Today, the market opened lower and closed down 6 points, which cooled down the recent stock market heat.

How crazy is the stock market? I believe everyone has seen it.

The Shanghai Composite Index experienced a "miracle" market with a strong rise of more than 600 points in 9 trading days before the holiday

After the holiday, the three major indexes opened higher collectively, with an increase of 10%

The turnover exceeded 3.45 trillion yuan, setting a historical high

Foreign capital rushed into the market to join the "buying"

The Hang Seng Index has risen 35.5% so far this year, leading the major global stock markets

The highest increase in Hong Kong stocks once reached 730%, comparable to the currency circle Tugoucoin!

Of course, the crypto market also took advantage of this wave of heat:

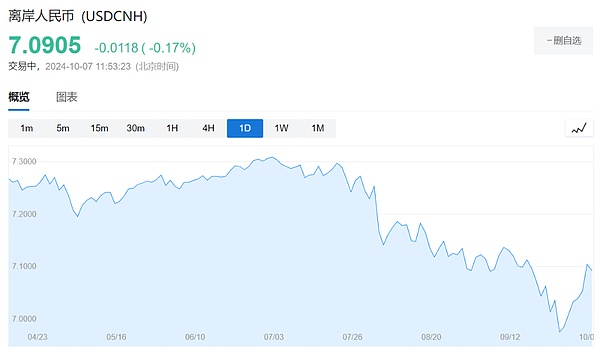

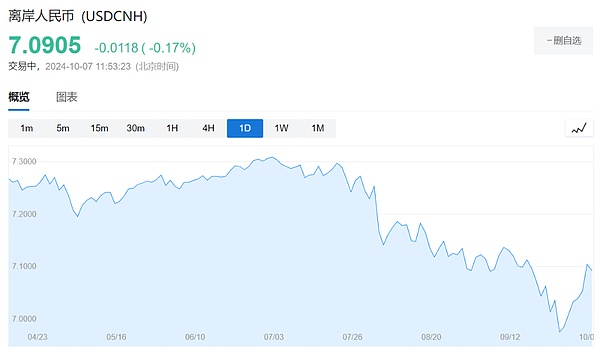

The largest stablecoin in the cryptocurrency circle, USDT (Tether), was sold off at a discount

It seemed to have become a "hot potato" in the hands of investors who were eager to exchange it back to legal tender

I didn't expect that the headline of the linkage between A-shares and the cryptocurrency circle would be - A-shares suck blood from the cryptocurrency circle

01 Current situation of A-share market: surging tide

On the first trading day after the holiday, the A-share market was extremely hot, and the three major indexes rose collectively. Only 20 minutes after the opening, the transaction volume exceeded 1 trillion yuan, and the increase exceeded 10% at the opening. More than 5,000 stocks rose, of which nearly 1,000 stocks hit the daily limit, and brokerage stocks soared across the board...

This magnificent market not only made investors excited, but also triggered heated discussions from all walks of life on the future market trend.How did the A-share market, which repeatedly triggered the 3,000-point defense battle, suddenly become successful?

Once upon a time, weak economic data and lack of market confidence caused A-shares to fall into a slump. With strong policy support and the recovery of market sentiment, the market also responded strongly.

So, in this wave of rise, what signals indicate the coming of the A-share bull market?

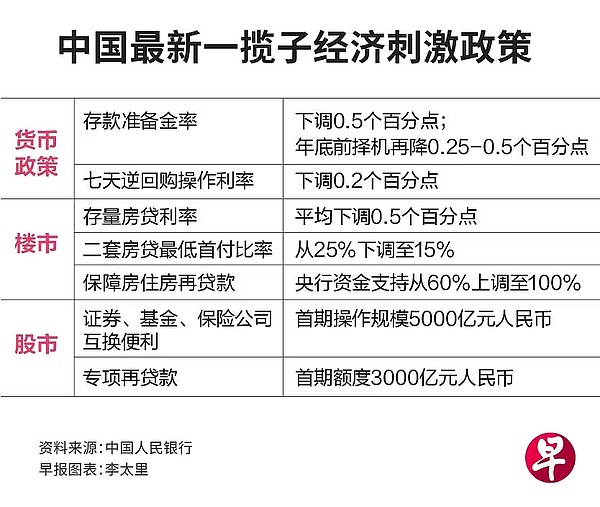

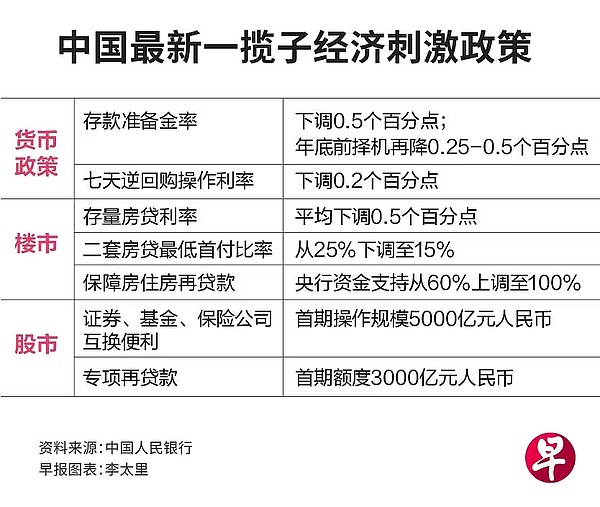

Unprecedented policy strength:On September 24, the central bank and the regulatory authorities jointly issued a package of easing policies, showing a strong intention to support the market. The bold statement of Governor Pan Gongsheng, "500 billion after 500 billion", gave the market a shot in the arm.

Trading volume hit a new high:The trading volume on October 8 was as high as 3.45 trillion yuan, which not only broke the historical record, but also showed that the market activity has increased significantly. High trading volume is usually an important signal of the coming of a bull market, showing investors' optimistic expectations for the market outlook.

Increase in foreign capital inflows into the market:Since the policy was released, Chinese concept stocks have generally risen, and many foreign institutions have expressed their optimism about the Chinese stock market. This wave of capital flow has injected new impetus into the market.

Overall valuation is still low:The current overall valuation of A-shares is still low, and the valuation percentile of the ChiNext Index is less than 8%, providing opportunities for medium- and long-term layout.

Securities firms are working overtime to attract customers:The number of investors opening new accounts is also surging. Data shows that on September 27, the net value of investors' bank-securities transfers soared to 7.04, a three-and-a-half-year high. Securities firms even temporarily opened services during the National Day holiday to meet the needs of investors.

02 Current Status of Crypto Market: Undercurrents

While the A-share market is hot, the crypto market seems a bit sluggish. After Bitcoin climbed to a two-month high of $66,500 on September 27, it fluctuated downward and fell to around $60,000 in early October.

Is there a new opportunity brewing in the crypto market? When will the bull market start? We can pay attention to the following signals:

Macroeconomic and policy changes

Recently, the Federal Reserve announced a sharp interest rate cut of 50 basis points. The influx of incremental funds caused by the release of water has promoted the overall rise of the crypto market. Loose monetary policies are generally considered to be beneficial to speculative assets such as cryptocurrencies, so the market is optimistic about the future market. In addition, as the US employment data picks up, the market generally expects that it will further stimulate the rise of Bitcoin prices.

Incremental funds continue to enter the market

Incremental capital inflows are one of the important indicators for judging the bull market in the currency circle.

ETF

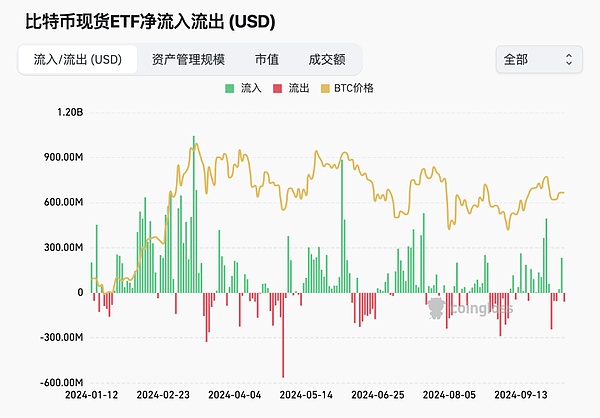

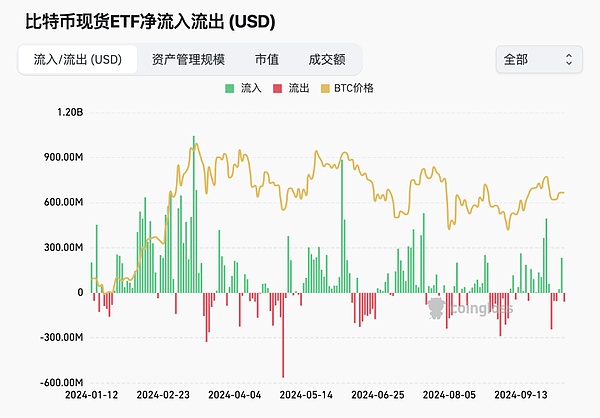

The net inflow of Bitcoin spot ETFs has a significant impact on prices. Sustained net inflows indicate that the market demand for Bitcoin is increasing, and this positive sentiment tends to be reflected in the price, causing it to remain stable or rise.

On the contrary, if there is a large net outflow, it may put downward pressure on the price of Bitcoin. The outflow of funds usually means that investors lack confidence, which may lead to a negative price drop. Therefore, the flow of funds in spot ETFs is an important indicator for investors to judge market trends.

In the past month, there have been only 6 days of net outflows from Bitcoin spot ETFs, and the magnitude has decreased compared with the previous period. At present, after a period of price fluctuations and downward movements, the confidence of OTC funds is gradually recovering.

Data source: Coinglass

Stablecoins

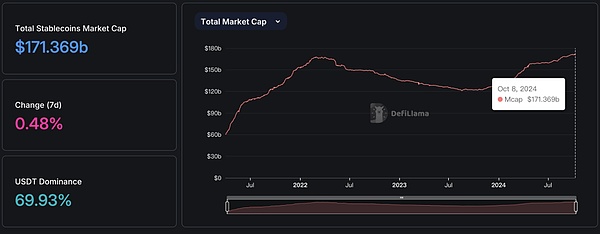

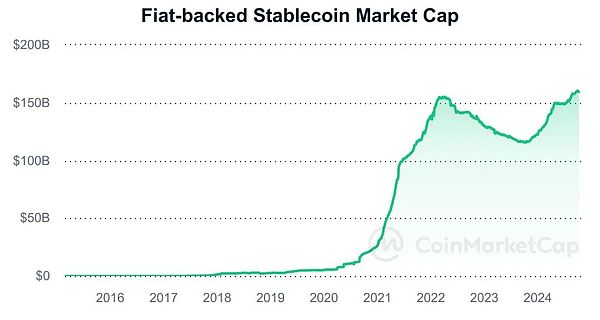

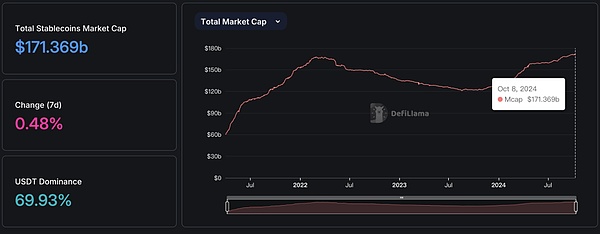

The market value of stablecoins reflects the entry of incremental funds to a certain extent. In the crypto market, when users buy stablecoins with fiat currency, these funds will flow into the market, driving up the market value of stablecoins. Observing the changes in the market value of stablecoins can help judge the flow of funds in the market.

As shown in the figure below, the total market value of stablecoins soared to US$168 billion in August, surpassing the record of US$167 billion in March 2022, setting a record high. At present, the total market value of stablecoins is still breaking previous highs, and the latest data on October 8 is US$171.3 billion.

Data source: Defillama

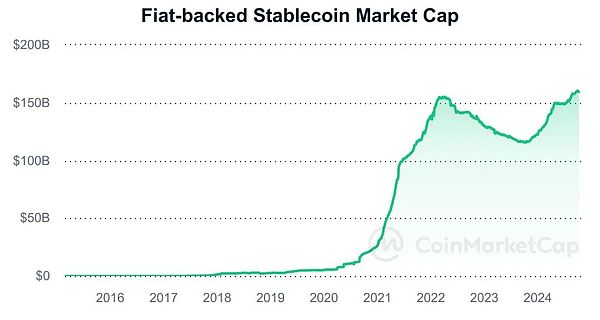

The total market value of stablecoins backed by fiat currencies has also reached a record high and is still growing. This data only includes stablecoins backed by fiat currencies, and does not involve algorithmic stablecoins that rely on complex algorithms. As shown in the figure below:

Data source: CoinMarketCap

It is worth mentioning that at present, Tether (USDT) ranks first with a market value of nearly US$119.6 billion, accounting for nearly 70% of the total market value of stablecoins. USD Coin (USDC) followed closely behind and is also growing steadily, with a market value of approximately $35.3 billion. As market confidence recovers, the continued demand for these two stablecoins will also increase. The following figure shows the change in USDT market value.

Data source: CoinMarketCap

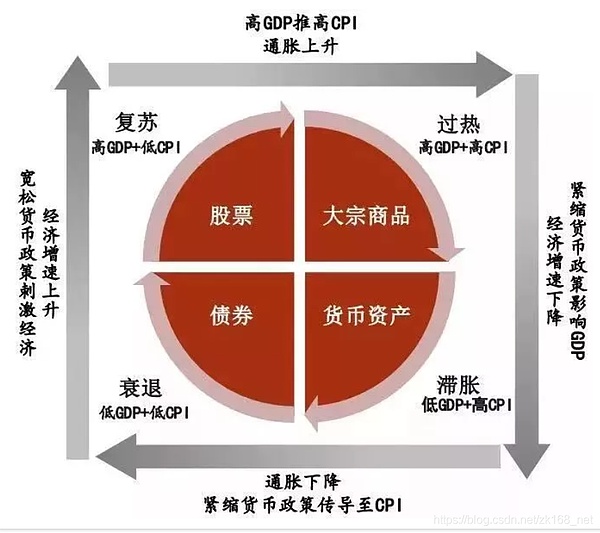

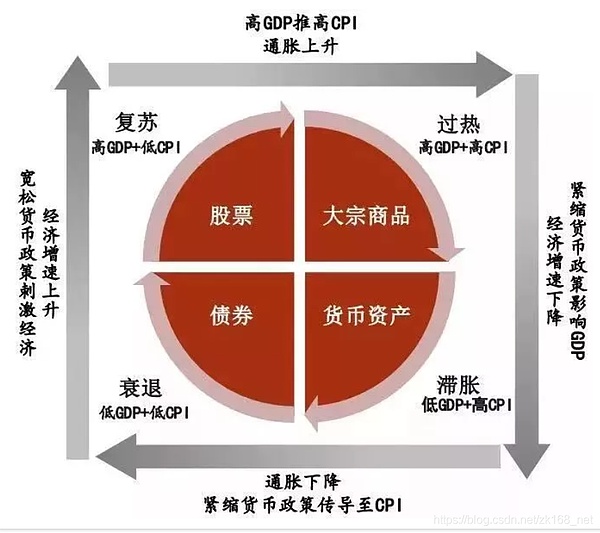

Merrill Lynch Clock Cycle

The Merrill Lynch clock is an important tool for evaluating the relationship between economic cycles and asset performance, dividing the economic cycle into four stages: recession, recovery, overheating and stagflation.

Characteristics: Slow or stagnant economic growth and low inflation.

Investment strategy: Bonds perform best at this time because interest rates fall and fixed income attracts investors.

Characteristics: The economy begins to pick up, growth accelerates, and inflation remains at a low level.

Investment strategy: Stocks become the best investment choice, corporate profits increase, and market confidence increases.

Characteristics: Economic growth remains strong, but inflation rises.

Investment strategy: The allocation value of stocks is relatively strong, commodities perform outstandingly, and investors may face the risk of interest rate hikes.

Characteristics: Economic growth is below potential and inflation remains high.

Investment strategy: Holding cash is the best choice because other assets perform poorly.

Cryptocurrency is a risky asset, and funds usually flow into the crypto market during the recovery and overheating periods of the Merrill Lynch clock. The reason is that market confidence gradually recovers during the recovery period, capital inflows increase, cryptocurrencies are favored as high-risk assets, and prices tend to rise. Although economic growth is strong during the overheating period, inflation rises and investors' demand for cryptocurrencies such as Bitcoin increases, which may lead to rapid price increases.

Therefore, when the market is in these two stages, the possibility of a Bitcoin bull market is greater. On September 18, the Federal Reserve announced a sharp interest rate cut of 0.5%. The United States has entered a cycle of interest rate cuts. From the Merrill Lynch clock, it is probably in the transition stage from recession to recovery, and the bull market may be just around the corner.

In addition, according to Bloomberg data, the correlation coefficient between cryptocurrencies and the MSCI World Stock Index is close to 0.6, one of the highest levels in the past two years. This shows that the trends between the two markets are getting closer and closer, and when the stock market performs well, the cryptocurrency market may also rise accordingly.

On-chain data indicators

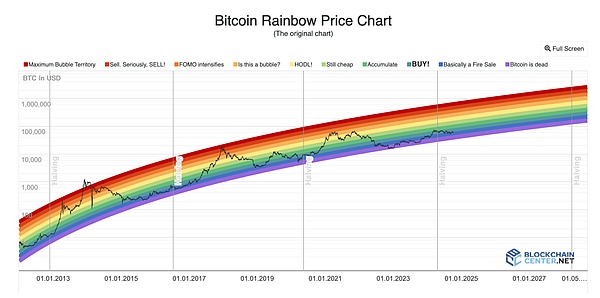

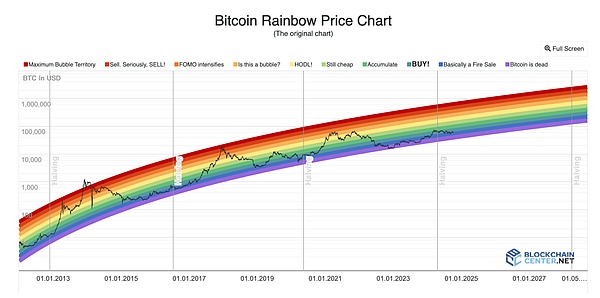

Bitcoin Rainbow Price Chart

The rainbow chart is a long-term valuation tool for Bitcoin, using a logarithmic growth curve to predict the potential future price direction of Bitcoin. The warmer colors above show when the market may be overheated, which is a better selling point; the colder colors indicate that the overall market sentiment is usually depressed, which is a better buying point. The rainbow chart can be used to assist in judging the arrival of bull market signals.

There are a total of 10 color bands in the chart. Taking today, October 8, as an example, BTC is in the "buy" range of the green color band, and the market is generally hot. If one day the BTC price is in the yellow, orange, and red color bands of the rainbow chart, it means that the market is gradually heating up and the bull market signal is becoming more and more obvious.

For more analysis of the line data indicators, please refer to Biteye's recent article: "Will the market reverse? Check out 7 Bitcoin bottom-picking indicators"

03 Summary

In the past half month, funds have poured into the Chinese stock market. All-in A-shares no longer seem to be a joke in the capital market.

In contrast, although the current market momentum of the crypto market is insufficient, in the long run, Bitcoin is still the leader among all types of asset performance this year. According to the latest statistics from Goldman Sachs on October 8, Bitcoin has risen by more than 40% this year, outperforming major stock indexes, fixed income securities, gold and oil.

When will the crypto bull market come? It depends on the heart and the deeds.

By observing and tracking a series of positive signals, along with the global economic recovery and policy support, I believe that the crypto bull market is just around the corner!

Joy

Joy