Author: Kyle Liu, Investment Manager at Bing Ventures

Introduction:The growth of the DeFi field is crucial to the development of the entire cryptocurrency ecosystem. However, there are still some challenges in the design, implementation, and maintenance of DeFi exchanges, liquidity pools, and smart contracts. To address these challenges, artificial intelligence (AI) technology is widely used in the DeFi ecosystem.

Market competition and changes

Define the concepts of AIGC and DeFi

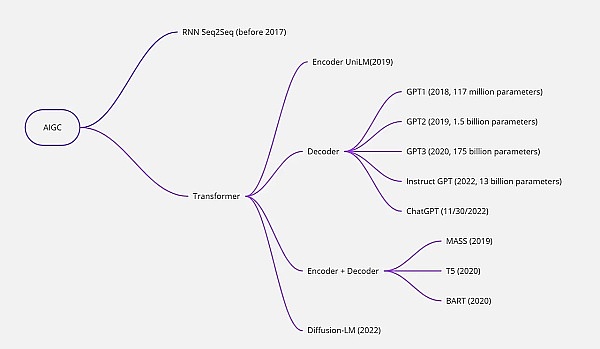

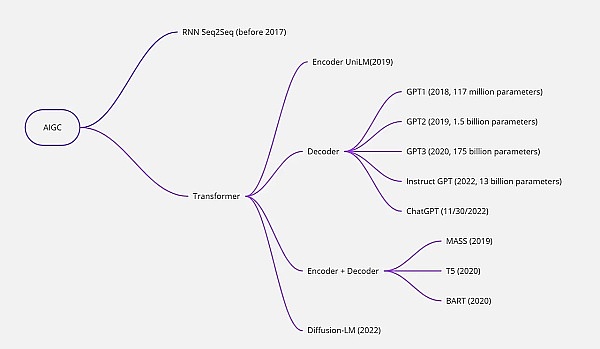

AIGC (AI Generated Content) is content generated by artificial intelligence. With the continuous development of technology, With the development, the application fields of AIGC are becoming more and more extensive. In the DeFi field, AIGC can be used for data analysis and smart contract writing, but it also faces content quality and authenticity issues. In the future, the combination of AIGC and DeFi will bring more opportunities and solutions to the digital economy, such as decentralized NFT markets and digital identity authentication. But new technologies and mechanisms need to be developed to ensure the quality and authenticity of content generated by AIGC.

Development of the DeFi market

Artificial intelligence applications in the DeFi market are in a stage of rapid growth, and will provide more support for various DeFi services in the future. The decentralized and open data nature of DeFi provides tremendous opportunities for training and developing artificial intelligence models, such as arbitrage bots, that attempt to maximize profits from expected asset price fluctuations. However, it is very important to protect the underlying data used to train artificial intelligence models, and various protection techniques can be adopted, such as protecting it as a trade secret or applying for a patent.

Emerging services such as smart contracts, decentralized exchanges and lending platforms in the DeFi market can improve the efficiency and accessibility of financial services, but the supervision and risk management of these new services still need to be continuously improved. In the future, as the amount of data increases, the prospects for artificial intelligence applications will become more extensive, and the potential of the DeFi market and financial innovation space can be further expanded.

Source: Peter Luo

Application of AIGC in DeFi

AI technology can be used in DeFi systems Optimization and intelligence enable more precise risk control and more efficient trading strategies through AI algorithms. At the same time, the data and transaction records of the DeFi system can provide a large amount of training data and application scenarios for AI, further enhancing the application and development of AI technology. Intelligent investment, credit evaluation, smart contracts, and decentralized governance are important application scenarios for the combination of DeFi and AI, which can improve the security and governance efficiency of the system. The combination of DeFi and AI will promote innovation and change in the financial field, and will produce the following three major trends in the future financial market:

The application of AIGC in trading

AI in trading The application potential is huge. Token ranking predictions can be generated using unsupervised learning methods, while clustering algorithms and dimensionality reduction techniques can extract relevant features and cluster the data set. This helps in better understanding market trends and making more informed decisions. AI can also help traders execute arbitrage trades and optimize asset allocation strategies.

AI can also play an important role in risk assessment in transactions, identifying and flagging suspicious activity and protecting users from fraud and other financial crimes. With the continuous development of the DeFi market and the continuous advancement of AI technology, the application potential of AI in DeFi intelligent trading algorithms will become greater and greater, and it is expected to play an important role in establishing trust in the DeFi ecosystem.

Application of AIGC in asset management

AI technology has huge potential in the field of DeFi asset management. Automated market makers (AMM) are one of the key areas. AI can optimize algorithms to reduce the bid-ask spread and provide a more economical trading method. By leveraging AI to manage dynamic token collections, DeFi protocols can optimize asset allocation and liquidity management, providing investors with efficient, low-risk investment options. AIGC technology can quickly screen the most potential investment targets and avoid risks to increase returns. AIGC technology will become an important part of DeFi asset management in the future.

Application of AIGC in smart contracts

AI can enhance the security and reliability of smart contracts by identifying malicious code, monitoring network traffic, and detecting abnormal behaviors. At the same time, by automatically generating smart contract code, developers' errors and omissions can be avoided and the quality and reliability of the contract can be improved. In addition, smart contract generation tools allow non-professional developers to quickly generate smart contract codes, thereby promoting the popularity and development of DeFi applications. Most importantly, AIGC technology can realize automated contract development and testing through intelligent contract generation and testing, thereby improving development efficiency and reducing labor and time costs.

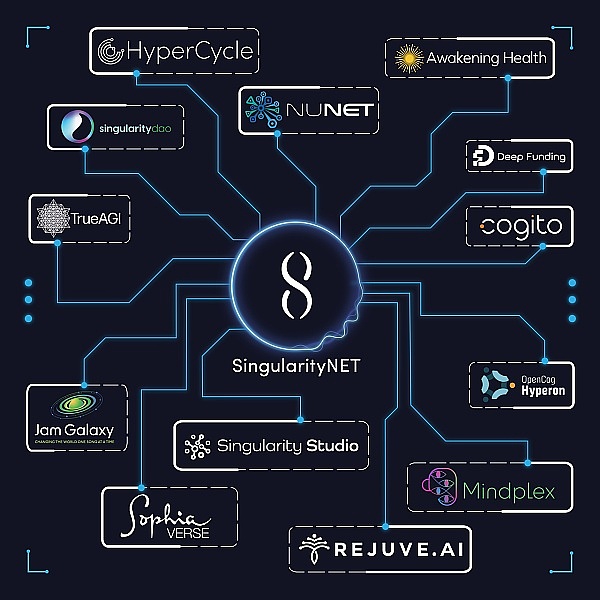

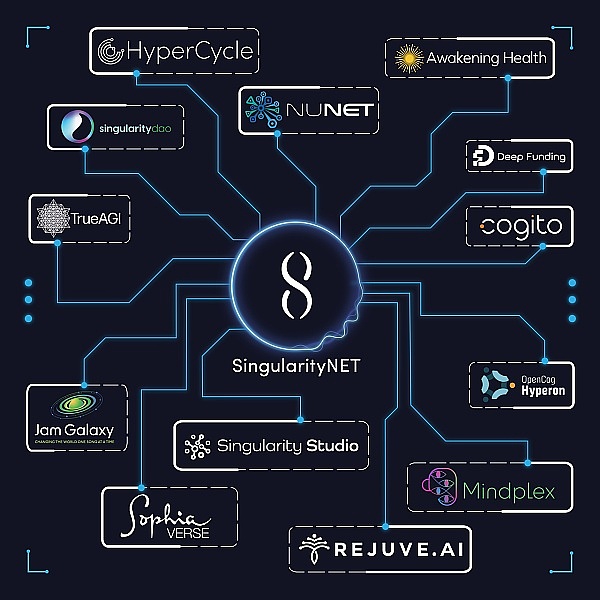

Source: singularitynet

Future directions and core issues

The application of AI in DeFi may become DeFi itself and the main threshold for AI applications. Safety issues will attract more attention in future research, including research on intrinsic safety and external safety. The applicability of AI in financial institutions requires more data to support it, but limitations due to security issues have resulted in an insufficient number of experiments. We believe that issues that need to be paid attention to in the research of AI in DeFi include whether the application of AI can add value to the original liquidity of DeFi, whether the application of AI meets security requirements, and the relationship between the robustness and reliability of the system and security. What trade-offs will arise?

The impact of AIGC technology on privacy

Data privacy and security issues: AIGC technology may leak personal privacy information. Strict privacy protection measures must be taken, such as encrypting user data and limiting the scope of data use.

The spread of misleading and false information: AIGC technology can quickly generate a large amount of natural language content, which may contain false information or misleading content. The quality and accuracy of AIGC technology need to be improved nature, and strengthen the supervision and review of the content they generate.

Security issues of DeFi platforms

Smart contract vulnerabilities: AI generation There may be a certain degree of errors and flaws in the content. These flaws may lead to vulnerabilities in the code in the smart contract, leaving opportunities for hackers to attack. It is necessary to strengthen the auditing and testing of smart contracts.

Bot attacks and fraud: Attackers can use AIGC technology to generate false natural language content, induce users to commit fraud or undermine system security. It is necessary to strengthen the security of AIGC technology. security and preventive measures, such as enhanced user authentication and access control.

Conclusion and findings

We believe that AI technology will play an increasingly important role in the DeFi ecosystem. Specifically, we are optimistic about the application of AI in the following segments:

Market forecasting and intelligent investment decision-making: AI technology passes Machine learning and predictive analysis technology can improve the accuracy of market trend predictions and provide traders with technical and fundamental analysis services. This provides DeFi with the opportunity to automate trading and portfolio management.

Automated audit/security protection: AI technology can improve the speed and accuracy of smart contract audits through technologies such as NLP and image recognition, automatically improve the effectiveness of smart contracts, and reduce KYC /AML error rates and fraud risks.

Fraud detection and credit scoring: AI technology can identify dishonest activities by analyzing trends in large data sets, and can also use credit scores to promote lending activities and provide better offers loan price.

Automated portfolio management: AI technology can use machine learning predictive models to perform tasks such as portfolio planning, strategy evaluation, pool weight calculation, signal generation, and sentiment monitoring to build automated agents Engage in active portfolio management.

Distributed lending: AI technology and distributed ledger technology can work together to design smart contracts and improve indicators such as standardization, automation, data frequency and sensitivity to achieve more efficiency loan operations.

For these tracks, Bing Ventures believes that the application of AI technology will bring higher efficiency, better risk control, and more reliable investment to the DeFi ecosystem. strategies, and more standardized and efficient loan operations. In these segmented tracks, we are optimistic about projects that apply AIGC technology to improve DeFi efficiency and investment accuracy.

JinseFinance

JinseFinance