Author: Viee; Source: Biteye

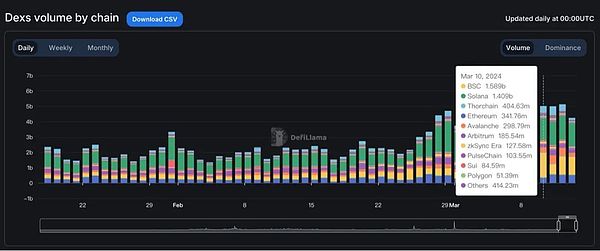

According to DeFiLlama data, DEX transactions on the BSC chain on March 10 The volume surpassed the DEX on the Ethereum chain and took the top spot in one fell swoop.

At the same time, BNB’s price has increased by nearly 30% in the past week, and trading volume has also increased significantly. The performance so far in 2024 is better than that of similar tokens, with the largest increase among exchange tokens and a far leading increase among public chain native tokens.

As the native token of Binance Exchange and the BNB Chain fuel token, such eye-catching popularity naturally triggered the market’s bullish sentiment towards BNB, the golden shovel.

Why is BNB token the golden shovel of this bull market? What wealth code does this round of rise contain? The next book will take you to explore the huge potential and opportunities of BNB tokens.

01 BNB Recent gains

Recently, the price of BNB has surged again, briefly exceeding 630 USDT, hitting a high of 630 USDT on December 2, 2021 new high since.

How strong is BNB’s rise? It has gained 50% since the beginning of March and is up more than 80% in the past 30 days.

Looking back at the last bull market, BNB once hit a historical high of 690.93 USDT, and then experienced price fluctuations from 2022 to 2023, maintaining 200-400 USDT Around the level, it is currently only 9% away from the all-time high price.

This rising momentum means that the market is less worried about the Binance regulatory incident. BNB still showed strong resilience after the storm, and to a certain extent Rebuild your confidence.

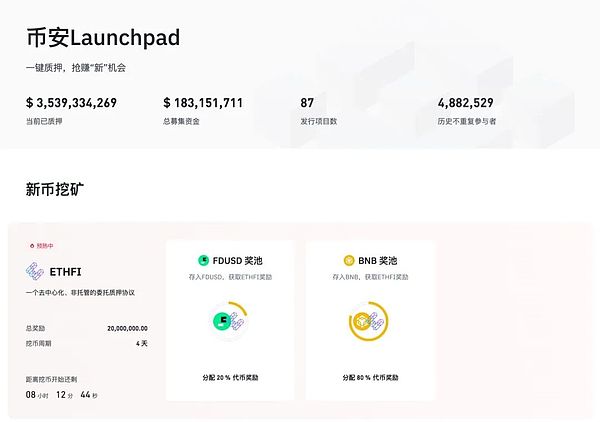

In addition, Binance Launchpool (new currency mining) also provides a key driving force for the rise of BNB.

02 Binance Launchpool

Binance Launchpool is a service provided by the Binance exchange. Users can obtain token rewards for new projects by staking cryptocurrencies. This section is also called new coins. Mining.

This process is a bit like staking mining, except that the mined coins cannot be traded immediately, and may contain high-quality projects with potential. In other words, the exchange allows users to participate and obtain new coins that are about to be listed at lower costs and risks.

BNB's rapid rise in currency prices can be explained in many ways, and Binance Launchpool is an indispensable part of it. The mining rules are very simple. Users participate in mining by staking BNB and FDUSD to obtain new currency rewards. This makes Binance Launchpool’s empowerment of BNB directly hit the core of the currency price rise.

For example, the launch of Launchpool’s on-chain derivatives exchange AEVO on March 6 brought a significant boost to the price of BNB.

In less than a week, BNB rose from 400 USDT to 500 USDT, attracting the attention and participation of a large number of investors.

Looking back, since the first quarter, Binance has launched 7 Launchpool projects at high frequency, with the number of participants ranging from hundreds of thousands to hundreds of thousands. With such a large amount of demand continuing to pour in, the price of BNB will naturally rise all the way.

Launchpool yield: BNB returns are higher

Currently, the pledge currencies used to mine new tokens in Launchpool are BNB and mainstream stablecoins. Biteye uses the official pledge data released by Binance as a basis to calculate the complete mining of projects launched this quarter. The annualized rate of return over the period.

1) Participating in Launchpool is a relatively safe and highly profitable mining method.

2) BNB mining yield is much higher than the other two stable coins, almost equivalent to the sum of the two. Binance Launchpool can be said to be a “sound financial lottery” tailor-made for BNB holders.

Why do you say that? Let’s take a look at Launchpool’s historical performance rate of return below??

1) Launchpool’s new currency mining rate of return from 2024 Q1 to now

2) Use different tokens Mining yield comparison

Note: The current price reference time is 19:00 on March 13 (UTC+8)

1. Judging from the mining APY of Launchpool in the past seven periods, the average rate of return brought by its online price performance on that day is more than 100%, and MANTA, which has the highest income, has reached 186.92%. .

If you play at the highest price in history, APY will double. And because the mining time is generally short, the time occupied by user funds is greatly reduced. Therefore, participating in Launchpool can be said to be a safer and more profitable mining method.

2. It can be seen from the above overall increase ratio that the increase ratio of new coins recently launched on Binance Launchpool is almost 200%, while XAI At its highest price, it was nearly 3 times the closing price on the first trading day.

It can be seen from the listed currencies that there are many high-quality projects, which is also one of the important reasons for the subsequent rise in currency prices.

Most of these high-quality projects are issued through Launchpool, such as the much-watched derivatives trading platform AEVO, the dark horse Pixel on the blockchain game track, and the L3 game competition Daoxin Xai is almost a project with very good fundamentals and a strong user base. It also has certain development potential in the future.

It can be said that the new currency projects listed on Binance have good returns.

3. By comparing the three mining methods and calculating the yield brought by the online price performance, BNB mining yield is much higher than the other two stablecoins. , almost equivalent to the sum of the two.

Imagine that when you hold 100 BNB in the bull market and put it into the pool for mining under basically flat operation, 1000u will be mined in 5-7 days. It will be in the pocket, and it will be a golden shovel for the bull market.

03 Platform development

BNB has the dual concept of "platform currency + public chain currency", and its value mainly depends on the transactions behind it. The fundamental situation here is the so-called "it's easy to enjoy the shade against a big tree".

This is also in line with a basic rule: the development of the platform directly affects the market performance of its tokens.

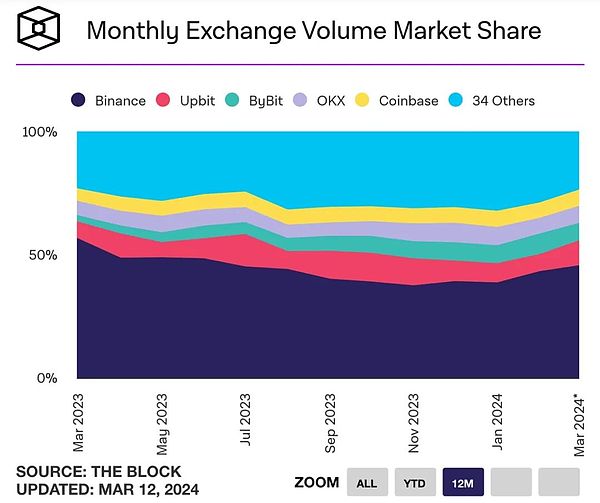

Market share

Judging from the market share performance, despite being affected by disturbances such as the FTX incident in recent years, Binance's market share remains stable at around 50%, maintaining its status as the "number one exchange" unaffected.

As can be seen from the figure below, Binance’s market share has been steadily increasing since Q1. In 2023, Binance attracted more than 40 million new users and has accumulated 170 million registered users, an increase of nearly 30% from the end of the previous year.

Business level

So from a business perspective, BNB is backed by Binance What kind of empowerment can it bring to it?

The answer is that the ceiling is high enough and the imagination is big enough. As the world's largest cryptocurrency exchange, Binance has not been limited to its own trading business in recent years, but has strived to create a comprehensive cryptocurrency ecosystem.

First of all, Binance’s investment at the exchange level can be described as “holding user needs in the palm of its hand”, including upgrading Binance Square to retain more creators and Active users, the number of creators on Binance Square has increased from 1,200 to 11,000 over the past year, and the number of daily active users has increased from less than 700,000 to more than 1.6 million.

The Launchpool project is launched frequently, allowing users to earn new gains that exceed the rate of return of most financial management. Binance uses the brand effect to benefit users, achieving mutual benefit and win-win results. while enhancing user loyalty.

The copy trading function was launched in October last year. The average weekly trading volume in three months exceeded US$2 billion, and it gradually became a social trading platform.

Recently, Binance has launched Futures NEXT, which allows you to earn rewards by predicting the tokens listed on Binance Futures. The NEXT Pool displays the potential listing tokens nominated by users. A curated collection of coins.

The most noteworthy thing is that the Web3 wallet was launched in the Binance app in November last year, making it easier for users to switch between CeFi and DeFi without having to Cumbersome registration only requires one click.

On the one hand, this update effectively lowers the threshold for new users to enter the Web3 ecosystem, and on the other hand, it also makes it easier for old users to perform on-chain operations.

In addition, in response to strong user demand, Inscription Market officially launched the Binance Web3 wallet on February 1.

The latest update was on March 15. The Web3 wallet has completed Solana network integration, helping users easily manage and trade Solana network tokens and access multiple dApps. .

There is no doubt that the exchange has always been at the core of Binance’s territory, and Binance Labs, as an investment and incubation project line, also plays a pivotal role.

Binance Labs uses industry-leading resources and financial advantages to support the accelerated development of excellent projects and reduce their burden of listing and liquidity construction. This strategy not only attracts high-quality projects and teams, but also brings more users to Binance, achieving mutual benefit and win-win results, and promoting the prosperity of the entire ecosystem.

In the past year, Binance Labs has mainly focused on the fields of Web3 chain games, defi ecology and ZKP (zero-knowledge proof), contributing many application scenarios and business models to the Users have brought more diverse product options.

In addition to the above sectors, as we all know, Binance’s ecosystem has also expanded to the public chain, forming a CeFi+DeFi closed loop.

BNB Chain has developed into a comprehensive DeFi system including multiple chains, integrating computing, storage and Layer 2 technology.

This is not just a single chain, but a comprehensive "family bucket" multi-chain development, becoming an existence that cannot be ignored in the DeFi field.

Based on the prosperous BNB Smart Chain and the decentralized storage platform of BNB Greenfield, it has brought significant gains to the BNB Chain ecology.

At the same time, the low-cost transaction opBNB based on Optimism technology was introduced, filling the gap in Layer 2 and further significantly reducing the already low-cost BNB Smart Chain. gas cost.

BNB Chain 2023 Annual Report pointed out that the number of daily active users exceeded 1 million in the past year, which has achieved significant growth. On March 10, the DEX trading volume on the BSC chain reached US$2.474 billion, ranking first.

The daily trading volume of DEX on the Ethereum chain is US$2.038 billion, ranking second; the daily trading volume of DEX on the Solana chain is US$1.361 billion, ranking second three.

Since the last quarter, BNB Chain has been updated in multiple directions:

Cheaper. Official plans are to double opBNB transaction speeds and reduce gas fees by 10 times.

More comprehensive. The One BNB concept is introduced to integrate BSC, opBNB and Greenfield into a cohesive ecosystem, ensuring seamless interaction between decentralized computing and storage solutions.

More airdrops. On March 13th, BNB Chain launched the "Airdrop Alliance Plan", which will release retroactive airdrops to BSC and opBNB users, aiming to reward the community's support for BNB Chain, which can be seen from BNB Chain's vigorous development of the on-chain ecology. Since BNB's current quarterly automatic destruction is anchored to the total number of blocks produced by the BNB Chain, the more active the ecology on the chain is, the more worth looking forward to for the currency price to rise.

It is foreseeable that a vigorous multi-chain system will further become an important force in the DeFi public chain.

04 Summary

In the Web3 field, Binance’s business territory has expanded over the years and has extensively covered many aspects: from From core exchange functions to cloud services, PoW mining pools, staking services, to financial and payment solutions, as well as investment and incubation activities around Binance Labs.

At the same time, with the strong strength of BNB Chain in the DeFi field, Binance has achieved coverage in almost every important field.

Having said that, BNB, the golden shovel, is the only carrier of value capture in the Binance ecosystem. In addition to the platform currency, it also has a public chain currency ecosystem. imagination, while reaping the development dividends of Binance and BNB Chain, the long-term value is very considerable.

Coinlive

Coinlive

Coinlive

Coinlive  cryptopotato

cryptopotato Bitcoinist

Bitcoinist Coindesk

Coindesk Others

Others Siew Meng

Siew Meng Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist