Author: Brayden Lindrea, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

The cryptocurrency market plummeted, with some altcoins falling more than 10%, but one industry analyst pointed out that there was no "clear catalyst" to explain why.

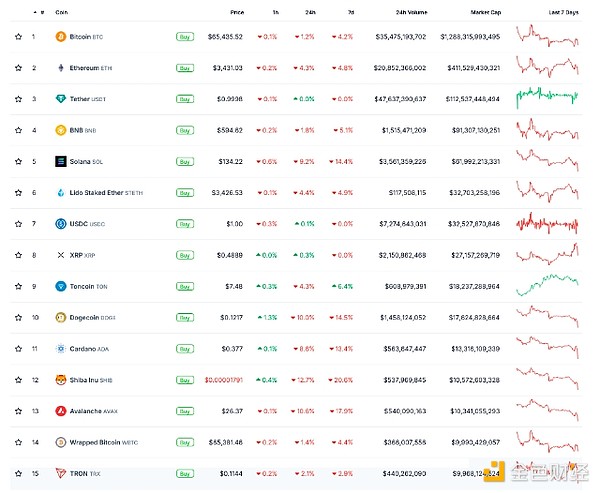

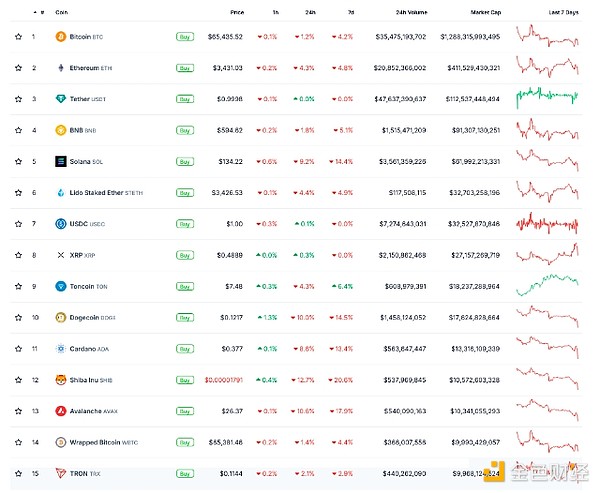

The market capitalization of cryptocurrencies has fallen to $2.46 trillion, down 3.5% in the past 24 hours. CoinGecko data showed that on June 17, Shiba Inu and Avalanche were the two worst hit among the top 20 altcoins by market value, falling 12.7% and 10.6% respectively on the day.

Uniswap (UNI) and Dogecoin also saw double-digit declines, while Solana fell 9.4%. Ripple's XRP was the only non-stablecoin that did not lose money, although it only saw a small increase of 0.1%.

In the past 24 hours, Bitcoin and Ethereum fell 1.3% and 4.4% respectively.

Price changes of the top 15 tokens by market capitalization in the past hour, 24 hours and 7 days. Source: Coingecko Henrik Anderrson, chief investment officer at asset manager Apollo Crypto, said he couldn’t pinpoint a primary reason for the market’s drop — but he believes a recent drop in interest in spot Bitcoin exchange-traded funds could be a factor. “There is no clear catalyst from what I can see, but it looks like negative flows into BTC ETFs led to altcoin weakness, which triggered liquidations among leveraged long traders in Bitcoin, Ethereum, and Dogecoin,” Andersson noted. Spot Bitcoin ETFs have seen outflows in five of the past six trading days, according to data from Farside Investors.

Digital asset firm 10xResearch also linked the recent altcoin crash to a drop in spot Bitcoin ETF flows over the past week — but believes the relationship is inversely proportional.

“While Bitcoin’s failure to rebound despite weak inflation data was surprising, the collapse of Ethereum and altcoins was probably foreseeable,” 10xResearch added.

Number of Bitcoin miners grows double-digit despite price crash

Meanwhile, Bitcoin mining stocks have performed strongly in recent weeks and are currently recovering some of the ground lost from the April halving event, according to an industry analyst.

“Mining stocks underperformed before the halving due to concerns about profitability after the halving,” said Mitchell Askew, chief analyst at Blockware Solutions.

But those concerns have now been alleviated, and mining stocks are regaining balance after underperforming Bitcoin and its proxy stocks such as MicroStrategy (MSTR).

Askew noted that the Valkyrie Bitcoin Miners exchange-traded fund WGMI is now up about 54% since the halving event, suggesting that market confidence has returned to the mining industry.

YouQuan

YouQuan