Author: Nianqing, ChainCatcher

Last night, Blast officially opened airdrop applications. In the recent "airdrop is dead" anger caused by ZKsync and LayerZero, Blast and its founder Tieshun Pacman were also complained by the community without surprise. There are three main points of complaints:

The token collection process is irritating

The price of the token after listing is lower than expected, and the income of users participating in staking is low

The top 1% of the activity addresses need to wait for a 6-month linear unlocking period

Specifically, before claiming the airdrop, users need to be forced to watch a video lasting dozens of minutes, in which the founder Pacman will introduce Blast's token economics and development plan in detail. In addition, after watching the video, you must download the mobile app and get 4 prompt words before you can finally claim the token.

Secondly, before Blast went public, multiple analysts had valued the token, and even the more pessimistic valuations were all above $0.03. After the token was launched, Blast's FDV was only about $2 billion. In contrast, Arbitrum, Optimism and other L2s had FDVs of nearly $10 billion when they were released (which also shows to some extent that retail investors no longer pay for VC coins with high FDV).

However, compared with the token price, some users who participated in large-scale staking reported that their airdrop benefits were very low. For example, Christian, co-founder of NextGen Venture, said that he deposited more than $50 million in Blast, but only received an airdrop worth $100,000. Christian also angrily called Blast a scam project and called Pacman a "serial scam". @beijingduck2023, the "big brother" of Blast points, pledged about 10 million US dollars, and with a total score of 281.2 billion and 1.22 million gold points, he only received 64,000 BLAST, worth more than 1,000 US dollars. In addition, large accounts (the top 0.1% of addresses, about 1,000 addresses) need to wait for a 6-month linear unlocking period.

But objectively speaking, Blast has much fewer negative reviews in the community than ZRO and ZK recently. X user @CryptoWoodBro mentioned that 7% of the Blast airdrop in the first phase was given to pledge points and 7% was given to gold points. Pledge points can be automatically earned by lying down and not moving, which is suitable for whales with large funds; gold points require studying the rules of each project and in-depth participation, which is suitable for retail investors with small funds willing to work hard. In addition, some rules allow points to double/expand. Therefore, the Blast airdrop actually takes care of the interests of retail investors and provides retail investors with small amounts of funds with the opportunity to make a small profit and "get rich through hard work".

The era of "short, flat and fast" has long ended

Although Blast's airdrop did not check witches and took into account a certain degree of fairness (especially taking care of some retail investors), which slightly extinguished the discussion of "airdrops are dead", the point-based airdrop represented by it is still not the way forward for Web3 projects.

Blast had a "reputation crash" because of the point-based gameplay before the airdrop. In March, the new point-based gameplay released on the Blast mainnet was accused of PUA. The new rules require users to migrate ETH points to the mainnet and enjoy a 10x expansion, but users need to pay more than $50 in gas fees for migration, which is too costly for small retail investors, and users find that the expansion coefficient is a random number of 0-10 times after migration. Although Blast officials later fixed the bug, it also left behind criticisms that the points calculation rules were not transparent. Previously, the official also secretly issued a large number of gold points to some Dapps.

Related reading: "Rat warehouses, big investors take all, air investment qualifications are deprived, and "fleecing" people trapped by points"

When the community was discussing the points system, someone said that whether this round of points-based pua would end or not depended largely on the performance of Blast's launch. The price of Blast was too much lower than expected, and the points-based airdrop pua would naturally "extinct". There are also many OGs and KOLs who have declared that "they will no longer participate in interactive activities based on points in the future."

But even if Blast fails, does it mean the demise of the points-based airdrop?

Although the community has long complained about the points system, brushing points is still a common marketing and incentive method for current Web3 projects.

Some well-known un-coined projects are as follows:

Scroll released the Scroll Marks user points statistics rules on May 15, mainly counting the user's bridging data and gas burning data scores since the launch of the Scroll mainnet on October 10, 2023. Later projects will issue airdrops based on Scroll Marks;

Linea launched the first phase of the Linea Surge points plan (Volt 1) on May 17. Linea Surge will run for 6 months (6 Volts). There are three main ways to obtain points, namely ecosystem points, recommendation points, and early adoption and historical contribution points;

Backpack launched the account transaction volume points system in February, and the points ranking will serve as an important reference data for future airdrop qualifications or Launchpool projects;

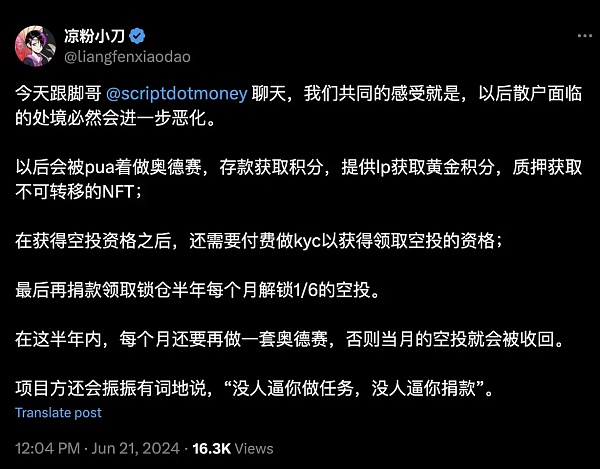

In addition, many projects such as KIP Protocol, KiloEx, Swell, and Puffer Finance have launched points activities. Will projects with non-points incentives be better? No. The situation faced by retail investors will become increasingly difficult. Without the points system, it will be difficult for users to get rid of being nodes, doing tasks on third-party platforms, doing Odyssey, pledging to provide LP, purchasing NFTs with no actual value, etc.

Although the airdrops of the project parties have reached the extreme, it does not mean the end of the airdrop era. The Mao Party has not stopped because of one or two setbacks. There are still a large number of addresses interacting on these unreleased projects. It's just that the "short, flat and fast" era has come to an end temporarily, that is, the era of zero-cost and low-cost airdrops has completely ended. This marks that the "airdrop industrialization" has officially entered a mature period, and users have become "Web3 product testers" with certain capital and certain professional knowledge, competing for the depth of participation.

Airdrops are not dead, why do project owners and the Mao Mao Party no longer buy into each other?

Project owners can never satisfy everyone, but why does the negative sentiment brought about by this year's airdrops seem to be particularly prominent?

The most important reason for this situation is the overall sluggish market. Although this round of BTC ETFs has brought about an increase in BTC prices and some altcoins, there is actually not much new capital flowing into the crypto market. There is only rotation between new concept sectors. After being repeatedly beaten by the "value coins" with high valuations and low circulation, retail investors finally completely disenchanted them and chose not to pay for fomo. VC, project owners, exchanges, and retail investors' stock capital game, most projects fell sharply after airdropping because not many people explained the market. In addition, after the "value coin" loses its wealth-making effect, it is also difficult to attract new users to enter the market.

Secondly, airdrops are no longer a good business for both project owners and users. The industrialization of airdrops has created an irreparable cognitive gap between project owners and users.

The best airdrop in history is Uniswap, and no one can refute this. But no one can replicate the airdrop feast that belongs only to the founders. The so-called good is composed of three factors that are now impossible to complete: users do not have too high expectations for airdrops from project owners, the interaction threshold is extremely low, and the value of airdrops is high.

The "wealth-making effect" brought by airdrops has fostered the industrialization of airdrops, gradually widening the cognitive gap between project owners and users.

For project owners, airdrops are a sign of product-market fit. Project owners often believe that their products can meet the existing market needs (But how many Web3 projects have real usage scenarios and core values? ), airdrops are rewards for actual users. This way of thinking directly leads to the arrogance of the project side. As Bryan, the founder of LayerZero, said in response to "mandatory donations", "If you don't want to donate, don't apply for tokens. This is not something you own, but something provided by others." For the project side, token airdrops have become "alms" to users.

For users, the result of the industrialization of airdrops is that they will default to expect every project to airdrop, and they will participate in it as "workers" and "farmers", pay technology, time and cost, help the ecological construction and push up the data and valuation of the project, help it obtain more financing, and deserve corresponding rewards.

From the results, for the project side, if the airdrop threshold is set low, it means that it will attract "low-value" users, and there will be a risk of selling after the token is released. Short-term and low-value users will quickly withdraw funds and transfer liquidity to the next "farm" after obtaining airdrops; for users (especially retail investors), even if the amount of funds is small, they have actually paid costs in the interaction process, and usually because the airdrop rules of the project side are not transparent, they often face the risk of being reversed.

The "perfect airdrop" advocated by Hayden Adams, the founder of Uniswap, which can shape a culture of rewarding early adopters, fairer and broader value distribution, simpler self-service adoption, and make the public willing to try new things, can achieve early liquidity and early price discovery, etc., may only be achieved once, after all, Web3 has never been a utopia.

Airdrops need to be redefined

Jupiter co-founder Meow made a point in the recent discussion around the LayerZero airdrop. He believes that "airdrops are gifts. Not rewards, not a loyalty program, and not a means of growth. It's that simple. If you ask what you can get from it, it is no longer a gift, and then loses its meaning and fails the original sincerity." He further explained that in order to help protocol developers think about how to conduct airdrops.

He mentioned that we need to give a clear definition of airdrops. Airdrops are airdrops, incentives are incentives, rewards are rewards, and growth is growth. All these confusions in terms have led to the problems that exist in airdrops now.

In fact, I agree with his latter point of view. A clear definition is actually more conducive to solving the problems we mentioned above and making up for the cognitive differences between the project party and the users. Perhaps, the project party should separate the money spent on user growth from the airdrop budget as a gift.

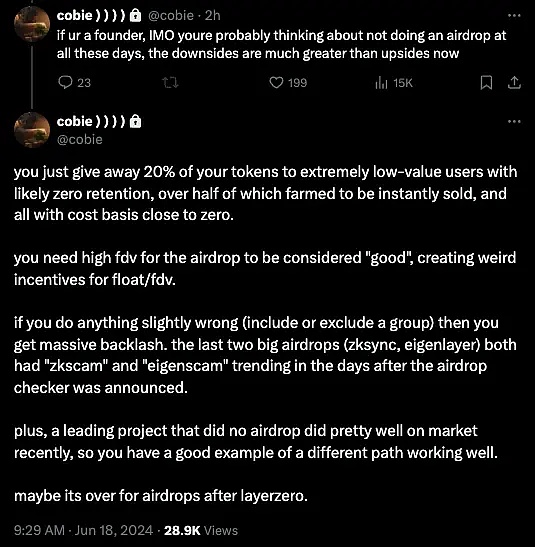

Crypto KOL Cobie discussed the "death of airdrops". He believes that the current status of airdrops is difficult to meet the needs of users, and its reputation can easily be backfired by small mistakes. The project party may try to not issue airdrops and other better listing methods.

Binance co-founder He Yi also recently wrote that the fratricide between the Lumao Studio and the L2 project has turned into a farce, and the Lumao era may be coming to an end. As an ordinary investor, the ICO of 2017, the IEO of 2021, the nesting dolls, and even the wool-pulling strategy of 2023 may not be suitable for today's market.

In the era of "airdrop" industrialization, we may really need to redefine airdrops and redesign the rules on this basis.

Although there is no absolutely perfect airdrop or incentive method, the most important thing for project parties to pay attention to is that what users need most is fairness, fairness, and fairness!

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive Bitcoinworld

Bitcoinworld Clement

Clement Coinlive

Coinlive  Coindesk

Coindesk Nulltx

Nulltx Coindesk

Coindesk Mirror

Mirror