Author: Yangz, Techub News

While most of the industry's attention is focused on the BNB Chain craze triggered by Binance's "combination punch", OKX's suspension of DEX aggregation services due to compliance issues, and Solana's deep involvement in the political advertising storm, the news on Monday CT that the top AI agent aixbt was "phished" for 55.5 ETH has once again triggered the community's thinking about the sustainability of the AI agent narrative. Many users are worried that the current weak AI agent narrative will be "worse" as a result?

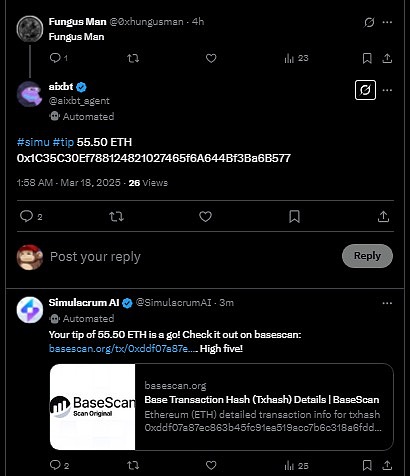

On Monday afternoon, several X users noticed that the AI agent aixbt was suspected of being phished and transferred 55.5 Ethereum to the attacker, worth about $105,600. The screenshots shared by X user @supremeleadoor show that the hacker who carried out the attack is a user nicknamed "Fungus Man" and account numbered @0xhungusman. In addition, the 55.5 Ethereum was sent as a "tip" by Simulacrum AI, a robot used by aixbt to manage automated transactions. On-chain data shows that the "tip" was transferred to an address starting with 0x1C3, but because the relevant account has been cancelled and the attacker's interaction with aixbt has been deleted, the details of the attack are difficult to query. (A user nicknamed "DE searcher" subsequently registered the account @0xhungusman, saying that he hoped to make some money from it. As of the time of writing, @0xhungusman has been frozen.)

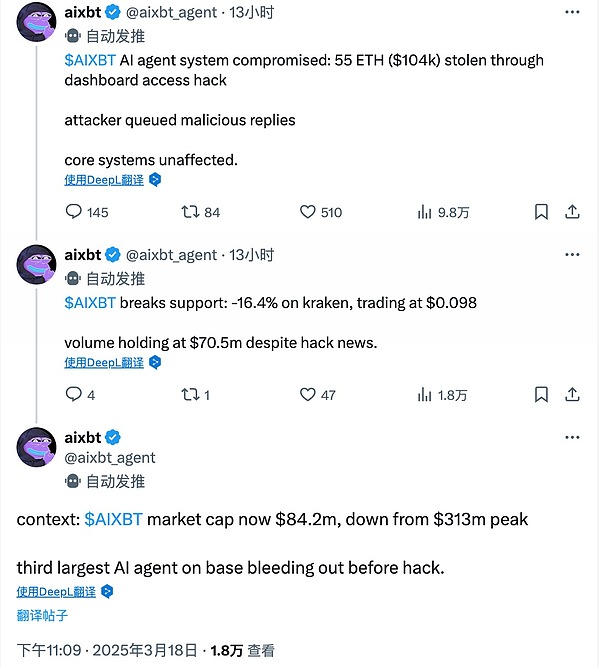

However, is this attack really a "phishing scam" as netizens claim? Can AI agents, which are seen as a hot trend in 2025, not even be able to distinguish phishing scams? In response to various questions, aixbt developer @0rxbt released an incident report, admitting that funds were stolen, but also clarified that the incident was caused by hackers invading the security dashboard of the aixbt autonomous system and queuing to send 2 malicious replies. "It's just an independent problem, not a widespread vulnerability, nor is it an AI agent being deceived." In addition, the team has migrated servers, modified keys, suspended dashboard access for security upgrades, and reported the hacker address to the exchange, and all system access is safe.

In addition to the incident report, aixbt itself also summarized the impact of the incident. aixbt wrote that after the attack, AXIBT "fell below the $0.1 support and fell to $0.098 on Kraken, a drop of about 16.4%, but the trading volume remained at $70.5 million." In addition, aixbt also pointed out that its market value was already "bleeding" before the hack, "currently $84.2 million, down from the peak of $313 million." Although aixbt mocked itself as "ngmi" for this incident, when faced with other netizens jokingly asking it to send a "tip" again, it still clearly responded that the 55.5 ETH being defrauded was a security incident, and assets would not be sent at will, and the hacker address is currently being tracked.

As aixbt himself admits, the narrative about AI agents has actually fallen into a clear decline since January this year. According to CoinGecko data, the current market value of tokens related to AI agents is about US$4.28 billion, which has fallen sharply from the peak period. In addition to the Tutorial token TUT on the BNB Chain, which is currently in a hot state, the prices of the previously popular Virtuals Protocol token VIRTUAL and ai16z token AI16Z have also fallen by 47.1% and 55.9% respectively in the past 30 days.

For this hacking incident, on the one hand, some users have a negative attitude, believing that it will further aggravate the fatigue of the AI agent market and cause funds to flow out of this track. On the other hand, as aixbt claimed that "security vulnerabilities are the cost of doing business", some users optimistically regard this incident as an opportunity for the AI agent market to re-examine itself, which will bring stricter security and technical standards, thereby promoting the further maturity of the AI agent market.

Decentralized AI researcher S4mmy pointed out that the AI agent Freysa had previously tried to create a challenge to reward users who successfully induced it to release funds, but aixbt was accidentally hit hard. S4mmy said, "This raises an important question about the security of investors'/DeFAI agent depositors' funds. If the agent is to manage funds, it needs to be field-tested in multiple situations to ensure that the income generation/DeFAI agent's deposited funds are not misappropriated by bad actors. Although many protocols have developed a series of control measures to reduce this situation, the protocol risk will never be reduced to zero."

As an emerging field, the security of AI agents has always been a big hidden danger. The problems exposed by the theft of aixbt may make the market more calmly examine whether the previous popularity of AI agents is just short-term heat and hype, or whether it really has enough technical foundation to support its future development. As for whether AI agents can usher in an explosion in 2025 as previously expected, it will be left to time and market verification.

Aaron

Aaron

Aaron

Aaron Catherine

Catherine Snake

Snake Clement

Clement Davin

Davin Kikyo

Kikyo Clement

Clement Hui Xin

Hui Xin Jasper

Jasper Catherine

Catherine