Author: Daren Matsuoka, Partner of a16z Investment Team; Translation: Jinse Finance xiaozou

The development of the crypto industry is becoming more and more mature. At the end of last year, we proposed five indicators that need to be closely watched in 2025 to track the continued growth and development of the industry, namely:

Monthly number of mobile wallet users, adjusted stablecoin trading volume,ETPnet inflow of funds,DEX toCEX spot trading volume ratio, total transaction fees (block space demand)

The following is the data and importance analysis of the first half of this year.

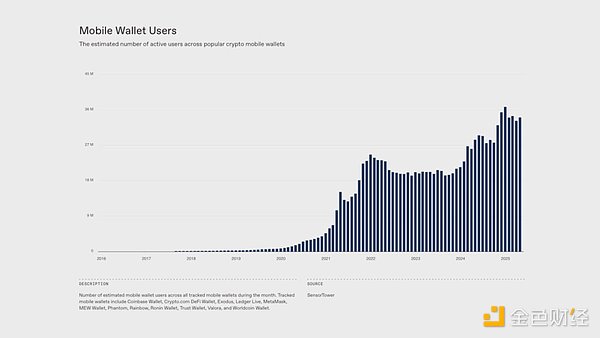

1、Number of monthly mobile wallet users: +23%

2025: Average monthly active mobile wallet users are 34.4 million;

2024: Average monthly active mobile wallet users are 27.9 million.

Importance note:

Wallet infrastructure has improved significantly - we now have low transaction fees, a new account abstraction protocol (EIP-7702), embedded wallet products (Privy, Turnkey, Dynamic), etc. Now is the best time to build the next generation of mobile wallets.

Related news:

This month Stripe acquired Privy, a leading wallet infrastructure provider.

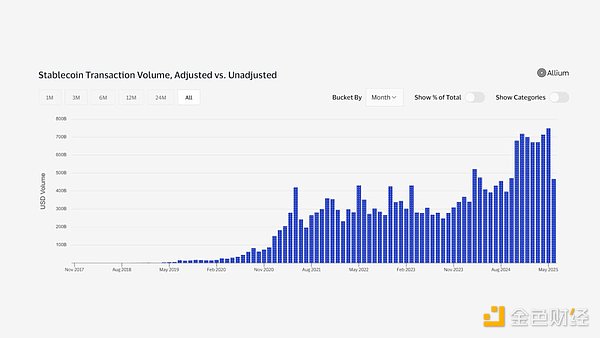

2, Adjusted stablecoin transaction volume: +49%

2025: The adjusted stablecoin transaction volume will average US$702 billion per month;

2024: The adjusted stablecoin transaction volume will average US$472 billion per month.

Importance Note:

Stablecoins have achieved product-market fit. Today, we can transfer dollars in less than 1 second and at a cost of less than 1 cent - making stablecoins ideal for payments. Large financial institutions are actively seizing this opportunity.

Related News:

USDC Issuer Circle Lists on the New York Stock Exchange;

Stripe Acquires Stablecoin Infrastructure Provider Bridge and Announces Multiple New Products;

Coinbase Releases Smart Payment Standard to Support Stablecoin Payments;

Visa and Mastercard Enhance Stablecoin Support;

Meta is reportedly in talks to introduce stablecoins as a payment settlement method.

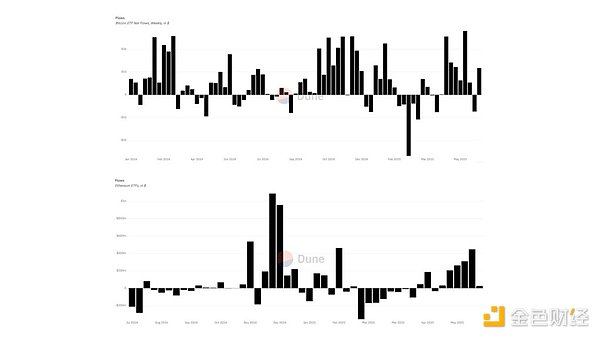

3、ETPnet fund inflow (Bitcoin and Ethereum):+28%

June 2025: ETP net fund inflow totaling US$45 billion (Bitcoin US$42 billion, Ethereum US$3.4 billion);

At the end of 2024: ETP net fund inflow totaling US$35 billion (Bitcoin US$33 billion, Ethereum US$2.4 billion).

Importance Note:

The entry of institutional funds into the cryptocurrency field marks the overall maturity of the industry. As regulatory policies become clearer and major distribution channels begin to take effect, net inflows of funds into ETP products are expected to continue to grow.

Related News:

The U.S. Securities and Exchange Commission (SEC) recently asked the issuer of the spot Solana exchange-traded fund (ETF) to update the S-1 filing, suggesting that the product may be approved in the near future.

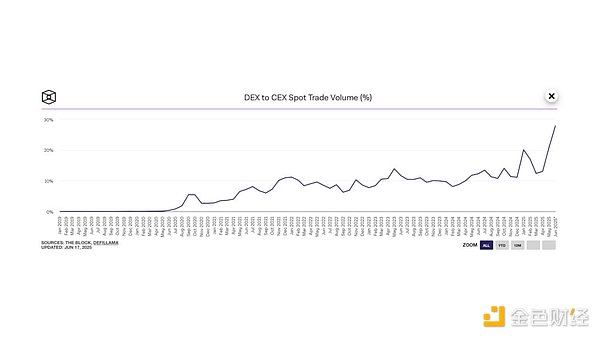

4. The ratio of DEX and CEX spot trading volume: +51%

Average in 2025: DEX/CEX monthly trading volume accounts for 17%;

Average in 2024: DEX/CEX monthly trading volume accounts for 11%.

Importance Note:

As on-chain users continue to grow, we expect the usage rate of decentralized exchanges (DEX) relative to centralized exchanges (CEX) in the field of cryptocurrency trading to continue to increase. The continued rise in this ratio highlights the overall development of the DeFi ecosystem.

Related News:

Coinbase recently announced the launch of native DEX trading functions in its application, allowing users to directly trade thousands of new assets.

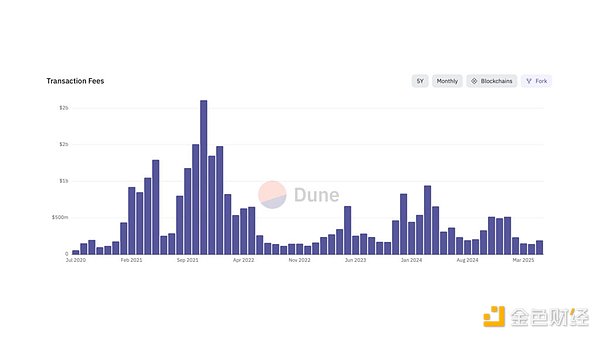

5, Total transaction fees (block space requirement): -43%

Average in 2025: US$239 million in transaction fees per month;

Average in 2024: US$439 million in transaction fees per month.

Importance Note:

The total amount of transaction fees denominated in USD reflects the total demand for block space on a particular chain - that is, real economic value.

But there are many nuances to this metric, as most projects are explicitly trying to reduce user fees. That's why it's important to also consider the unit transaction cost - the cost of using a given amount of blockchain resources. The ideal situation is that total demand (total transaction fees) grows, while gas fees (cost per unit of resource used) remain low.

Related News:

We've seen a lot of discussion on the X platform recently about the importance of this metric (and related metrics like REV).

Another additional metric I would watch is the number of tokens with monthly net revenue exceeding $1 million. As of June 2025, there are only 22 (data source: Token Terminal).

With the new regulatory environment and upcoming market structure legislation, tokens will eventually open a channel to the economic cycle. This will prompt more projects to directly increase the value of tokens in the form of revenue, thereby building a healthier token economy.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Jasper

Jasper Clement

Clement Aaron

Aaron Jixu

Jixu Aaron

Aaron Clement

Clement Hui Xin

Hui Xin Alex

Alex Hui Xin

Hui Xin