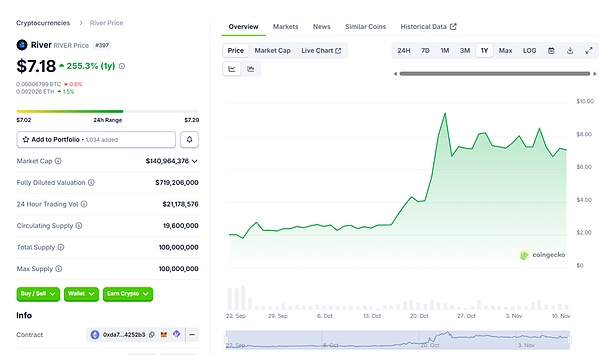

04River

Although this project hasn't completely broken free of its veto, the project team has already started to renege on their promises.

River only raised two million US dollars in VC funding, but after TGE in September, its current FDV (Full Float Market Value) is a whopping 700 million US dollars!

The price of maintaining a high market value is that large shareholders are more likely to dump their shares.

After the price fluctuations a few days ago, the project team suspended the exchange of $RIVER Pts to $RIVER to avoid further impact from large sell-offs. Project teams arbitrarily changing rules always leads to community protests. However, someone revealed that $RIVER's funding background is highly similar to BEVM, a Bitcoin ecosystem project from Softrug. So, you know what that means.

Weatherly

Weatherly