Source: PermaDAO

A new AI-driven narrative is about to dominate the DeFi space, permanently and radically changing how the cryptocurrency market works.

AI agent-driven finance will soon become a reality, and its impact on the industry will be profound and unimaginable.

What does AgentFi mean?

AgentFi, Autonomous Finance, Agentic protocols… these are several terms we have come across that attempt to define the same concept. They all describe a future where AI agents will be able to access DeFi markets and execute profitable strategies without human oversight.

At first, AgentFi is a simple and obvious idea, but let’s explore its features and how it is implemented.

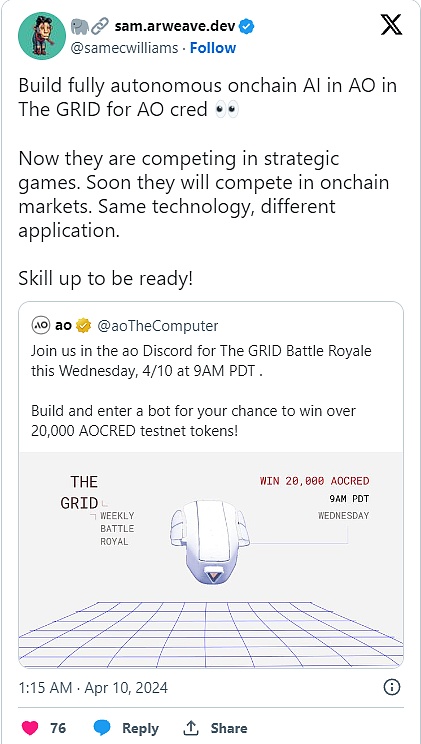

@aothecomputer recently published this article, which got us thinking about the inevitable shift in the current DeFi space towards a trustless, autonomous agent-driven market.

What is AgentFi?

DeFi has disrupted financial markets by making them permissionless and open. Basic operations such as asset exchange, lending, and borrowing can now be performed in a trustless manner anywhere there is an internet-connected device. This is all thanks to powerful smart contracts.

However, DeFi lacks an intelligent layer where bots can make complex market decisions. Currently, bots can act based on a few data events.

AgentFi refers to a world where bots can create and adjust complex strategies similar to fund managers.

The first question that comes to mind is: How is AgentFi built on top of DeFi primitives?

To answer this question, we need to understand how DeFi currently works and explore the difference between autonomous agents and bots currently running in DeFi protocols.

AgentFi vs DeFi

AgentFi has two key differences from DeFi, which opens up a range of new possibilities with trading markets.

1. The type of data that a bot may act on.

2. The ability of AI agents to proactively act beyond a predetermined configuration.

Currently, the data available in DeFi is quantitative. This is a stream of raw price data that is updated based on events, such as news or changes in liquidity.

DeFi bots monitor these price changes and execute strategies based on preconfigured parameters set by their owners. These bots require a lot of supervision because they lack intelligence.

If market conditions change, they run a greater risk of being unprofitable. They can only react to preset data triggers. They cannot "wake up" and proactively update their strategies.

What is different about autonomous agents is that they will be able to access and interpret not only quantitative data, but also qualitative data.

So, agents only react to price changes, AI agents will be able to interpret the information hidden behind the numbers.

Agents will be able to read speeches, announcements, and also read the facial expressions of speakers or the tone of a news article, and combine this with real-time data to guide decisions.

But DeFi has no reliable access to qualitative data, so where will it come from? This is exactly the magic built by AO on Arweave.

Arweave is a storage layer for all kinds of data, not just raw price data from oracles.

There is no limit to the data uploaded to Arweave. Since processes on AO can use data from Arweave, AI agents built on AO can access a whole new dimension of data for their Defi operations. It's like adding sound to a movie.

Autonomous agents will have the ability to read more than just the nuances of price. In other words, they will gain a new degree of intelligence beyond numbers. Their strategies will be powered by LLMs on AO.

Even more, the system design in AO allows these agents to "wake up" automatically. Compare this to the MEV bots on Ethereum.

It constantly monitors trades until a MEV opportunity arises. The bot tries to react as quickly as possible to take advantage of it.

On AO, autonomous agents can be set to proactively act outside the limits of certain preset parameters. Combine this with sophisticated financial AI as an engine and you get an unstoppable 24/7 trading agent that learns and adapts to changing market conditions.

To make all this happen, just upstream real-time reliable data to Arweave, where every process in AO can add them to its inputs.

AgentFi will create endless possibilities in the Defi space. Just thinking about these agents is enough to make your head explode.

Imagine a world where AI agents can adopt the strategies of the most successful traders. Now imagine that you can bet on them by funding their operations on a Defi app — Warren Buffett vs Jim Simons vs Simon Cockwell.

On the 24/7 live trading arena, only the fittest will survive.

A brief summary of how AgentFi is built on top of Defi:

Current Defi robots include the following characteristics:

Autonomous Financial Agents include the following characteristics:

Because the AgentFi narrative is exciting, we may not have considered the risks and consequences. For now, all we can do is prepare for this shift, which will soon happen on AO.

For reference, also check out @goodalexander’s great article on Agentic Protocols, which inspired this article. We will dive deeper into these ideas soon.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Edmund

Edmund Cheng Yuan

Cheng Yuan Huang Bo

Huang Bo Sanya

Sanya 8btc

8btc