Stock tokenization is becoming the most prominent narrative for the convergence of TradFi and Web3 in 2025.

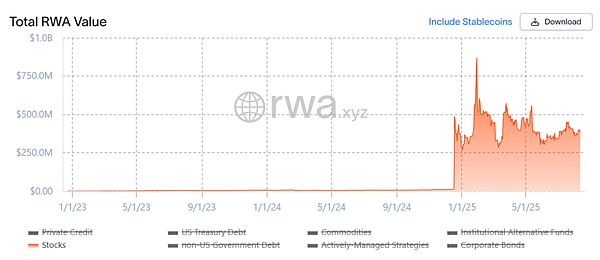

rwa.xyz data shows that the scale of stock tokenized assets has jumped from almost zero to hundreds of millions of dollars this year. This is due to the accelerated transition of stock tokenization from concept to implementation—evolving from synthetic assets to physical stock custody, and extending to higher-level forms such as derivatives.

This article will briefly review the evolution of stock tokenization models, review key projects, and look forward to its potential development trends and changes in the landscape.

Source: rwa.xyz

The Past and Present of US Stock Tokenization

What is stock tokenization?

Simply put, it is to map traditional stocks into digital tokens through blockchain technology. Each token represents a portion of the ownership of the underlying asset. These tokens can be traded on the chain 24/7, breaking through the time and geographical limitations of the traditional stock market and allowing global investors to participate seamlessly.

From the perspective of Tokenization, the tokenization of U.S. stocks is actually not a new concept (further reading: "Behind the "Stock Tokenization" Boom: The Evolutionary Roadmap of the Tokenization Narrative"). After all,

as early as the last cycle, representative projects such as Synthetix and Mirror have explored a complete set of on-chain synthetic asset mechanisms:

This model not only allows users to mint and trade "U.S. stock tokens" such as TSLA and AAPL through over-collateralization (such as SNX and UST), but can even cover fiat currencies, indices, gold, and crude oil, almost covering all tradable assets. The reason is that the synthetic asset model allows users to mint synthetic asset tokens by tracking underlying assets and over-collateralizing them. For example, a user can stake $500 in crypto assets (such as SNX or UST) to mint and trade synthetic assets pegged to the underlying asset price (such as mTSLA or sAAPL). This entire mechanism utilizes oracle quotes and on-chain contract matching, without a real counterparty. Therefore, theoretically, this model offers unlimited liquidity with zero slippage. However, this model doesn't guarantee actual ownership of the underlying stock; it merely "bets" on the price. This means that if the oracle fails or the collateralized assets collapse (Mirror's failure stemmed from the UST crash), the entire system faces the risk of liquidation imbalances, price decoupling, and a collapse of user confidence.

Source: Mirror

AndThe biggest difference in this wave of "U.S. stock tokenization" craze is that it adopts the underlying model of "real stock custody + mapping issuance".This model is currently divided into two main paths. The core difference lies only in whether it has the issuance compliance qualifications:

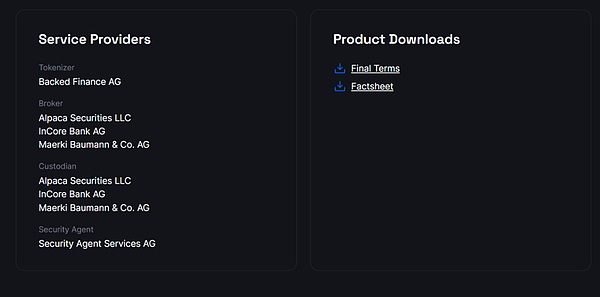

One is the "third-party compliance issuance + multi-platform access" model represented by Backed Finance (xStocks) and MyStonks. Among them, MyStonks xStocks collaborates with Fidelity to achieve 1:1 anchoring to real stocks, purchasing and entrusting stocks through Alpaca Securities LLC and others;

The other type is the Robinhood-style proprietary closed loop of licensed brokerages, which relies on their own brokerage licenses to complete the entire process from stock purchase to on-chain token issuance;

From this perspective, the key advantage of this round of stock tokenization craze is that the underlying assets are authentic and verifiable, with higher security and compliance, and are more easily recognized by traditional financial institutions.

Representative Project Inventory: The Upstream and Downstream Ecosystem from Issuance to Trading

From an operational architecture perspective,a fully functional tokenized stock ecosystem must at least include an infrastructure layer (public blockchain, oracles, and settlement systems), an issuance layer (issuers), and a trading layer (CEX/DEX, lending, and other derivative trading platforms).Without any one of these layers, the ecosystem will struggle to achieve secure issuance, effective pricing, and efficient trading.

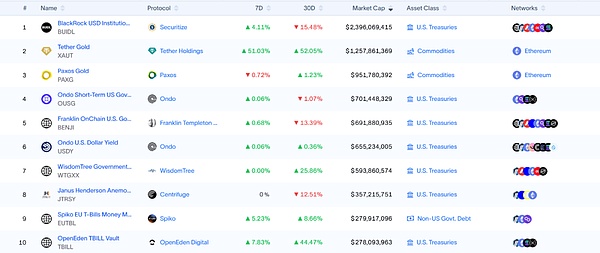

Based on this framework, we can see that the major market participants are currently deploying strategies around different links. Given the relative maturity of infrastructure (such as public chains, oracles, and settlement networks), the issuance and trading stages represent the primary battleground for tokenized equities. Therefore, this article will focus on representative projects that directly impact user experience and market liquidity. Ondo Finance: The Equity Extension of a Leading RWA Tokenization Platform First up, of course, is Ondo Finance. As a leading project in the RWA tokenization space, it was initially positioned as an on-chain bond and treasury bond tokenization platform. As of the time of writing, Ondo Finance, leveraging its two flagship U.S. Treasury products, USDY and OUSG, maintains a firm position among the top ten largest RWA tokenization platforms.

Source: rwa.xyz

However, since last year, Ondo Finance has attempted to expand its territory to the stock market, including cooperating with regulated custodians and clearing institutions such as Anchorage Digital to securely custody real U.S. stocks and issue equivalent tokenized assets on the chain. This model not only provides compliance protection for institutional investors, but also builds a cross-asset liquidity pool on the chain, allowing tokenized stocks to be traded in combination with assets such as stablecoins and RWA bonds.

Last month, Ondo Finance and Pantera Capital planned to launch a $250 million fund to support RWA projects. Ondo's Chief Strategy Officer Ian De Bode said that the funds will be used to acquire equity and tokens in emerging projects.

Injective: A public chain tailored for financial RWA

Injective has always been positioned as "financial infrastructure" and is one of the public chains focusing on high-performance financial applications. Its independently developed on-chain matching and derivatives trading modules enable it to have targeted optimizations in terms of latency, throughput, and order book depth.

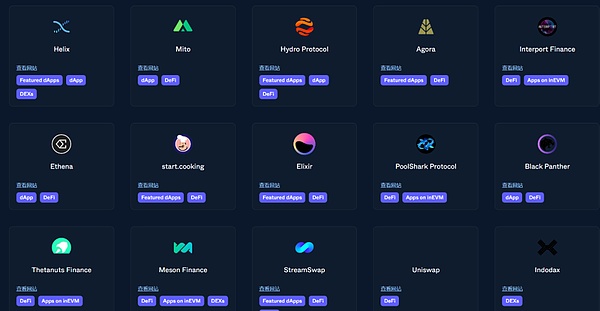

As of now, the Injective ecosystem has aggregated more than 200 projects, covering decentralized exchanges (Helix, DojoSwap), on-chain lending (Neptune), RWA platforms (Ondo, Mountain Protocol), NFT markets (Talis, Dagora) and other fields.

In the RWA track, Injective's advantages are mainly reflected in two aspects:

Wide coverage of asset categories: Injective ecological projects represented by Helix have supported transactions of a variety of tokenized assets including US technology stocks, gold, foreign exchange, etc., expanding the asset spectrum of RWA on the chain;

Direct connection capabilities with traditional finance: Injective has cooperated with Coinbase, Circle, Fireblocks, WisdomTree, Galaxy Thanks to this positioning, Injective is more like a public chain base exclusively for RWA, providing issuers with a stable compliance landing and asset management channel, and a high-speed, low-cost execution environment for trading platforms and aggregation tools, and also laying the foundation for the future derivatives and combination of stock tokens.

Source: Injective

MyStonks: A Pioneer in On-Chain U.S. Stock Liquidity

As a pioneer in this wave of U.S. stock tokenization, many users should have come into contact with the tokenized U.S. stocks issued by MyStonks on the chain. It also cooperates with Fidelity to ensure that the on-chain token assets are fully anchored to real stocks. In terms of trading experience, MyStonks utilizes a Payment for Order Flow (PFOF) mechanism, routing order flow to professional market makers for matching. This significantly reduces slippage and transaction costs, while increasing order execution speed and depth. For ordinary users, this means that when trading US stocks on-chain, they can enjoy liquidity close to that of traditional brokerages while retaining the advantages of 24/7 trading. It is worth noting that MyStonks is not limited to on-chain spot trading, but is actively expanding into diversified financial services such as derivatives, lending, and staking. In the future, users will not only be able to engage in leveraged trading of US stock tokens, but also use their holdings as collateral to access stablecoin liquidity, and even participate in portfolio investment and yield optimization strategies. Backed Finance: A Cross-Market Compliance Expander Unlike MyStonks, which focuses on US equities, Backed Finance's layout has been designed from the outset with a cross-market and multi-asset perspective. A key highlight is its compliance model's close alignment with Europe's MiCA regulatory approach. The team operates within the Swiss legal framework, strictly adhering to local financial regulatory requirements. They issue fully-pegged tokenized securities on-chain and have established a stock purchase and custody system with partners such as Alpaca Securities LLC to ensure a 1:1 mapping between on-chain tokens and off-chain assets.

In terms of asset range, Backed Finance not only supports the tokenization of US stocks, but also covers ETFs, European securities, and specific international index products, providing global investors with multi-market, multi-currency, and multi-target investment options. This means that investors can simultaneously allocate US tech stocks, European blue-chip stocks, and global commodity ETFs on the same on-chain platform, breaking the geographical and time constraints of traditional markets.

Block Street: A Liquidity Releaser for Tokenized Stocks

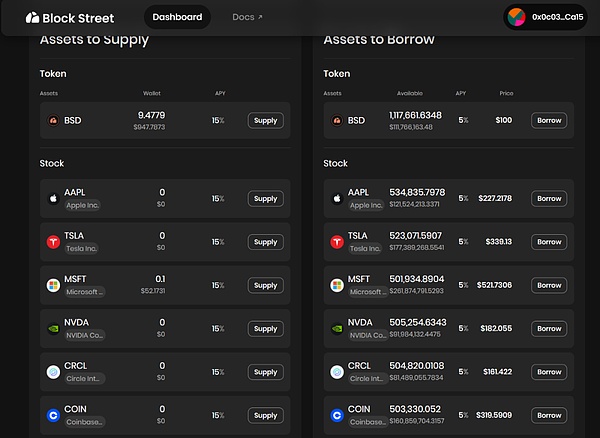

As one of the few DeFi protocols currently focused on tokenized stock lending, Block Street has set its sights on releasing liquidity in the more downstream and potentially more explosive direction.

This is also a niche track where the "trading layer" of tokenized stocks is still blank. Taking Block Street as an example, it provides on-chain mortgage and lending services directly to holders -Users can deposit tokenized US stocks such as TSLA.M and CRCL.M directly into the platform as collateral, and obtain stablecoins or other on-chain liquid assets according to the collateral rate, realizing the "no asset sale, liquidity at hand" capital utilization model.

Block Street just launched its beta version last week, allowing users to experience converting tokenized stocks into liquid capital, allowing holders to release funds without selling their assets. This can be regarded as filling the gap in the DeFi lending field for tokenized stocks. It is worth observing whether subsequent similar lending, futures and other derivatives will build a "second curve" for the tokenized stock market.

Source: Block Street

How to further tear down the wall? Objectively speaking, the biggest advancement in this new wave of US stock tokenization lies in its "real stock custody" model and the elimination of barriers to entry: Any user simply downloads a crypto wallet and holds stablecoins, and can directly purchase US stock assets anytime, anywhere through a decentralized exchange (DEX), bypassing account opening requirements and identity checks. This requires no US stock account, no time difference, and no geographical or identity restrictions. However, the problem is that most current products are still focused on the initial issuance and trading layers, essentially remaining in the initial stages of digital certificates. They haven't truly transformed these products into on-chain financial assets that can be widely used for trading, hedging, and fund management. This means they lack the ability to attract professional traders, high-frequency funds, and institutional participation. This is a bit like ETH before the DeFi Summer. At that time, it could not be lent, used as collateral, or participate in DeFi. It was not until protocols like Aave gave it functions such as "collateralized lending" that it released hundreds of billions of dollars in liquidity. If US stock tokens want to break through this dilemma, they must replicate this logic and make the deposited tokens "live assets that can be mortgaged, traded, and combined." Therefore, if the first curve of the tokenized US stock market is the growth of trading volume, then the second curve is to increase the capital utilization rate and on-chain activity of tokenized stocks through the expansion of financial instruments. Only such a product form has the potential to attract a wider range of on-chain capital flows and form a complete capital market cycle. Under this logic, in addition to the instant buying and selling of tokenized stocks, a richer range of derivatives trading on the "transaction layer" is particularly critical—whether it's DeFi lending protocols like Block Street, or future short-selling tools, options, and structured products that support inverse positions and risk hedging. The key lies in who can first create highly composable and liquid products, and who can provide an integrated on-chain experience of "spot + short selling + leverage + hedging." For example, tokenized US stocks can be used as collateral to complete fund lending on Block Street, new hedging targets can be constructed in options protocols, and composable asset baskets can be formed in stablecoin protocols. Overall, the significance of stock tokenization lies not only in bringing US stocks and ETFs onto the blockchain, but also in opening up the "last mile" between the real-world capital market and the blockchain. From Ondo at the issuance level, to MyStonks and Backed Finance for trading and cross-market access, to Block Street for liquidity release, this sector is gradually building its own underlying infrastructure and closed-loop ecosystem. Previously, the main battlefield for RWAs was dominated by US Treasury bonds and stablecoins. However, with the accelerated influx of institutional funds and the continuous improvement of on-chain trading infrastructure, tokenized US stocks have become composable, tradable, and collateralized living assets. Stock tokenization is undoubtedly expected to become the largest and most incremental asset class in the RWA sector.

Alex

Alex

Alex

Alex JinseFinance

JinseFinance YouQuan

YouQuan JinseFinance

JinseFinance cryptopotato

cryptopotato BNB Chain

BNB Chain Others

Others Numen Cyber Labs

Numen Cyber Labs Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph