破解加密悖论:超越Code is Law 迈向Model is Trust

加密市场,BTC,破解加密悖论:超越Code is Law 迈向Model is Trust 金色财经,我们是否正在实质性迈向理想的未来?

JinseFinance

JinseFinance

Author: Bai Ding & Noah, GodRealmX

On February 5, 2025, Justin Sun started a live broadcast to promote the stablecoin USDD2.0, which caused USDD to be de-anchored for a time, and aroused a lot of doubts and criticisms from the market. The unsuccessful move became a joke for a while. The direct cause of this turmoil was that Justin Sun talked about the 20% yield of USDD in the live broadcast, advocating how superior the design of this project was and how stable the collateral was. This "bluffing" approach caused widespread dissatisfaction among people.

Recently, market sentiment was low, and the USD0++ de-anchoring incident was still in sight. Stablecoins are already very sensitive, and USDD has a "criminal record" of de-anchoring more than once, so people cannot have a friendly impression of it. Of course, the most important thing is that as long as the three words "Justin Sun" are mentioned, people can't help but be more careful.

Sun Yuchen promoted the PSM module of USDD2.0 on Twitter

As for USDD (Decentralized USD), it is an old project launched by Sun Yuchen in 2022 to take advantage of the popularity of LUNA and UST. Its recently released 2.0 version claims to provide 20% mining income, which has aroused heated discussions in the market. Many people have discussed this, and from the data, some people have indeed participated in USDD 2.0 mining.

Currently, USDD's circulating market value has reached 160 million US dollars, and its daily trading volume exceeds 5 million US dollars.Although it is not large in size, it has attracted widespread attention under Sun Yuchen's high-profile publicity.

But since it is Sun Yuchen's project, it is basically accompanied by risks. So is USDD worth participating? In this article, we will start from the UST-LUNA dual-token economic model, introduce the origin and development of USDD, its mechanism design, and the many depegging events in history, and objectively analyze its future prospects in combination with market comments.

Sun Yuchen promotes USDD and touches on Li Lin

On February 5, Sun Yuchen conducted a live broadcast on Twitter Space with the theme of "Can we trust Sun Ge again in this wave of USDD?", introducing the 2.0 upgrade of USDD launched on January 25 this year, focusing on its high yield of up to 20%, and emphasizing that USDD ensures stability through designs such as over-collateralization and PSM (stable peg).

As in the past, Sun Yuchen's marketing sense in the live broadcast was very strong and quite inflammatory: "USDD is as stable as an old dog", "If you don't understand USDD, just think of USDD as a mirror proxy of USDT", "Using USDD on TRON is no different from using USDT, except for the high interest rate".

However, this live broadcast had the opposite effect, and the market had serious doubts about Sun Yuchen's publicity. There are three main reasons:

1. Risks brought by high returns:20% APY is too high, which makes people feel difficult to sustain. In addition, it is Sun Yuchen's project. Users are worried that the high yield is a means to lure funds into the market. There is no real value support behind it. Participating in it is like trying to get the skin of a tiger.

2. Unpegging "Criminal Record": In the past three years, USDD has been unpegged more than once, and there have been rumors of misappropriation of reserve assets. The market still has doubts about its stability.

3. Suspected of creating contradictions and diverting traffic:Sun Yuchen often promotes his projects in various forms in front of the public. However, when he was promoting USDD recently, he suddenly changed his tone and mentioned that when acquiring Huobi in 2022, Li Lin concealed a financial loophole of 30 million US dollars. Sun Yuchen had to pay out of his own pocket to fill the gap. He used this to emphasize that if there is a problem with USDD, he will do the same. Unexpectedly, due to his bad reputation, the market did not buy it, but thought that Sun Yuchen was deliberately creating topics to divert traffic.

Sun Yuchen“implied” Li Lin

The subsequent series of events deepened people’s doubts about Sun Yuchen and USDD. First, Li Lin responded in a long article that during the delivery process of Huobi in October 2022, there were major differences between the two parties in the calculation method of user assets, and the facts were inconsistent with Sun Yuchen’s statement.

In addition, the asset reserve situation behind USDD is also quite problematic. In August 2024, Justin Sun claimed that the over-collateralization rate of USDD reached 1.23 times, but the third-party agency Bluechip said that the actual collateralization rate of USDD may be only 53%, and most of it is stored in multi-signature addresses, which may be transferred at any time. Of course, judging from the minting mechanism of USDD at this time, it is not an "over-collateralized" stablecoin, but it is still considered stable.

Image source: Techflow

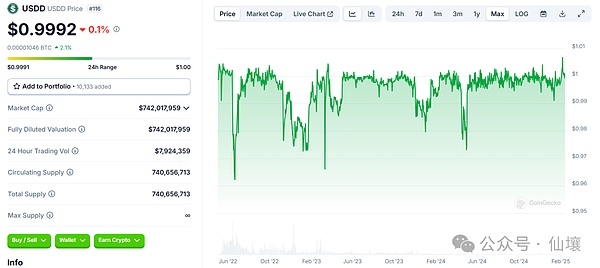

On February 7 this year, USDD was slightly de-anchored, with the lowest drop to around 0.98, but it returned to the anchor after a short time. In response, Justin Sun said that this was just a "short-term fluctuation" and continued to promote USDD on Twitter under the slogans of "high yield" and "good stability". However, judging from public opinion, people still do not think highly of USDD.

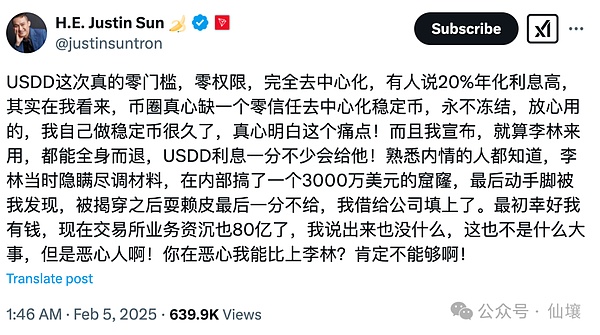

Screenshot of tweets from old users who participated in USDD mining in 2022

Origin of USDD: Born to ride on the popularity of LUNA

USDD was born in May 2022.At that time, Justin Sun launched the earliest version of USDD on Tron in order to ride on the popularity of LUNA and UST, and touted its superiority. A few days later, the shocking LUNA zeroing incident occurred.

In June 2022, USDD experienced a serious depegging. For this reason, Justin Sun lied about introducing the "over-collateralization" system, calling a black cat a white cat, hoping to maintain the stability of USDD, but during this period, the USDD-TRX stabilization model was still retained; since then, USDD has experienced many depegging incidents, until January 25, 2025, USDD released version 2.0, abandoned the stabilization model, and truly changed to over-collateralization.

With this in mind, we believe that in order to deeply understand USDD and why it later introduced over-collateralization, it is necessary to sort out the ins and outs of LUNA and UST, so that we can understand the problems of USDD.

LUNA and UST were founded by Korean Do Kwon in 2018. He launched the public chain Terra and released a dual-token model based on it, including the native token LUNA and the algorithmic stablecoin UST. This stablecoin relies on its dual-token exchange mechanism and arbitrage behavior to maintain stability. It lacks actual collateral behind it, and has opened a "new chapter" for stablecoins. However, its sudden collapse has greatly damaged the image of algorithmic stablecoins.

Do Kwon's approach is bold. In order to make UST gain value support, it allows two-way exchange of UST and LUNA worth $1. In short:

When UST > 1 USD, you can destroy 1 USD of LUNA, mint 1 UST, and sell UST in the market for profit → UST selling pressure increases → UST falls back to 1 USD;

When UST < 1 USD, you can destroy 1 UST, get back LUNA worth $1, and sell LUNA in the market for profit → UST buying increases → the price rises back to 1 USD.

From its model, as long as there are always active arbitrageurs and whales in the market, UST can be stabilized at around $1. But there is a premise behind this, that is, LUNA must always have sufficient liquidity, and its market value should be significantly higher than UST to cope with large-scale UST withdrawals.

With this in mind, Terra has made various efforts to increase the market's recognition of LUNA and UST. They supported the establishment of the Chai payment application, directly using UST as a settlement tool; launched the Anchor Protocol, attracting users to deposit UST for interest with an APY of about 20%; and established the Mirror Protocol, allowing users who pledge UST to mint US stock tokens (such as mTSLA) on the platform. These efforts to vigorously expand the application scenarios of UST are very similar to Sun Yuchen's current operations on USDD.

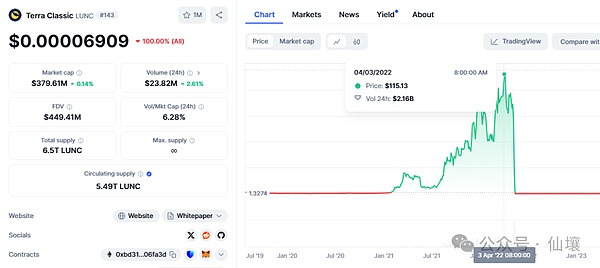

With Terra's unremitting efforts, many big investors were motivated by Anchor's high yield and bought a large amount of LUNA to mint it as UST. The economic flywheel of the dual-token model took off, and the price of LUNA soared from less than $1 at the beginning of 2021 to nearly $120 in April 2022. The market value of circulation exceeded $40 billion, and the market value of UST also exceeded $18 billion. It can be said to be in its heyday.

However, all this is just a false prosperity. Although LUNA's market value is more than twice that of UST, if UST big holders really withdraw collectively, LUNA's market value will shrink rapidly in the process, and it will be impossible to achieve the rigid redemption of 1 UST → 1 USD LUNA.

To make matters worse, in May 2022, the Federal Reserve raised interest rates by 50 basis points, and the market reacted violently and quickly turned bearish. LUNA's market value shrank sharply to about US$20 billion, while UST's market value was about US$18 billion. It is easy for a discerning person to see that LUNA's liquidity at this time cannot support large-scale UST withdrawal behavior at all, and any disturbance can trigger a chain reaction.

At this time, the Terra team was going to set up a larger stablecoin exchange pool (4Crv) on Curve, and temporarily withdrew $150 million of UST from the 3Crv pool. The liquidity of UST in the market was greatly reduced. The long-lurking shorts seized the opportunity and dumped $84 million of UST on Curve at one time, causing UST to de-anchor to 0.985, attracting many UST big holders to follow suit and sell.

The overconfident Terra team said that there was no need to rescue the market for the time being. Soon, panic spread to the entire UST community. More big holders rushed to unlock the interest-bearing UST on the Anchor platform, triggering a large-scale UST exit stampede. More and more people unlocked UST to exchange for LUNA and sold it, and eventually fell into a death spiral. In just three days, UST fell below $0.6, and the price of LUNA quickly fell to nearly 0. A phenomenal token with a market value of more than $40 billion at its peak was wiped out, and countless Koreans lost their homes.

In the final analysis, the root cause of all this is that UST lacks the value support of real money and silver. Behind it is the LUNA token issued by Terra out of thin air. As long as LUNA liquidity is tight, UST will fall into crisis. Terra's behavior is actually making money out of nothing. After the collapse of LUNA, people generally developed a fear of algorithmic stablecoins and were more willing to believe in stablecoins with real money as collateral, even the widely criticized USDT.

On May 5, 2022, Justin Sun launched the original version of USDD, which is similar to UST in main mechanism, except that there was a lot of discussion about UST-LUNA decoupling in the market at that time, so USDD added a rule, cutting off the free exit channel in the primary market: except for the whitelist institutions recognized by the Federal Reserve, no one else can destroy USDD and mint $1 TRX, so as to reduce the selling pressure of TRX when USDD decoupling and prevent the death spiral from happening.

This is equivalent to directly closing the window of USDD→TRX free exchange in the primary market, allowing only whitelist institutions to enter and exit freely.For most people, once USDD decoupling, you can only sell USDD directly in the secondary market. In the design of UST-LUNA free exchange, UST can always be freely exchanged with $1 LUNA, and the existence of this channel can effectively reduce the direct selling pressure of UST.

So why did we always see USDD depegging in the past? A big reason is here. It gave up the most efficient means of regulation, the "market". Once USDD depegged for a short time, big investors would sell USDD in large quantities in panic. Sun Yuchen disagreed with this, saying that USDD only allowed whitelisted institutions to freely exchange between USDD and TRX, which was "macro-control".

USDD Subsequent Versions: Fake "Over-collateralization" Real "Frequent Depegging"

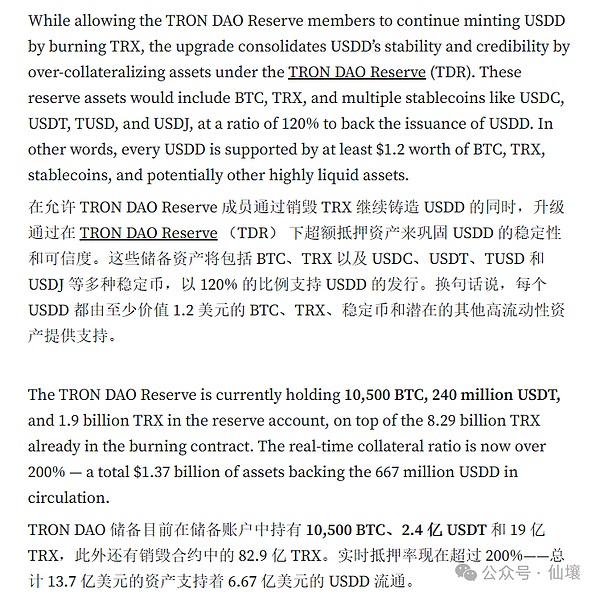

Dramatically, UST-LUNA collapsed within a week after USDD went online. Due to the huge impact, algorithmic stablecoins became a rat crossing the street for a while. Justin Sun is very sensitive to the market. On June 5, 2022, he announced an upgrade, calling himself USDD, which introduced an "overcollateralization" system, using real gold and silver to prevent decoupling. In addition, Justin Sun established Tron DAO Reserve as the issuing and management agency of USDD, which is responsible for regulating reserve assets, stabilizing currency prices and market liquidity.

Official article of USDD in Medium

When it was first launched, USDD was promoted wildly on major platforms as "the first decentralized over-collateralized stablecoin", but a closer look reveals that there are many problems.

First, the "first decentralized over-collateralized stablecoin" is obviously DAI launched in 2017, so it is not USDD's turn anyway.

Official statement of USDD in Medium

The second one is more critical. Sun Yuchen is obviously changing the concept. Let's take a look at the official statement of USDD in the picture above. It clearly states that the minting method of USDD is still to destroy TRX, and the reserve assets of the BoF are only used to "consolidate the stability of USDD." In short, USDD still uses the original calculation model. Don't be afraid of decoupling. The BoF is very rich and will pull up the market in the secondary market to prevent USDD from decoupling.

But the problem is that USDD is actually still stable, and it is not an over-collateralized stablecoin based on CDP like DAI. USDD's "excess reserves" are usually kept in the vault of the Federal Reserve of Poland, and are used to intervene in the price of USDD in the secondary market. For example, when the price of USDD is lower than $1, the Federal Reserve of Poland can sell reserve assets such as BTC and USDT, buy back USDD, and pull its price back to $1, and vice versa.

If we examine the "collateral" of USDD in the primary market, we will find that USDD can actually only be exchanged with TRX, and these TRX will be worth about 670 million US dollars in June 2022, which is basically the same as the circulating market value of USDD of 667 million US dollars. Obviously, this is more dangerous than the 200:180 market value ratio of LUNA and UST on the eve of the thunderstorm.

Of course, this is not over yet. These TRX reserves are stored in 5/7 multi-signature addresses and may be transferred at any time. This is undoubtedly another big thunder of USDD, which will be explained in detail later.

That is to say, USDD is essentially a more unstable dual token, and its idea is not to be afraid of de-anchoring, and to use reserve funds to temporarily rescue the market in the secondary market after de-anchoring, just like my country's intervention in exchange rates. This is another major reason why USDD always de-anchors.

In addition, even if people believe that Sun Yuchen will rescue the market, the asset reserve ratio of the BoF is also the key. In addition to TRX, the BoF has been repeatedly exposed to misappropriation of funds and private transfer of reserve funds. In this way, USDD is difficult to be recognized by the market, and user distrust is the third reason why USDD often de-anchors.

Here we review the major depegging events that have occurred in the history of USDD.

The first timeInJune 2022, the adverse impact of the UST incident was still affecting the market, and many shorts targeted the decentralized stablecoin track and bombarded it. A wallet address borrowed 170 million USDD through the JustLend lending platform and sold a large number of USDD on KuCoin, causing market panic, and USDD once fell to $0.91.

Image source: Tronscan

The short is suspected of shorting TRX at the same time and making a lot of profits. USDD's depegging made the market believe that whitelisted institutions would destroy a large amount of USDD to mint TRX, and then immediately cash out TRX, which made the market generally bearish on TRX, causing TRX to fall 40% rapidly. It was because of this incident that Justin Sun increased the reserve ratio of the Waves Fed.

The second serious depegging occurred in November 2022. It was revealed that the actual collateral rate of USDD was only 50%, and it has been in a state of light depegging. As soon as the Waves incident came out, USDD once dropped to $0.969. In the 3Crv pool on Curve, USDD once accounted for 86%.

For this depegging incident, Justin Sun still used the old method, investing in repurchases and making public statements to dispel the panic in the market and make USDD return to the anchor. It can be seen that the media reports at this time have frequently used such a term as "collateral rate", which is irrelevant. It can only be said that Sun Yuchen's public relations ability is great.

Report on USDD de-anchoring and 50% collateral rate in November 2022

The third serious de-anchoring was on December 12, 2022.The South Korean financial regulator issued a risk warning for the algorithmic stablecoin USDN (Neutrino USD) of the Waves ecosystem, pointing out that its reserve assets are insufficient and there is a risk of de-anchoring. This warning has caused widespread market concerns about the stability of the algorithm, and USDD, as a similar project, has suffered from selling pressure.

These are the three most serious USDD depegging incidents that have occurred in the past. In addition, USDD has experienced many depegging incidents in 2023 and 2024. Stablecoins are so unstable, and with the three words "Justin Sun", it is no wonder that the market cannot trust them.

Image source: CoinGecko

Due to the excess reserve mechanism of USDD, Sun Yuchen's way of solving the depegging problem is always the same:payingtorepurchase+personal IP endorsement. But because of his dark history and public image, it is difficult for people to trust him. Some people say that although the depegging is frequent, Sun Yuchen at least chooses to rescue the market every time.

But we have reason to speculate that he is still willing to rescue the market at present, just because the USDD ecosystem is not large enough and the cost of rescuing the market is not high. Do Kwon held 4 billion US dollars in "reserve assets" at that time. Facing the collapse of UST-LUNA, he quietly put the money into his own pocket and watched LUNA and UST return to zero.

Big Thunder in the Minting and Destruction Process of USDD

As mentioned earlier, there are major crises hidden in the minting and destruction process of USDD. It claims to be decentralized, but the minting process is absolutely centralized. This was analyzed when USDD was first issued in 2022, but now it has been forgotten by most people.

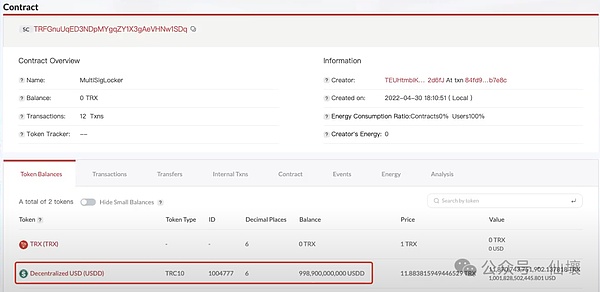

The decentralized stablecoins we are familiar with are often minted based on market demand and smart contracts. According to the white paper, USDD pre-minted 999.9 billion coins before the project went online and stored them in a multi-signature contract called "Insurance contract".

Insurance contract

Every time the Fed issues additional USDD, it will transfer 1 billion USDD to the Authorized contract, which means that the Authorized contract is the real minting address.

Authorized contract

But it’s not over yet, the additional USDD will be transferred from the Authorized contract to a TRC-20 Token address, and then these USDD will be issued according to the whitelist and finally flow into the market.

So, from minting to issuance, USDD is actually a completely human operation, controlled by three multi-signature wallets, and the market launch process is also monopolized by institutions in the white list, and there is not much decentralization.

The above is the minting/issuance process of USDD. Let's look at the destruction process. USDD is similar to UST. You can destroy TRX to mint USDD, but the "destroyed" TRX is not sent to the black hole address, but transferred to a 5/7 multi-signature address called "MultiSigTRXBurn", and the holders behind these multi-signatures are not clear. In other words, this part of the "destroyed" TRX has a great risk of flowing back into the market.

What does this mean? Sun Yuchen issued a virtual coin called USDD, asking you to exchange it with the TRX in your hand. The USDD you get is equivalent to a certificate that can be exchanged for TRX. Algorithmic stablecoins are like making money out of nothing, so Sun Yuchen is killing two birds with one stone. From today's perspective, the narrative of stability has little future. USDD is not popular as a stable currency, and so many hidden dangers in its production process make it untrustworthy.

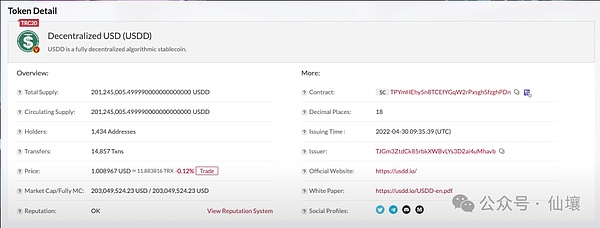

USDD2.0: Still full of problems

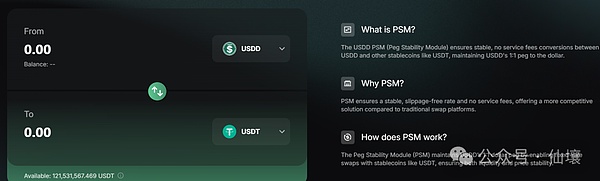

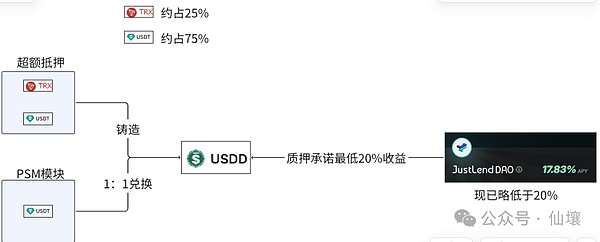

After reading the above analysis, everyone has a basic understanding of the old version of USDD. As for Sun Yuchen's vow that "USDD will not be de-anchored", they have their own judgment. Recently, Justin Sun has been promoting USDD version 2.0 on Twitter. The update involves risk control, liquidation, decentralized governance and other aspects. The more discussed contents include: 1. Changes in the minting method 2. PSM module (stable peg) 3. Super high annualized return of at least 20%, fully supported by TRON DAO's reserves.

4. Decentralized governance

The original version is now called "USDDOLD", and USDD2.0 is suspected to have abandoned the original equivalent TRX destruction and casting channel, and changed to casting USDD with TRX or USDT over-collateralization, basically abandoning the idea of calculation stability and using the CDP model like DAI.

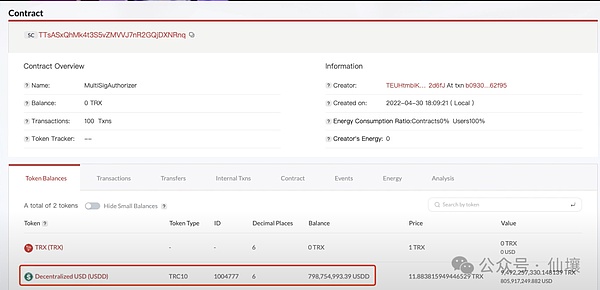

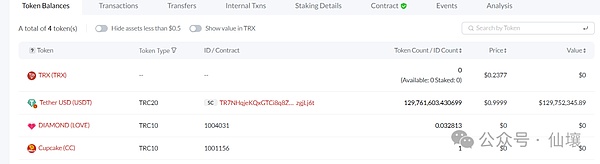

According to the official address data of USDD, the current locked amount of TRX is about 42 million US dollars, and the locked amount of USDT is about 1.3 million US dollars. A total of about 16.6 million USDDs have been minted, and the current market value of USDD is nearly 150 million US dollars. What's going on?

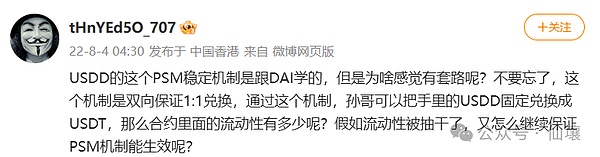

This is because of the PSM module of USDD 2.0: users can directly exchange USDD and USDT 1:1 on the official website. This is equivalent to giving users a reassurance: Sun Yuchen will bear the risk of USDD depegging at any time.

Image source: PSM module of USDD official website

It can be seen that there are about 130 million USDT in the PSM deposit address, corresponding to the market value of the remaining USDD.

Image source: Tronscan

This leads to a new problem: If the USDT in the PSM module is counted as collateral, it means that TRX only accounts for about 25% of the TVL of the collateral, and most of the collateral is USDT. Combined with Sun Yuchen's promise of at least 20% annualized return, we can simplify the entire mechanism as follows:

As long as you deposit your USDT,Sun Yuchen will give you 20% interest per year. When asked about the source of income, Justin Sun replied, "There is no other reason, it's purely because we have a lot of money, so don't ask me questions like "Where does the income come from" anymore."

Of course, this can be interpreted as Justin Sun playing a big game, in order to promote the use of USDD and the TRON ecosystem, and to give benefits to users, but this explanation is not convincing for Justin Sun, who is almost the first sickle in the encryption industry.

In addition, the PSM module is not a new product of USDD2.0. This function is also available in USDOLDD, which is a learning idea from DAI. Some people raised doubts that year.

Here is a bold guess: Sun Yuchen has a large amount of USDD waiting to be cashed out, but the secondary market is not deep enough, and the shipment will cause a crash. What to do? Use high returns to attract users to exchange USDT for USDD through the PSM module. In this way, on the one hand, USDD can be shipped, and on the other hand, there is USDT liquidity in the PSM pool, and Sun Yuchen can use it to cash out the remaining USDD in his hand for USDT without loss. If the above assumption becomes a reality, the PSM pool may be forced to close due to insufficient USDT depth.

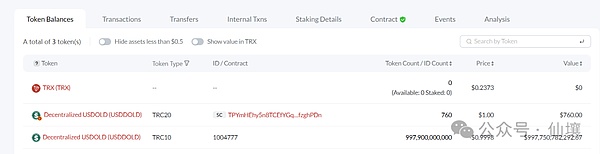

Back to reality, the decentralized governance advocated by USDD means that the community can influence the minting and currency policy through voting to improve transparency and user trust. Now we have not seen USDD 2.0 has specific measures for this. In addition, we have mentioned before that there are still 997.9 billion USDD under the name of the multi-signature address Insurance contract corresponding to the old version of USDD, which has become a sword of Damocles hanging over the head of the USDD community.

Image source: Tronscan

USDD has launched version 2.0, which no longer tells the story of algorithmic stablecoins, but has transformed into an over-collateralized stablecoin with super high yields, and promised to exchange 1:1 with USDT. In the previous version, as an algorithmic stablecoin with excess reserves, Sun Yuchen used word games to promote the idea of calling a black cat a white cat, but in fact he secretly mobilized the reserve assets, which was difficult to convince the public. Now USDD2.0 is an over-collateralized stablecoin, and the collateral assets are its foundation. Whether it will continue the previous style or do things steadily, we don’t know. As for USDD 2.0’s “depositing USDT can get Sun Yuchen to spend a lot of money”, this story sounds even more unreal. After all, Sun Yuchen never suffers losses for no reason. Based on past experience, Sun Yuchen is not trustworthy, so USDD 2.0 is likely to be a trick played by him. First of all, this super high rate of return is definitely unsustainable. The current rate of return has been maintained at around 18% for a while. Secondly, Sun Yuchen can't spend money for no reason. He must have a back-up plan. In addition, the huge amount of USDD in the insurance contract may be sold, which is a big thunder. This is not groundless worry. Many people still remember how Sun Yuchen harvested leeks with TRON and TRX, and a person often has path dependence on the way of making money that he is good at.

加密市场,BTC,破解加密悖论:超越Code is Law 迈向Model is Trust 金色财经,我们是否正在实质性迈向理想的未来?

JinseFinance

JinseFinanceWeb 3.0, Code Nation: A brief history of "Code is Law" Golden Finance, the consequences of code errors may be more serious than human errors.

JinseFinance

JinseFinanceUSDD’s Bitcoin collateral was removed without a vote by its DAO, but Justin Sun insisted that this was a normal event in DeFi.

JinseFinance

JinseFinanceTRON DAO Reserve has moved support for USDD from Bitcoin to TRX with the transfer of 12,000 Bitcoin, raising questions about the stability of the stablecoin amid reliance on more volatile assets.

WenJun

WenJunFor tokens with a specific utility, a rule of thumb is - a token should be issued when its utility is essential to the crypto project.

JinseFinance

JinseFinance2023 has gotten off to a rather good start for the crypto market but not for Huobi.

cryptopotato

cryptopotatoETH’s Shanghai upgrade is highly anticipated because once executed, this change will allow users to withdraw their staked Ethereum.

Catherine

CatherineAlthough it took more than a week to schedule FTX’s first bankruptcy hearing, it did finally happen. The live tweets detailed what went on.

Catherine

CatherineFrom utility to aesthetic, digitally-native brands are looking to solve problems associated with the fashion industry using blockchain technology.

Coindesk

CoindeskThe ‘Ethereum is a security’ debate has been going on for a while now. With the move to proof of ...

Bitcoinist

Bitcoinist