Manta Pacific Introduction

The recent futures price of the popular Blast on Aevo has continued to increase with TVL, rising from a low of $3.5 to $3.50 in just one week. 15.5 dollars, and then fell back to 7 dollars. It can be seen that the L2 model, which focuses on native revenue, has begun to be recognized by the market.

Can Manta, which has also recently used New Paradigm to launch native revenue, surpass Blast? Let’s first take a look at the advantages of Manta. Players who enter Manta early have more profit opportunities than Blast. ??

Manta Network is a modular blockchain for zero-knowledge (ZK) applications. Manta Network was founded by a team of experienced founders from prestigious institutions such as Harvard and MIT.

Manta Network has received investment from many top Web3 investment funds, including Binance Labs and Polychain Capital.

Manta Pacific is an Ethereum Layer 2 specially designed for ZK applications. It is currently based on OP Stack and is fully compatible with the EVM environment and Solidity development language;

< p style="text-align: left;">Manta Pacific will implement zkEVM based on Polygon CDK in the future; at the same time, it will use Manta's general circuit to implement ZK as a service, and use Celestia's modular data availability to provide low gas costs.

It can be said that Manta Pacific provides the perfect environment to support ZK applications. Solidity developers do not need cryptography knowledge or learn new languages to implement ZK functions by calling the SDK or API.

(Note: Manta’s universal circuit is a zero-knowledge proof (ZK) circuit library, specially designed for general scenarios, and provides ZK- As-a Service, you can enable ZK functions in existing applications with just a few lines of code, including compliant DeFi payments, Web3 Social authentication, full-chain game shuffling functions, etc. Through the universal circuit on Manta Pacific , developers can easily deploy EVM-native ZK applications.)

Manta Pacific launched its mainnet Alpha version on September 12, 2023 , currently the third largest OP Stack L2, second only to Optimism and Base. Once fully transitioned to zkEVM in the future, Manta Pacific may become the largest Polygon zkEVM-based L2 network.

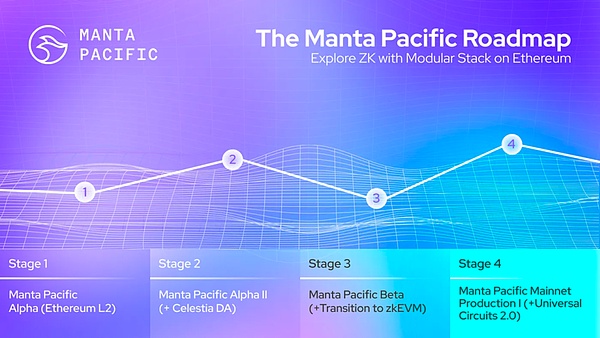

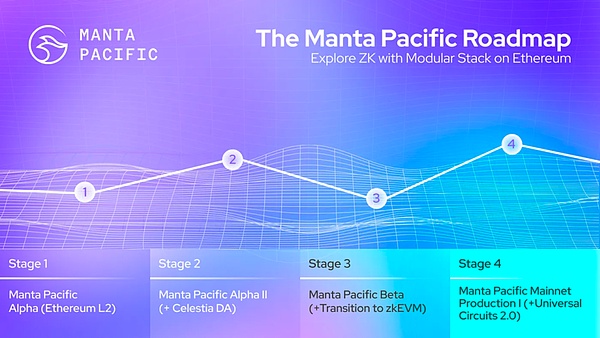

Judging from the launch of Manta Pacific, its future development will be divided into four different stages:

< p style="text-align: left;">

(1) Manta Pacific Alpha (Ethereum L2)In the current version, Manta Pacific is based on Ethereum's Optimistic Rollup, using Ethereum's Data Availability (DA).

It utilizes the Universal Circuits of the Manta network to enable developers to use Solidity and the Universal Circuits SDK to quickly build and deploy ZK-related applications.

Therefore, all existing Ethereum smart contracts can be seamlessly adapted to Manta Pacific, and new application scenarios can also be opened based on ZK's functions. , such as verifiable DID/KYC, fully on-chain games based on ZK, and synergy between DeFi and decentralized identity, etc.

(2) Manta Pacific Alpha II (+Celestia DA)

< p style="text-align: left;">At this stage, Manta Pacific will achieve data expansion by integrating Celestia's modular data availability (DA), significantly reducing gas costs for users to interact with dApps within the Manta Pacific ecosystem. .

Celestia's cost has a sub-linear relationship with Ethereum's gas price, making it much cheaper than Ethereum's existing cost.

(3) Manta Pacific Beta (+ transition to zkEVM)

< p style="text-align: left;">In this phase, Manta Pacific plans to fully transition to zkEVM and leverage Polygon's ZK certifier.

The final phase of the network architecture will be to use Manta's general circuitry for built-in ZK features to support a wide range of ZK applications, combined with Validium services and Celestia DA and zkEVM and Polygon CDK for scalability.

(4) Manta Pacific production-level main network I (+ Universal Circuit 2.0)< /p>

In the last stage, Manta Pacific will officially launch the main network. For the Manta Pacific main network, Manta Pacific will further upgrade the general circuit to achieve lower gas costs. At the same time, the novel ZK technology is used to unlock new application scenarios.

Judging from Manta Pacific's roadmap, it will become the first zkEVM L2 to switch from Optimistic Rollup to Validium. This transformation is achieved using Polygon CDK and significantly reduced by Celestia DA. It eliminates gas fees and increases security through Ethereum consensus and cryptographic proof of on-chain activities. It can be said that it is a very forward-looking L2 at present.

New Paradigm Activity

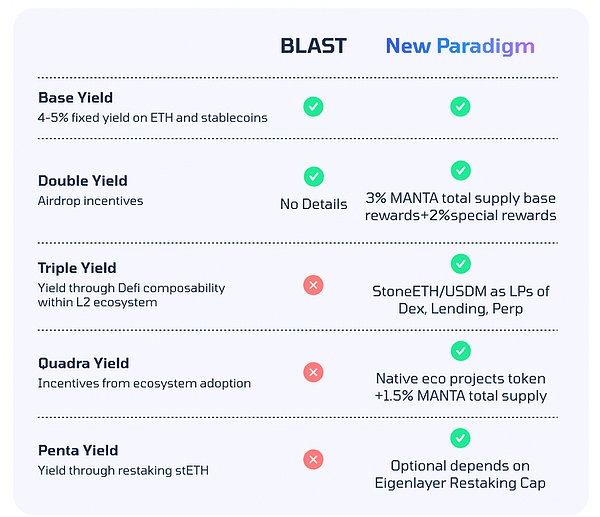

Recently, the Manta public chain has launched New Paradigm, a liquidity incentive activity within the ecosystem. Similar to the Blast liquidity staking launched by Blur a while ago, users can pledge their own funds to obtain future token airdrop rewards.

However, compared with Blast, New Paradigm’s advantage lies in its rich ecological projects and shorter payback period. Users can get it as soon as January 2024. You can get token airdrops, and Blast’s airdrop may not go online until May. In comparison, the fund utilization rate in New Paradigm is much higher than that in Blast.

(1) The expected rewards of the event include the following parts:

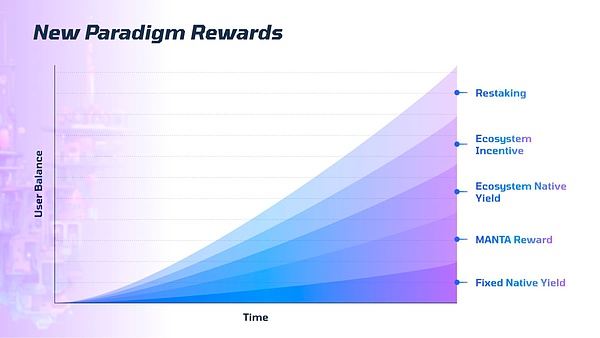

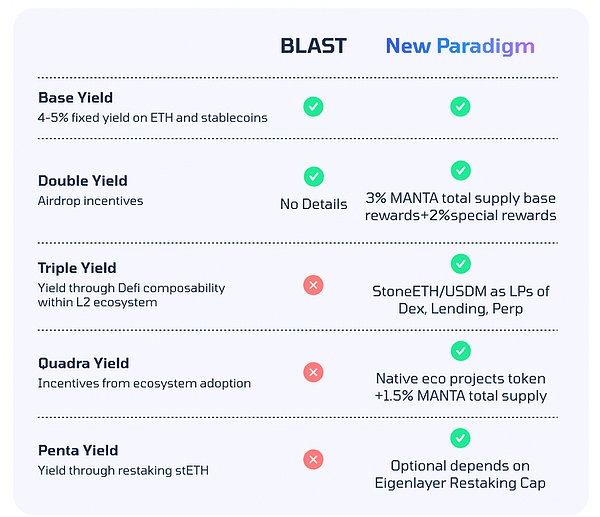

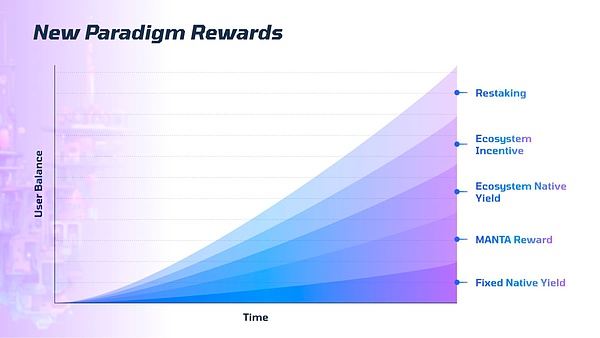

New Paradigm has five sources of income, including fixed income, NFT incentives, and superimposed income brought by the unique DeFi composability within the L2 ecosystem.

1. After ETH and USDC cross-chain to the Manta ecosystem, just like Blast, even if the assets are left unchanged, there will be an interest of about 5%;< /p>

2. Participate in activities and pledge assets to receive future MANTA token airdrops;

3. Participate in project interactions within the Manta ecosystem and obtain potential airdrop opportunities for the project itself;

4. After staking ETH and USDC, the Stone and wUSDM obtained will be used to participate in Manta Projects within the ecosystem, such as lending projects, obtain the benefits provided by the project itself;

5. Through Restaking of stETH (optional, in the future it will be based on Eigenlayer Restaking Cap Is there an open upper limit to the income gained from joining Eigenlayer);

p>

(It should be noted that ETH will become Stone after being deposited, and USDC will become wUSDM after being deposited. If there is no GAS in subsequent interactions, you can use Third-party bridges, such as MiniBridge, cross-chain to the Manta network, which will save GAS even more.

To participate in the event, you must go through the event page Only by depositing funds can you obtain blind box fragments, but the GAS required for subsequent interactions in the Manta ecosystem can be cross-chained through a third-party bridge: https://minibridge.chaineye.tools/)

(2) The specific steps are as follows:

1) Deposit cross-chain ETH or USDC into Manta Pacific to earn income and box fragments. The deposit period is open until January 2024;

2) Users receive STONE and wUSDM on Manta Pacific within 24 hours of depositing. MANTA token rewards can be claimed through NFT as early as January 2024;

3) 69 days after the MANTA token rewards are issued, users can redeem them through STONE and wUSDM Return to ETH and USDC;

For detailed strategies, please see the [Best Strategy Tutorial for Participating in Manta New Paradigm?] launched by Biteye to maximize profits?? https:// mirror.xyz/0x30bF18409211FB048b8Abf44c27052c93cF329F2/XbI07A9ib7-xsOD8W0nRPC2EascVlD1idHusJcYu9CQ

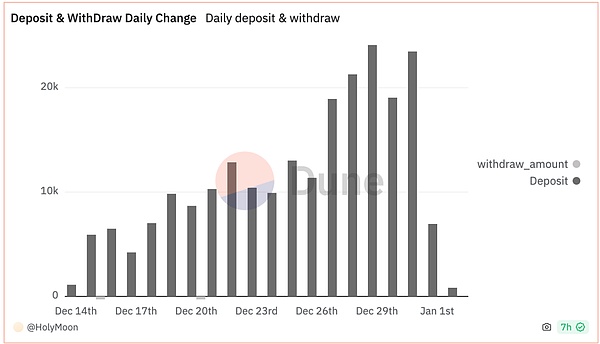

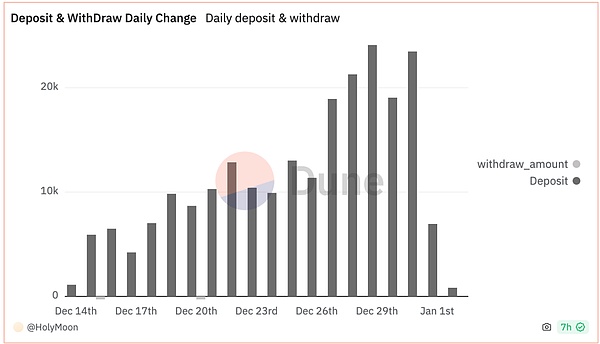

Currently New Paradigm’s deposit activity has entered the final sprint stage.

StakeStone and Mountain Protocol

In New Paradigm, the income from the user's pledged ETH comes from the StakeStone protocol, and the income from the pledged USDC comes from the Mountain Protocol. Next, I will introduce to you these two key protocols in the Manta ecosystem:

(1) StakeStone

StakeStone is a full-chain LST (Liquid Stake Token) protocol, dedicated to building a decentralized all-in-one staking protocol, a cross-chain market for LST liquidity, providing easy staking services for stakers, backed by Hashkey Capital, and obtained Secure3Audit of audit. https://github.com/Secure3Audit/Secure3Academy/blob/main/audit_reports/StakeStone/StakeStone_final_Secure3_Audit_Report.pdf

Users can deposit ETH to obtain STONE, for example, If user A deposits 100 ETH in exchange for a certain amount of STONE, and the value of 1 STONE becomes 1.04 ETH after one year, the user can use 100 STONE to withdraw 104 ETH from StakeStone.

When users deposit ETH into StakeStone, they will receive STONE immediately. At the same time, the received ETH goes into the vault contract and awaits deployment. After the deployment is executed, the ETH in the treasury contract will be sent to Lido in exchange for stETH, which will then be saved in StakeStone’s strategy treasury.

In the future, sETH may be deposited into Eigenlayer for heavy pledge to obtain more income for STONE holders.

Currently, the total amount of ETH deposited in StakeStone is growing steadily.The total number of deposited ETH has reached 225,498, which is approximately $515M.

(https://dune.com/HolyMoon/stakestone)

(2) Mountain Protocol

Mountain Protocol is an institutional-level compliance-regulated income stablecoin protocol, developed by Coinbase Vencture Participated in the investment and has been audited by many well-known audit institutions such as OpenZeppelin.

The stable currency USDM it issues is backed by short-term U.S. Treasury bonds, which are currently one of the safest assets in the world.

The main reserves behind USDC and USDT are also short-term Treasury bonds of the United States. According to the risk rating report of the stable currency rating agency Bluechip, the risk rating of USDM is the same as that of DAI. The same, therefore, Mountain has two important features: security and compliance.

In New Paradigm, after users deposit the stable currency USDC, they will automatically receive wUSDM (Wrapped USDM) on Manta Pacific, similar to Lido's wstETH .

During the New Paradigm event, users can consider placing wUSDM in other protocols to earn interest. wUSDM is the same as any other ERC20 token and can be used with Various smart contracts, decentralized applications and wallets on L2 interact.

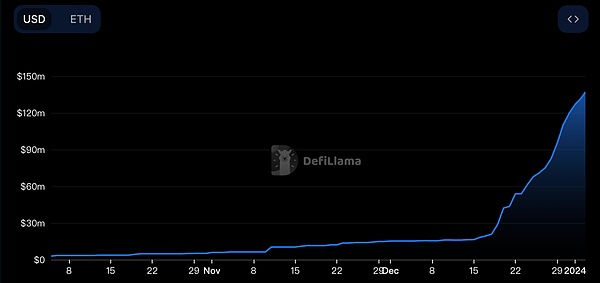

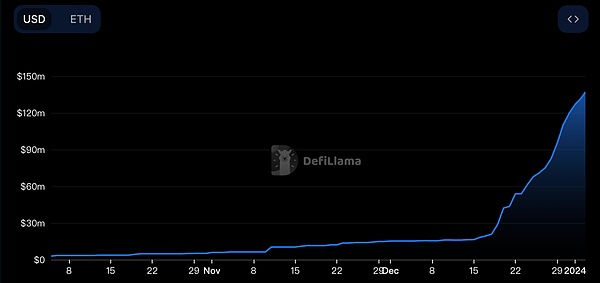

The current circulation of USDM has reached $136M according to DefiLlama data, which has greatly increased after cooperating with Manta.

(https://defillama.com/protocol/mountain-protocol)

List of ecological data and ecological projects

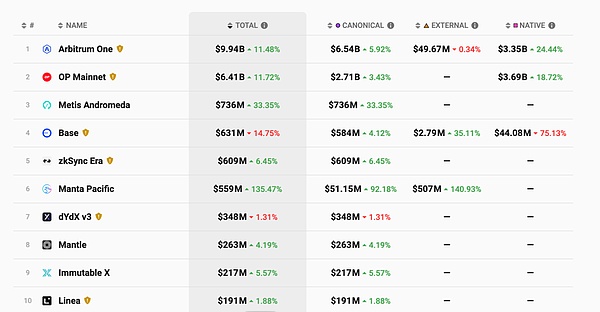

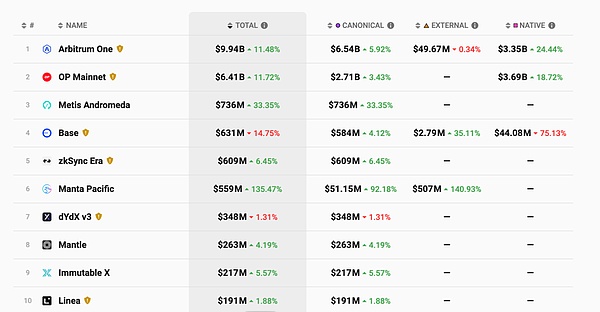

From the data of L2 Beat, the current TVL of Manta has reached $559M, which has exceeded It has included popular L2 public chains such as Linea and Starknet, and is currently ranked sixth.

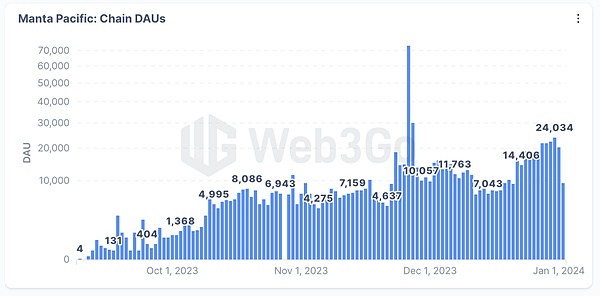

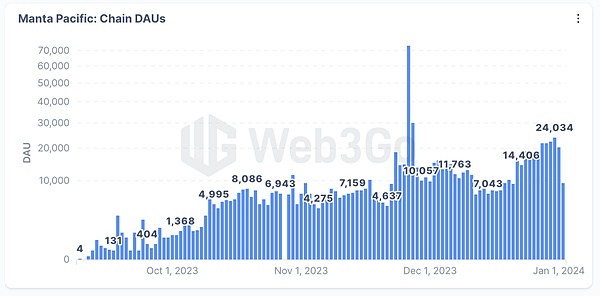

Judging from the on-chain data, there are currently nearly 7 million TXs in the Manta ecosystem, the total wallet addresses have reached 446,454, and the daily activity on the chain has increased significantly in the past three months.

(https://analytix.web3go.xyz/layout/dashboardDetail/3a6f41b3-bb1c-43b1-a1e8-bd1158033e31)

There are currently more than 200 ecosystem projects on Manta Pacific, most of which have not issued coins. It is foreseeable that Manta has brought a large number of new users through the New Paradigm event this time, and at the same time, a large number of people have been deposited on the chain. Funds will continue to circulate in the ecosystem, interact with projects in the Manta ecosystem, and gradually cultivate loyal users on the chain.

The following is an introduction to some key ecological projects on Manta:

1. QuickSwap: QuickSwap is currently the DEX with the largest transaction volume in the Manta ecosystem, and is also one of the largest and most well-known DEX in the Polygon ecosystem.

2. iZUMi Finance: iZUMi is a multi-chain DeFi protocol that provides one-stop liquidity services (LaaS) and innovatively proposes discrete liquidity automatic market making. The model has received over $50M in financing from investors including IOSG Ventures, Fenbushi Capital, Hashkey Capital, BIXIN Ventures and other investors.

3. LayerBank: LayerBank is currently the largest lending agreement in the Manta ecosystem. The agreement has been audited by Peckshield. The current TVL has reached $265M, and its current TVL in Linea , are deployed on Scroll, but currently the main TVL is distributed in Manta.

4. Symbiosis: Symbiosis is a cross-chain DEX and liquidity protocol that has received $2M from DWF Labs, Shima Capital, Binance Labs, Dragonfly, Amber Group, etc. Financing.

5. PacificSwap: PacifiSwap is a DEX protocol using the ve (3,3) model. It is developed based on the Pancake Swap model and uses the innovative CLAMM algorithm.

6. AsMatch: AsMatch is an online dating application based on zero-knowledge proof ZK. Users can choose to match or not match other users by swiping left or right. You can also fill in the ZK Proof Key of zkSBT into the App to verify the behavior and identity on the chain, which belongs to the Social category in Manta.

7. Orbiter Finance: Orbiter Finance is a decentralized Rollup bridge used to transfer native assets of Ethereum. It provides infrastructure for Layer 2 and is currently the largest One of the cross-chain bridges, it has received $3.2M in financing from Starkware and Amber group.

8. Minibridge: Minibridge is a cross-chain bridge optimized for small-amount transfer scenarios. It has the advantages of low rates and fast payment. It is rated on dappsheriff For users' favorite bridge, the rate is 50% off during the New Paradigm event. MiniBridge is the Ethereum Shanghai 2023 award-winning team.

Summary

As the currency issuance approaches in 2024, the MANTA token The coming airdrop is bound to add to the popularity of L2 in the first quarter of 2024. At the same time, as Manta integrates with Celestia in the next stage, the dual characteristics of modular blockchain and ZK EVM can bring unique advantages to Manta .

Therefore, at this stage, most of the projects in its ecology have not yet issued coins, and coupled with the strong background of Binance investment, the degree of chain roll-up is also Chains such as Zksync are much smaller. It can be said that it is a very cost-effective operation to participate in the interaction of the chain, increase asset returns and bet on future airdrops of ecological projects.

Catherine

Catherine