Just when everyone was still immersed in the mood of remembering 3.12, a financing news made the market explode.

On the evening of March 12, Binance officially announced that Abu Dhabi MGX had completed a $2 billion investment in Binance. This investment not only refreshed the largest single investment amount of a crypto company in terms of amount, but also the largest investment paid in cryptocurrency in history.

As the leader of the most core trading platform in the crypto market, although CZ later tweeted that only a minority stake was sold, Binance's sale still caused a lot of discussion in the market. On the other hand, the market was also full of curiosity about the sudden dark horse Abu Dhabi MGX.

3.12 of this year may be the quietest 3.12. The decline had already been set the day before, and only the shock was still there, leaving everyone in awe of the market. However, the quiet day was broken by Binance's financing news.

That night, Binance and Abu Dhabi MGX jointly issued a statement, saying that the two had completed a landmark $2 billion investment, and this financing was the first institutional investment accepted by Binance so far, marking an important step for Binance in promoting the adoption of digital assets and strengthening the role of blockchain in global finance. CZ also tweeted to confirm the news, saying that the transaction was 100% paid by stablecoins, and Abu Dhabi MGX obtained a minority stake in Binance.

In fact, the market was not surprised when the news was released. The rumor of Binance's sale has been around for a long time. As early as 2021, Wu said that Binance Global Station was considering a valuation of 200 billion to 300 billion US dollars, and attracted investment from sovereign funds controlled by governments in Singapore and other places, but the subsequent financing ended in failure. Temasek, an investment company wholly owned by the Singapore government's Ministry of Finance, chose FTX, which had a more Wall Street background at the time, and the countless troubles caused by this transaction need not be repeated.

From the end of last year to February this year, the market was also full of rumors that Binance would be sold, which led CZ to speak out on February 17 to refute the rumor, mentioning that this was a strategy for competitors to divert attention. As a shareholder, he would not sell Binance, but emphasized that single-digit investment in the future might be allowed. It can be seen that CZ's speech at the time had already released a signal that Binance's equity could be acquired. Combined with the current information, perhaps the rumor was not exaggerated. Binance should have been in consultation with the institution at the end of last year.

From an investment perspective alone, Binance, as a core ecological niche in the crypto market, is undoubtedly an excellent investment target. According to its press release, Binance is far ahead in the industry, with a trading volume that exceeds the sum of the following cryptocurrency trading platforms, more than 260 million registered users worldwide, and a cumulative trading volume of more than 100 trillion US dollars. But precisely because it is a leader, and an alternative centralized leader in the decentralized world, it is not short of money, which is the norm for Binance. After all, not all platforms can quietly take out billions of dollars to deal with government fines.

Why does Binance want to sell its equity? Is Binance short of money in the bear market?

To discuss the reasons, we have to start with this mysterious investment institution. MGX, an investment institution located in Abu Dhabi, is very low-key and has not been established for a long time. According to the official website, MGX was established on January 22, 2024, and has only been around for more than a year. It is still a newcomer among investment institutions. From the perspective of investment, MGX is positioned as a technology investment company, focusing on accelerating the development and adoption of AI and advanced technologies by establishing world-leading partnerships in the United Arab Emirates and around the world. MGX focuses on investing in areas where AI can provide value and economic impact on a large scale, including semiconductors, infrastructure, software, technology-enabled services, life sciences, and physical AI.

In short, MGX is an investment institution focusing on AI. AI is hot, and investment institutions are also crowded. Investment in AI is not uncommon. But what is strange is that before Binance, in September last year, MGX launched an AI fund of more than $30 billion with asset management giant BlackRock and global giant Microsoft. This fund not only demonstrates the wealth of MGX, but also reflects the strong strength behind the institution. In the investment circle that has always been famous for worshipping the powerful and trampling the weak, not every rookie can be at the same starting line as the top bosses, not to mention that it later acquired the tough bone Binance.

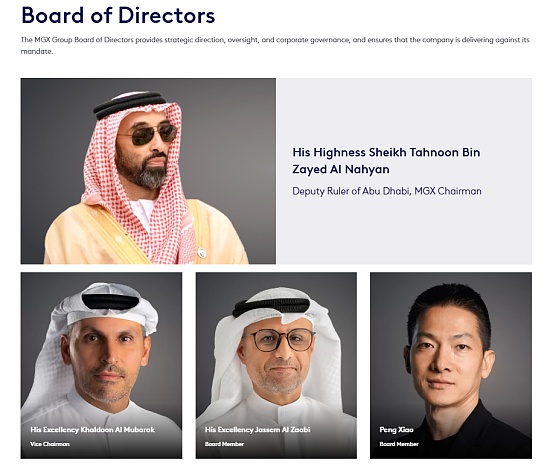

Continue to dig deeper, the mysterious background of this institution finally surfaced. It is mentioned in the official information that the chairman of the board of directors of MGX is Sheikh Tahnoun bin Zayed Al Nahyan, who is the current deputy chief of Abu Dhabi and the national security adviser of the UAE. The national security adviser and deputy chief have already shown that his relationship with Abu Dhabi is unusual, and looking down the name, all the questions have been answered.

The full name of the current founding father and president of the UAE is Sheikh Zayed Bin Sultan Al-nahayan, and the current president's name is Sheikh Mohamed bin Zayed Al Nahyan. Although the names are very long, a careful look will reveal that the three names overlap very much. In fact, the chairman of the board of directors of MGX is the son of the founding president of the UAE and the younger brother of the current president.

Searching for news about Tahnoun is not common, but Bloomberg once described him as being in charge of more than $1.5 trillion in state-owned assets and private funds, and emphasized that for any financial person, meeting him means a huge opportunity.

It is enough to see that MGX is a thorough state-owned capital of Abu Dhabi, and behind it is the world's richest white-clad group of people. Furthermore, it has a great relationship with the Abu Dhabi sovereign fund. In this context, it is not surprising that MGX can successfully invest in Binance. The saying that money makes the devil push the mill has gold content everywhere.

As for how Binance can connect with Abu Dhabi, the industry speculates that it is because of the current Binance CEO Richard Teng. Before Binance, Richard Teng served as the CEO of the Abu Dhabi Financial Services Regulatory Authority for 6 years. On the other hand, Binance's expansion in the UAE is also quite large. Binance employs about 1,000 employees in the UAE, accounting for about 20% of its more than 5,000 employees worldwide.

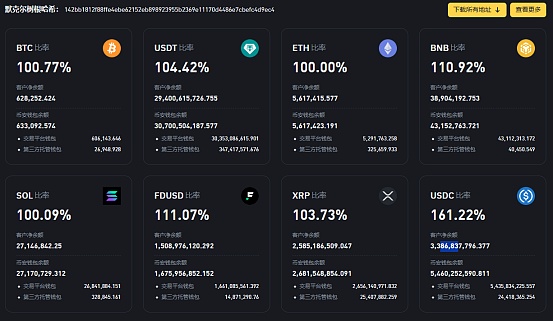

But to acquire Binance, it is not enough to have money. As mentioned above, Binance is not so short of money. Judging from the reserve data, as of March 1, 2025, after deducting the net balance of customers, Binance holds 4,840 Bitcoins and 8 ETHs, but its USDT is 1.3 billion and USDT is 2.1 billion. Overall, the reserve is very healthy, and as a platform, Binance's cash flow is also very strong. 260 million users' daily transactions will generate high fees. There are market rumors that Binance's daily fees can reach 30-40 million US dollars.

This is also the reason why Binance only sold a single-digit stake. Equity is the carrier of real money and silver, and it is also a symbol of power. Under this background, Binance will certainly not sell equity on a large scale. But why give up the shares now that there is no shortage of money? At the core, this is most likely the protection fee between Binance and the founder team.

From the perspective of the founder, this year is not so easy. Binance's sky-high fine is secondary, and CZ's imprisonment is the key. Although CZ's imprisonment was less than 4 months under various mediations, I believe that no one wants to try the taste of imprisonment again. At the same time, with the growth of Binance's scale, as an alternative centralized institution of a decentralized platform, the collision between government sovereignty and decentralization is intensifying. In addition to the US jurisdiction that was finally quelled, harassment in Nigeria has continued to escalate. Just on February 20, the Nigerian Federal Taxation Bureau filed a lawsuit with the Federal High Court in Abuja, demanding that Binance pay more than $2 billion in back taxes and compensate $79.51 billion.

Although Nigeria is only a small country, there is still a huge gap between the state machinery and individual power, not to mention that Nigeria is not the last one. As long as the struggle between the government and the decentralized world does not stop, other countries will inevitably file charges against Binance. The Binance founding team, who is at the top of the wealth in the currency circle, may not be able to easily retreat under the political struggle and power crushing without seeing the knife light.

In this context, seeking political resources for protection is the most reasonable and far-sighted approach. This move is not only responsible for its own safety, but also an objective guarantee for Binance's long-term stability. He Yi's speech further confirmed this point. He said that sovereign funds are welcome (in the future), "let's forget about financial investors." It can be seen that Binance is seeking political resources rather than financial resources. Based on this, it is not surprising that the founding team, which is already based in the UAE, chose Abu Dhabi. In addition, Abu Dhabi's international status and mediation ability in global politics are second to none among investors, and funds are the last consideration.

In addition to the main political protection, the introduction of external capital also has a positive impact on the long-term operation of the enterprise. In fact, looking at Binance in the past year, although it is still the leader, public opinion controversy has never stopped. Either He Yi's personal friendships were blocked by the market, or CZ's magical speech angered the market. The market performance is also going downhill, the value discovery is not as good as that of the emerging exchanges, the VC tokens are resisted, and the listing effect is gradually declining. In addition, as the scale of Binance continues to expand, the disease of large companies emerges, and internal corruption and low management efficiency have also become key problems that Binance faces in its development.

In this context, gradually letting go, strengthening supervision and standardization may also be one of the purposes of Binance to introduce external institutions. This is almost an inevitable choice for all companies to develop to a certain scale. After all, the problems that individuals and families can solve are few. If you want to achieve sustainable and stable development, the appropriate introduction of external capital and professional groups to achieve refined management and professional development is a realistic path, especially in the relatively gray field of encryption.

Of course, at this stage, Binance has not yet released a signal of change. Judging from the introduction of minority equity by capital, it does not want to disperse management rights. In addition to political protection, it is more likely to use the Middle East as an anchor to find a correct positioning and open up new markets, but whether the long-term strategy will change is still undecided.

On the other hand, Binance's "making friends" with Abu Dhabi is another milestone for traditional institutions to enter the crypto space, heralding the arrival of the compliance era. It is foreseeable that the integration of sovereign funds, capital institutions and the crypto space will become increasingly in-depth.

After all, decentralization has returned to the context of the centralized world. Even the rebellious boss has become a "good boy" looking for a backer, so what else can we talk about?

Anais

Anais