Source: ADCDE

As the discussion on Bitcoin expansion heats up, Bitcoin's second-layer solutions have emerged in the past six months.

The ideal Bitcoin second layer should not only inherit the security features of Bitcoin, but also build an extensible and programmable on-chain financial infrastructure.

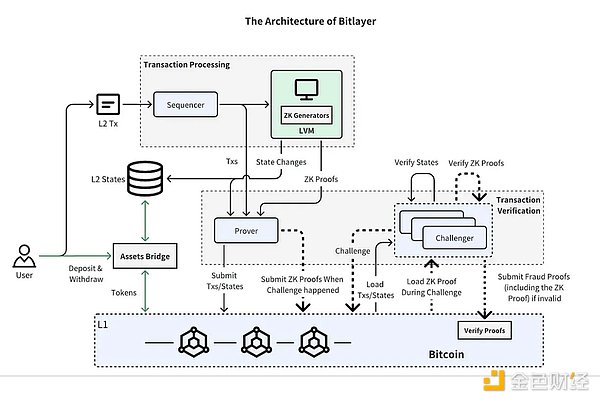

Bitlayer has led the Bitcoin second-layer solution based on BitVM, using layered virtual machine technology (Layered Virtual Machine), using zero-knowledge proof (zkp) and optimistic verification (op) mechanisms to support various types of calculations. In addition, Bitlayer has built a dual-channel two-way locked asset bridge through OP-DLC and BitVM bridge, thereby achieving the same security as Bitcoin's first layer.

At the same time, the success of a chain is inseparable from the construction of an ecosystem. Bitlayer has currently reached ecological construction and cooperation with 80 projects, and the intended TVL has exceeded 1 billion US dollars.

1. Bitlayer's design and advantages

Bitlayer's main technical innovation lies in the use of the latest BitVM computing paradigm and OP-DLC bridge.

Compared with other Bitcoin second-layer solutions, Bitlayer aims to solve the three core problems faced by the second layer and proposes corresponding solutions:

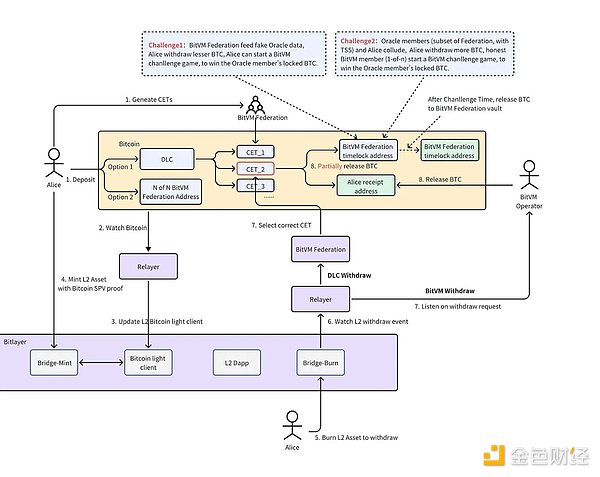

Trustless 2-Way Peg — Combining OP-DLC and BitVM bridge, it introduces an innovative model that goes beyond the traditional multi-signature model.

Layer 1 Verification — Inheriting the security of Bitcoin through BitVM.

Turing-Completeness — Supports multiple virtual machines and achieves an environment that is 100% compatible with the Ethereum Virtual Machine (EVM).

Design Architecture

Optimistic Verification

Bitlayer uses the same optimistic execution mechanism as Optimistic Rollup, combined with the architecture of the MATT proposal (Merkelize All The Things). The system will be based on fraud proofs and challenge-response protocols, and will not make any changes to Bitcoin's consensus rules.

(Source: Bitlayer Technical White Paper)

We know that submitting a large program to the Taproot address requires a lot of off-chain calculations and communications, but its on-chain footprint is very small. As long as both parties cooperate, they can perform arbitrarily complex, stateful off-chain calculations without leaving any traces on the chain. Only in the event of a dispute does it need to be executed on the chain. If a participant proves the invalidity of the transaction, the transaction will be rolled back.

Bitlayer uses off-chain computing and communication, and then submits the state and zero-knowledge proof to the first-layer blockchain in a compressed format, reducing data load and related costs, and achieving second-layer expansion.

Build a trustless cross-chain bridge

The security of bridged assets has always been the key to second-layer solutions, and the core issue lies in the method of asset control. The most common industry method is that the second-layer platform operator sets up multi-signature accounts based on MPC-TSS (multi-party computation and threshold signature scheme) or Schnorr technology, and users transfer their assets to these accounts. This traditional method causes users to completely lose control of their assets, while Bitlayer uses OP-DLC + BitVM technology to allow users to retain partial control of their assets, my assets are my own.

Through a dual-channel two-way padlock bridge, Bitlayer can not only meet the first-layer users' demand for autonomous control of BTC deposit and withdrawal operations, but also ensure that native second-layer users can withdraw smoothly.

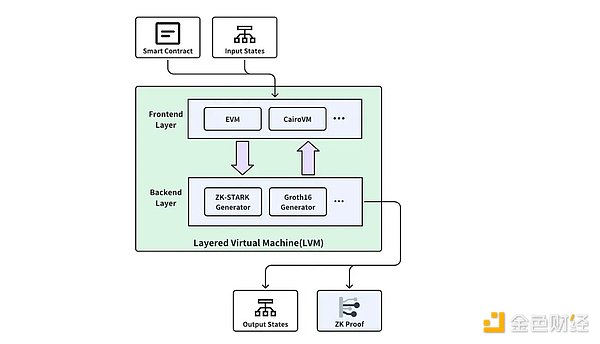

Layered Virtual Machine

To implement financial functions such as mortgage lending, Swap and complex contracts, Bitcoin Layer 2 needs a virtual machine (VM) with programmable execution capabilities.

Bitlayer introduces a layered virtual machine (LVM), which decouples the front-end execution of smart contracts from the back-end zero-knowledge proof generation, and supports a variety of smart contracts and zero-knowledge proof verifiers. With Taproot, ZK-STARKs verification is simplified to ensure security and computational flexibility.

By integrating support for EVM within the LVM framework, developers can seamlessly leverage existing EVM-based smart contracts while benefiting from the enhanced execution capabilities provided by the layered architecture.

II. Bitlayer Ecosystem Flourishes

In terms of ecological construction, relying on strong cooperative resources, Bitlayer currently has 80 ecological partners, including infrastructure, stablecoins, wallets, retrieval, etc. We believe that after the mainnet is listed, Bitlayer's ecology will be in a state of flourishing.

Current ecosystem partners include: StarkWare, Hacken, AWS Cloud, Ankr, Polyhedra, Macaron, Trustin, Babylon, Particle Network, Meson, Nubit, BitSmiley, TokenPocket, Xverse, Flash Protocol, Umoja.xyz, RunesTerminal, Lamina, NFTGO, Giants Planet, Surf Protocol, Tria, Tonka Finance, Ordimint and Caliber.

In order to encourage development on Bitlayer, Bitlayer officially announced a series of ecosystem incentive plans on March 29. The first event, Ready Player One, will issue public chain tokens worth $50 million to ecosystem builders and project parties, and encourage Dex, Wallet, NFT Marketplace, Lending, LSD, Bridge, Stablecoin and other types of projects to be built on Bitlayer.

Currently, Bitlayer is still discussing in-depth cooperation with 180 potential partners, and is preparing a series of incentive activities to attract users to participate in the construction of the Bitlayer community, including the launch of Galxe and TaskOn loyalty points and ecological project ranking activities, as well as official NFTs.

III. Looking to the future

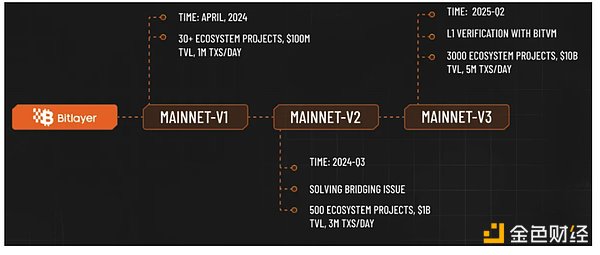

Roadmap

With less than 10 days until the Bitcoin halving, the Bitlayer mainnet V1 will be launched in the near future.

In the next 1-2 years, we firmly believe that we will see more Bitcoin-native innovations built and deployed on Bitlayer. Bitlayer can take advantage of the momentum of Bitcoin and become a benchmark for the development of the Bitcoin ecosystem.

Financing

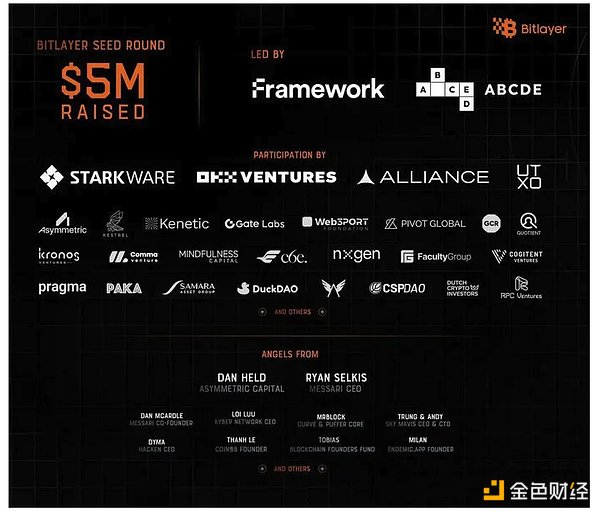

Recently, Bitlayer received US$5 million in financing, led by Framework Ventures and ABCDE Capital, and followed by StarkWare, OKX Ventures, Alliance DAO, UTXO Management, Ametry Capital, Kenetic Capital, Kestrel, Global Coin Research, Pivot Global and Web3Port.

Well-known angel investors include Messari CEO Ryan Selkis, Messari co-founder Dan McArdle, Asymmetry Capital founder Dan Held, Hacken CEO Dyma, Sky Mavis CEO Trung and CTO Andy, and Kyber Network founder Loi Luu, etc.

Bitlayer's seed round of financing has been strongly supported by ecosystem partners, including Hacken, AWS Cloud, Ankr, Polyhedra, Babylon, Particle Network, Meson, Nubit, BitSmiley, TokenPocket, Xverse, Flash Protocol, Umoja.xyz, RunesTerminal, etc.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance