Source: a16z crypto editorial "Making the United States the Capital of Cryptocurrency: What It Takes to Do"

Author: Christian Catalini, co-founder of Lightspark and MIT Cryptoeconomics Lab

Translated by: 0xjs@黄金财经

The United States benefits from what economists call an "exorbitant privilege." As the issuer of the world's reserve currency, it can borrow in its own currency and support new spending. However, this does not mean that it can simply print money - U.S. Treasuries still have to attract buyers on the open market. Fortunately, U.S. debt is widely regarded as the safest asset in the world, ensuring strong demand, especially in times of crisis when investors scramble for safe assets.

Who profits from this exorbitant privilege? First are U.S. policymakers, who gain extra flexibility in fiscal and monetary decisions. Second are banks - they are at the center of global financial flows, charging fees and exerting influence. But who are the real winners? American companies and multinationals, who are able to conduct much of their business in their own currency and can issue bonds and borrow more cheaply than foreign competitors. Let’s not forget consumers, who enjoy greater purchasing power, lower borrowing costs, and more affordable mortgages and loans.

The result? The United States can borrow more cheaply, run larger deficits longer, and withstand economic shocks that would cripple other countries. However, this exorbitant privilege is not inevitable—it must be earned. It depends on America’s economic, financial, and geopolitical power. Ultimately, the entire system depends on one key factor: trust. Trust in America’s institutions, governance, and military. And most importantly, trust that the dollar is ultimately still the safest place for global savings.

All of this has a direct impact on the Trump administration’s proposed Bitcoin reserve plan. Proponents are not wrong about Bitcoin’s long-term strategic role—they’re just premature. Today, the real opportunity lies not in simply hoarding Bitcoin; it lies in intentionally shaping Bitcoin’s integration into the global financial system in a way that strengthens, not undermines, America’s economic leadership. This means leveraging USD stablecoins and Bitcoin to ensure that the next era of financial infrastructure is one in which America leads — not reacts. Before we get to that, let’s first analyze the role of reserve currencies and the countries that control them. The Rise and Fall of Reserve Currencies History is clear: reserve currencies belong to the world’s economic and geopolitical leaders — until they no longer do. At their peak, dominant nations dictate the rules of trade, finance, and military power, providing global credibility and trust in their currencies. From the Portuguese real in the 15th century to the U.S. dollar in the 20th century, reserve currency issuers shape the markets and institutions that others emulate. But no currency stays on the throne forever. Overreaching—whether through war, expensive expansion, or unsustainable social promises—ultimately erodes credibility. The Spanish real, once backed by vast Latin American silver reserves, depreciated as Spain’s mounting debt and economic mismanagement undermined its dominance. The Dutch guilder also depreciated as relentless warfare drained the Netherlands’ resources. The French franc dominated in the 18th and early 19th centuries but depreciated under the weight of revolution, the Napoleonic wars, and financial mismanagement. And the pound, once a cornerstone of global finance, collapsed under the weight of postwar debt and the rise of American industrial dominance.

The lesson is simple: Economic and military strength can create a reserve currency, but financial stability and institutional leadership are what sustain it. Lose that foundation, and the privilege is gone.

Is the dollar’s reign coming to an end?

The answer to that question depends on where you start counting. The dollar cemented its position as the world’s reserve currency around World War II, with the Bretton Woods Agreement, and even earlier, as the United States became the world’s leading creditor after World War I. In any case, the dollar has been dominant for more than 80 years. That’s a long time by historical standards, but not unprecedented—the British pound dominated for about a century before declining.

Today, some argue that the Pax Americana is unravelling. China’s rapid advances in artificial intelligence, robotics, electric vehicles, and advanced manufacturing signal a shift in power. Beyond that, China also holds significant control over critical minerals necessary to shape our future. Other warning signs are emerging. Marc Andreessen called DeepSeek’s R1 launch America’s AI Sputnik moment—a reminder that American leadership in emerging technologies is no longer guaranteed. Meanwhile, China’s expanding military presence in the air, at sea, and in cyberspace, along with its growing economic influence, raises a pressing question: Is the dollar’s dominance threatened?

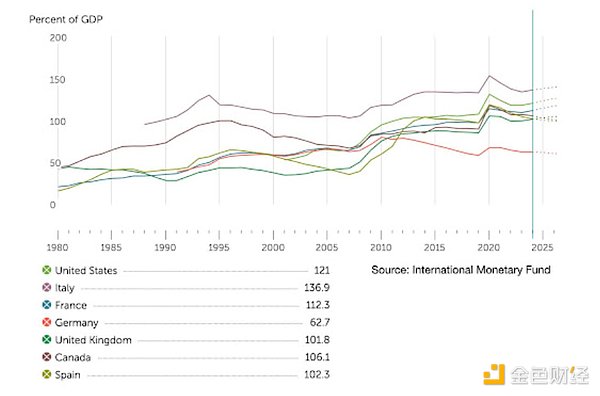

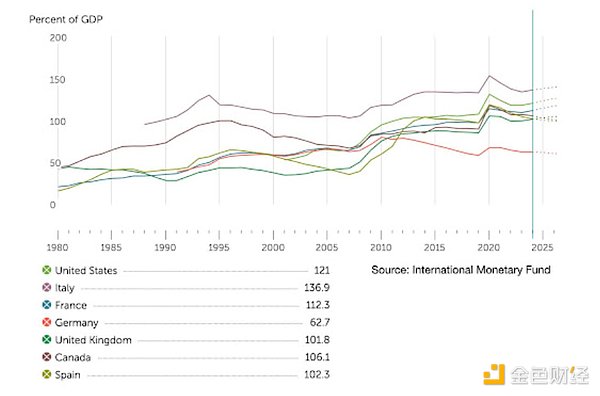

Debt as a percent of GDP. Source: IMF

The short answer: Not yet. Despite rising debt and false propaganda predicting an imminent collapse, the U.S. is not on the verge of a fiscal crisis. Yes, the debt-to-GDP ratio is high, especially after pandemic spending, but it’s in line with other major economies. More importantly, global trade is still largely based on the dollar. The renminbi is closing the gap with the euro in some international settlements, but it is far from replacing the dollar. The real question is not whether the dollar will collapse. It hasn’t collapsed yet. The real concern is whether the United States can maintain its lead in innovation and economic strength. If trust in U.S. institutions declines or the United States loses its competitive advantage in key industries, cracks in the dollar’s dominance may begin to show. Those who are short the dollar are not just market speculators—they are also geopolitical rivals of the United States. This does not mean that fiscal discipline does not matter. It is extremely important. Reducing spending and making government more efficient, through a Department of Government Efficiency (DOGE) or otherwise, would be a welcome shift. Streamlining outdated bureaucracies, removing barriers to entrepreneurship, and promoting innovation and competition would not only reduce wasteful public spending; it would also strengthen the economy and bolster the dollar’s position.

Combined with the United States’ continued breakthroughs in artificial intelligence, cryptography, robotics, biotechnology, and defense technology, this approach could reflect how the United States regulates and commercializes the Internet—driving a new wave of economic growth and ensuring that the dollar remains the world’s undisputed reserve currency.

Can a Bitcoin Reserve Solidify U.S. Financial Leadership?

The idea of a strategic Bitcoin reserve is discussed below. Unlike traditional reserve assets, Bitcoin lacks the historical backing of national institutions and geopolitical power. But that’s exactly the point. It represents a new paradigm: no state sponsor, no single point of failure, fully globalized, and politically neutral. Bitcoin offers an alternative that is not constrained by the traditional financial system.

While many consider Bitcoin a breakthrough in computer science, its true innovation is much more profound: it redefines how economic activity is coordinated and how value moves across borders. Operating as a decentralized, trustless system (and with a single anonymous creator who has no control), the Bitcoin blockchain can serve as a neutral universal ledger—an independent framework for recording global credits and debits without relying on central banks, financial institutions, political alliances, or other intermediaries. This is not only a technological advancement, but also a tectonic shift in how global financial coordination operates.

This neutrality makes Bitcoin uniquely resilient to the debt crises and political entanglements that have historically unravelled fiat currencies. Unlike traditional monetary systems, which are closely tied to national policies and geopolitical shifts, Bitcoin is not controlled by any single government. This also makes it possible to serve as a common economic language between countries that would otherwise resist financial integration or reject a unified ledger system altogether. For example, the United States and China are unlikely to trust each other’s payment channels – especially as financial sanctions become an increasingly powerful tool of economic warfare.

So how will these fragmented systems interact? Bitcoin can serve as a bridge: a global, trust-minimized settlement layer that connects otherwise competing economic sectors. When this reality becomes a reality, it would certainly make sense for the United States to hold a strategic Bitcoin reserve.

But we are not there yet. For Bitcoin to move beyond an investment asset, critical infrastructure must be developed to ensure scalability, a modern compliance framework, and seamless integration with fiat currencies to achieve mainstream adoption.

Bitcoin reserve proponents aren’t wrong about its potential long-term strategic role. They’re just premature. Let’s unpack why.

Why do countries keep strategic reserves?

The reason countries keep strategic reserves is simple: in a crisis, access is more important than price. Oil is the classic example—while futures markets allow price hedging, no amount of financial engineering can replace having physical reserves on hand when supply chains are disrupted by war, geopolitics, or other disruptions.

The same logic applies to other necessities—natural gas, grains, medical supplies, and, increasingly, raw materials. As the world transitions to battery-driven technology, governments have begun stockpiling lithium, nickel, cobalt, and manganese to prepare for future shortages.

And then there’s currency. Countries with large foreign debts (often denominated in dollars) hold dollar reserves to facilitate the rollover of debt and guard against domestic currency crises. But here’s the key difference: No country is currently holding a significant amount of debt in Bitcoin — at least not yet.

Bitcoin proponents argue that Bitcoin’s long-term price action makes it an obvious reserve asset. If the U.S. buys now and continues to adopt, the investment could multiply in value. However, this approach is more in line with the strategy of a sovereign wealth fund, which focuses on capital returns rather than reserves that are critical to national security. It’s more suited to resource-rich but economically unbalanced countries seeking asymmetric financial windfalls, or to countries with weak central banks hoping Bitcoin can stabilize their balance sheets.

So where does that leave the U.S.? The U.S. doesn’t need Bitcoin to run its economy just yet, and despite President Trump’s recent announcement of a sovereign wealth fund, cryptocurrency investments may still (rightly) be left primarily to private markets for efficient allocation.The strongest case for Bitcoin reserves is not economic need, but strategic positioning. Holding a reserve could signal that the U.S. is determined to lead in crypto, establish a clear regulatory framework, and position itself as the global hub for DeFi, just as it has dominated traditional finance for decades. However, at this stage, the costs of such a move could outweigh the benefits.

Why a Bitcoin Reserve Could Backfire

Beyond the logistical challenges of accumulating and securing a Bitcoin reserve, the bigger issue is one of perception, and the costs could be high. At worst, it could signal a lack of confidence in the U.S. government’s ability to sustain its debt, a strategic misstephanding victory to geopolitical rivals like Russia and China, both of which have long sought to weaken the dollar.

Not only has Russia pushed for de-dollarization abroad, its state-backed media has for years pushed a narrative that questions the dollar’s stability and predicts its imminent devaluation. Meanwhile, China has taken a more direct approach by expanding the reach of the yuan and digital payments infrastructure—including through a domestically focused digital yuan—to challenge the U.S.-dominated financial system, especially in cross-border trade and payments. In global finance, perceptions matter. Expectations don’t just reflect reality; they help shape it.

If the U.S. government began hoarding Bitcoin on a massive scale, markets might interpret it as a hedge against the dollar. That perception alone could trigger investors to sell dollars or reallocate capital, undermining the position the U.S. wants to protect. In global finance, beliefs drive behavior. If enough investors begin to doubt the dollar’s stability, their collective actions will turn that doubt into reality.

U.S. monetary policy relies on the Fed’s ability to manage interest rates and inflation. Holding Bitcoin reserves could send a conflicting message: If the government has confidence in its own economic tools, why would it store assets that the Fed can’t control?

Could Bitcoin reserves alone trigger a dollar crisis? Very unlikely. But it also might not strengthen the system—and in geopolitics and finance, unforced errors are often the most costly.

Lead with Strategy, Not Speculation

The best way for the United States to reduce its debt-to-GDP ratio is not through speculation, but through fiscal discipline and economic growth. History shows: reserve currencies do not last forever, and those that do depreciate do so due to economic mismanagement and overextension. To avoid following the footsteps of the Spanish real, the Dutch guilder, the French livre, and the British pound, the United States must focus on sustainable economic strength rather than risky financial bets.

The United States has the most to lose if Bitcoin becomes the global reserve currency.The transition from dollar dominance to a Bitcoin-based system will not be smooth.Some believe that a rising Bitcoin value could help the United States “pay down” its debt, but the reality is much harsher. Such a shift would make it much more difficult for the United States to finance its debt and maintain its economic influence.

While many believe that Bitcoin cannot possibly become a true medium of exchange and unit of account, history suggests otherwise. Gold and silver are valuable not only because they are scarce, but also because they are divisible, durable, and portable, making them effective money—even without sovereign backing or issuance, as Bitcoin is today. Similarly, China’s early paper currency was not a government-mandated medium of exchange. It evolved from commercial promissory notes and certificates of deposit (representing an already trusted store of value) before becoming widely accepted as a medium of exchange.

Fiat currencies are often viewed as an exception to this pattern—once declared legal tender by a government, they immediately become a medium of exchange and subsequently a store of value. But this oversimplifies reality. Fiat currencies have power not just because of legal decree, but because of the government’s ability to enforce taxation and debt obligations through that power. Money backed by a state with a strong tax base has inherent demand because businesses and individuals need it to pay their debts. This power to tax allows fiat currencies to retain value even without direct commodity backing.

But even fiat money systems aren’t built from scratch. Historically, their credibility has been underpinned by commodities that people already trust, most notably gold. Paper money gained acceptance precisely because it was once redeemable for gold or silver. Only after that trust had been reinforced for decades did the transition to pure fiat money become feasible.

Bitcoin is on a similar trajectory. Today, it’s viewed primarily as a store of value—volatile but increasingly viewed as digital gold. However, as adoption grows and financial infrastructure matures, its role as a medium of exchange may follow. History shows that once an asset is widely recognized as a reliable store of value, the transition to effective money is a natural progression.

For the United States, this presents a significant challenge. While there are some policy levers, Bitcoin operates largely outside of the traditional controls that countries have over their currencies. If it becomes a global medium of exchange, the United States will face a stark reality—reserve currency status is not easily relinquished or shared.

This doesn’t mean the U.S. should crack down on or ignore Bitcoin—if anything, it should actively participate in and shape its role in the financial system. But buying and holding Bitcoin simply for appreciation isn’t the answer either. The real opportunity is larger—but also more challenging: promoting Bitcoin’s integration into the global financial system in a way that strengthens, not undermines, America’s economic leadership.

Bitcoin Platforms for the U.S.

Bitcoin is the most established cryptocurrency, with an unparalleled record of security and decentralization. That makes it the strongest candidate for mainstream adoption, first as a store of value and eventually as a medium of exchange.

For many, the appeal of Bitcoin is its decentralization and scarcity—factors that drive its price higher as adoption increases. But that’s a narrow view. While Bitcoin’s value will continue to rise as it becomes more popular, the real long-term opportunity for the U.S. lies not just in holding Bitcoin, but in actively shaping its integration into the global financial system and establishing itself as an international hub for Bitcoin finance.

Simply buying and holding Bitcoin is a perfectly viable strategy for all countries outside the United States—both accelerating adoption and capturing financial upside. But the United States has more at stake and must do more. It needs to take a different approach—not only to maintain its status as the issuer of the world’s reserve currency, but also to enable massive financial innovation on the dollar’s “platform.”

The key precedent here is the Internet, which transformed the economy by moving information exchange from proprietary to open networks. Today, as the financial rails shift toward a more open and decentralized infrastructure, the U.S. government faces a similar choice to the incumbent governments that predated the Internet. Just as those companies that embraced the Internet’s open architecture flourished and those that resisted eventually became irrelevant, the United States’ attitude toward this shift will determine whether it can maintain its global financial influence or cede ground to other countries.

The first pillar of a more ambitious, future-oriented strategy is to treat Bitcoin as a network, not just an asset. As open, permissionless networks drive new financial infrastructure, incumbents must be willing to give up some control. By doing so, however, the United States can unlock significant new opportunities. History shows that those who adapt to disruptive technologies strengthen their position, while those who resist them ultimately lose.

The second key pillar of Bitcoin is to accelerate the adoption of U.S. dollar stablecoins. With proper regulation, stablecoins can strengthen the public-private partnerships that have underpinned America’s financial dominance for more than a century. Stablecoins, far from undermining the dollar’s hegemony, will strengthen it, expanding the dollar’s influence, enhancing its utility, and ensuring its relevance in the digital economy. Moreover, they offer a more agile and flexible solution than slow-moving, bureaucratic central bank digital currencies or ill-defined unified ledger schemes such as the Bank for International Settlements’ “internet of finance.”

But not every country is willing to adopt a dollar stablecoin or operate entirely within the U.S. regulatory framework. Bitcoin plays a key strategic role here—acting as a bridge between core dollar platforms and non-geopolitically aligned economies. In this context, Bitcoin can act as a neutral network and asset, facilitating the flow of funds while strengthening the U.S.’s central position in global finance, thereby preventing it from ceding ground to alternative currencies such as the renminbi. Even if it becomes a pressure-release valve for countries seeking alternatives to the dollar’s hegemony, Bitcoin’s decentralized, open nature ensures that it is closer to the economic and social values of the United States than to those of authoritarian regimes.

If the U.S. successfully implements this strategy, it will be at the center of Bitcoin financial activity and have greater influence to shape these flows in line with U.S. interests and principles.

It’s a subtle but viable strategy that, if implemented effectively, will allow the dollar’s influence to last for decades to come. Rather than simply hoarding Bitcoin reserves (which could indicate concerns about the stability of the dollar), Bitcoin could be strategically integrated into the financial system, driving the development of the dollar and dollar stablecoins on the network, so that the U.S. government becomes an active manager rather than a passive spectator.

What’s the benefit? A more open financial infrastructure, while the U.S. still controls the “killer app” — the dollar. This approach mirrors what companies like Meta and DeepSeek are doing by open-sourcing AI models to set industry standards while monetizing elsewhere. For the U.S., it means expanding the dollar platform to make it interoperable with Bitcoin, ensuring continued relevance in a future where cryptocurrencies play a central role.

Of course, like any strategy to oppose disruptive innovation, this one has risks. But the cost of resisting innovation is obsolescence. If any administration can do that, it’s the current one — with its deep expertise in platform wars and its clear understanding that staying ahead is not about controlling entire ecosystems but about shaping how value is captured within them.

Joy

Joy