Author: The DeFi Investor Source: X, @TheDeFinvestor

In today’s article:

The main cryptocurrency drivers in April

This week’s on-chain Alpha

The latest developments in DeFi

1.The main cryptocurrency drivers in April< /strong>

April will be a big month for cryptocurrencies.

The highly anticipated Bitcoin halving is about to happen.

Not only that, there are several well-known projects that are about to release their tokens or undergo major upgrades.

Here are four important cryptocurrency events to watch over the next month:

< strong>1. Bitcoin halving

The next Bitcoin halving is expected to occur in approximately 22 days.

Once effective, it will reduce the number of new Bitcoins in circulation by 50%.

However, it is worth noting that the current inflation rate of Bitcoin is already very low (less than 2% per year).

So, from a fundamental perspective, I don’t think the halving is a big deal. But from a psychological perspective, this is not the case.

Many people know that Bitcoin has historically performed extremely well in the months following each halving event. Therefore, they are likely to buy crypto assets again soon, expecting history to repeat itself.

In addition, the Hong Kong Securities and Futures Commission is expected to approve the first launch of a spot Bitcoin ETF in Hong Kong in the second quarter.

All events have paved the way for Bitcoin.

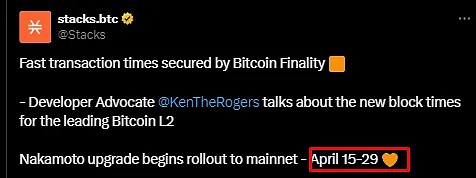

2.Stacks Nakamoto upgrade

Stacks is a Bitcoin second-layer solution that makes smart contracts and dApps more powerful plan.

Stacks’ Nakamoto upgrade has been in development for a long time and appears to finally be rolling out on mainnet starting next month.

Nakamoto upgrade will:

Allow Stacks on Use sBTC (an asset anchored to BTC) in DeFi

Reduce network block time from 10 minutes to a few seconds Bell

Increase the scalability of Stack L2

This upgrade may trigger a new round of Bitcoin L2 craze.

Stacks token $STX can also be considered a beta version of Bitcoin.

Stacks is by far the most popular project built on Bitcoin.

3.Solana airdrop season

Last year, Jito announced The massive airdrop revitalized the Solana ecosystem. In April, several other well-known Solana dApps will launch tokens:

Parcl

-

Drift Protocol

Kamino

All these protocols will undergo airdrops.

This list only includes airdrops that have been officially confirmed, so there may actually be some that are unannounced.

Large-scale airdrops can have a huge positive impact on the ecosystem because they inject more liquidity into it. For example, here's what happened to $SOL after the $JTO was announced in November 2023:

Considering that the market value of SOL has now exceeded 80 billion US dollars, I think it is unrealistic to expect SOL to grow another 2-3 times in the short term. .

However, Solana will likely benefit significantly from these ecosystem airdrops, as it has in the past.

4. Eigenlayer mainnet launch + potential token launch

Eigenlayer token is likely to be launched in late April or May Launched at the beginning of the month.

There are multiple reasons for this:

Eigenlayer mainnet confirmation Will be launched in the next few weeks (this may be the best time for Eigenlayer to also launch the token at the same time)

Many early investors said The token will be released in late April or early May

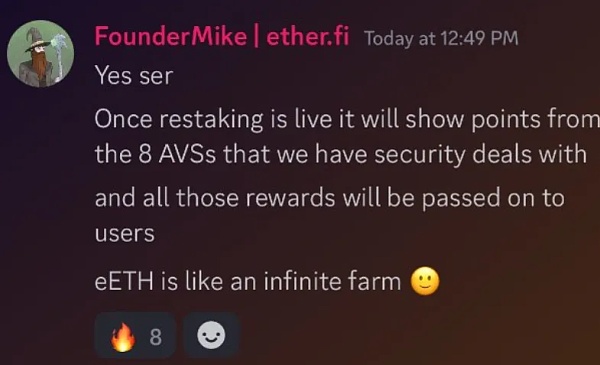

Also, April may also be the first Eigenlayer active verification service ( AVS) online month. Altlayer is a popular example of AVS, a decentralized protocol for rollup.

The protocol that chooses to "rent" security from Ethereum through Eigenlayer is called AVS (can be an oracle, side chain, L2, etc.)

Many of these AVS projects may conduct airdrops for Eigenlayer users, just like Altlayer did when it launched its token a few months ago.

According to the Etherfi team, 8 AVS will soon begin distributing points or token rewards to EtherFi’s eETH liquidity re-staking token holders.

2. Alpha on the chain

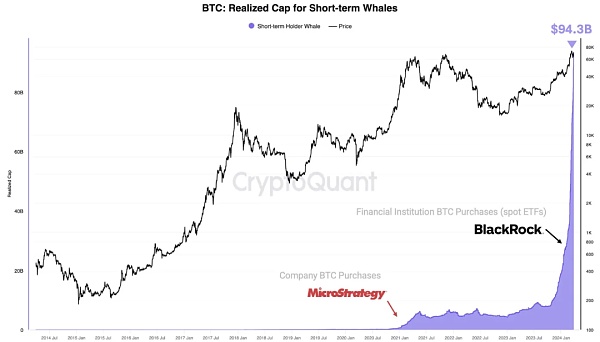

In the past 6 months, US$86 billion of institutional funds have flowed into Bitcoin

Same as above As shown in the figure, institutional inflows into Bitcoin have increased dramatically since the launch of the spot Bitcoin ETF.

This got me thinking about what will happen to Ethereum’s institutional adoption if a spot Ethereum ETF is also approved later this year.

It is becoming increasingly clear that institutions are beginning to realize that cryptocurrencies are indispensable.

3. Latest developments in DeFi

CTFC reconfirms that ETH is a commodity, increasing the possibility of approving a spot Ethereum ETF

Ethena announced that the $ENA token will be launched on April 2nd. 5% of $ENA supply will be airdropped to early adopters

Optimism allocates $3 billion in Optimism Collective & Superchain Grant

NEAR Protocol launches Chain Signatures, which enable NEAR accounts to sign transactions for any blockchain. The goal is to improve the cross-chain user experience

Circle released its cross-chain transfer protocol on Solana. Now, USDC holders can transfer USDC on 8 chains with 1:1 capital efficiency

Zero1 launches Keymaker, a marketplace related to decentralized artificial intelligence. Keymaker aims to become the largest decentralized artificial intelligence ecosystem

Ankr launches Neura, a platform for artificial intelligence Built blockchain. Neura will leverage Bitcoin’s security with Babylon to secure its network

Polygon launches dApp Launchpad, developers enter Polygon The gateway to the ecosystem. dApp Launchpad aims to improve the Polygon developer experience

Angle Protocol launches USDA, a revenue-generating and RWA-backed USD stablecoin. USDA will have several anti-decoupling mechanisms and have the same liquidity as USDC

PancakeSwap announced the launch of MancakeSwap, PancakeSwap's The first DEX affiliated with the Mantle network. Mancake will pay 60% of its revenue to Pancakeswap

Liquity showcases key features of Liquity V2, user-set interest rates, Designed to create an efficient market between borrowers and stablecoin holders

EtherFi has released Points Season 2. The second quarter allocation is 5% of the total ETHFI supply and will end on June 30

Munchables, Blast L2 on A popular protocol suffered a $63 million hack. Fortunately, the hackers have returned the funds

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph