Written by Lostin, Helius Translated by Glendon, Techub News

If you hold SOL tokens and want to stake them, but don't understand Solana's staking mechanism? Don't worry, this guide will provide you with a comprehensive overview of SOL staking, covering the most common questions and all key areas. Let's get started!

Why stake SOL?

Staking SOL is not just about getting rewards - it is also crucial to the decentralization and security of Solana. By staking, SOL token holders can contribute to the stability and governance of the network. In this process, it is very important to choose a suitable validator to stake. Delegating tokens to a validator is like voting in a representative democracy, which reflects the trust that the validator can stay highly online and process blocks quickly and accurately. Other considerations include the validator’s ethical behavior, response to hard forks, and contribution to the Solana ecosystem.

Distributing staking power among reputable validators further promotes the decentralization of the network and effectively prevents any single well-funded entity from manipulating consensus decisions for personal gain.

What happens when you stake?

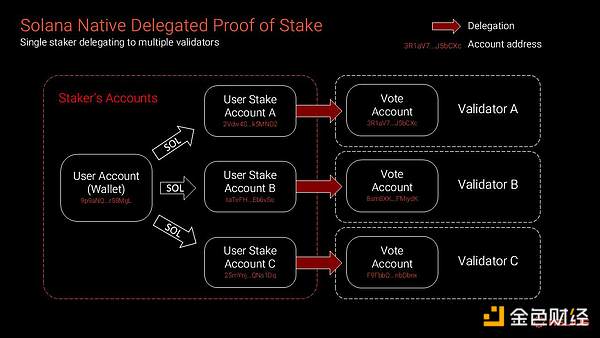

There are two types of staking on Solana: native staking and liquidity staking. Currently, 94% of staked SOL is in the form of native staking, so this article will focus on this form and briefly introduce liquidity staking later. For native staking, users can operate through a variety of platforms, including multi-signature fund management tools (such as Squads), popular wallets, and dedicated staking websites. The process of native staking is relatively simple: users simply deposit their tokens into a staking account and then delegate them to the validator’s voting account. A single user can create multiple staking accounts, each with the flexibility to delegate to the same or different validators.

Above: Single staker delegates to multiple validators

Each staking account has two key permissions: staking permission and withdrawal permission. These two permissions are automatically set by the system at the beginning of account creation and are assigned to the user's wallet address by default. Each permission has its own clear responsibilities. Withdrawal permission has higher control over the account, it has the right to remove tokens from the staking account and allows users to update the allocation of staking permissions.

The most important time unit in staking is the epoch. Each Solana epoch lasts for 432,000 slots, which is about two days. Staking rewards are automatically distributed to stakers every time a new epoch begins. There is no manual work required for stakers to do this, and they will see their account balance increase at the end of each epoch. Alternatively, users can claim their MEV rewards directly through the Jito website (more on this later).

When you stake SOL natively, your tokens are locked for the duration of the current epoch. If a user unstakes at the beginning of an epoch, there may be a cool-down period of up to two days before they can withdraw. If they withdraw at the end of an epoch, the process will be almost instant with no additional waiting.

Similarly, there is a warm-up period to start staking, which can last two days or be almost instant, depending on when the user starts their staking account. During this process, users can check the Solana block explorer to track the progress of the current epoch.

How do operators make money?

Validator operators make money in three main ways:

Issuance/Inflation: New tokens are issued

Priority fees: Users send SOL to validators to prioritize their transactions

MEV rewards: Users pay Jito tips to validators to include transaction packages

Validators’ revenue is all denominated in SOL, and the size of their revenue is directly tied to their staked amount. Operating costs are mostly fixed and denominated in a mix of SOL and fiat currency.

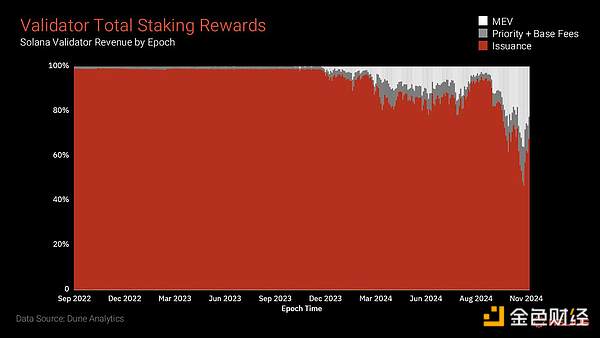

Above: Solana Validator Total Staking Rewards (Data Source: Dune Analytics, 21.co)

Token Issuance

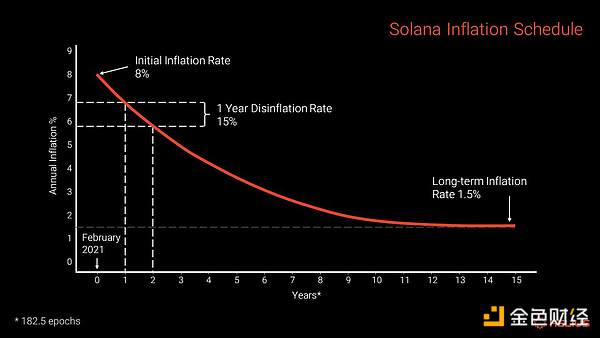

Solana regularly issues new SOL tokens according to the inflation plan and distributes these tokens to validators as staking rewards at the end of each epoch. Currently, Solana's inflation rate is 4.9%, and this rate will decrease by 15% each year until it eventually stabilizes at a long-term inflation rate of 1.5%.

The amount of staking rewards a validator receives depends mainly on the number of points it earns by correctly voting to become a block node on the chain. If a validator experiences downtime or fails to vote in a timely manner, the points it receives will be reduced. With an average number of points, a validator with 1% of the total staked amount can expect to receive rewards of approximately 1% of the total inflation.

In addition, the validator's staking rewards are further broken down and allocated based on the size of the delegation of its stakers. In the process, the validator can charge a certain percentage of the total inflation rewards received by its stakers as a commission. This commission rate is usually a single-digit percentage, but can be any number between 0% and 100%.

Above: Solana Inflation Schedule

Priority Fees

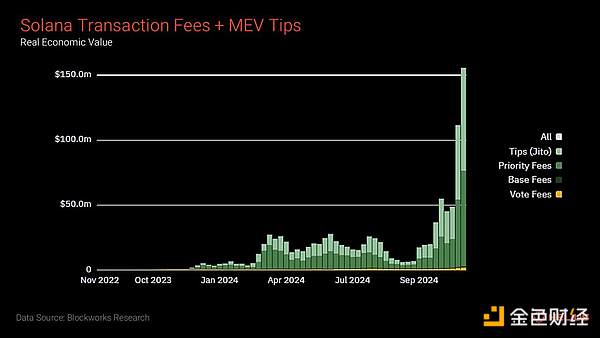

In the Solana network, validators selected as current block builders receive fees from each transaction processed, which are divided into two types: basic fees and priority fees. These fees are immediately credited to the validator's identity account. Prior to this, validators could receive 50% of the basic fee and 50% of the priority fee, and the rest was destroyed. With the passage of SIMD-96, this fee structure is coming, and block producers will be allowed to receive 100% of the priority fee.

By paying the priority fee, they can ensure that their transactions are processed first in the block. This mechanism is particularly important in a variety of scenarios, including arbitrage, liquidation, and NFT minting, which often have extremely high transaction speed requirements. Because complex transactions require more computing power, they usually require higher priority fees. Generally speaking, accounts with popular tokens with high demand require higher priority fees.

Compared to priority fees, although the base fee contributes relatively less revenue, it plays an indispensable role in preventing spam. In order to maintain the security and stability of the network, the Solana system fixes the base fee at 0.000005 SOL (5000 lampors) per signature to reduce the risk of malicious transactions and network congestion.

MEV (Jito) Rewards

Currently, validators operating the Jito validator client account for more than 90% of the total SOL staked. Jito introduces an off-protocol block space auction mechanism that takes place off-chain, allowing searchers and applications to submit groups of transactions called bundles. These bundles typically contain time-sensitive transactions, such as arbitrage or liquidation. To incentivize block builders to prioritize these transactions, each bundle comes with a "tip". This provides validators with an additional source of income in addition to priority fees and base fees.

In 2024, Jito's MEV revenue has grown from negligible to the main source of income for validators. For validators, they can use a mechanism similar to inflation rewards to set and collect their MEV commissions. And stakers also share the remaining fees based on the relative size of their delegation to block builders.

Above: Data quantifying the growth of priority fees and Jito tips. Data source: Blockworks Research

Where does APY come from?

The annualized percentage yield (APY) is an important indicator of the annualized compound percentage yield that a staker can earn if they stake at the current interest rate for a full year. This yield is affected by a variety of complex factors, including but not limited to the current issuance rate of the network, the performance and uptime of the validator, the user's reward to the validator, and the current staking rate (that is, the proportion of staked SOL to the total amount). Currently, multiple websites provide a list of validators ranked by APY, among which StakeWiz is one of the most comprehensive websites.

Specifically, the sources of APY are mainly divided into two parts: issuance rewards and MEV rewards.

Issuance rewards

In the Solana network, validators distribute staking rewards based on the scale of their stakers' delegation. When distributing rewards, validators will charge a certain percentage of service commissions, ranging from 0% to 100%. In addition, the rewards obtained by validators are not only determined by the scale of their stakers' delegation, but also closely related to their voting performance. Each successful vote will earn points for the validator, and these points are an important basis for them to obtain rewards.

Based on the following factors, well-managed validators will generate higher rewards:

Minimum downtime: Validators will not receive points during downtime because they cannot participate in voting.

Timely voting: If validators continue to lag in consensus participation, they may receive fewer points.

Accurate voting: Points are only awarded if you vote on subsequently confirmed blocks.

MEV (Jito) Rewards

MEV rewards are playing an increasingly important role in the composition of staking rewards. This growth is driven by growing on-chain transaction volume and the resulting arbitrage opportunities. In the near term, Jito MEV tips account for about 20-30% of total rewards, greatly improving the returns of stakers. Similar to issuance rewards, validators receive commissions ranging from 0% to 100% on MEV tips. In addition, Jito also charges a 5% commission on all MEV-related revenue as a platform service fee.

Other Considerations

However, stakers do not focus solely on commission percentage when choosing a validator. Although low-commission validators may bring higher direct returns, many still tend to choose high-commission validators such as Coinbase, driven by factors such as vendor lock-in and regulatory arbitrage. For example, funds using Coinbase Custody must usually be staked exclusively on Coinbase's validators. On the other hand, centralized exchanges also benefit from retail users' behavior of prioritizing convenience over yield optimization. For off-chain users, they may not be sensitive to sub-par returns, which gives exchanges greater flexibility in the rewards they offer.

Finally, new protocol mechanisms such as SIMD-123 are designed to let validators share block rewards directly with stakers. If successfully implemented, this will provide stakers with an additional source of income.

Key Players in the Solana Staking Ecosystem

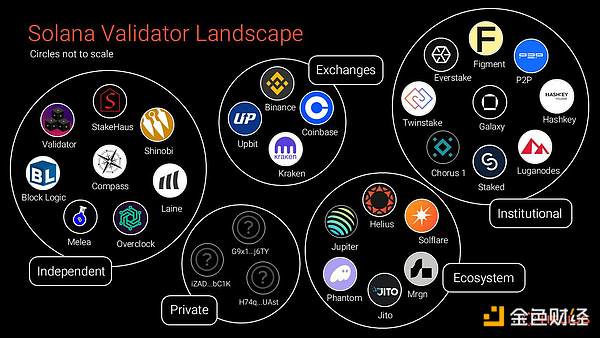

Solana validators can be divided into several categories.

Ecosystem Teams

Many notable Solana application and infrastructure teams run validators that complement their core businesses. For example, Helius runs a validator to support its RPC service.

Examples:

Helius

Mrgn

Jupiter

Drift

Phantom

Centralized Exchanges

Centralized Exchanges are one of the Solana validators with the highest staking rates, providing a one-click staking solution for off-chain exchange customers.

Examples:

Kraken

Coinbase

Binance

Upbit

Institutional Solution Providers

These companies specialize in providing customized staking services for institutional clients. They support multiple blockchains to meet a wider range of customer needs.

Example:

Figment

Kiln

Twinstake

Chorus One

Independent Teams

Solana’s validator ecosystem includes many independently operated mid-sized and long-tail validators. Some validators have been active since genesis and contribute to the ecosystem through education, research, governance, and tool development.

Examples:

Laine

Overclock

Solana Compass

Shinobi

Private Validators

The network also has over 200 private validators. Their stake is self-delegated and may be controlled by an operating entity. These validators are characterized by a 100% commission rate and no public identity information on the block explorer and dashboard.

What is Liquidity Staking?

Liquidity staking allows users to diversify their staking exposure across multiple operators through staking pools, which are able to issue Liquidity Staking Tokens (LSTs), which represent a user's ownership share in the underlying staking account.

LSTs

LSTs are a yield asset that accrues rewards based on the annualized yield (APY) of the underlying staking account. In native staking, each epoch reward directly increases the staked SOL balance. Unlike native staking, in liquidity staking, the number of LSTs remains constant, but their value relative to the SOL token increases over time.

LSTs improve the capital efficiency of staking by unlocking DeFi opportunities. A typical example is depositing LSTs as collateral on a lending platform, which enables users to perform lending operations while maintaining their positions and still receive staking rewards.

Currently, although only 7.8% of SOL pledges are liquid pledged, the growth rate of this part is very rapid. Data shows that liquidity pledges have accumulated 32 million SOL, up from 17 million at the beginning of 2024, with an annual growth rate of 88%. Among them, JitoSOL has become the most popular liquidity pledge token among Solana LSTs with its 36% market share. Other notable options include Marinade (mSOL) and JupiterSOL (jupSOL), which account for 17.5% and 11% of the market respectively. Tax advantages

In fact, liquidity pledge also brings tax advantages to users. In many jurisdictions, staking rewards issued in the form of tokens are considered taxable events, (similar to stock dividends) and are taxed as income when received. However, since the mechanism of LSTs is such that the user's wallet balance remains unchanged and only the value increases, users do not trigger a taxable event every time a reward is issued.

Is SOL staking safe?

Native staking provides a direct and secure way for stakers to participate in the network validation process. In this way, stakers always control and keep their SOL. If the validator is offline or performs poorly, non-custodial stakers have the right to unstake at any time and freely switch to other validators with better performance. In the event of a network outage, the position of the native staker is also not affected and will remain unchanged once network activity resumes.

Similarly, as another option, liquidity staking also provides security in its own unique way. Currently, the staking pool program has been audited nine times by five reputable companies to ensure its robustness. Nevertheless, investors still need to be aware of market volatility and potential risks when using liquidity staking. During adverse market conditions or "black swan events", LSTs may trade temporarily below their underlying value. While these deviations are generally short-lived, investors should consider tail risks, especially when using LST as collateral.

Punishment Mechanism

Slashing is a penalty mechanism that curbs malicious or harmful behavior by reducing delegated stakes. Although Solana has not yet implemented a slashing mechanism, network developers are actively considering this option and may introduce it in the future.

Finally, stakers should follow best practices and securely manage their private keys to prevent loss or theft.

How does staking SOL differ from staking ETH?

Solana and Ethereum differ in their staking methods. Solana integrates delegated proof-of-stake (dPoS) directly into its core protocol, enabling delegation without relying on external solutions. This design has resulted in Solana’s staking participation rate reaching 67.7%, a significant percentage of total supply, much higher than Ethereum’s 28%. In contrast, Ethereum’s transition from proof-of-work to proof-of-stake has relied more on third-party platforms such as Lido and Rocket Pool to provide delegation and liquidity staking services.

On Ethereum, on the other hand, home staking is the only native staking option, which requires validators to have high technical proficiency and specialized hardware. Validators must stake at least 32 ETH and ensure that their hardware is always online and fully maintained. This self-custodial approach has earned Ethereum a reputation as a highly decentralized blockchain, with thousands of home stakers forming the foundation of the network.

While home staking has a prominent presence on Ethereum, liquidity staking is also widely used through some major platforms. Among them, Lido occupies a leading position in the market, controlling more than 28% of the staked ETH supply. Lido enables investors to enjoy staking rewards while maintaining ETH holdings by issuing yield tokens stETH. However, like all liquid staking tokens, stETH also faces some risks, including smart contract vulnerabilities and stETH price deviations from ETH. More importantly, Ethereum's inflation returns are relatively low, and the annual interest rate for staking ETH with Lido is only 2.9%, which is much lower than the yield of staking SOL. In addition, Lido charges a 10% fee on staking rewards, which further reduces the actual return of investors.

Finally, it is worth affirming that Ethereum includes a slashing mechanism to punish validators for improper behavior, but slashing events rarely occur.

Conclusion

This article comprehensively explores the concept, mechanism and importance of Solana staking. Whether it is experienced participants or newcomers to the Solana ecosystem, a deep understanding of staking is crucial. Staking not only provides a way for long-term SOL holders to obtain competitive returns, but also is a core element that supports the basic mechanism of Solana network security and decentralization.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Jasper

Jasper Jasper

Jasper Hui Xin

Hui Xin Hui Xin

Hui Xin Joy

Joy Jixu

Jixu Jixu

Jixu