The "Sun Cut" effect is still fermenting, and WBTC is deeply involved in a crisis of public opinion.

On August 9, WBTC custodian BitGo officially announced a joint venture with Hong Kong company BiT Global, and plans to migrate WBTC’s BTC management address to the joint venture’s On the surface, it was an ordinary enterprise-level joint venture strategy, but it caused an uproar in the market.

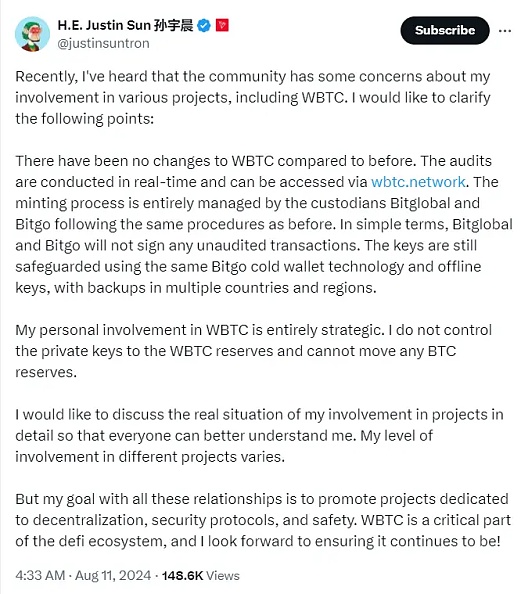

The reason is not other than the addition of Justin Sun. It is reported that BiT Global is very closely related to Sun Yuchen and the Tron ecosystem. Rumors claim that BiT Global is actually controlled by Sun Yuchen. Although Justin Sun and BitGo subsequently responded, claiming that they would not have any manipulation influence on WBTC, the results were of little effect.

As the foundation currency in the Ethereum Defi ecosystem, WBTC’s role is self-evident, and the notorious “Sun Cut” is associated with it, which makes users The heart is uneasy. So far, all major acceptors of WBTC have used their heel votes, which means that the withdrawal is obvious. However, the follow-up of WBTC is still unclear.

Before talking about the incident, let’s introduce WBTC.

As we all know, the blockchain is a completely closed ledger system. The ecology on the chain is highly rooted within the system. For links outside the system, additional technologies are required. Means and approaches, for example, if you want to obtain external data, you need middleware such as oracles to assist in the connection.

The problem is that existing on-chain applications mainly focus on cryptocurrency, and cross-chain transactions of cryptocurrency are an objective and realistic need. Among them, there are Mainstream currencies are especially important, but it is difficult to achieve direct asset flow in a closed ecosystem. How do Bitcoin and Ethereum conduct on-chain transactions and mortgages?

Simplifying the problem slightly, if you use RMB to exchange for US dollars in traditional finance, you may go directly to a bank or other intermediate point to exchange. Blockchain can also adopt similar methods. means, but due to the lack of entity and differences in network structure, it needs to issue redeemable certificates on another chain as a substitute for redemption. In response to this problem, various means such as hash locking and relayer networks emerged, which further gave rise to so-called anchor currencies.

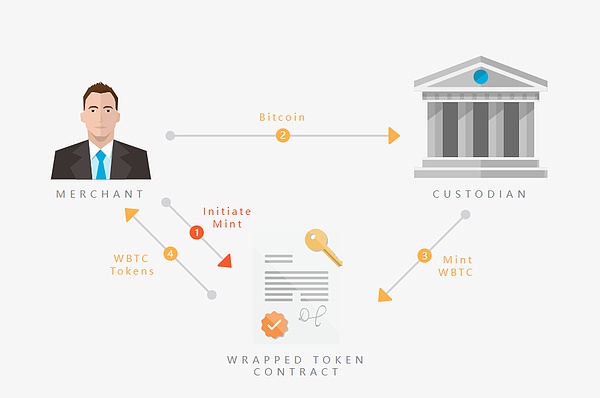

Anchor currency refers to mapping a certain digital asset on the chain to another chain through some technical method. Through this mapping, users can achieve Cross-chain trading activities of cryptocurrencies revitalize currency liquidity. WBTC is one of the anchor currencies of Bitcoin, and its full name is Wrapped Bitcoin. It is an ER20 token issued on the Ethereum network that is linked to BTC on a 1:1 basis. It is jointly initiated by Kyber, Republic Protocol and BitGo.

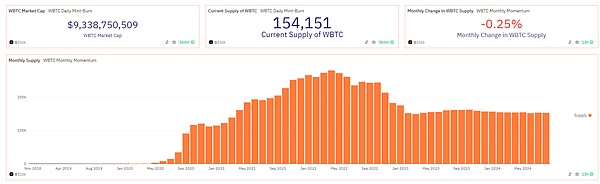

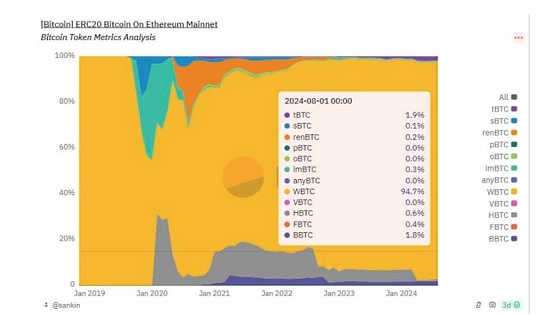

Proposed in 2017 and put into use in 2019, WBTC has almost witnessed the rise of the entire Defi summer, and it has also rapidly developed into the largest anchor on Ethereum. Set Bitcoin. Currently, WBTC supports multiple networks such as Ethereum, Base, Kave, Osmosis, and Tron. Among them, the Ethereum mainnet casting accounts for 99.8%. 154,151 WBTCs have been minted, which is approximately US$9.33 billion, accounting for 0.78% of the total market value of Bitcoin. According to data from Dune, on August 12, more than 41% of WBTC was currently used in the lending ecosystem, of which the largest acceptor was MakerDAO, and nearly 32% was used for direct transactions.

Since the main function is the lending ecosystem, there will naturally be a chain reaction. This is also the reason why WBTC has attracted great attention from the market this time. As for why the custodian is so strict, the operating mechanism can be seen. WBTC draws on the second-tier operating system in the traditional banking system. The custodian is similar to the issuer, which mainly issues and destroys WBTC based on the number of Bitcoins it obtains. The acceptor is the operator, facing users directly and providing users with access to it. and acceptance services for exchanging WBTC.

It can be seen that the custodian is the core controller of WBTC. The market needs to ensure that the custodian will not do evil and cause excessive currency issuance or shortage. Currently, the only custodian of WBTC is BitGo. BitGo, established in 2013, is a veteran institution that has experienced bulls and bears in the crypto world. The market's trust in it has already been established. The fact that WBTC can operate for nearly 7 years is the most intuitive evidence.

But although BitGo is worthy of trust, the reputation of Justin Sun, who is about to enter the market, is not so good. Although he has occupied the commanding heights of worldly success, he is also the leader of Chinese Web3 startups. However, after selling 6 billion TRX at a high in 2018 and cashing out 300 million U.S. dollars in a single day, he became famous and the continuous hype methods have left the market with a low bottom line. Some people in the circle even use the term "poor only". "Leftover money" is used to describe him, which shows the love-hate attitude in the industry. Such a person may be able to control the crucial WBTC, and the panic surrounding control will inevitably accelerate the spread.

Excluding Justin Sun himself, BitGo and Bit Global will establish a joint venture, which undoubtedly means that WBTC has added an additional custody service provider, which naturally needs to be carefully verified. But BiT Global, apart from the rumored strategic partnership between BitGo, Justin Sun and the Tron ecosystem, is only a very new company. Judging from the registration information, BiT Global, headquartered in Hong Kong, was established on August 9, 2023. It has been established for only one year and has no outstanding advantages. Its biggest selling point represents the compliance and professional qualifications of "TCSP (Trust Trust Service)". or company service provider)", according to information disclosed on the official website, this license, launched in 2018, has 6,852 licensees as of August 20, 2024, and its gold content is difficult to convince the public.

Liu Feng, the founder of BODL Fund, even made conjectures, looking back on the US$100 million financing event that BitGo received in August 2023. At that time, BITGO did not announce its investors, and only news came out that it included Asian investors. At this time, BiT Global was established at the right time, which made people wonder whether this joint venture was premeditated. Of course, there is currently no substantial evidence for this speculation.

In response to market speculation, Justin Sun and BitGo also came on stage to clarify. Sun Yuchen tweeted that his personal participation in WBTC is purely a strategic consideration. He will not control the WBTC private key and cannot perform any operations on BTC reserves. It is only to promote the security and decentralized development of the project.

BitGo CEO Mike Belshe downplayed Justin Sun's involvement, emphasizing BitGo's security, "Bit Global has a dedicated team to manage multiple customer accounts, and they are responsible for ensuring safe custody. They cannot lend out funds. "You cannot give funds to Justin Sun (Sun Yuchen), me or anyone else at will, otherwise you will violate the law and face the risk of jailing." But taking a step back to discuss, even if the custody is as normal, Justin Sun, who is already facing lawsuits from the US authorities, Affiliates may also encounter regulatory issues.

However, in this context, it is obvious that the market is using heel votes, and the strongest reaction is from the front-line acceptors.

As early as the BitGo announcement was issued, MakerDAO immediately launched a proposal to "reduce the size of WBTC collateral", requiring WBC-related items in the core vault to The guarantee amount is reduced to 0, borrowing WBTC in SparkLend is prohibited, and the loan mortgage rate of WBTC is reduced from 74% to 0%. This proposal has been passed. As of August 9, the cumulative number of WBTC transferred to the exchange by Wintermute has reached 5860.67, with a total value of US$348 million. The loss of acceptors means that the number of ports directly facing users is reduced, and WBTC’s follow-up prospects do not seem bright.

Some people may ask, since the centralized anchoring of Bitcoin is so uncontrollable, why not consider introducing decentralization for management?

In fact, long before WBTC, the decentralized BTC-anchored currency track had begun to be explored simultaneously. However, the disadvantages of decentralization were also very exposed. Obviously, the first is that the chain effect is significant, so it is difficult to maintain stability when the market fluctuates violently. The second is that it is highly dependent on mechanism design and community governance, resulting in a lack of security and difficulty in management.

For example, sBTC launched by Synthetix. Since Synthetix completely abolished non-USD spot synthetic assets on Ethereum, synthetic assets are guaranteed by collateral in the form of SNX tokens. , ultimately limiting the promotion of sBTC, and until now, the disclosed daily trading volume is only around $280,000. renBTC, which was once as famous as WBTC, even announced its suspension due to being caught in the FTX scandal.

Despite this, throughout this track, the participants are not indifferent. Dune data shows that the current custody on the Ethereum chain BTC also includes a variety of solutions including HBTC, imBTC, tBTC, etc., but the development can only be described as unsatisfactory. Most of them are to meet the needs of a specific segment, rather than targeting large-scale applications.

With the loss of WBTC's credibility, other currencies on the track will naturally experience traffic overflow, and tBTC has also received some discussion in recent days. Compared with other anchored currencies, tBTC has been in operation for a long time, has 4 years of issuance experience, has more than 10,000 BTC bridges, and has real-time proof of funds on the chain. Dune data shows that the number of tBTC holders is 1,269, accounting for approximately 2.1% of the BTC share on Ethereum. The top contracts holding tBTC include Mezo, Wormhole, Curve, etc. But unfortunately, in terms of market value, there are only 3,344 tBTCs. Compared with more than 100,000 WBTCs, the magnitude is not the same.

What I have to admit is that from a market perspective, the only large-scale BTC-anchored currency that is universal is WBTC. The moat does not seem to be long, but it has outstanding performance in the direction of ecological depth. In a short period of time, It is currently difficult to find a suitable replacement. But in the long term, compared with highly centralized custody methods, decentralized assets will inevitably have a share, and the innovation competition around this track will become increasingly fierce.

On the other hand, the core purpose of anchoring BTC is only to maximize the use of asset liquidity. In addition to the introduction of external liquidity, the revitalization of internal liquidity is also extremely important. Important, this is one of the reasons why Bitcoin L2 is currently booming. After Bitgo’s controversial move, the American cryptocurrency exchange Coinbase hinted that it will launch a new product called “cbBTC” that will run on Bitcoin L2 to promote the application of Bitcoin’s native DeFi. The market speculates that this is another synthetic product. Anchor coins.

What is quite interesting is that although acceptors and users have successively sold WBTC, mysterious large investors have also taken action to sweep the goods. According to Lookonchain data, on August 19 , an unknown whale address snapped up more than 347 WBTC, the total number of WBTC in the wallet was 1953, the total value was US$118 million, and the average price was US$58853. It is unclear whether this move is a sign of optimism about future prospects or whether there are other ideas.

XingChi

XingChi

XingChi

XingChi JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Beincrypto

Beincrypto Beincrypto

Beincrypto Coindesk

Coindesk Bitcoinist

Bitcoinist