Unpacking bitsCrunch: High Community Activity but Severe Lack of Scale

According to Certik's Skynet Ranking, bitsCrunch ranks 38th in the field of artificial intelligence and 8th among AI projects not yet listed on exchanges.

Snake

Snake

Author: Mankiw, Mankiw LLP

With the rapid development of financial technology, traditional financial markets are gradually moving towards a new era of digital transformation. Against this backdrop, Hong Kong, as a leading international financial center, is actively exploring the tokenization of real-world assets (RWAs) and striving to promote the further development of the financial market through innovative technologies. The Ensemble project recently announced by the Hong Kong Monetary Authority (HKMA) is a concrete manifestation of this innovative effort.

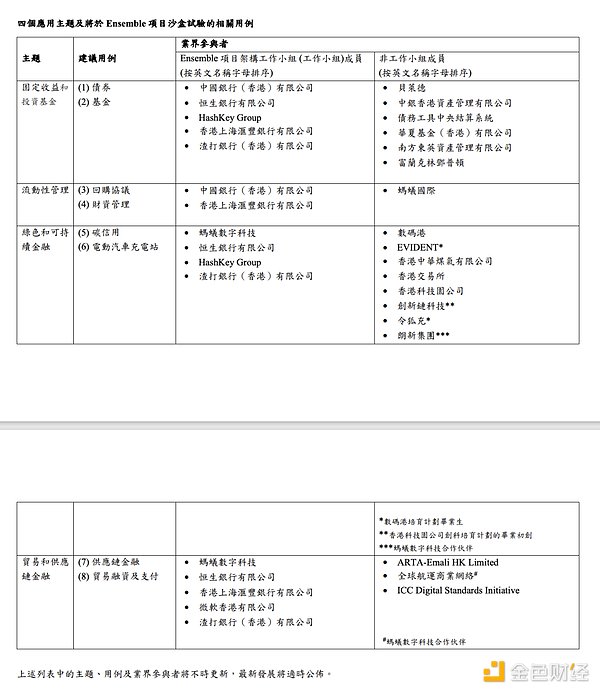

*Source: Ensemble Project DocumentThe first phase of the Ensemble project covered four major themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain financing. Through these trials, Hong Kong hopes to promote the development and development of new economic sectors while consolidating its position as an international financial center. In these trials, Ant Digits' in-depth participation is eye-catching, especially in the two thematic cases of green and sustainable finance and trade and supply chain finance, where Ant Chain's blockchain technology and AIoT technology have shown great potential.

Through Ant Chain’s blockchain and AIoT (artificial intelligence + Internet of Things) technology, the operating status of physical assets can be recorded in real time and the data can be securely uploaded to the blockchain. This technology not only improves the asset valuation of enterprises, but also enables all parties involved to assess asset value and collaboratively manage risks, ultimately improving the financing efficiency and accessibility of enterprises. With the support of Ant Digits and the HKMA’s Ensemble project, New Electric Road, a subsidiary of Longxin Technology, a new energy company listed in the mainland, as the operator and service provider of the new energy digital platform, used some of the charging piles operated on the platform as RWA anchor assets and successfully obtained the first RWA (Real World Assets-tokenization) cross-border financing in Hong Kong. This financing will be used for the energy storage and charging pile industries in the new energy field.

Through the tokenized asset platform built by Ant Digits, the Global Shipping Business Network (GSBN) issued an electronic bill of lading (eBL). In the process, HSBC, Hang Seng Bank and Bank of China (Hong Kong) facilitated the transfer of electronic bills of lading using tokenized deposits to settle. Ant Digits CEO Zhao Wenbiao attended the launch event of the Hong Kong Monetary Authority. He said: Ant Digits is very honored to be one of the first participants in the Ensemble project and provide technology and solutions for it. With the support of the Hong Kong Monetary Authority, Ant Digits can participate in various innovative projects and apply the digital technology accumulated over the years. In the future, we will also jointly launch a variety of RWA projects with more partners to provide technical support for high-quality projects in China and around the world, especially new energy entity projects, to help them obtain more development opportunities. We also welcome willing partners to explore the support of new technologies for the real economy.

Among the above two case studies, the "Green and Sustainable Finance" theme carried out by Ant Digital and Longsun Technology has achieved some impressive results. Therefore, this article will focus on analyzing and discussing this case study, exploring how RWA based on new energy physical assets can achieve cross-border financing through technological innovation, and deeply interpreting the legal and compliance issues involved in this process.

According to relevant reports from CCTV.com, Longsun Group and Ant Digital completed the first domestic RWA based on new energy physical assets (i.e., physical asset tokenization) in Hong Kong, with an amount of approximately RMB 100 million.

As the operator and service provider of the new energy digital platform, Longsun's Xindiantu currently covers nearly 400 cities across the country, with more than 1,800 cooperative operators, more than 1.4 million connected charging devices, and more than 15 million registered users. In this first RWA attempt, Xindiantu used some of the charging piles operated on the platform as RWA anchor assets, and issued "charging pile" digital assets on the blockchain based on trusted data. Each digital asset represents part of the income rights of the corresponding charging pile.

Ant Chain, a subsidiary of Ant Digital Technology, provides technical support to ensure the security, transparency and non-tamperability of data on the asset chain. This innovative approach greatly improves the efficiency of asset management and risk control capabilities, while creating a clear and credible green investment environment for investors.

Longxin Group pointed out that in the future, it will continue to empower the development of new energy RWA with professional services, help small and medium-sized operators to enhance asset value and obtain convenient financing opportunities, and release business development momentum by enriching long-term capital.

Industry insiders believe that the financing method of new energy RWA trusted chain uses multiple technologies such as the Internet of Things, blockchain, and artificial intelligence to provide a unique and innovative financing channel with broad development prospects for new energy asset investors, builders, and operators. It also provides a new investment channel for global investors and investors outside China to invest in China's new energy assets, and provides a new way to link assets and funds on both ends of the supply and demand sides. The innovative financing method of new energy RWA trusted chain will help China's large number of small and medium-sized energy storage, charging pile operators and other energy companies to revitalize existing high-quality assets, improve the liquidity of heavy assets, form a virtuous cycle of investment and financing, accelerate the green transformation of my country's energy structure, and truly realize technology empowerment of physical assets. The injection of new capital will promote new energy to move towards intelligence and greening, and help the construction and development of China's new energy industry.

Although the initial stage of the Ensemble project focused on specific topics such as green finance and fixed income, Mankiw predicts that it will expand to a wider range of asset classes over time. As the HKMA further refines its understanding of tokenization of real-world assets, Ensemble has the potential to expand into areas such as real estate, trade finance, and intellectual property tokenization. A plausible timeline for this evolution could be within the next 2-3 years, which is consistent with the broader adoption curve observed in fintech innovations. This gradual expansion could impact Hong Kong's financial ecosystem, further integrating tokenized assets into the institutional framework and increasing liquidity in niche markets. Such an expansion would not only contribute to the establishment of a strong RWA ecosystem in Hong Kong, but would also enhance investor confidence. With increased transparency and wider access to tokenized assets, this development has the potential to consolidate Hong Kong's position as a regional digital financial center.

The assets involved in RWA projects often span different jurisdictions, such as Longsun Group's new energy assets located in mainland China, while financing activities are conducted in Hong Kong. This requires coordination of the laws of the two places. In mainland China, the asset management and financing of new energy projects need to comply with local energy regulatory policies and financial laws, while in Hong Kong, they need to comply with local securities laws and financial regulations. This cross-border legal coordination requires detailed legal due diligence before the project is implemented to ensure the smooth progress of the project.

The issuance of tokens in Hong Kong involves compliance requirements at multiple legal levels. In particular, under the existing financial regulatory framework, issuers need to handle it with caution to ensure compliance with the regulations of the Hong Kong Securities and Futures Commission (SFC).

First, the issuer must clarify whether its token is a security. According to the Hong Kong Securities and Futures Ordinance (SFO), the definition of securities includes shares, bonds, unit trusts, derivatives and other forms. The SFC's guidelines clearly state that if a token gives the holder the right to share in the company's profits or participate in management, then the token will be considered a security. Therefore, the actual function of the token and the rights of the holder are key considerations, and the formal design cannot circumvent the application of securities law.

Once a token is identified as a security, the issuer needs to prepare and publish a prospectus or offering document that complies with the requirements of the Securities and Futures Ordinance. These documents should disclose in detail the nature, risks, issuance method, financial status and management information of the token. Failure to comply with these disclosure requirements may result in the issuance activity being deemed illegal. However, in certain circumstances, such as when the token is only intended for professional investors or qualified investors, the issuer may be exempted from issuing a full prospectus. However, even with an exemption, the issuer is still required to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

In addition, if the token issuance involves intermediary business, such as arranging token sales or providing advisory services, the relevant institution or individual may need to apply for an appropriate license (such as a Type 1 license: a securities trading license) under the Securities and Futures Ordinance. Engaging in regulated activities without permission will be considered illegal and may result in fines or criminal liability. As Hong Kong strengthens its regulation of the crypto asset market, virtual asset service providers (VASPs) also need to ensure that their services meet the requirements of the SFC, including applying for licenses and complying with relevant regulations.

Investor protection is also an important consideration in token issuance. When selling tokens to investors, issuers need to conduct investor suitability tests to ensure that investors understand the investment risks and have the corresponding risk tolerance. For retail investors, strict control is especially required to prevent investment losses caused by information asymmetry or insufficient investor education. At the same time, the SFC has a zero-tolerance policy on market manipulation and false statements. Issuers must ensure that all public statements and promotional materials are true and accurate, and must not make misleading statements or exaggerate the potential benefits of tokens.

Transparency and continuous disclosure obligations are also key compliance requirements that token issuers must comply with. Once a token is identified as a security, the issuer must disclose any major events or information in a timely manner, such as changes in financial status or management changes, to ensure market transparency and investors' right to know. In addition, the Token issuer may need to submit reports to the SFC regularly to explain the operation, market performance and compliance status of the Token to help regulators monitor market operations and prevent potential risks.

When it comes to cross-border financing, the regulatory provisions on foreign exchange management and cross-border capital flows must also be considered. RWA projects based on new energy physical assets usually involve large cross-border flows of funds. According to China's current foreign exchange management regulations, cross-border capital flows must be carried out under the supervision of the State Administration of Foreign Exchange. Therefore, the project party needs to pay special attention to the compliance of foreign exchange management to ensure that relevant regulations will not be violated during the project financing process to avoid restrictions on capital flows.

Let's use a simple case to explain the compliance issues of cross-border capital flows:

Suppose Xiao Ming owns a new energy company in mainland China that specializes in operating charging piles. In order to expand his business, Xiao Ming decided to raise funds through the financial market in Hong Kong.

Xiao Ming set up an SPV company in Hong Kong

In cross-border financing, setting up an SPV (special purpose vehicle) is a common structuring method. According to China's Company Law and relevant laws of Hong Kong, companies can set up independent SPVs in Hong Kong for specific purposes, such as asset holding and financing.

Xiao Ming set up an SPV company in Hong Kong. The purpose of doing so is to tokenize its new energy charging pile assets through the SPV and raise funds in the Hong Kong market. Through the SPV, Xiao Ming can flexibly manage assets and raise funds while avoiding the complexity of conducting such transactions directly in mainland China.

Raising funds in Hong Kong through SPV

According to the Hong Kong Securities and Futures Ordinance, if securities or tokens are issued in Hong Kong, they must comply with Hong Kong securities regulatory requirements, including registration, disclosure and investor protection requirements. In addition, token issuance may be regarded as securities and needs to comply with the Hong Kong securities regulatory framework.

Xiaoming's SPV company raises funds by issuing tokens related to new energy charging piles. Xiaoming needs to ensure that the issuance of these tokens complies with Hong Kong's securities regulations, including the necessary registration and disclosure with the Hong Kong Securities and Futures Commission (SFC) to ensure that investors' rights and interests are protected.

Repatriating funds to the mainland

China's Foreign Exchange Administration Regulations stipulate that enterprises must comply with the regulations of the State Administration of Foreign Exchange (SAFE) when conducting cross-border capital flows. In particular, when large amounts of funds are remitted inward, enterprises need to submit relevant applications to the State Administration of Foreign Exchange, explain the purpose of the funds, and obtain approval.

After Xiao Ming's SPV company successfully raises funds in Hong Kong, it needs to remit the funds back to mainland China. According to the "Foreign Exchange Administration Regulations", Xiao Ming needs to submit an application to the State Administration of Foreign Exchange, explaining the source of funds (financing through the Hong Kong market) and the purpose (for the expansion of new energy projects). After the State Administration of Foreign Exchange reviews and approves it, Xiao Ming can legally remit the funds back to the mainland.

Use and management of funds

According to the regulations of the State Administration of Foreign Exchange, the funds remitted from abroad by enterprises usually need to be deposited in special purpose accounts (such as foreign exchange capital accounts) and used in accordance with approved purposes. The use of funds may need to be reported to the State Administration of Foreign Exchange on a regular basis to ensure its compliance.

Once the funds are remitted back to mainland China, Xiao Ming's company needs to keep the funds in a dedicated foreign exchange account and use them for the purpose for which they were originally applied. For example, to purchase new charging pile equipment or build new charging stations. If the use of the funds changes, it may be necessary to re-declare and re-approval from the State Administration of Foreign Exchange.

Cross-border data transfer is a highly sensitive compliance area, especially when it comes to data flows between mainland China and Hong Kong. When companies transfer data across borders, they must meet the regulatory requirements of both places to ensure the security and legality of data transfer. This includes not only technical measures for data processing, but also user awareness, privacy protection and compliance processes. By strictly following the legal framework, companies can reduce compliance risks in cross-border data transfer, protect user privacy and ensure the legal operation of projects.

Regulatory requirements in Hong Kong:

In Hong Kong, the Personal Data (Privacy) Ordinance (PDPO) is the main legal basis for regulating the processing of personal data. The Ordinance clarifies the basic requirements for companies when collecting, processing, storing and transmitting personal data. In particular, when transferring data across borders, companies need to focus on the following aspects:

Legality and transparency of data transfer. When companies transfer personal data to areas outside Hong Kong, they must ensure that such transfer is legal and transparently disclose to users the purpose, location and identity of the recipient of the data transfer. According to Article 33 of the Personal Data (Privacy) Ordinance, although it has not yet been formally implemented, it stipulates in principle that companies shall not transfer personal data to areas with a lower level of privacy protection than Hong Kong without the approval of the Office of the Data Protection Commissioner (PCPD). Therefore, companies must conduct due diligence to ensure that the data privacy protection standards of the recipient's country or region are equivalent to or higher than those in Hong Kong.

User informed consent. According to the PDPO, companies must obtain explicit consent from users before conducting cross-border data transfers. This means that companies need to clearly explain to users how the data will be processed, the destination of the transfer, potential privacy risks, etc. If the user refuses to provide consent, the company must provide reasonable alternatives or take measures to limit the scope and type of data transfer.

Data minimization and purpose limitation. The principle of data minimization requires companies to collect only the minimum amount of data required to complete a specific task when collecting and processing data. For example, an e-commerce company should only collect personal information required by users to complete a purchase, and should not collect other data unrelated to the purchase. The principle of purpose limitation requires that data processing is limited to the purpose originally set to prevent data from being abused.

Responsibilities of data processors. Hong Kong law requires companies to ensure that when selecting overseas data processors, they have adequate privacy protection capabilities. Companies need to sign a legally binding agreement with overseas processors to clarify their responsibilities. These agreements should cover technical measures, data breach handling plans, etc. to ensure that overseas data processors take appropriate protective measures.

Data retention and deletion policy. The PDPO requires companies to formulate clear data retention and deletion policies to ensure that personal data is only retained for the necessary period and securely deleted after the retention period is reached. For data transferred across borders, companies must also ensure that overseas processors also comply with this policy. For example, when users request to delete data, companies and processors need to take measures to ensure that the data is completely removed to prevent secondary leakage.

Regulatory requirements in mainland China:

In mainland China, cross-border data transfer is subject to strict legal supervision. The Cybersecurity Law, the Data Security Law and the Personal Information Protection Law constitute the main legal framework for companies when conducting cross-border data transfer. These laws clearly stipulate the responsibilities and obligations of companies in protecting personal information and important data, especially during data transmission and storage.

ZKP, as a privacy protection and compliance technology, can effectively help companies cope with these legal requirements.

First, mainland China requires companies to conduct strict security assessments and obtain explicit consent from users when transferring personal information and important data across borders. These measures can ensure that ZKP technology meets the compliance requirements for cross-border data transmission while ensuring data privacy. Companies are also required to sign legally binding agreements with overseas institutions that receive data to ensure that adequate security protection measures are taken for the data.

Second, companies need to establish a sound compliance mechanism, regularly record and audit cross-border data transmission, and conduct risk assessments and compliance reviews in a timely manner to cope with the regulatory requirements of mainland China and Hong Kong. This process can help companies proactively identify potential risks and take corrective measures in data processing and cross-border transmission to ensure their operational compliance.

Regular compliance reviews and risk assessments: In order to ensure the long-term compliance of the RWA tokenization project, companies need to conduct compliance reviews and risk assessments on a regular basis. As global data privacy laws continue to evolve, companies must constantly adjust their data management strategies to ensure that their data processing processes comply with the latest legal and regulatory requirements. In particular, in Hong Kong and mainland China, ZKP technology can serve as an effective tool to help companies cope with the ever-changing challenges of privacy protection and regulation, and ensure their continued operation and growth in a strict regulatory environment.

Zero-Knowledge Proof ("ZKP") allows a party to prove the authenticity of a statement without revealing any additional information, thereby achieving the dual goals of data verification and privacy protection. This technology not only meets the regulatory requirements for data privacy in Hong Kong and mainland China, but also provides companies with an effective means to deal with compliance challenges.

In RWA tokenization, ZKP can be applied to the following aspects:

Asset ownership verification. ZKP can prove that an entity owns a specific tokenized asset without revealing the entity's identity or other sensitive information.

Transaction compliance verification. ZKP can prove that a transaction complies with relevant regulations and agreements without revealing the specific details of the transaction.

User identity verification. ZKP can prove that a user's identity meets specific conditions (for example, investor qualifications) without revealing the user's personal information.

By adopting ZKP technology, the RWA tokenization platform can maximize user privacy while ensuring data security and transparency, thereby promoting the healthy development of the RWA tokenization industry. In addition, enterprises can also meet the dual challenges of data privacy and compliance requirements through privacy-enhancing technologies such as ZKP and hybrid chain technology, thereby ensuring data security and preventing sensitive information from being leaked or abused during transmission.

Asset tokenization will bring a series of complex tax considerations to asset owners and investors, involving multiple aspects. First, the sale or transfer of tokenized assets may trigger capital gains tax or stamp duty, depending on the nature of the underlying assets. For example, the tokenization of real estate or financial assets may be subject to different tax rules. In addition, due to the decentralized and global nature of tokenization, transactions in such assets often involve cross-border activities, further exacerbating the complexity of taxation. Cross-border tax issues may include withholding taxes, double taxation, and how tax treaties in different jurisdictions apply to transactions in tokenized assets.

Moreover, in some cases, investors and companies may face questions about how to classify and declare tokenized assets. For example, whether to treat tokenized assets as securities, commodities or currencies has a direct impact on their tax treatment. Since tax compliance involves a wide range of regulations and rules, unclear regulatory guidance may lead to companies and investors facing high fines or litigation risks, especially in complex structures involving multinational investors and different tax systems.

Therefore, a clear tax and regulatory framework for such assets is essential to ensure the smooth development of tokenized assets. Tax authorities in various countries will need to provide detailed guidance to help market participants better understand the tax treatment of tokenized assets in order to reduce compliance risks and pave the way for tokenized innovation in the global market.

In RWA projects, clear legal documents and effective dispute resolution mechanisms are key links to ensure the smooth progress of the project and the protection of the rights and interests of stakeholders. Since RWA projects involve complex cross-border transactions and multiple parties, the accuracy and completeness of legal documents are particularly important. In addition, the design of the dispute resolution mechanism is directly related to the handling methods and results of disputes between the parties during the implementation of the project.

First, detailed legal contracts must be signed between all parties, which should clearly define the rights, obligations and responsibilities of each party. In RWA projects, contracts usually involve multiple levels of content, including the tokenization process of assets, the rights and interests of token holders, the distribution of proceeds, and the terms of data management and privacy protection. The rights of token holders must be clearly listed in the contract, especially for the part involving the distribution of income, which needs to clarify the calculation method, distribution cycle and various factors that may affect the income. In addition, the contract must also contain clear breach of contract liability clauses. If the participating parties fail to perform their contractual obligations, the contract should specify in detail the legal liabilities and compensation measures that the breaching party should bear. This can not only reduce disputes caused by differences in understanding or performance issues during the operation of the project, but also provide parties with a clear legal basis when disputes occur and quickly resolve problems.

For parts involving cross-border transactions, legal documents need to pay special attention to the legal differences between jurisdictions. Since RWA projects may involve the laws of multiple countries or regions, the applicable law and the jurisdiction for dispute resolution should be clearly specified in the contract to reduce the complexity caused by future legal conflicts. Generally, choosing a neutral jurisdiction that is acceptable to all parties can reduce legal risks and improve the efficiency of dispute resolution. Arbitration clauses are one of the common dispute resolution methods in cross-border transactions. By incorporating arbitration clauses into contracts, parties can obtain fair arbitration through arbitration institutions when disputes arise, without having to go through lengthy and complicated court proceedings. Arbitration institutions usually have transnational legal experience and are better able to handle complex disputes involving multiple jurisdictions. Therefore, it is recommended to clearly select arbitration as the preferred dispute resolution method in the contract and designate an international arbitration institution recognized by both parties, such as the International Chamber of Commerce (ICC) or the Hong Kong International Arbitration Center (HKIAC). At the same time, the contract should stipulate the law applicable when the dispute occurs. Since RWA projects usually involve the laws of multiple countries, choosing a country that is acceptable to all parties and has a relatively stable legal environment as the applicable law of the contract can provide a clearer legal basis for dispute resolution. Hong Kong law is often selected as one of the applicable laws in cross-border transactions due to its mature commercial legal system and independent judicial system.

Continuous update and review of documents. Legal documents are not static. As the project progresses and the external environment changes (such as the update of laws and regulations or changes in market conditions), the contract and related legal documents may need to be updated and revised. To this end, project participants should establish a regular document review mechanism to ensure that the content of the contract is always consistent with the actual situation of the project and legal requirements. When potential risks or compliance issues are discovered, the parties should promptly revise the contract to avoid disputes caused by delayed or inaccurate legal documents. Through well-designed legal documents and dispute resolution mechanisms, RWA projects can operate effectively in the complex environment of cross-border transactions and reduce risks caused by contract ambiguity or legal conflicts. All parties should fully discuss and determine the appropriate legal framework and dispute resolution mechanism at the beginning of the project to ensure the legal security and sustainability of the project.

Hong Kong's RWA projects, such as Ensemble, demonstrate the deep integration of FinTech and green finance and provide valuable experience for the digital transformation of global financial markets. With the rapid development of the RWA field, companies and investors need to face increasingly complex compliance challenges. Therefore, understanding and complying with local and international regulations and formulating sound legal documents and dispute resolution mechanisms will be the key to project success.

In the future, the Ensemble project is expected to cooperate or share knowledge with international projects such as Ubin in Singapore, help establish global tokenization and blockchain regulatory standards, and further enhance Hong Kong's international status. By learning from the experience of other financial centers, Hong Kong can accelerate the development of its RWA ecosystem.

As the Ensemble project moves from the sandbox to actual application, the regulatory environment will also evolve. It is expected that a customized licensing system will be introduced in the future, especially to strengthen supervision in KYC, AML, data governance and cybersecurity. In addition, the regulatory sandbox may also be extended to emerging technology areas such as DeFi, AI and digital identity solutions, ensuring that Hong Kong's regulatory framework is both flexible and supportive of innovation.

The continued development of Ensemble will drive the transformation of Hong Kong's financial market. Traditional banks will be forced to accelerate their pace of innovation, fintech companies will expand their markets through projects, and institutional investors can broaden their investment options with the help of tokenized assets. As the global demand for sustainable development increases, the application scenarios of RWA, especially financing in the real economy such as new energy, will be further expanded. In short, the RWA project is expected to become an important force in promoting changes in the global financial system in the coming years, and Hong Kong will play a vital role in this change.

According to Certik's Skynet Ranking, bitsCrunch ranks 38th in the field of artificial intelligence and 8th among AI projects not yet listed on exchanges.

Snake

SnakeAmidst speculation, Cosmos Network's ATOM token eyes potential growth following the proposed merger of two key decentralised exchanges, Osmosis and UX Chain, within its ecosystem.

YouQuan

YouQuanhis authorization allows Crypto.com to expand its product offerings in the UK market.

Alex

AlexThe OpenAI controversy reflects a battle between corporate profits and altruistic goals in AI, prompting concerns about societal impact and the call for democratic governance.

Hui Xin

Hui XinMistral AI, a French startup, is securing a remarkable $487 million in funding led by Andreessen Horowitz, positioning it as a strong competitor in the AI market against giants like OpenAI.

YouQuan

YouQuanThe Internal Revenue Service's Criminal Investigations Unit is reportedly grappling with a surge in crypto-related tax evasion cases

Aaron

AaronOpenSea, once a dominant player, now holds only 17% of the market share

Alex

AlexDespite this, Bukele has declared that El Salvador has no intention to sell.

Alex

AlexThe U.S. Securities and Exchange Commission (SEC) has prolonged the evaluation period for NYSE Arca's proposed rule change, aiming to list Grayscale Ethereum Trust shares as an exchange-traded product.

Aaron

AaronAmidst a surge in cryptocurrency interest, Phoenix Group's debut on the Abu Dhabi Securities Exchange marks a pivotal moment in the region's financial evolution.

Hui Xin

Hui Xin