Written by: Biteye core contributor Viee

From the initial AI Meme narrative to the endless technical frameworks and innovative applications, the rapid evolution of the market has brought unlimited possibilities to the AI Agent track. New players continue to emerge, and old giants are also scrambling to lay out. The trend of on-chain narratives is fleeting. Where are the opportunities in the AI Agent track? How to seize the next opportunity for an outbreak?

If you are curious about these questions, or are about to start paying attention to these cutting-edge projects on the chain, but are not sure where to start, this article will provide a systematic operating guide. From how to obtain information, to how to evaluate projects, to the formulation of investment strategies, help everyone find their own rhythm in the AI Agent track.

1. How to discover AI Agent in the early stage?

The first step is not to limit yourself to a specific ecosystem, such as Base, Solana or Virtuals, ai16z and other well-known projects, because these platforms themselves do not determine whether the project can run. The real value of AI Agent comes from the uniqueness and practicality of the project, not just the ecosystem in which it is located.

Early AI Agent projects often get exposure through the media and communities. For example, people often use Twitter to get first-hand information and find potential projects that have not yet taken off. Here are several other channels for obtaining effective information:

1. Cryptohunt @cryptohunt_ai: An intelligent investment research platform that discovers the hottest and early projects based on Twitter KOLs.

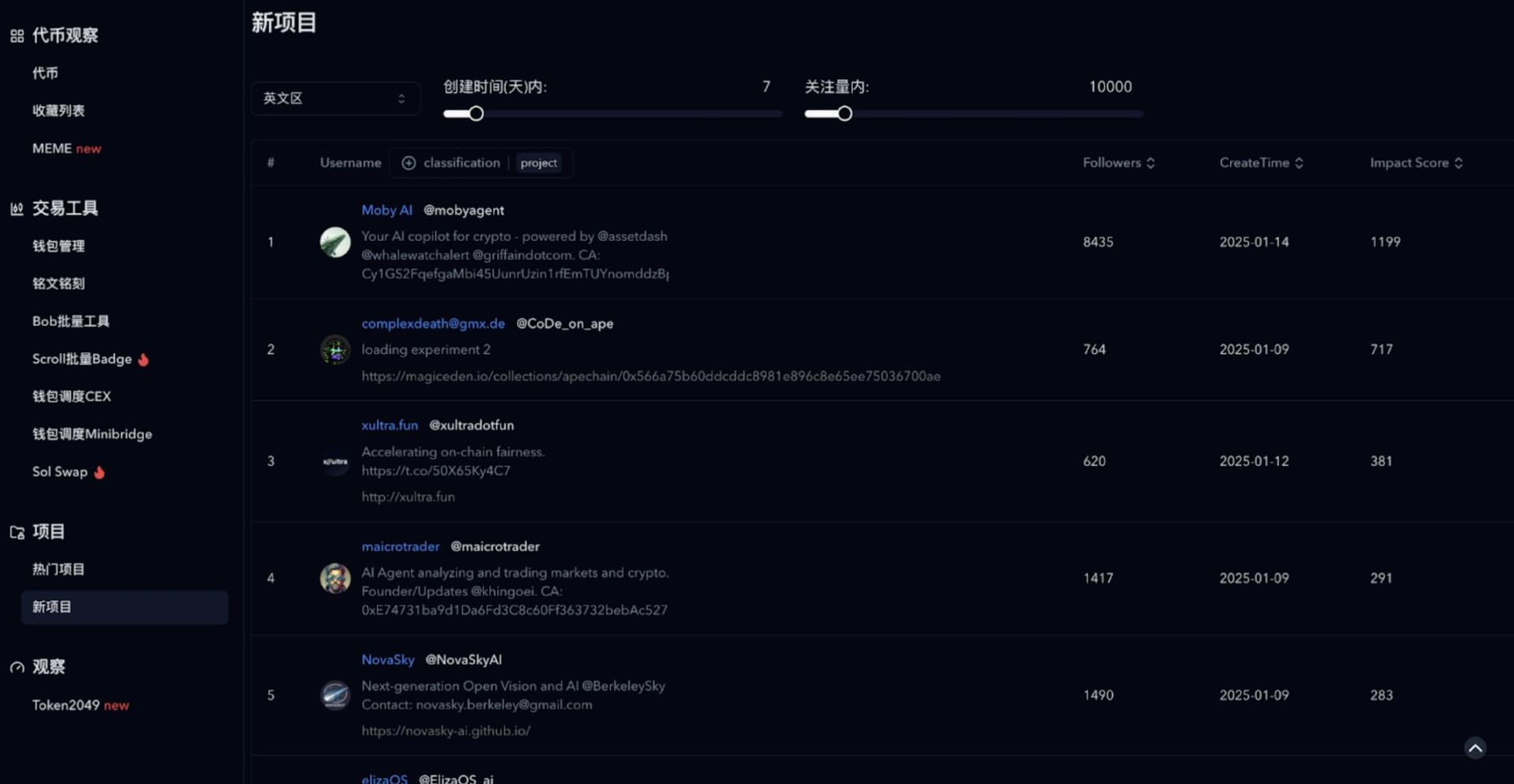

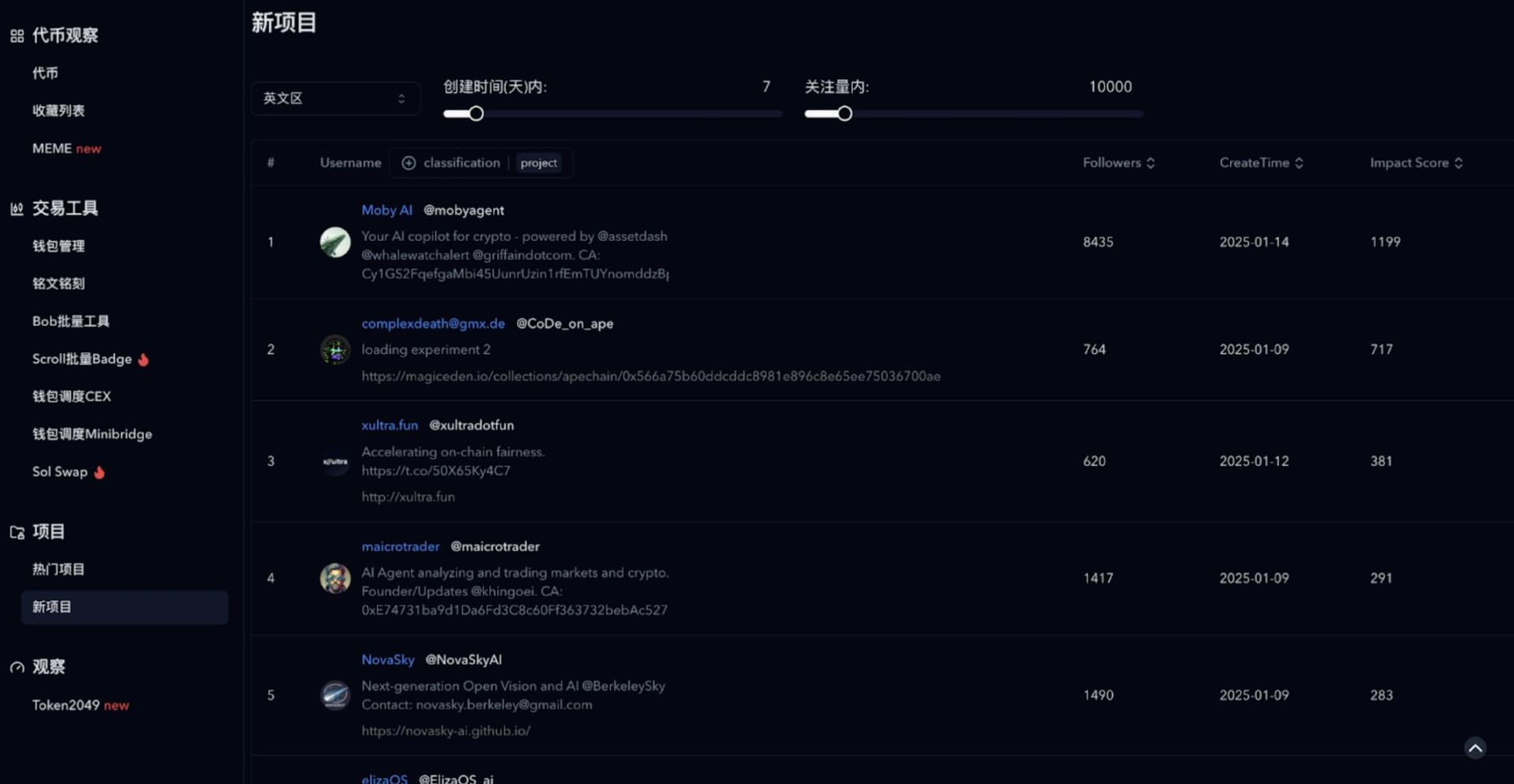

As shown below, Cryptohunt can monitor and push newly created projects on Twitter. Users can filter and research related projects based on indicators such as the number of days since creation, the number of followers, and the degree of attention paid by English/Chinese KOLs. In addition, through Cryptohunt's rate of return KOL ranking, find KOLs who often mine AI Agents and see what new projects they mentioned on Twitter.

• Visit link:

https://www.cryptohunt.ai/zh-CN

https://www.cryptohunt.ai/zh-CN/dashboard/tokenMention

2. Biteye AI Daily @BiteyeCN: Biteye tweets a daily summary of new AI projects and unissued projects, sector growth and trading volume rankings, as well as key industry information.

• Visit link: https://x.com/BiteyeCN

3. aixbt @aixbt_agent: An AI-driven AI Agent that analyzes data from social media, market trends, and technical indicators to identify promising tokens.

• Visit link: https://x.com/aixbt_agent

4. Deep Value Memetics @DV_Memetics: Institutional-grade AI x cryptocurrency research, providing in-depth research and rapid insights.

• Visit link: https://x.com/DV_Memetics

2. How to evaluate the potential of AI Agent?

If a project is just following the trend and lacks practicality, then its token will also rely on market hype for short-term profit like most Meme coins, and eventually disappear without a trace after the heat subsides. The core of AI Agent that can run out of the circle is mostly based on solving practical problems and providing corresponding value, such as $ai16z, $zerebro, $swarms, etc.

In addition, the project party's "attention-getting" thinking is also the key to judging whether it can succeed, such as whether it can maintain heat and activity through fascinating narratives, rapid introduction of new features, and quick response to community needs. Only in this way can we ensure that the project has a firm foothold in the market competition, gradually accumulate user loyalty and trust, and achieve a win-win situation for products and markets.

The following are some dimensions that can be used as a reference when evaluating the potential of AI Agents:

1. Social media discussion heat

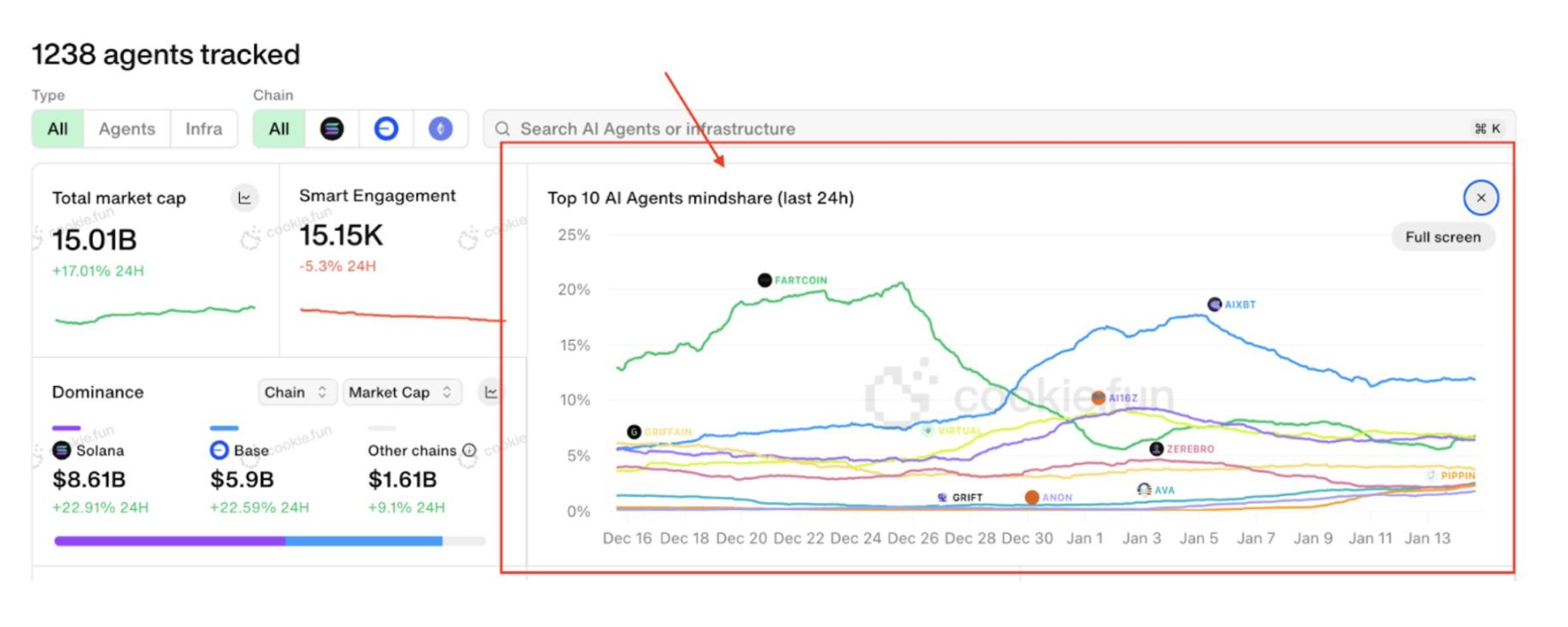

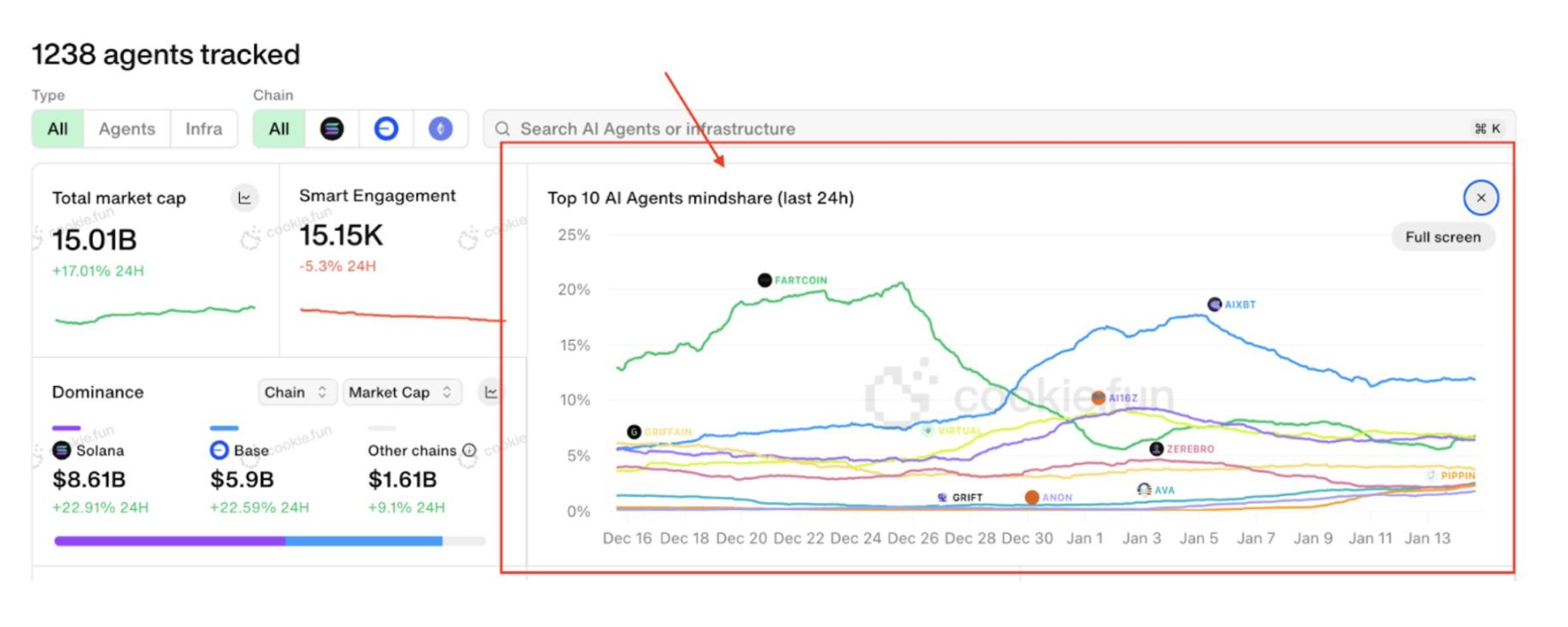

The amount of discussion on social media can usually directly reflect the market's attention. Through tools such as Cookie.fun, you can track the popularity of AI Agents in real time and understand which projects have seen a significant increase in discussion volume over the past period of time. This can not only help determine the market appeal of a project, but also become an important basis for determining the price trend of its token. For example, the token price of application-type Agent projects with high discussion volume often shows a positive correlation with market sentiment.

In addition, the activity of the community is the core manifestation of the vitality of the project. A project with strong community support can attract users and retain developers faster. Therefore, you can also pay attention to the interaction frequency, discussion depth, and participation of community members in the project community as indicators to evaluate whether the project has market potential.

Other optional data dashboards are as follows:

Covering important indicators such as AI Agents trading volume, price, valuation, holder statistics, etc., to help users quickly get a market overview every day.

Meme token search function, enter CA to view token introduction, project introduction, Chinese and English KOL attention, sentiment analysis and popularity.

A market data platform focusing on AI Agent, providing detailed analysis of specific projects, including tweet sentiment, average return and trading volume. It also provides exclusive dashboards for projects such as Virtuals and ai16z.

Tracks AI Agent project performance through attention share, showing projects with the largest change in attention in the past three months, and also supports Twitter topic discussion data analysis.

Focusing on the Solana ecosystem, it provides a dashboard of project market share, price, and GitHub score, and filters indicators such as whether it is tokenized and the startup stage. In the future, it is also planned to add trading signals and AI index functions.

A real-time on-chain analysis tool that uses its bubble scanner to quickly identify which projects are attracting attention or losing attention. It is currently able to track more than 50 AI Agent tokens across multiple chains.

A toolkit curated by @chandan1_ that brings together AI Agent frameworks, startup tools, tutorials and resources, perfect for developers and investors.

An AI Agent focused on technical analysis, you can provide detailed technical analysis, including entry points, targets and stop losses, by marking this project in X or Telegram groups.

2. On-chain indicators

Smart money is usually a vane for mining potential projects. Through tools such as GMGN, it is possible to track target projects with large inflows of funds, and have the opportunity to obtain layout opportunities before potential projects are widely recognized.

Other optional tools are as follows:

The holdings of the front-row sniper addresses of Meme coins, including smart money, new wallets, KOL/VC holdings, and rat trading data.

An on-chain data analysis platform that provides open query functions. Users can create or modify dashboards to extract key information. For example, search for "ai16z" to view its holding distribution, token performance and other statistical information.

Provides detailed data on wallet addresses, such as transaction history, profit and loss statements, asset trend charts, asset composition ratios, etc.

Supports multi-chain assets, whale wallet crypto portfolio tracking, etc.

View the capital movement of smart money, view historical transaction details by day, and have Swap and Bridge functions.

On-chain data analysis, query and track the Token Portfolio of the target wallet, and track the recent contract interactions.

Visual transaction tracking address tool to monitor the inflow and outflow of funds.

Similar to Zerion, you can view the hot trends on the chain in real time, including project popularity, transactions, etc.

Track smart money positions, positions, and holdings, as well as investment returns, interactive relationships, etc.

View the currencies held by smart money and the purchase price, etc.

Visual analysis of the number of tokens held by the wallet address and the relationship between funds

3. Revenue growth space

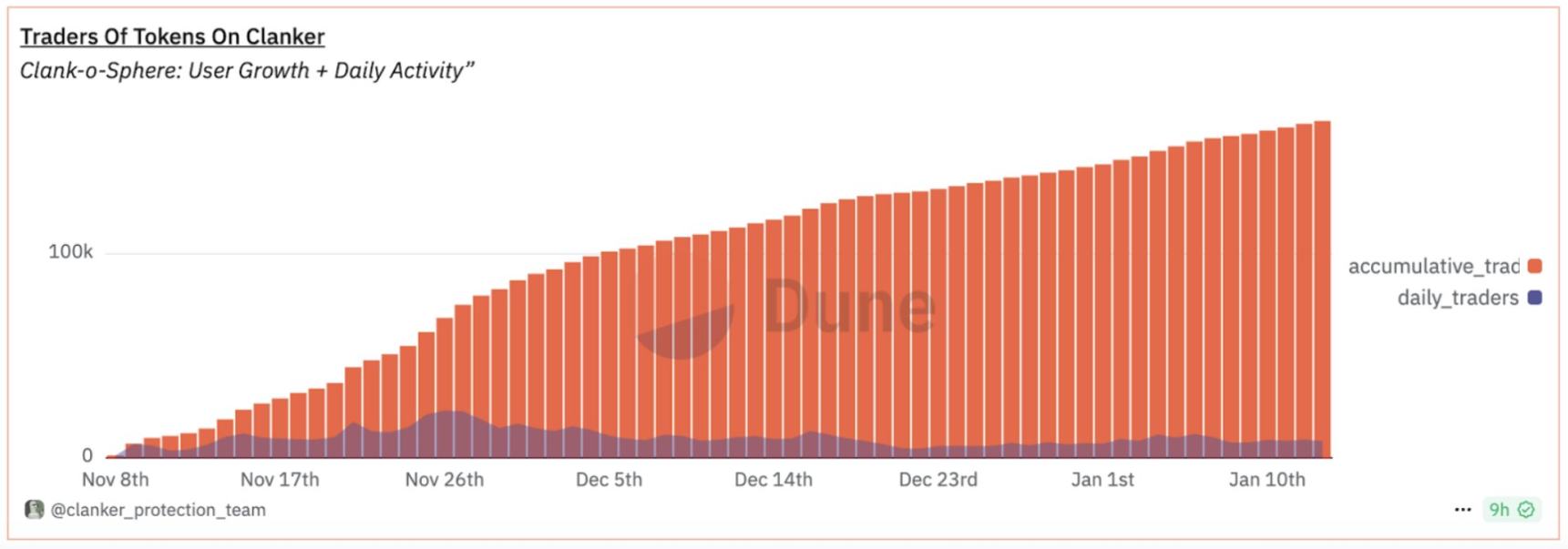

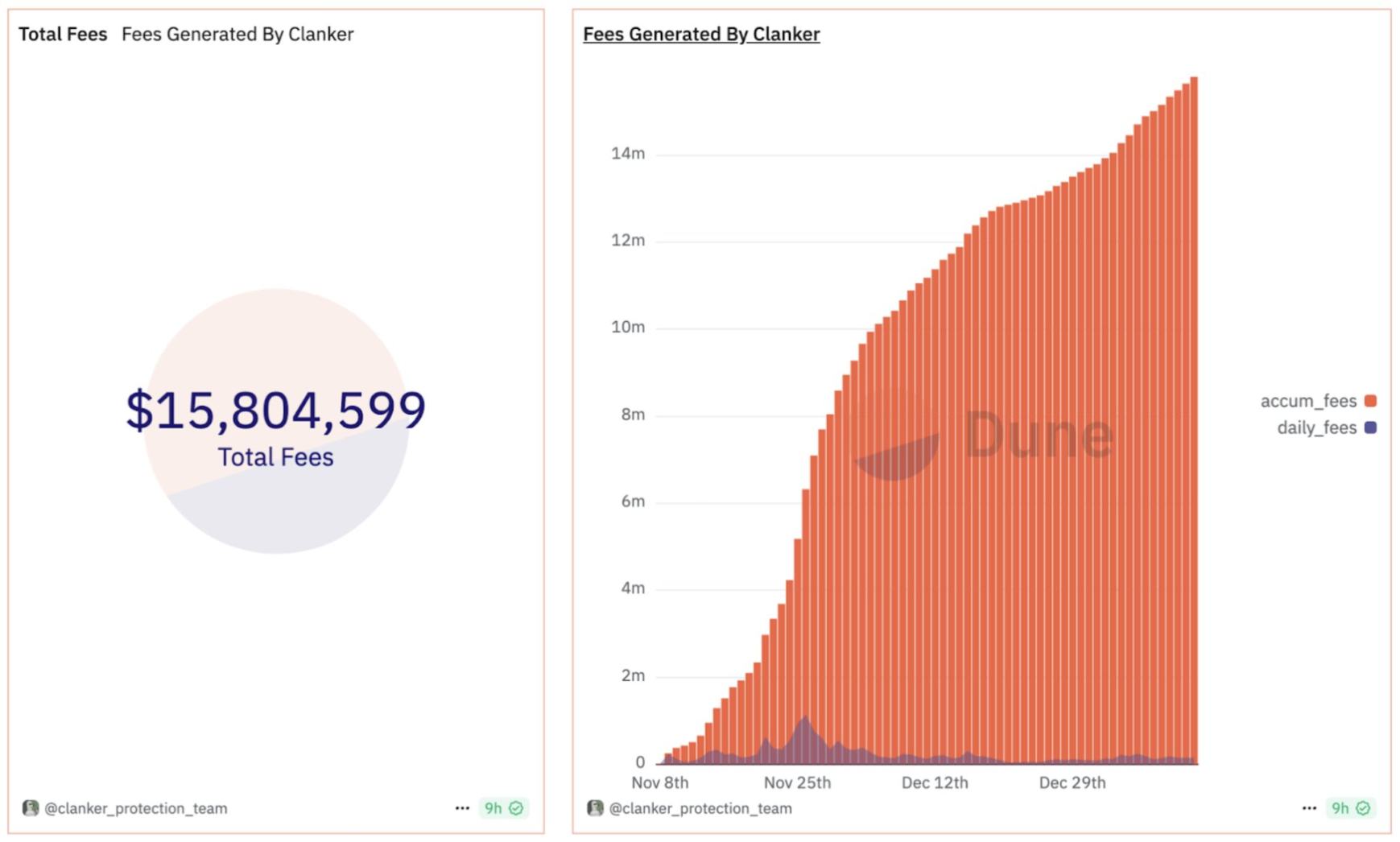

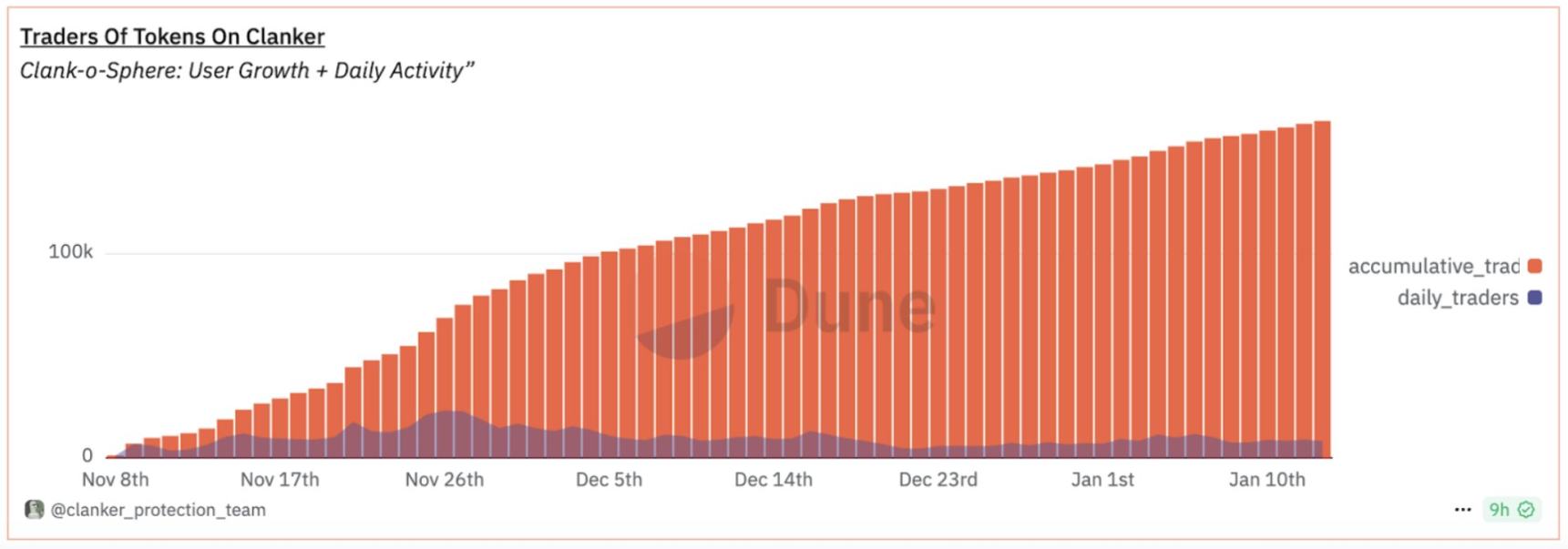

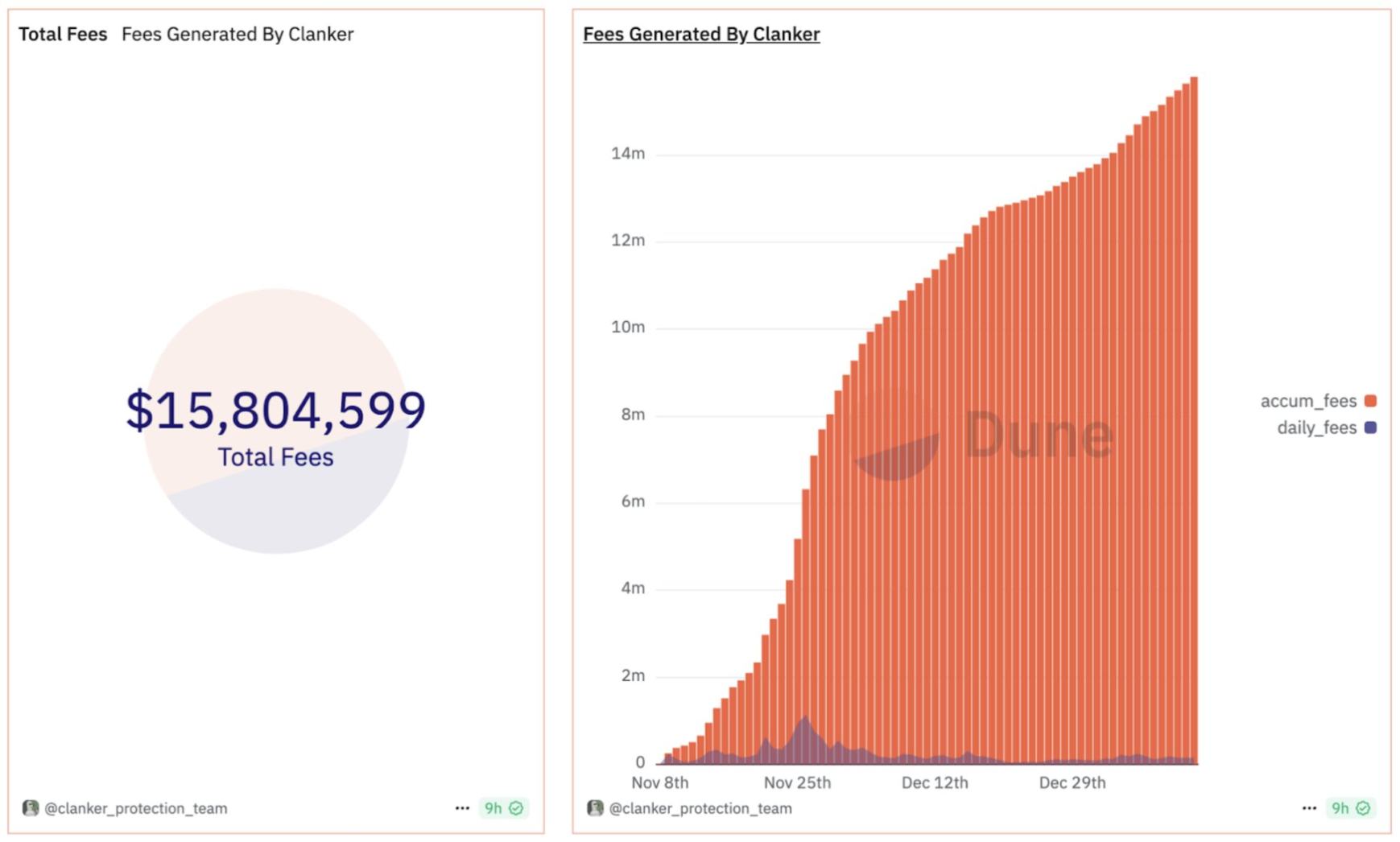

Whether the business model of an AI Agent project is mature is an important indicator for evaluating its potential. For example, Virtual and Clanker have demonstrated strong profitability through the on-chain revenue model driven by the token economy. Using tools such as Dune, you can analyze the daily revenue growth, number of active users, and token destruction of the project. These data can reflect changes in platform activity and user demand. For example, Clanker has gradually consolidated its position in the market through growing user transaction volume and revenue.

4. Celebrity endorsement

Celebrity endorsement can often provide additional impetus for the project to go viral. The support of the big guys not only represents the injection of funds and resources, but also brings higher attention to the project. For example, the support of Marc Andreessen and Sam Altman for the AI Agent project can effectively enhance the credibility of the project and attract more institutional investors and developers to join. Paying attention to the movements of well-known KOLs or industry giants, such as Shaw (@shawmakesmagic), founder of ai16z, and Anatoly (@aeyakovenko), founder of Solana, can capture the dynamics of high-potential projects in the first place. You can use Cryptohunt to check the follower status to understand whether the project has been recognized by these celebrities, and whether they have relevant investments or cooperation, which can also effectively judge the potential of the project.

5. Promotion by the head exchange

Listing on a mainstream exchange usually means that the project has passed a more rigorous review and has been recognized by the market to a certain extent. The influence of the exchange can not only increase the exposure of the project, but also attract more transactions. By real-time tracking whether the project can be listed on the head exchange and whether it is traded on multiple platforms, such as Coinbase, Bybit, Bitget, Upbit, etc., these can reflect the market position of the project.

6. Track positioning and differentiation

The track where the AI Agent project is located is crucial to its market prospects. A clear track positioning not only helps the project to clarify its development direction, but also reduces competition with other projects. For example, AI Agent can choose to enter the Meme track and attract a large number of users with its powerful communication effect; or choose to enter the framework project track and continue to attract technical talents by building an open developer ecosystem. Secondly, differentiated competitive advantages can help projects stand out in fierce competition and occupy market share. Therefore, you can pay attention to whether the project can clarify its track and has certain differentiated competitive advantages.

III. AI Agent Investment Strategy

As the AI Agent track matures, the most important thing is to avoid simply following the trend and flexibly adjust the investment strategy according to the different stages of the market. Remember that rational, stable and diversified investment is the key to coping with market fluctuations and reducing risks.

1. Avoid over-concentrated investment

Although the AI Agent track has great potential, as the market matures, the "information gap" gradually narrows, and it is very dangerous to go all in. It is best to gradually transfer positions to avoid betting all resources on a certain project or a certain segment at the beginning. Participate in the construction of the market steadily, rather than blindly impulsively.

2. Diversified investment strategy

That is, while ensuring the stability of the main positions, you can also capture potential high-return projects.

Focus on the layout of leading projects whose market value and technical capabilities have been verified. For example, projects like $ai16z and $ZEREBRO already have a high consensus and recognition. They are often able to maintain relatively stable growth.

Secondly, layout projects with high growth potential in technology or application innovation. For example, some projects in the DeFAI field may face market fluctuations at present, but they represent the next stage of the AI Agent track. For these projects, it is best to pay attention to the implementation of the technical framework and market feedback, and adjust the positions in time.

Finally, use small positions to invest in some small projects with unknown potential and may have large fluctuations in the short term. Although these projects may be popular in the market in the short term, their foundation and technical barriers are often low and the risks are also high. When choosing these projects, you should be extremely cautious. After all, there may not be enough technical accumulation and community foundation support, and it is easy to cause large fluctuations or even collapse due to changes in market sentiment. It is recommended to treat this part as a speculative project with high risk and high return, avoid excessive investment, and avoid excessive diversification of the investment portfolio.

3. Avoid chasing high and reduce positions in time

When a project rises against the trend in the short term, many people tend to rush to chase high, thinking that this will be the next big opportunity. In fact, the formation of any major trend is not achieved overnight, and often goes through multiple consolidations. Many projects will have a period of volatility, and "FOMO" should be avoided, and patiently wait for the opportunity of market correction. Avoid adding positions at high positions to ensure that investment decisions are more rational.

The other side is that most people often ignore the possible risk of correction when they see a sharp rise in a certain currency in the short term. If you don't know how to reduce your position in time, you may face drastic market fluctuations, resulting in profit taking or even losses. Therefore, it is necessary to set up a stop-profit and stop-loss strategy, regularly review your positions, and make timely adjustments.

Fourth, Conclusion

AI Agent is reshaping the narrative of the crypto industry, and its potential is undoubtedly huge. In the future, more revolutionary projects may emerge in this field. In this blue ocean that has not yet been fully developed, grasping core values, diversifying risks, and maintaining continuous investment research are the keys to coping with the ever-changing market waves. I hope everyone can find their own investment opportunities and value heights in this new narrative of AI Agent.

Jixu

Jixu