Author: Ciaran Lyons, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

The growing global M2 money supply could spark a sharp rise in Bitcoin, but analysts warn against betting everything on the emerging signal.

Pav Hundal, chief analyst at Australian cryptocurrency exchange Swyftx, noted: "This is not a market to bet all money on a quick correction, but our core forecast remains a strong move in March and beyond."

"It's not all doom and gloom"

"In normal times, global easing measures are a fairly reliable leading indicator for cryptocurrencies," Hundal said. "The data we have suggests that spot buyers are currently active and the U.S. has raised its debt ceiling by $4 trillion."

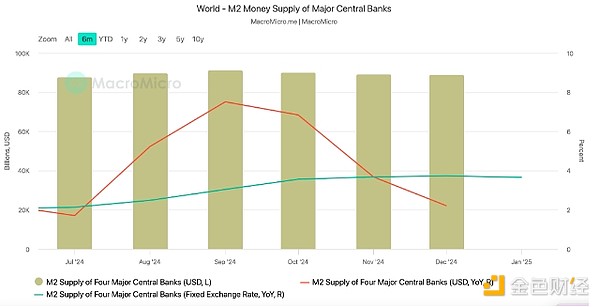

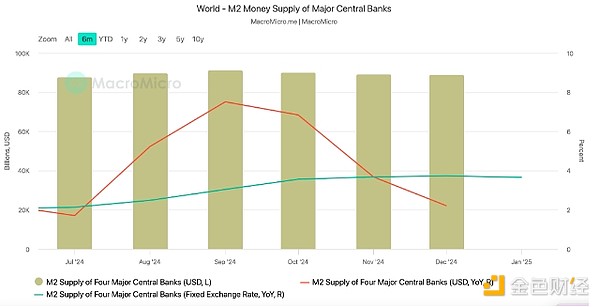

"It's not all doom and gloom," he added. According to MacroMicro, the M2 money supply of the four major central banks reached 3.65% year-on-year in January at a fixed rate.

The M2 supply of the four major central banks reached 3.65% in January. Source: MacroMicro

Many cryptocurrency analysts point out that historical trends show that increases in the global M2 money supply lead to higher Bitcoin prices, which is caused by increased liquidity and lower interest rates.

Economist Lyn Alden wrote in a September research note that Bitcoin moves in the direction of global M2 83% of the time.

Surge in U.S. Money Supply Could “Fuel Bitcoin’s Parabolic Rise”

“A weaker dollar has been a net positive for global M2 and hopefully it’s only a matter of time before Bitcoin does the same,” crypto analyst bitcoindata21 said in a Feb. 25 post.

Crypto analyst Colin Talks Crypto struck a similar note in a post, saying, “Global M2 money supply forecasts major volatility for Bitcoin.”

Investment research account Bravo Research said in a Feb. 25 post that U.S. money supply surged in just 10 days. Bitcoin fell below $90,000 on Feb. 25 for the first time since November, a day after Trump said his planned 25% tariffs on Canada and Mexico were "on schedule and on schedule." Earlier this month, he agreed to suspend the tariffs for 30 days.

Brian

Brian