Click to read:2024 Q1 Web3 Blockchain Security posture, anti-money laundering analysis review (1)

Elven’s report will focus on two key themes, providing comprehensive insights into recent regulatory developments in major jurisdictions and providing guidance for implementing effective internal controls to manage Digital assets in finance provide practical guidance.

First, the report will explore key regulatory and compliance events in the first quarter of 2024 in well-known financial centers such as Europe, Dubai, Singapore and Hong Kong, providing relevant figures Insights into the evolving asset regulatory environment.

Secondly, the report will conduct a comprehensive review of the cryptocurrency internal control framework from a financial perspective, emphasizing the importance of implementing strong internal controls and reconciliation processes to Effectively manage digital assets, reduce risks and protect profits.

Famous financial centers in Europe, Dubai, Singapore and Hong Kong Key regulatory and compliance events in the first quarter of 2024

*The length of this article is limited, please see the full report for a clear version.

Cryptocurrency Internal Control Framework (Financial Perspective) and Reconciliation

From a financial perspective, a crypto entity’s internal control framework focuses onensuring the accuracy, reliability, and completeness of financial reporting and transactions. Cryptocurrency reconciliation remains a core part of the framework.

Cryptocurrency Internal Control Framework (Financial Perspective)

< img src="https://img.jinse.cn/7202850_image3.png">

1. Cryptocurrency custody:< /p>

- Private keys and their backups must be stored separately and protected from internal and external threats.

- Strong measures have been implemented to protect private keys and their backups throughout their lifecycle.

- Written procedures should be in place outlining the steps to be taken if the primary wallet is lost, for backup and recovery purposes.

- In the event of contract termination, protocols must be in place to address the termination of individuals with access to the wallet and/or private keys.

2. Separation of duties:

- Trading, Finance There is a clear division of responsibilities between different functions such as management, accounting and reconciliation to prevent conflicts of interest and fraud.

- The authorization and approval process for financial transactions, including restrictions on authority to make transactions.

According to PwC's "Cryptocurrency Custody: Risks and Controls from an Auditor's Perspective",<<Cryptocurrency entities should ensure that only those who have Only authorized or approved employees can initiate the sale of cryptocurrencies - at least the dual control principle must be applied>>

3. Accounting Policies and Procedures:

- Clear accounting policies and procedures governing financial transactions related to trades, deposits, withdrawals, fees and commissions records, classification and reporting.

According to Ernst & Young's "Applying IFRS Accounting for Holders of Crypto-Assets",<<Crypto-assets have different terms and conditions. The purpose of holding cryptoassets also differs between entities, and even between business models within the same entity that holds cryptoassets. Accordingly, the accounting treatment will depend on the specific facts and circumstances and the analysis may be complex>>

- In accordance with U.S. GAAP (GAAP) or other applicable accounting standards to record transactions accurately and timely.

Updated August 2023 Accounting Standards Published by the FASB—Intangible Assets—Goodwill and Other—Cryptoassets (Subtopic 350-60): Cryptoassets Accounting Treatments and Disclosures,

<<For annual reporting periods, the revisions in this update require entities to disclose the following information:< /p>

·Summary of activity changes in crypto asset holdings during the reporting period, including increases (and descriptions of activities leading to increases), disposals, and profits and losses.

·For any disposal of cryptoassets during the reporting period, the difference between the disposal price and the cost basis and a description of the activities leading to the disposal

·If profits and losses are not presented separately, indicate the items in the income statement that recognize these profits and losses.

·Method for determining the cost basis of crypto assets>>

4. Financial Reporting:

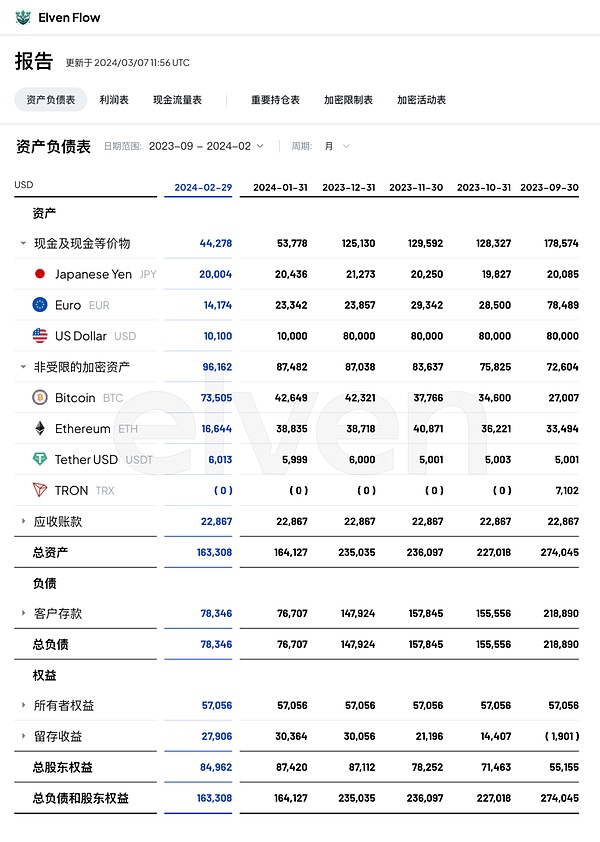

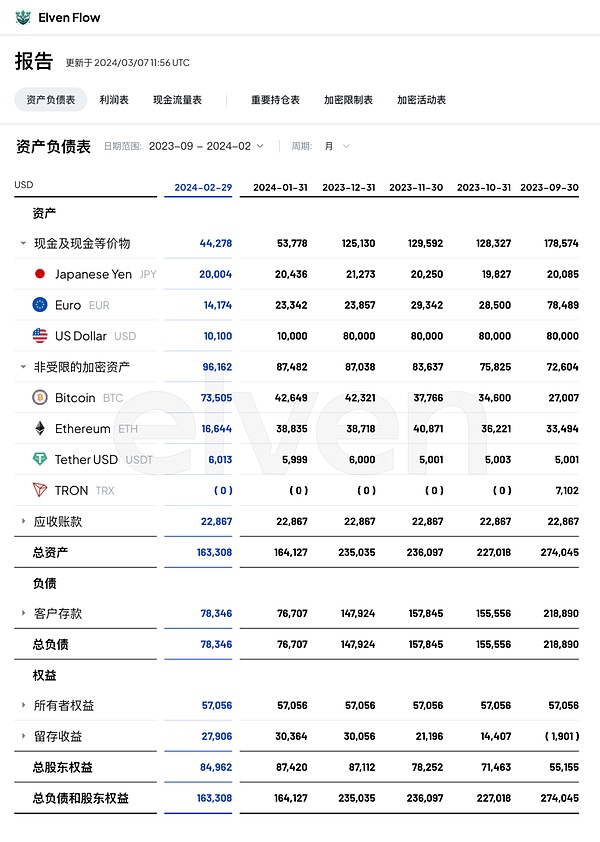

- Regularly prepare financial statements, including balance sheets, profit and loss statements and Cash Flow Statement to provide transparency and insight into the exchange’s financial performance.

- Independent verification and reconciliation of financial data to ensure accuracy and completeness.

- Comply with regulatory reporting requirements, including the submission of financial reports to the relevant authorities.

Balance sheet page generated by Elven professional encryption accounting software

Major support generated by Elven professional encryption accounting software There are pagesface

5. Asset and liability management:

- Monitoring and Manage assets and liabilities to maintain liquidity and solvency.

- Regularly reconcile asset and liability balances, including client funds, trading reserves and working capital.

- Risk assessment and management strategies to mitigate potential losses that may result from market volatility, credit risk and operational failure.

According to the International Organization of Securities Commission's "Final Report on Policy Recommendations for Cryptocurrency and Digital Asset Markets",

<<Crypto entities should:

1) Keep customer assets in custody or otherwise separate them from their own Separation of assets.

2) Disclose relevant information to customers in clear, concise and non-technical language:

·How client assets are held, and arrangements for protecting those assets and/or their private keys;

·Whether to use an independent custodian, sub-custodian or related party custodian (if any);

·The extent to which client assets are aggregated or pooled in consolidated client accounts, individual clients’ rights to aggregated or pooled assets, and the risk of loss arising from any aggregation or aggregation activities;

·Risks arising from crypto entities handling or moving customer assets directly or indirectly (e.g., through cross-chain bridges); and

· Complete and accurate information about the obligations and responsibilities of crypto entities using customer assets and private keys, including reimbursement terms and risks involved.

3) Have its own systems, policies and procedures, and conduct regular and frequent reviews of client assets with appropriate independent assurance. account.

4) Adopt appropriate systems, policies and procedures to reduce the risk of customer assets being lost, stolen or inaccessible. >>

6. Internal audit and compliance:

- Internal audit function to evaluate the effectiveness of internal controls, identify deficiencies, and recommend improvements.

- Compliance monitoring to ensure compliance with regulatory requirements, industry standards and internal policies.

- An external audit performed by an independent auditor to provide assurance to stakeholders and regulators regarding the reliability of financial reporting and internal controls.

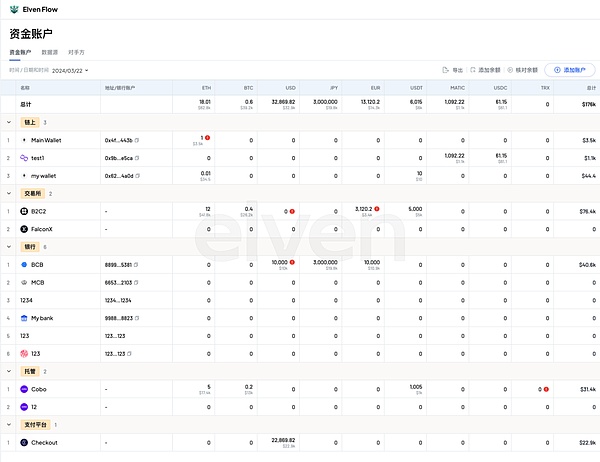

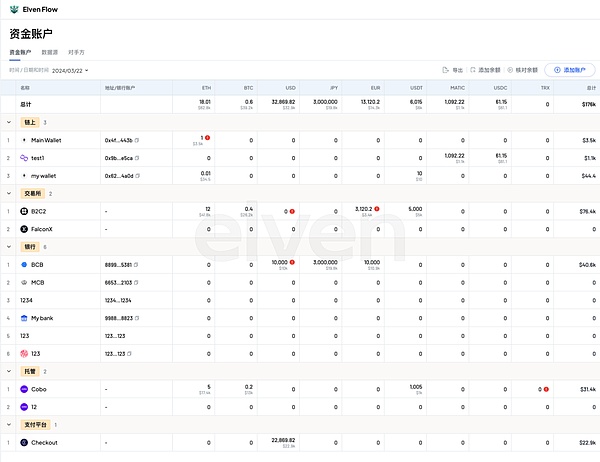

7. Money Management:

- Manage cash effectively Flows, including funds received from trading activity, customer deposits, and withdrawal requests.

- Investment policies and guidelines for managing cash reserves and excess funds.

- Control fund transfers and payments to prevent unauthorized transactions and fraud.

Fund management page generated by Elven professional encryption accounting software

8. Comply with regulatory requirements:

- Comply with applicable financial regulations, including Anti-Money Laundering (AML), Know Your Customer (KYC) and consumer protection laws.

- Regularly monitored and updated to ensure compliance with changes in regulatory requirements and industry best practices.

9. Employee training and publicity:

- Carry out Training programs designed to educate employees on financial controls, compliance requirements and ethical standards.

- Conduct communications campaigns to promote a culture of integrity, transparency and accountability within the organization.

10. Continuous Improvement:

- Continuous review and Evaluate financial controls and processes to identify areas requiring enhancement and optimization.

- Establish feedback mechanisms to collect input from employees, auditors, regulators and other stakeholders to achieve continuous improvement.

The framework aims to promote financial stability, transparency and trust in cryptocurrency entities, thereby enhancing investor confidence and market integrity.

Required by the Monetary Authority of Singapore (MAS)

In the context of daily reconciliation of customer assets

by digital payment token service providers,< /p>

Exploring cryptocurrency reconciliation (the core of the framework)

1. What is cryptocurrency reconciliation?

Cryptocurrency reconciliation is the process of comparing and verifying transaction data from multiple sources to identify discrepancies or missing transactions. This task is particularly challenging due to the complexity of managing various wallets, exchanges, chains, and tokens. It may involve matching transaction amounts, dates, addresses and other relevant details to ensure all transactions are accounted for correctly.

2. How to perform cryptocurrency reconciliation?

Web3 companies often use cryptocurrency accounting software that generates daily reconciliation reports.

Cryptocurrency reconciliation report generated by Elven professional crypto accounting software

3. Why is cryptocurrency reconciliation so difficult? important?

-Regulatory requirements of licensed parties

"Consultation Paper on Proposed Regulatory Measures for Digital Payment Token Services" (November 2023)

Monetary Authority of Singapore (MAS) Digital payment token service providers are required to conduct daily reconciliations of customer assets and keep transaction records, and maintain separate books and records for each customer, recording detailed information about customer assets at all times.

-Accuracy of financial records

For cryptocurrencies For exchanges and financial institutions, providing transparent and accurate transaction records can build customer trust. Reconciliations demonstrate a commitment to accountability and integrity and enhance the reputation of the service provider.

In accordance with the Recommendations on the Protection of Client Assets, <<Principle 1 - Intermediaries should maintain accurate and up-to-date records and accounts of client assets , in order to determine at any time the exact nature, amount, location and ownership status of client assets, and for which clients client assets are held. Records should also be kept in such a way that they can be used as an audit trail. >>

-Maintain trust with stakeholders to attract investors to invest

Ensuring the accuracy of transaction records is the foundation of financial integrity. Reconciliation helps verify that all transactions have been recorded and accounted for correctly, reducing the risk of errors or discrepancies.

References

1. ESMA75 -453128700-52 MiCA Consultation Paper - Guidelines on the qualification of crypto-assets as financial instruments

https://www.esma.europa. eu/sites/default/files/2024-01/ESMA75-453128700-52_MiCA_Consultation_Paper_-_Guidelines_on_the_qualification_of_crypto-assets_as_financial_instruments.pdf

2. DIFC Announces Enactment of New Digital Assets Law, New Law of Security, and Related Amendments to Select Legislation

https: //www.difc.ae/whats-on/news/difc-announces-enactment-of-new-digital-assets-law---new-law-of-security-and-related-amendments

< p style="text-align: left;">

3. Explanatory Brief: The Financial Institutions (Miscellaneous Amendments) Bill 2024https://www.mas.gov.sg/news/speeches/2024/explanatory-brief-the-financial-institutions-miscellaneous-amendments-bill-2024

4. SFC warns public of suspicious crypto-related products “Floki Staking Program” and “TokenFi Staking Program”

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR12

5. SFC and Police warn public of Aramex and DIFX for suspected virtual asset-related frauds

https://apps.sfc. hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR6

6. SFC warns public of suspicious crypto-related product “Yieldnodes.com masternode pool”

https://apps.sfc.hk/edistributionWeb/gateway/EN/news- and-announcements/news/doc?refNo=24PR34

7. SFC urges investors to check regulatory status of virtual asset trading platforms as transition period will end soon

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc? refNo=24PR14

8. SFC warns public of suspicious websites for impersonation and suspected virtual asset-related fraud

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR50

9. SFC warns public against unlicensed virtual asset trading platform MEXC

https:/ /apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR48

10. SFC warns public against unlicensed virtual asset trading platform Bybit

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and -announcements/news/doc?refNo=24PR47

11. SFC warns public of BitForex for suspected virtual asset-related fraud

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR40

12. SFC warns public of suspicious websites impersonating licensed virtual asset trading platforms

https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR39

< strong>13. SFC reminds public VATP application period has ended under transitional arrangements

https://apps.sfc.hk/edistributionWeb/ gateway/EN/news-and-announcements/news/doc?refNo=24PR37

14. Stablecoin Issuer Sandbox

https://www.hkma.gov.hk/eng/news-and-media/insight/2024/03/20240312/

15. Crypto custody: risks and controls from an auditor's perspective

https ://www.pwc.ch/en/insights/digital/crypto-custody-risks-and-controls-from-an-auditors-perspective.html

16. Accounting by holders ofcrypto assets

https://assets.ey.com/content/dam/ey- sites/ey-com/en_gl/topics/ifrs/ey-apply-ifrs-crypto-assets-update-october2021.pdf

17. Intangibles —Goodwill and Other—Crypto Assets (Subtopic 350-60)

https://www.fasb.org/page/ShowPdf?path= ASU%202023-08.pdf&title=ACCOUNTING%20STANDARDS%20UPDATE%202023-08—Intangibles—Goodwill%20and%20Other—Crypto%20Assets%20(Subtopic%20350-60)

18. Policy Recommendations for Crypto and Digital Asset MarketsFinal Report

https://www. iosco.org/library/pubdocs/pdf/IOSCOPD747.pdf

19. Consultation Paper on Proposed Regulatory Measures for Digital Payment Token Services

strong>

https://www.mas.gov.sg/publications/consultations/2022/consultation-paper-on-proposed-regulatory-measures-for -digital-payment-token-services

20. Recommendations Regarding the Protection of ClientAssetsFinal Report

https://www.iosco.org/library/pubdocs/pdf/IOSCOPD436.pdf

Weatherly

Weatherly