Author: Peter Horton, L1 protocol analyst; Translation: Golden Finance xiaozou

1. Key insights

Aptos is an L1 blockchain designed around the core principles of scalability, security, reliability and upgradeability. It was born from Meta's Diem and Novi projects and will come out in October 2022.

Aptos' technology stack has many novelties, such as the AptosBFTv4 consensus mechanism, Quorum Store memory pool protocol, Block-STM parallel execution engine and programming language Aptos Move.

Since July 2023, Aptos has processed an average of more than 475,000 transactions per day and has more than 72,000 daily active addresses. The online event was driven by a day-long public art-making event on social media platforms Chingari, Oracle Pyth and Graffio.

Aptos Labs and Aptos Foundation have established partnerships with many well-known companies and groups, such as Microsoft, Alibaba Cloud, NPIXEL, Rakuten Group, Coinbase Pay, etc. , many growth plans are focused on the Asia-Pacific region.

The debate about modularity and integration has become a mess. In short, both sides are tending to a similar ending: the modular chain was originally oriented towards verifiability and decentralization. , while the integration chain is optimized for low latency and high throughput.

Aptos is one of the largest players in the integration camp, and its development team Aptos Labs has raised approximately $400 million. Since going online in October 2022, the network has been rapidly upgraded, with more than 40 AIPs and 8 major versions. The Aptos ecosystem is relatively young, but it already has projects like on-chain order books, perp DEX, and social media platforms. In the recent mainnet test environment, Aptos achieved a peak of 30,000 TPS and over 2 billion daily transactions, and its goal is to exceed 1 million TPS. If it can continue to upgrade its technology and attract developers and users, Aptos will definitely succeed.

2. Background introduction

Aptos was born from Meta’s Diem and Novi projects. In 2019, Meta (then known as Facebook) officially announced the upcoming launch of a blockchain-based payment network. The project consists of the permissioned chain Diem (originally called Libra) and the Novi wallet (originally called Calibra). It is developed by Diem Association and Facebook subsidiary Novi Financial. Due to regulatory pushback, Diem and Novi were never released. Diem sold its assets to Silvergate Capital in 2022-1. In September 2022, Meta announced the end of Novi.

Aptos Labs was established in December 2021 and officially launched in February 2022. Aptos Labs was co-founded by Mo Sheikh, head of strategic partnerships at Novi, who previously led strategy at Consensys and founded the blockchain-based real estate platform Meridio, and Avery Ching, principal software engineer at Novi, who has a background in supercomputing . The remaining founding team members are PhDs, researchers, engineers, designers and strategists, many of whom have also worked at Diem or Novi.

In March 2022, Aptos Labs announced to raise US$200 million and simultaneously launched its public devnet and open source code base. The financing, which includes stock and token options, was led by a16z, with participation from Multicoin Capital, ParaFi Capital, Coinbase Ventures and many other investors. In July 2022, Aptos Labs announced another US$150 million in financing, with a valuation of US$2 billion, led by FTX Ventures and Jump Crypto. FTX Ventures also participated in the first round of financing; its investment is now controlled by FTX's bankruptcy proceedings. Further strategic investments from Binance Labs and Dragonfly Capital bring the total raised to approximately $400 million.

In Aptos Lab, the Aptos white paper will be released in August 2022 and the mainnet will be launched in October 2022. Some have expressed concerns about centralized exchanges increasing their support for Aptos’ native token, APT, ahead of the public release of full token economics information. Mo'Sheikh acknowledged these concerns in a tweet the next day. Since the launch of its main network, Aptos Network has completed several upgrades, and the current version is V1.8.0. The non-profit Aptos Foundation leads the development of the Aptos ecosystem.

3. Technology

The Aptos technology stack is designed around the core principles of scalability, security, reliability and upgradeability. It brings many new mechanisms to Aptos.

(1) Consensus

Aptos is a Delegated Proof of Stake (DPoS) L1 network using the AptosBFTv4 consensus protocol.

(2) AptosBFT

AptosBFT (originally called DiemBFT) went through four iterations during Diem and was subsequently used on the permissionless Aptos blockchain. The first AptosBFT is based on HotStuff, which itself is based on the traditional Practical Byzantine Fault Tolerance (pBFT) protocol. Aptos' current deployment - AptosBFTv4 - is now based on Jolteon, which improves HotStuff latency by 50% through a secondary view change in the form of pBFT.

In addition, in order to mitigate delays caused by leadership errors, AptosBFT selects leaders not only based on staking, but also based on performance (in short, "reputation"). Validator performance is a measure of their success as leaders (how often their proposals are submitted) and as non-leaders (how often they vote on proposals).

In the Aptos V1.5 upgrade completed on July 18, 2023, the deployment of Quorum Store further improved Aptos throughput. Quorum Store is an implementation of the memory pool protocol Narwhale. Quorum Store optimizes consensus by separating data dissemination from consensus. The separation of data dissemination and consensus is a key finding of the "Narwhal and Tusk" research article co-authored by researchers from Aptos Labs and Mysten Labs.

Before Quorum Store, transaction processing must go through the memory pool and consensus stages:

Memory pool phase: all transactions are broadcast to all validators.

Consensus phase: The leader broadcasts all transactions in the block it creates to all validators. Non-leaders vote on blocks by sending signed block metadata.

This resulted in two bottlenecks:

Repeated transaction propagation: During the mempool and consensus phases, all transactions are propagated twice to all validators.

Uneven distribution of work: During the consensus phase, the leader completes more work than the non-leader because the leader must send the original transaction instead of the signed block metadata (relatively small news). Therefore, the total bandwidth is capped by the bandwidth of the leader, and the bandwidth of non-leaders is not fully utilized.

Store adds an intermediate stage between the memory pool and the consensus protocol. The complete process is now as follows:

Memory pool phase: Transactions are no longer broadcast to validators, but sent to Quorum Store.

Quorum Store phase: The Quorum Store protocol receives transactions from the memory pool and sorts and packages the transactions according to the gas fee. Quorum Store sends these transaction packages to validators. After receiving the transaction package, the validator signs the transaction package and sends it to other validators. Once a transaction package receives more than 2/3 of the validator signatures, Quorum Store will create a Proof-of-Availability to ensure the uniqueness and availability of the batch.

Consensus phase: The consensus protocol is the same, except now the leader creates blocks using certified transaction packages from the Quorum Store instead of raw transactions from the mempool.

Solved the above two bottlenecks:

Repeated transaction propagation: The original transaction is propagated only once (from the memory pool to the Quorum Store), and then only the transaction package is propagated, thereby reducing the amount of data in the message.

Uneven distribution of work: During the consensus phase, the leader only needs to send the transaction package metadata (and the corresponding PoAv). This is much less workload than in the past and is comparable to the workload of non-leaders. In addition, the workload of all validators in the Quorum Store phase is equal.

(3) DPoS

Validators are compensated through inflationary staking rewards. Currently, all transaction fees are burned. Staking rewards are tied to the reputation of the validator (staking and performance). Rewards will be automatically distributed and combined every epoch (which will last two hours). Staked tokens are globally locked for a 30-day period.

Each validator sets a commission rate and remaining tokens are passed to their delegators. The entrusted pledge within the agreement will be deployed on the mainnet on April 20, 2023. Delegators need to pledge at least 11 APT to join. This will allow more of the community to participate in staking, and the minimum stake to participate as a validator is 1 million APT ($10.5 million as of December 26, 2023).

For validators, the staking limit is 50 million APT, which accounts for about 5% of the total supply. This is not a very strict upper limit. However, validator operators will be incentivized to launch multiple validator nodes if they obtain enough stake. It’s worth noting that locked tokens can also be used to stake and receive liquid rewards (after a global 30-day unlocking period).

There is currently no slashing mechanism for offline validators or malicious validators, but such a mechanism could be added in the future through governance.

(4) Execution

Once validators agree on the block order, they need to execute the transactions in the block and store the results permanently. Many blockchains have a sequential transaction engine, where transactions are ordered and executed one after another. To speed up execution, Aptos uses a parallel execution engine. In addition, unlike other networks that process transactions in parallel, such as Solana and Sui, Aptos does not require advance knowledge of user-declared dependencies.

To do this, Aptos uses Block-STM, which is built on the principles of Software Transaction Memory (STM) and optimistic concurrency control (OCC). STM libraries with OCC follow a general framework of executing transactions optimistically (i.e. assuming no dependencies exist), validating after execution, aborting when dependencies appear, and finally executing again. However, this approach is rarely used in practice due to performance limitations caused by managing dependencies and cascading rollbacks.

In order to cater for deployment and overcome these limitations of the OCC STM system, Block-STM utilizes a preset transaction sequence to evaluate dependencies and reduce the amount of rollbacks. One of the main findings of Bohm's (2014) research report is that predetermined trading sequences can be a good thing, not a curse. Block-STM makes even better use of the preset order than Bohm, refining dependency evaluation with each rollback in the system (thus, reducing the chance of further rollbacks).

Block-STM further improves general STM by leveraging various aspects of the blockchain, including:

VM Security: Move VM (more on Move below) ensures that uncommitted status does not negatively impact other ongoing transactions by catching errors and imposing gas fees.

Block granularity: Garbage collection is simple because it can happen between blocks. Although Block-STM initially only tracked block commitments to reduce synchronization costs, Aptos Labs later improved the algorithm. It now supports intra-block rolling commits without sacrificing performance.

Before introducing the specific steps of Block-STM, it will be helpful to first explain an already mentioned term - dependencies. Blockchain transactions consist of smart contract code that can read and write to shared memory. At execution time, each transaction has a list of read and write locations (called read-set and write-set respectively). If Mo's transaction reads from a location in shared memory (first written by Avery's transaction), then Mo's transaction depends on Avery's transaction. Transactions with dependencies must be executed sequentially, in this case Avery is executed before Mo.

Knowing this, we can take an in-depth look at each step of the Block-STM process, which is mainly divided into five stages:

Phase 1: Preset transaction ordering< /strong>

Since the last consensus phase, there are blocks containing transactions in sequence. As mentioned above, this preset sequence is a key advantage of Block-STM. Parallel execution results must produce the same rea-set and write-set (read-write set) as the sequential execution results.

Phase 2: optimistic execution

Block-STM optimistically executes transactions in parallel. In other words, it is executing the transaction without the dependencies existing.

Phase 3: Verification

The executed transaction is then verified, i.e. the dependencies are checked. This is achieved by re-reading the transaction's read-set and comparing it to the most recently executed read-set. If the two read-sets are not equal, the transaction is rolled back.

A key part of Block-STM is the continuous scheduling of execution and verification tasks in an efficient manner, in particular:

Note that verification is much cheaper than execution, so sequential verification (read-sets and then reads) is not a major bottleneck.

Phase 4: Rollback and re-execution

When the transaction is rolled back, an ESTIMATE tag is applied to the transaction write location. Then, if subsequent transactions read that location, they will see an ESTIMATE tag. While the ESTIMATE tag is being read, transaction execution will be suspended until the value overwrites the ESTIMATE tag. This occurs once the original, aborted transaction is successfully re-executed. Whenever a transaction is re-executed, scheduling ensures that any transactions that are higher in the preset order and depend on it will be re-validated.

This dynamic dependency management is a key concept of Block-STM. Without the ESTIMATE tag, the second transaction would be executed, and possibly rolled back, because its read position would be the write position of the rolled-back transaction. Therefore, Block-STM avoids the large amount of work wasted executing transactions that may be rolled back. In addition, dynamic dependency management brings several improvements to the upfront dependency system. The first is that users do not have to declare dependencies, supporting atomicity of arbitrarily complex transactions (complex transactions do not need to be decomposed). Second, it only manages dependencies when needed, rather than storing dependencies for all transactions. Finally, most dependencies are based on a state that is newer than when the block started.

Phase 5: Submission

Once Block-STM detects that the optimistic execution output of a transaction is correct, it is submitted by the rolling submission mechanism. Rolling commit relies on lightweight synchronization to validate and commit each wave of transactions before processing the next wave.

Block-STM achieved 170,000 TPS with 32 threads on the Aptos benchmark. This is a 17x improvement over sequential execution.

(5) Storage

When a block is committed, its data is permanently stored in the storage layer. While commits are done on a block-by-block basis, each individual transaction is stored individually in a Merkle tree after execution. Everything that happens on the blockchain—including transactions, state updates, and events—can be cryptographically proven based on a digest called a “root hash,” which is signed by the current validator for authentication . This approach differs from other blockchains where one needs to track the blockchain to verify historical transactions, allowing for more fine-grained provable data access.

To handle large amounts of data, Aptos uses two types of Merkle trees: Jellyfish Merkle trees for storing data on disk, and in-memory Sparse Merkle trees for fast updates. These trees are optimized to store data efficiently and allow concurrent updates. Aptos Labs is exploring further ways to scale storage, specifically storage sharding, which is detailed in the roadmap section.

(6) Move language

Move is a bytecode language inspired by Rust and created by the Diem and Novi teams. Move offers greater flexibility and security than Solidity and other Web3 programming languages.

Move consists of two types of programs: transaction scripts and modules. Transaction scripts are atomic and can only be used once, whereas modules are published in global state and stored there indefinitely.

Modules are similar to smart contracts in other programming languages. They define resources and their associated processes. A resource is like an object, and a procedure is an operation that can be performed on the resource, such as creating, modifying, or deleting. Resources are specifically designed to represent scarce assets like tokens. They have built-in protection features that help these assets avoid being mistakenly copied or discarded.

Modules enforce data abstraction, where types are transparent within their declaring module and opaque outside the living module. In other words, only the original module can create, destroy or update values. External access to module data is limited to the public procedures exposed by the module. These guarantees are enforced during execution by Move's bytecode verifier, a process that all modules and transaction scripts must pass before they can be executed by the Move VM. This data abstraction is more obvious in Move than in Solidity/EVM, where encapsulation is available but the implementation is less strict.

Move aims to eliminate attack vectors present in Solidity and the EVM, particularly those caused by the lack of first-class assets outside of Ethereum and re-entrancy attacks.

First-class assets: On EVM, ERC-20 and other assets do not have The same built-in scarcity and access control properties as Ether. Solidity developers need to implement these protections manually to avoid introducing bugs that lead to duplication, reuse, or loss of assets. In contrast, all assets on Move (not just native assets) are considered first-class assets with these protections.

Re-entrancy attack: Unlike EVM, Move does not have unsafe dynamic scheduling. Using unsafe dynamic scheduling, the VM (virtual machine) does not know what operations the external contract function is performing before the contract is run. Dynamic scheduling brings reentrancy attacks, which is one of the most common sources of blockchain hacking, including the recent Curve/Vyper exploit. In a reentrancy attack, a contract calls an external contract that calls back to the original contract and updates the balance before the execution of the original contract is completed, which can result in the loss of funds again and again.

The goal of Move is to make it harder for developers to make mistakes. In addition to bytecode verifiers, developers can also use Move Prover, a formal verification tool. Of course, Move does not eliminate the possibility of smart contract vulnerabilities. Programmers still need to establish appropriate safety invariants in their modules. Additionally, bytecode verifiers and Move Prover do not replace the need for auditing. Auditing firm CertiK observed several instances of developers not using Move's built-in protection mechanisms or adopting programming patterns, most likely porting from legacy code designs that ran counter to Move's design philosophy.

(7) Other main features

User security

Aptos has several features that optimize user experience and security, including Flexible key management, transaction result transparency and light client support.

Aptos account separates private keys and public keys, making key management flexible. Users can rotate their account private keys as a way to preempt or respond to attacks without having to transfer all assets to a new account. Users can also set up their accounts as multi-signatures with different permissions for each public key. For example, a user can create an account with two hot public keys that can sign transactions and a cold public key that can sign transactions but also rotate the private key. The user can then stipulate that 2/3 of the account keys are required to sign the transaction.

To prevent phishing attacks and increase transparency, wallets can use transaction pre-execution to interpret transaction results in a readable format before the user signs.

Aptos also enhances transaction security by adding expiry times and serial numbers to transactions. Serial numbers function like nonces on the EVM and help prevent replay attacks.

Light clients allow people to easily verify the blockchain state by downloading only the block headers. This minimizes trust assumptions when accessing blockchain data. Doing so is especially important for high-performance blockchains like Aptos, which have higher node hardware requirements.

Upgradeability

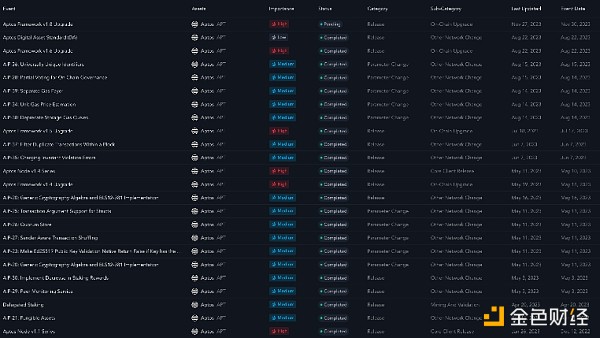

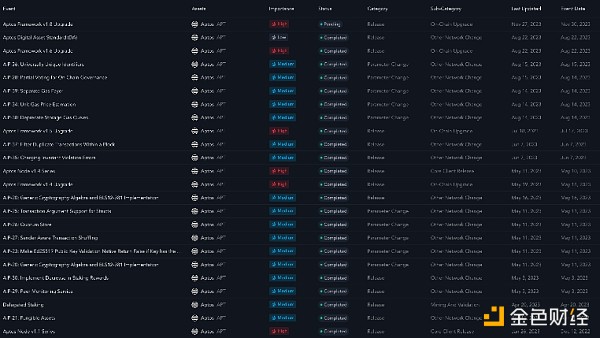

Aptos is designed to support frequent protocol upgrades. This is largely because validator management is on-chain, allowing validators to easily sync to new upgrades. Parts of Aptos itself are also written in the Move language, which reduces time to market, as mentioned above. Since launch, Aptos has implemented approximately 46 optimization recommendations.

4. Token Economics

(1) Overview

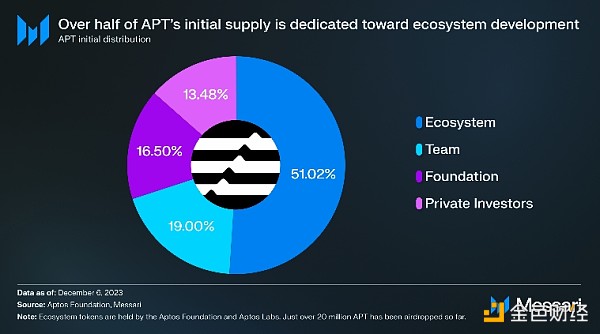

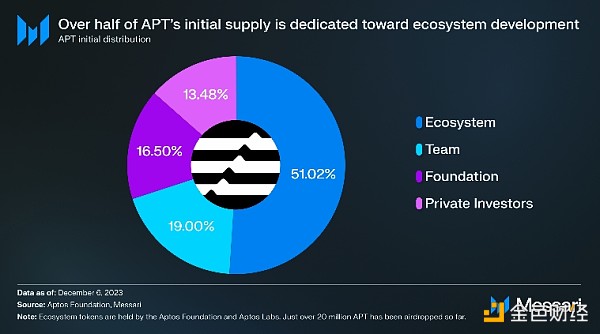

Aptos’ native token APT is used for security and resistance to Sybil attacks (validators and delegators Staking), resource consumption (transaction fees) and on-chain governance. Initially, 1 billion APT was distributed into several baskets with different locking periods. APT has no fixed supply and currently has an annual inflation rate of 6.895%. All transaction fees are currently burned.

(2) Initial distribution

As mentioned earlier, only 1 billion tokens were initially distributed. Additionally, 13% of the tokens are not locked at the outset, and the remaining tokens are distributed according to the distribution schedule. The specific allocation is as follows:

As mentioned earlier, only 1 billion tokens were initially distributed. Additionally, 13% of the tokens are not locked at the outset, and the remaining tokens are distributed according to the distribution schedule. The specific allocation is as follows:

Ecosystem (accounting for 51.02% of the initial total supply) : The largest share of APT’s initial allocation is geared toward ecosystem development. About a quarter of these tokens are unlocked at genesis, with the remainder unlocked linearly every month over the next 10 years. Prior to the distribution, approximately 80% of these tokens were held by the Aptos Foundation, with the remainder held by Aptos Labs. The APT airdrop in the genesis phase distributed more than 20 million tokens from the ecosystem basket to more than 110,000 participants.

Team (19% of total initial supply): These tokens were distributed to Aptos Labs according to the following four-year distribution schedule: One-year lock-up period , unlocking 6.25% per month for the next 6 months, and then 2.083% per month for the next 30 months. Please note that if Aptos Labs employees join after creation, they will still be subject to the same four-year distribution schedule.

Foundation (16.5% of total initial supply): These tokens are allocated to the Aptos Foundation, of which 3% (5 million tokens) are distributed during the founding phase, The remaining tokens will be distributed according to the same four-year distribution schedule as those distributed to the team. The foundation plans to use the tokens to host events, aid legal support, and sponsor research. Among other initiatives, the foundation will cover operating expenses to help validator operators and promote a more decentralized geographical distribution of validator nodes.

Private investors (accounting for 13.48% of the initial token supply): These tokens will be distributed to Aptos Labs’ private investors who choose to purchase the tokens. and adhere to the same four-year distribution schedule as team and foundation token distributions.

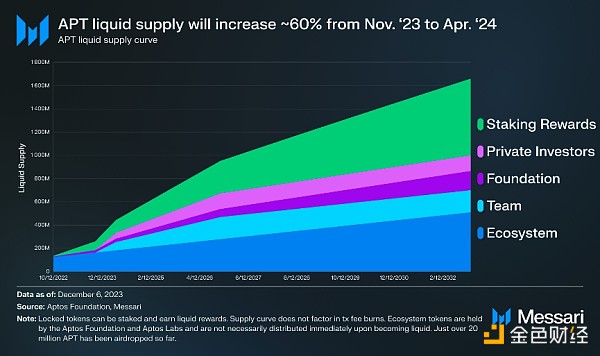

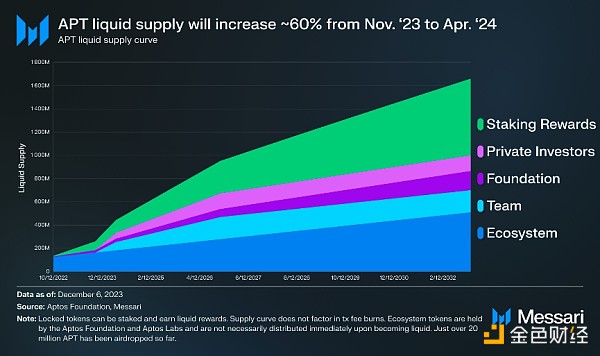

As mentioned above, APT inflates as stakers receive continuous rewards. In the first year after creation, the annual inflation rate is set at 7%, and then decreases by 1.5% each year (i.e., 6.895% in the second year) until it stabilizes at 3.25%. Please note that this rate is set based on the initial total supply of 1 billion APT and is subject to governance.

As mentioned above, APT inflates as stakers receive continuous rewards. In the first year after creation, the annual inflation rate is set at 7%, and then decreases by 1.5% each year (i.e., 6.895% in the second year) until it stabilizes at 3.25%. Please note that this rate is set based on the initial total supply of 1 billion APT and is subject to governance.

The unlocking schedule for the initial distribution of APT is designed to avoid major unlocking events. The most dramatic increase in APT’s liquidity supply will occur during the six-month unlocking period from mid-November 2023 to mid-April 2024. During this period, tokens begin to be unlocked for the team and private investors. During this period, the initial distribution (i.e. excluding staking rewards) of the liquidity token supply will increase by approximately 60%, from 209 million to 334 million.

Locked tokens can be used for staking and receive liquidity rewards. Since in-protocol delegation does not launch until mid-April, airdrop recipients and other smaller token holders are diluted during the first six months of mainnet launch unless they coordinate themselves to pool more than 1 million tokens.

5. Network activities

(1) Usage rate

After the excitement following the network's launch, network usage (measured by transactions and active addresses) declined, not picking up until July 2023. Since then, Aptos has processed an average of over 475,000 transactions per day and has over 72,000 daily active addresses. Several factors are driving the rise in usage, including the integration of social media platform Chingari and Oracle Pyth.

After the excitement following the network's launch, network usage (measured by transactions and active addresses) declined, not picking up until July 2023. Since then, Aptos has processed an average of over 475,000 transactions per day and has over 72,000 daily active addresses. Several factors are driving the rise in usage, including the integration of social media platform Chingari and Oracle Pyth.

Chingari is a video sharing mobile application, similar to TikTok, and has been downloaded more than 100 million times on Google Play Store. It was originally released as a Web2 platform in 2018 and later added on-chain features such as virtual gifts.

Pyth integrated with Aptos on July 13th, bringing its low-latency price feeds. Since July 13, Python has accounted for approximately 17.7% of Aptos’ total trading volume. Note that this size of transaction volume is not uncommon for the network that Pyth is on.

On October 19, driven by Graffio’s public art creation activities, the number of daily active addresses exceeded 600,000. To celebrate the network's one-year anniversary, Aptos contributors invited community members to doodle on a public digital canvas for 24 hours. Each individual painting is registered as an on-chain transaction. Participants then received an NFT version of the final canvas. The campaign brought 605,000 unique addresses and 1.3 million transactions.

The increased activity brought about by Graffio caused network outages and block production ceased on October 18. The incident was resolved in approximately 5 hours. The Aptos Foundation published a report on October 20, determining that the root cause of the incident was non-deterministic code, stemming from performance-focused code changes made to the Aptos core code base on August 22, 2023.

Recent transaction activity is driven by inscriptions, which is a common trend on many blockchains. NFT marketplace BlueMove launched the APT20 standard in mid-December. On December 23rd and 24th, there were 6.8 million transactions, mainly due to APT20 minting.

(2) Security and decentralization

As of December 26, 2023, the Aptos network has 123 active validators from 27 countries and 54 cities. The number of validators has gradually increased since the launch of the network, with the initial number of validators being approximately 100. The validator network’s current Nakamoto coefficient is 18, which is higher than the median of other networks. Since the Aptos Foundation holds a majority of the total token supply, it can help distribute stakes fairly fairly among validators.

There are 907 million pledged APT (valued at $9.8 billion as of December 26, 2023), accounting for 84.6% of the total APT supply. As mentioned above, locked tokens can be used for staking and receive liquidity rewards. Relative to its circulating supply, 296% of the tokens are staked. On October 5, Coinbase Cloud authorized APT to its validators and added APT staking on Coinbase Prime.

6. Ecosystem

(1) DeFi

In more than a year since its launch, the Aptos DeFi protocol has accumulated nearly $127 million in TVL from 32 protocols, with TVL of all networks Ranked 26th. Aptos’ DeFi TVL mainly comes from five protocols: Thala Labs, Liquidswap, Aries Markets, PancakeSwap and SushiSwap.

In more than a year since its launch, the Aptos DeFi protocol has accumulated nearly $127 million in TVL from 32 protocols, with TVL of all networks Ranked 26th. Aptos’ DeFi TVL mainly comes from five protocols: Thala Labs, Liquidswap, Aries Markets, PancakeSwap and SushiSwap.

Thala dominates the Aptos protocol with a TVL of US$43 million, accounting for 45% of the market share. Thala offers a suite of DeFi products, including a CDP, an AMM, a liquidity staking protocol and a token issuance platform. Thala is also currently developing the governance tool Parliament. It raised US$6 million in a seed round of financing in the fourth quarter of 2022, launched the governance token THL at the end of March 2023, and launched the mainnet shortly thereafter. Its CDP mints Move Dollar (MOD), and as of December 26, 2023, there are a total of 8.3 million liquid tokens. MOD and THL are both full-chain fungible tokens (OFTs). OFT is a multi-chain token standard created by LayerZero Labs that is cross-chain interoperable with fungible token standards. Most of MOD’s overcollateralization support is based on LayerZero as well as Wormhole-based USDC.

At the end of the third quarter, Thala announced the establishment of DeFi incubator Thala Foundry in cooperation with the Aptos Foundation. Foundry received $1 million in initial funding and will allocate $50,000 to $250,000 to Aptos DeFi projects, as well as additional developer and business development support.

LiquidSwap is one of the first AMMs running on Aptos. It is developed by Pontem Network, which also developed the Pontem wallet for Aptos. It has a TVL of $20 million and a 21% market share.

Aries Market is a lending and margin trading protocol. It was released shortly after the launch of the Aptos mainnet and has recently shown significant growth in TVL, which jumped from less than $2 million to more than $11 million in October 2023. Growth in December brought Aries' TVL to nearly $20 million and a 20% market share. Previously, at the end of November, Aries launched trading products powered by Econia.

Econia is an on-chain order book engine that took shape during the first Aptos hackathon in 2021 and launched at the end of November. Earlier this year, it raised $6.5 million in seed funding in a round led by Dragonfly. In addition to Aries, Econia’s infrastructure currently supports trading on Kana Trade, Gator Trade (developed by Pontem), SwapGPT and Hippo Labs.

BNB Chain’s top DeFi protocol PancakeSwap launches AMM on Aptos. From the end of 2022 to mid-July 2023, PancakeSwap is the Aptos protocol with the highest TVL. However, it is now in fourth place with a 6% market share.

In late November, SushiSwap released V2 AMM on Aptos, making Aptos the first non-EVM supported by SushiSwap. So far, SushiSwap has nearly $5 million in TVL, occupying 5% of the market share.

Since the cost of not staking is approximately 7% dilution, the Liquidity Staking Protocol is critical to continuing to grow Aptos’ DeFi ecosystem. In late October, the liquidity staking protocol Amnis Finance was released. It is now the leading liquidity staking protocol on Aptos with nearly $33 million in TVL, ahead of Thala’s $23 million liquidity staking protocol. To incentivize growth, Amnis has launched a points program that will be used for airdrops of its upcoming tokens.

Other projects and integrations include:

Merkle Trade: Merkle Trade is a perp DEX launched at the end of October. Since its launch, Merkle Trade’s total trading volume has exceeded $277 million.

Oasis Pro: In mid-November, Oasis Pro integrated with Aptos in the FINRA (U.S. Financial Industry Regulatory Authority)-registered market.

(2) Consumer

Social

As mentioned above, Chingari is on Aptos One of the most popular applications in terms of transaction volume and active addresses. Other social apps currently running or about to launch include TowneSquare and Overmind.

TowneSquare announced its construction plans in August 2023. It is building a mobile application integrated with on-chain activity and authentication systems to support on-chain social feeds, ticketing, whitelisting, affiliate marketing and other use cases.

Overmind is the first platform focused on Quests: where developers can compete for coding challenges and rewards to earn rewards and on-chain credentials. Overmind has partnered with the Aptos Foundation to award approximately $50,000 to developers through its mission. In mid-October, it opened early access to its open-source, decentralized social network, and shortly afterwards launched a "Race to Keys" program to encourage developers to build friend.tech-style key functionality.

Games

Games have always been another core consumer area that Aptos Labs and Foundation focus on. At the end of February, Aptos Labs released a game software development kit (SDK) for development and construction on Unity, one of the most popular game engines. Aptos Labs is also developing a verifiable on-chain randomness module, a key aspect for games and other applications. AIP-41 proposes the creation of a new Move module that would allow developers to easily add on-chain randomness to their smart contracts. Once implemented, there are plans to host a hackathon focused entirely on building with on-chain randomness.

While many games are still in development, some are already online. At the end of October, the arcade-style shooting game AptosArena was released, with a first-week bonus exceeding US$10,000. It attracted over 12,000 addresses in its first weekend and is being updated based on feedback from initial players.

Aptos Labs and the Aptos Foundation have established partnerships with several well-known gaming companies and conglomerates, including:

NPIXEL: NPIXEL is a Korean AAA game company. It established a partnership with Aptos Labs in the fourth quarter of 2022 to bring its METAPIXEL game to the Aptos network, and ended the second trial of the upcoming game Gran Saga Unlimited in the third quarter of 2023.

NEOWIZ: NEOWIZ is a Korean game development and publishing company. The Aptos Foundation partnered with NEOWIZ and its Web3 subsidiary Intella X in mid-August.

MARBLEX: MARBLEX is the Web3 subsidiary of Netmarble, the largest mobile game company in South Korea. MARBLEX partnered with the Aptos Foundation at the end of August to develop the MARBLEX WARP Bridge and integrate its multi-chain games with Aptos. The bridge will connect Aptos with MARBLEX’s existing ecosystem, including its MBX token and gaming NFTs.

Lotte Group: Lotte Group is one of the largest retail conglomerates in South Korea. Rakuten Group established a partnership with the Aptos Foundation at the end of August, bringing its subsidiary Dahong Communications' Bellyland to Aptos.

Readygg: Readygg is an infrastructure company that aims to bring Web2 players to the Web3 world. It works with Web2 game publishers to help integrate their games with Web3. Through the efforts of Aptos, four publishers including Minijuegos, ToroFun, CimuGames and Aeria Canada plan to integrate with Aptos before the end of this year.

BlockGames: BlockGames is building a cross-chain, cross-game game and player network. It recently announced plans to integrate with Aptos.

GuardianLink: Aptos Labs has partnered with GuardianLink to integrate its Jump.trade NFT market, giving users access to Meta Cricket League NFT games.

NFT

Since its launch, NFT trading volume has been approximately $19.4 million, with most activity concentrated shortly after launch. More than 74% of the transaction volume is completed through the Topaz market. Since its launch on August 1, Wapal has accounted for 15% of transaction volume, while Topaz’s transaction volume market share is 50%. Wapal is an NFT marketplace for "professional traders" similar to Blur and Tensor, using a points system to incentivize activity and will be used for airdrops. Wapal recently launched a codeless NFT issuance platform.

Since the launch of the APT20 standard on December 10, NFT transaction volume has increased. BlueMove accounted for 41% of NFT trading volume, with a total trading volume of $674,000.

NFT on Aptos is also applied to several real-world use cases. KYD Labs is a Web3 ticketing company. It provides ticketing services for a number of live events, including the WonderBus Music Festival and Korea Blockchain Week closing event SEOULBOUND. Aptos Labs has twice partnered with NBCUniversal to launch digital fan experiences for the films Renfield and The Exorcist: Believer. In early November, the Aptos Foundation partnered with South Korean amusement park and media group Seoul Land. Seoul Land’s digital subsidiary RXMeta will launch a new festival experience called Bloom on Aptos, powered by NFT ticketing and membership.

At the end of August, Aptos Labs launched the Aptos Digital Asset Standard (DA). DA focuses on NFTs, with features such as dynamic NFTs, soul-bound tokens, lower gas costs, giving NFTs the ability to own other NFTs, simplified airdrop support, and more.

7. Roadmap

(1) Technical optimization

As mentioned above, Aptos is designed to support frequent upgrades. To test and highlight several ongoing upgrades, Aptos Labs recently released the results of Previewnet, a testing environment designed to simulate the Aptos mainnet. From November 6 to 21, the environment supported more than 9 billion transactions, 2 billion of which occurred within 24 hours. Peer-to-peer transactions peaked at 30,000 times per second, and more than 1 million NFT limited collections were minted within 90 seconds.

One of the major upgrades to unlock this higher performance is storage sharding, which is dividing the state store into multiple RocksDB instances. Storage sharding is planned to be launched on the mainnet in 2024. In addition, improvements have been made to the execution engine, state synchronization algorithm and network stack, which Aptos Labs will introduce in detail later.

Optimized NFT minting performance comes from a new solution called Aggregators. Historically, minting of limited-supply NFTs has required sequential execution because they are named sequentially (e.g., "Cryptopunk#4317"). Aggregators are a novel, conflict-free counting mechanism that enables parallel execution of limited-supply NFT minting. Aptos Labs recently published a blog post detailing Aggregators.

Aptos Labs’ next goal is to first achieve the phased goal of 100,000 TPS on the journey to achieve more than 1 million TPS. In addition to the improvements being tested in Previewnet, another major upgrade in development is Shoal, a new consensus mechanism. Shoal combines the characteristics of DAG and BFT to reduce latency and improve throughput.

Finally, Aptos Labs is developing a new Aptos Move compiler, which introduces a series of new language features designed to simplify the coding process and expand functionality. These include receiver-style function calls, first-level higher-order functions, and user-defined capabilities. Aptos Labs expects to implement most of the new features in the first half of 2024.

(2) Growth Strategy

In order to develop the Aptos ecosystem, the Aptos Foundation held hackathons and launched funding programs. Aptos Labs and the Aptos Foundation also have partnerships with a number of partners. In addition to these two entities, there are other groups also engaged in growth activities, such as India-based developer community Move Developers DAO (MDD). Overall, many growth efforts are focused on the Asia-Pacific region.

In addition to the partnerships mentioned in the ecosystem section, Aptos also has partnerships with the following major partners:

Microsoft: In early August, Aptos Labs announced its cooperation with Microsoft. The collaboration will bring Microsoft Azure AI capabilities to Aptos, starting with Aptos Assistant, a chatbot designed to help users and developers log into Aptos. GitHub's Copilot feature will also support Aptos Move.

Google Cloud: Aptos Labs has partnered with Google Cloud to implement several initiatives and integrations, such as Google Cloud running Aptos Validator and indexing Aptos data for BigQuery, providing APT and Google Cloud Points’ accelerator program, co-hosting hackathons, and more.

Alibaba Cloud: In late November, the Aptos Foundation cooperated with Alibaba Cloud to develop the Web3 developer community in the Asia-Pacific region. The Aptos Foundation has become the main blockchain sponsor of the Alibaba Cloud Singapore Innovation Accelerator Program and plans to co-launch the Move developer community in Asia and co-organize a series of hackathons and other activities.

SK Telecom: In early November, Aptos Labs cooperated with SK Telecom and its technology partner Atomrigs Labs to develop a Web3 wallet service called T Wallet. Aptos is SK Telecom's first non-EVM partner.

Flowcarbon: In mid-September, the Aptos Foundation cooperated with Flowcarbon to build Aptos into a carbon-negative blockchain. The Aptos Foundation will purchase and cancel carbon credits tokenized by Flowcarbon.

Coinbase Pay: In mid-September, Aptos Labs cooperated with Coinbase Pay to integrate Coinbase’s legal currency deposit function into the wallet Petra developed by Aptos Labs. In June, Petra mobile wallet was launched on Google Play and Apple App Store. At the end of October, it was integrated with the hardware wallet Ledger.

The hackathon and grant programs are as follows:

Aptos World Tour Hackathon: In 2023, the Aptos Foundation held hackathons in Seoul, the Netherlands and Singapore, and plans to hold another one before the end of the year. The total prize money for these three hackathons exceeds $760,000.

Aptos Funding Plan: The Aptos Foundation announced the Aptos Funding Plan ahead of the mainnet launch in 2022. By early May 2023, the foundation announced that it had awarded more than $3.5 million to 50 teams and opened a second round of applications.

Artist Grant Program: In April 2022, the Aptos Foundation launched a $20 million artist and creator grant program.

Registry funding plan: In mid-July, the Aptos Foundation released the registry funding plan. The registry lists a number of project ideas, initially including seven projects primarily related to gaming and Move infrastructure. Applications for these seven projects have closed and the projects are already in the development stage. The foundation plans to add new projects regularly.

Outlier Ventures Accelerator: In early August, Outlier Ventures announced the launch of the Move accelerator in partnership with the Aptos Foundation. The 12-week project concluded in early October, followed by a demo event that month.

Move Developer DAO (MDD): MDD has helped organize several hackathons and other events. The most recent events include Indore Blockchain Day and Pune Blockchain Day. and REVA HACK.

ABCDE Highlight: Asian Web3 venture capital and accelerator studio ABCDE Highlight has partnered with the Aptos Foundation to launch an Asia-focused funding program to promote community stickiness.

Aptos Winter School: The Aptos Foundation will host a two-week accelerator event for Indian student developers in late December.

Galxe Task: In early December, the Aptos Foundation announced a four-week on-chain task event based on Galxe.

8. Conclusion

Aptos is an L1 blockchain built around the core principles of scalability, security, reliability and upgradeability design. Aptos was born out of Meta's Diem and Novi projects and will be released in October 2022. Aptos' technology stack has many innovations, such as the AptosBFTv4 consensus mechanism, Quorum Store memory pool protocol, Block-STM parallel execution engine and programming language Aptos Move.

Since July 2023, Aptos has processed an average of more than 475,000 transactions per day and has more than 72,000 daily active addresses. Online events are driven primarily by social media platforms Chingari, oracle Pyth, and a day-long public art creation event on Graffio. Plans to grow the ecosystem include partnerships, hackathons, funding programs, and more, many of which are geared toward the Asia-Pacific region.

XingChi

XingChi

As mentioned earlier, only 1 billion tokens were initially distributed. Additionally, 13% of the tokens are not locked at the outset, and the remaining tokens are distributed according to the distribution schedule. The specific allocation is as follows:

As mentioned earlier, only 1 billion tokens were initially distributed. Additionally, 13% of the tokens are not locked at the outset, and the remaining tokens are distributed according to the distribution schedule. The specific allocation is as follows: As mentioned above, APT inflates as stakers receive continuous rewards. In the first year after creation, the annual inflation rate is set at 7%, and then decreases by 1.5% each year (i.e., 6.895% in the second year) until it stabilizes at 3.25%. Please note that this rate is set based on the initial total supply of 1 billion APT and is subject to governance.

As mentioned above, APT inflates as stakers receive continuous rewards. In the first year after creation, the annual inflation rate is set at 7%, and then decreases by 1.5% each year (i.e., 6.895% in the second year) until it stabilizes at 3.25%. Please note that this rate is set based on the initial total supply of 1 billion APT and is subject to governance.  After the excitement following the network's launch, network usage (measured by transactions and active addresses) declined, not picking up until July 2023. Since then, Aptos has processed an average of over 475,000 transactions per day and has over 72,000 daily active addresses. Several factors are driving the rise in usage, including the integration of social media platform Chingari and Oracle Pyth.

After the excitement following the network's launch, network usage (measured by transactions and active addresses) declined, not picking up until July 2023. Since then, Aptos has processed an average of over 475,000 transactions per day and has over 72,000 daily active addresses. Several factors are driving the rise in usage, including the integration of social media platform Chingari and Oracle Pyth.  In more than a year since its launch, the Aptos DeFi protocol has accumulated nearly $127 million in TVL from 32 protocols, with TVL of all networks Ranked 26th. Aptos’ DeFi TVL mainly comes from five protocols: Thala Labs, Liquidswap, Aries Markets, PancakeSwap and SushiSwap.

In more than a year since its launch, the Aptos DeFi protocol has accumulated nearly $127 million in TVL from 32 protocols, with TVL of all networks Ranked 26th. Aptos’ DeFi TVL mainly comes from five protocols: Thala Labs, Liquidswap, Aries Markets, PancakeSwap and SushiSwap.