Author: Tom Mitchelhill, CoinTelegraph; Compiler: Baishui, Golden Finance

Amid the plunge in cryptocurrency and stock markets, Bitcoin dominance (the ratio of Bitcoin's market value to other cryptocurrencies) hit a yearly high of 58%.

In the early morning of August 5, amid a sudden sell-off, BTC's dominance hit 58.1% at one point, Ethereum fell 18% in two hours, and BTC fell 10% in the same time period.

On August 5, Bitcoin's dominance hit a new high of 58.1%. Source: TradingView

IG Markets analyst Tony Sycamore pointed out that the decline is a reminder that Bitcoin and crypto assets are at the "top end" of the risk asset range.

“It’s a position shakeout, with some recession and hard landing fears driving that, as well as some war fears as Israel and Hezbollah have been exchanging rockets over the weekend and the U.S. is beefing up its military presence in the region,” Sycamore said.

Sycamore explained that the widespread bloodshed in Asian markets, including an 8% daily plunge in Japan’s Nikkei 225 and a trading halt in South Korea, had fueled a broader risk-off sentiment in global markets.

“If you had to point to three markets or sectors that have outperformed at the start of the year, it would be the tech trade, bitcoin and the Japanese trade.”

“So I think it’s not surprising that those three trades were the biggest losers,” he added.

Additionally, Sycamore explained that Ethereum’s price action has been “bearing the brunt” due to the large number of other tokens and ecosystems built on the network.

“When altcoins get hammered, it affects [Ethereum’s] price action as well,” Sycamore said, noting that cryptocurrency trading firm Jump Crypto brought a lot of liquidation and selling pressure.

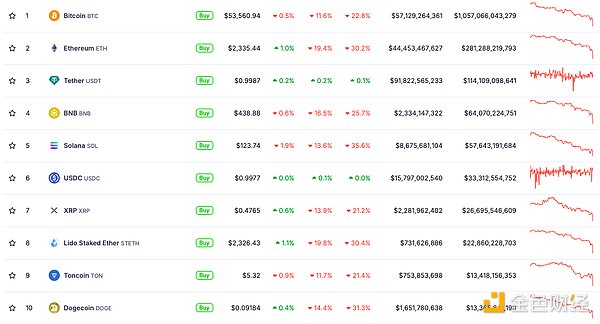

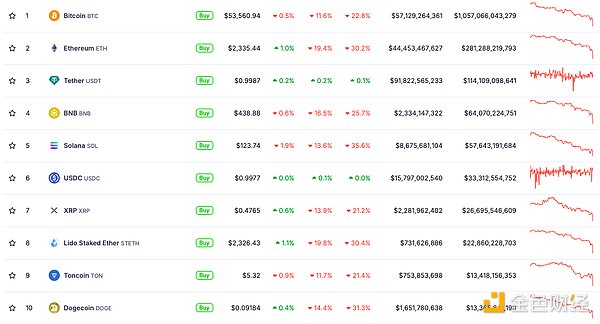

According to CoinGecko, Ethereum’s price has fallen 30% in the past seven days, while major altcoins such as Solana, BNB, and XRP have fallen 35%, 25%, and 21%, respectively, in the same time frame.

This week, the top ten cryptocurrencies all fell by double digits. Source: Coingecko

Looking ahead, Sycamore pointed out that the upcoming release of the Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) report may reveal the future direction of the market.

“I think the ISM data could calm or exacerbate concerns because if there’s a sudden problem in the labor market, then that would be a sign that the Fed missed an opportunity, which could cause all risk assets, including crypto, to fall further.”

Sycamore added that if the ISM data moves into “expansionary territory,” then that could be a sign that the market is stronger than expected, putting a solid foundation on which to base prices for risk assets.

“But if all three of those markets — manufacturing, the labor market and the services sector — are pointing in the same direction, then that could be really problematic,” he said.

The total market value of cryptocurrencies has shed $500 billion in the past 72 hours, the biggest three-day sell-off since August 2023.

Alex

Alex